This is a form questionnaire an attorney may ask his/her client to answer to assist with estate planning.

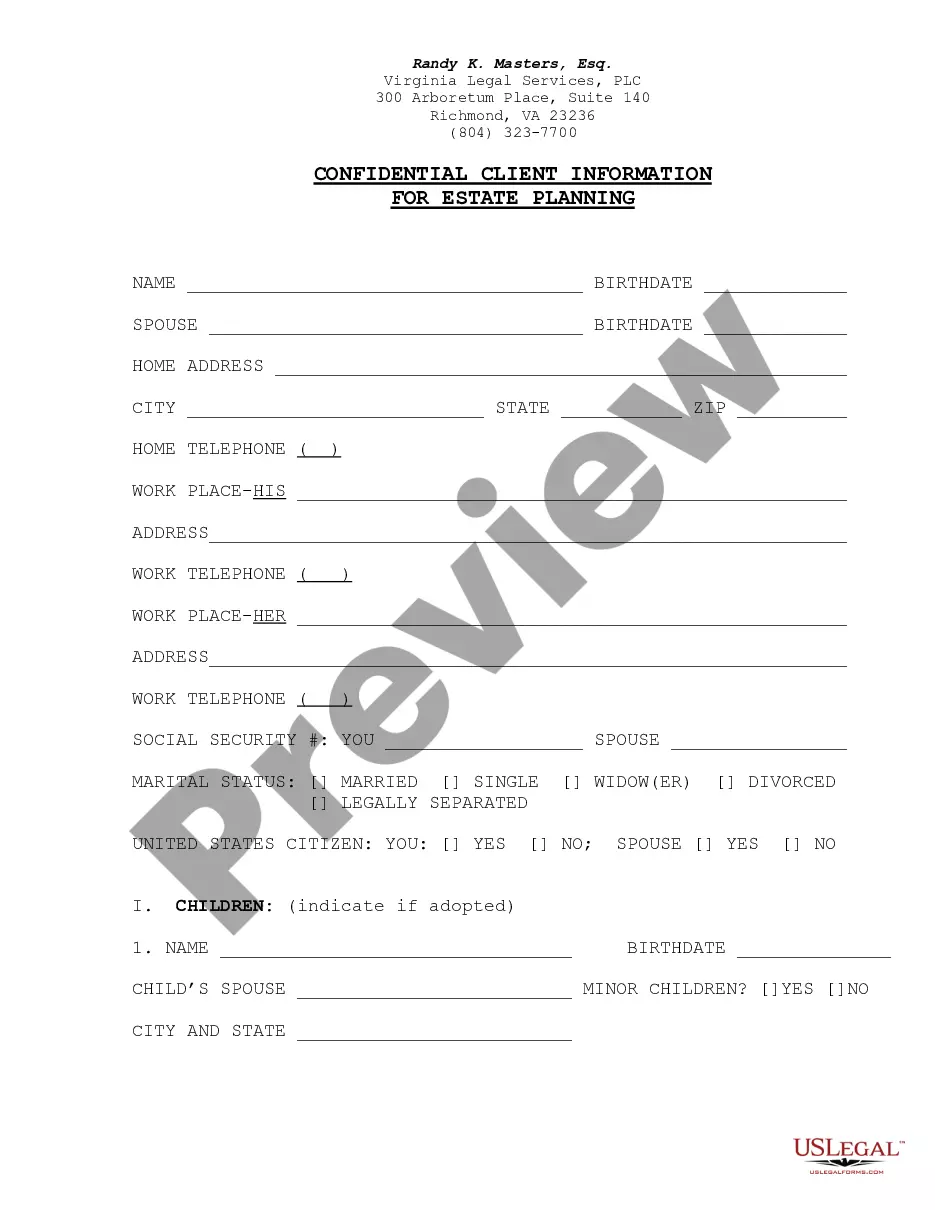

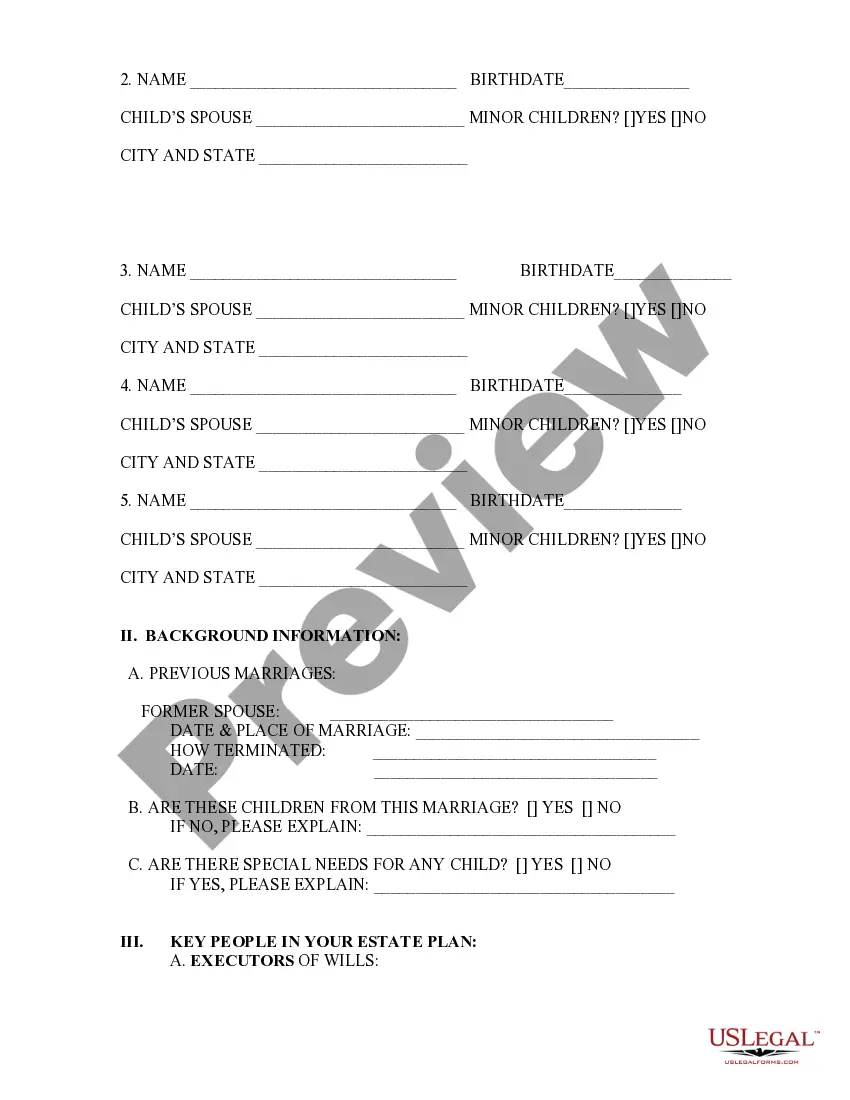

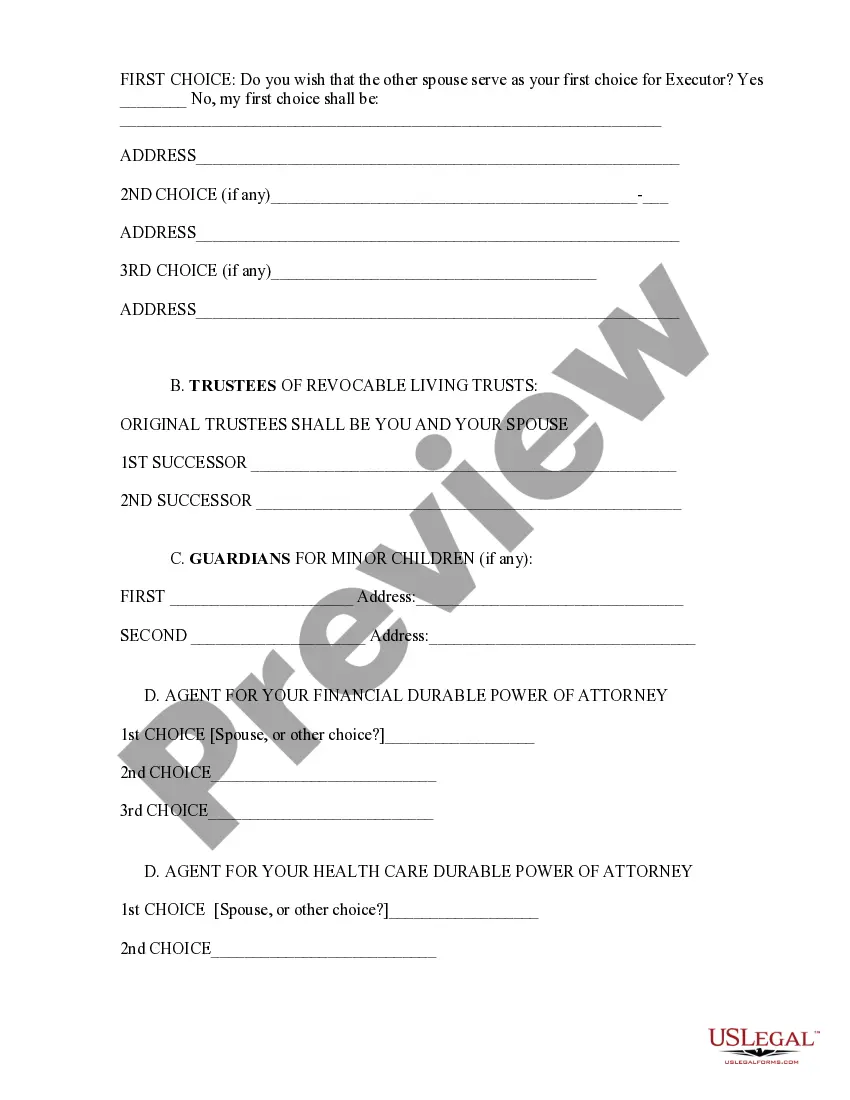

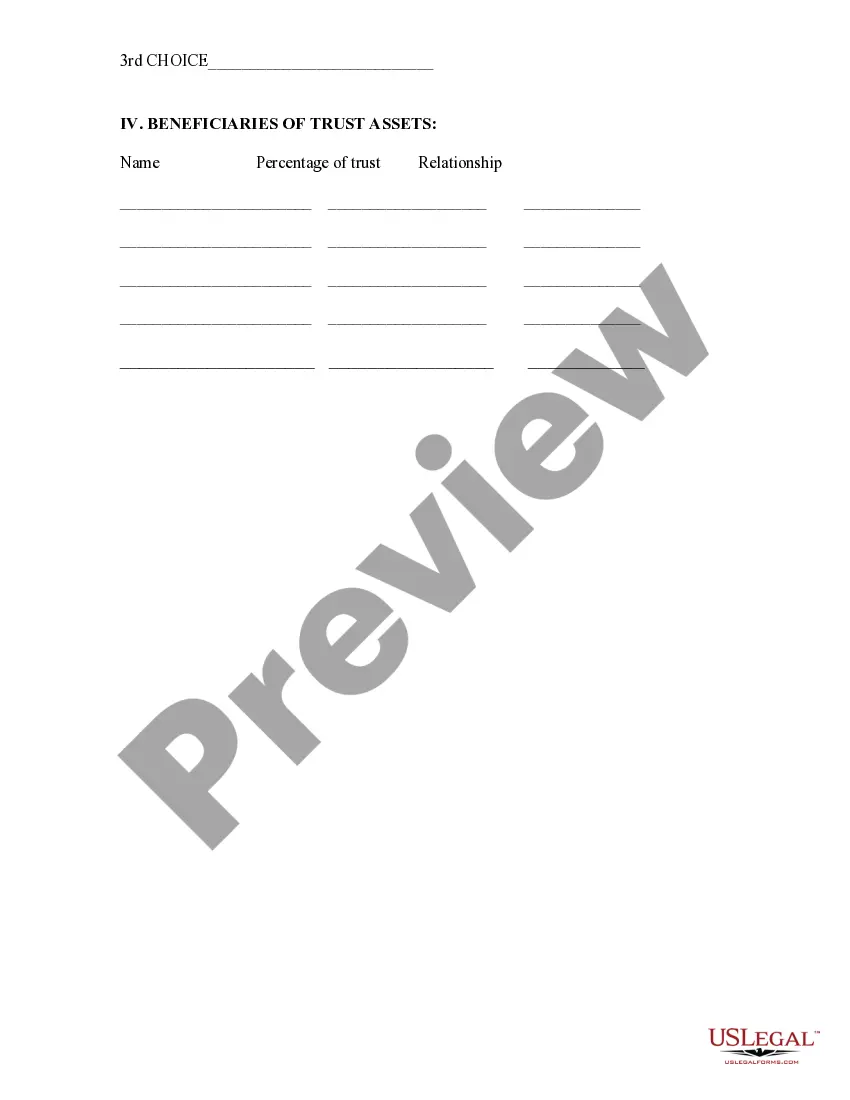

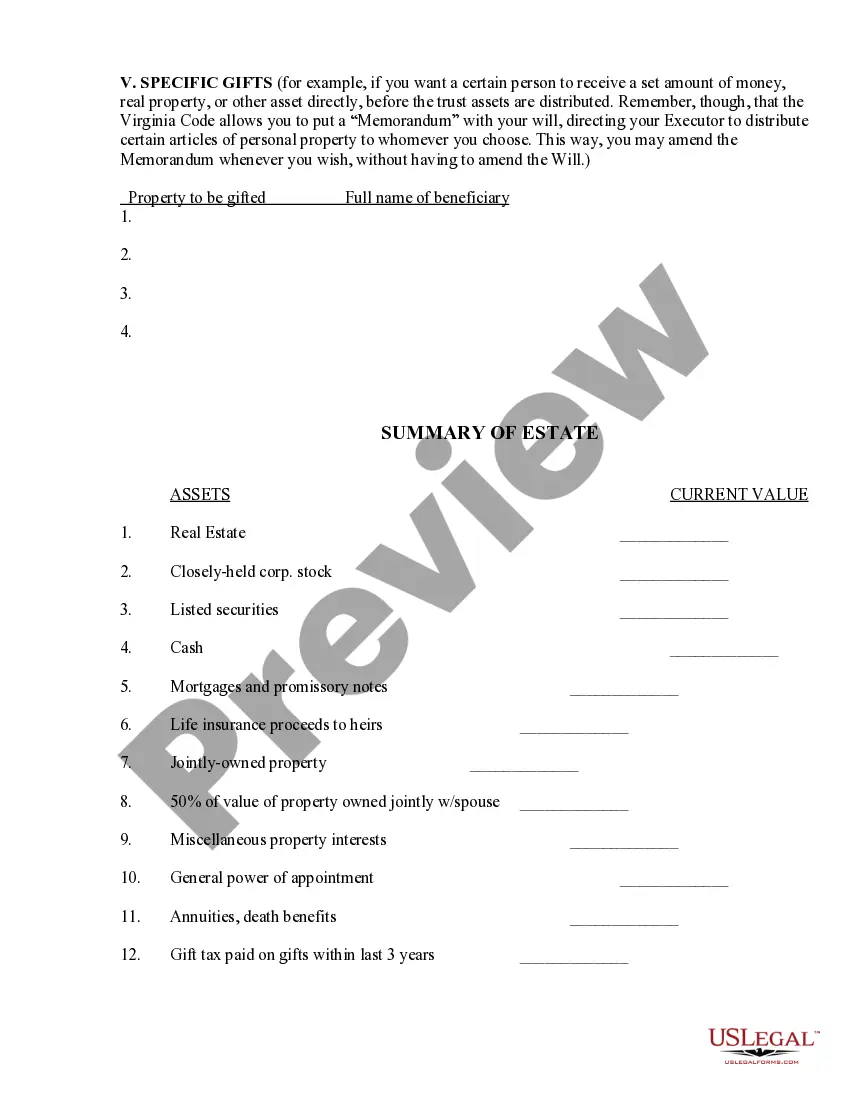

Fairfax Virginia Trust Questionnaire is a comprehensive and detailed document designed to assess an individual's specific needs and gather essential information for establishing a trust in Fairfax, Virginia. This questionnaire aims to assist attorneys, financial advisors, and estate planners in creating tailored trust arrangements that align with the client's wishes and goals. Covering a wide range of topics, the Fairfax Virginia Trust Questionnaire helps ensure that each aspect is thoroughly considered and addressed. By completing this questionnaire, individuals can provide their legal representatives with a clear understanding of their assets, beneficiaries, and preferences, enabling them to establish a trust that meets their unique requirements. It is crucial to fill out this questionnaire meticulously to avoid any potential legal complications or misunderstandings. The Fairfax Virginia Trust Questionnaire typically includes the following sections: 1. Personal Information: This section requests basic details, including the individual's name, contact information, and social security number. It also involves identifying the spouse, if applicable, and their information. 2. Trust Intentions and Goals: Here, individuals can outline the primary objectives and purposes of establishing the trust, such as asset protection, wealth preservation, or charitable giving. This section helps attorneys understand the client's overarching intentions. 3. Beneficiaries: In this part, individuals need to specify the beneficiaries who will receive distributions from the trust. They can provide the names, relationship to the settler, and their contact information. 4. Assets: This section delves into the individual's assets, comprehensively assessing their various types, including real estate, investments, bank accounts, life insurance policies, retirement funds, and business interests. Individuals must provide detailed information about each asset, including values, ownership titles, and account numbers. 5. Trustee and Successor Trustee Nomination: Here, individuals can designate the primary and alternate trustees responsible for managing and administering the trust. This section may also request information regarding the trustees' contact details and relationships with the settler. 6. Special Instructions: This section enables individuals to communicate any specific instructions or conditions they wish to impose on the trust administration or the distribution of assets to beneficiaries. Overall, the Fairfax Virginia Trust Questionnaire is a critical document in the trust creation process, enabling the legal professionals to understand the client's wishes, organize their assets effectively, and tailor the trust to achieve their desired outcomes. By carefully completing this questionnaire, individuals can ensure their trust accurately reflects their intentions and protects their assets for generations to come. Different types of Fairfax Virginia Trust Questionnaires may include variations made by different estate planning attorneys or law firms practicing in Fairfax, Virginia. These variations might incorporate specific additional sections or sections customized for particular trust types, such as revocable living trusts, irrevocable trusts, special needs trusts, or charitable trusts.Fairfax Virginia Trust Questionnaire is a comprehensive and detailed document designed to assess an individual's specific needs and gather essential information for establishing a trust in Fairfax, Virginia. This questionnaire aims to assist attorneys, financial advisors, and estate planners in creating tailored trust arrangements that align with the client's wishes and goals. Covering a wide range of topics, the Fairfax Virginia Trust Questionnaire helps ensure that each aspect is thoroughly considered and addressed. By completing this questionnaire, individuals can provide their legal representatives with a clear understanding of their assets, beneficiaries, and preferences, enabling them to establish a trust that meets their unique requirements. It is crucial to fill out this questionnaire meticulously to avoid any potential legal complications or misunderstandings. The Fairfax Virginia Trust Questionnaire typically includes the following sections: 1. Personal Information: This section requests basic details, including the individual's name, contact information, and social security number. It also involves identifying the spouse, if applicable, and their information. 2. Trust Intentions and Goals: Here, individuals can outline the primary objectives and purposes of establishing the trust, such as asset protection, wealth preservation, or charitable giving. This section helps attorneys understand the client's overarching intentions. 3. Beneficiaries: In this part, individuals need to specify the beneficiaries who will receive distributions from the trust. They can provide the names, relationship to the settler, and their contact information. 4. Assets: This section delves into the individual's assets, comprehensively assessing their various types, including real estate, investments, bank accounts, life insurance policies, retirement funds, and business interests. Individuals must provide detailed information about each asset, including values, ownership titles, and account numbers. 5. Trustee and Successor Trustee Nomination: Here, individuals can designate the primary and alternate trustees responsible for managing and administering the trust. This section may also request information regarding the trustees' contact details and relationships with the settler. 6. Special Instructions: This section enables individuals to communicate any specific instructions or conditions they wish to impose on the trust administration or the distribution of assets to beneficiaries. Overall, the Fairfax Virginia Trust Questionnaire is a critical document in the trust creation process, enabling the legal professionals to understand the client's wishes, organize their assets effectively, and tailor the trust to achieve their desired outcomes. By carefully completing this questionnaire, individuals can ensure their trust accurately reflects their intentions and protects their assets for generations to come. Different types of Fairfax Virginia Trust Questionnaires may include variations made by different estate planning attorneys or law firms practicing in Fairfax, Virginia. These variations might incorporate specific additional sections or sections customized for particular trust types, such as revocable living trusts, irrevocable trusts, special needs trusts, or charitable trusts.