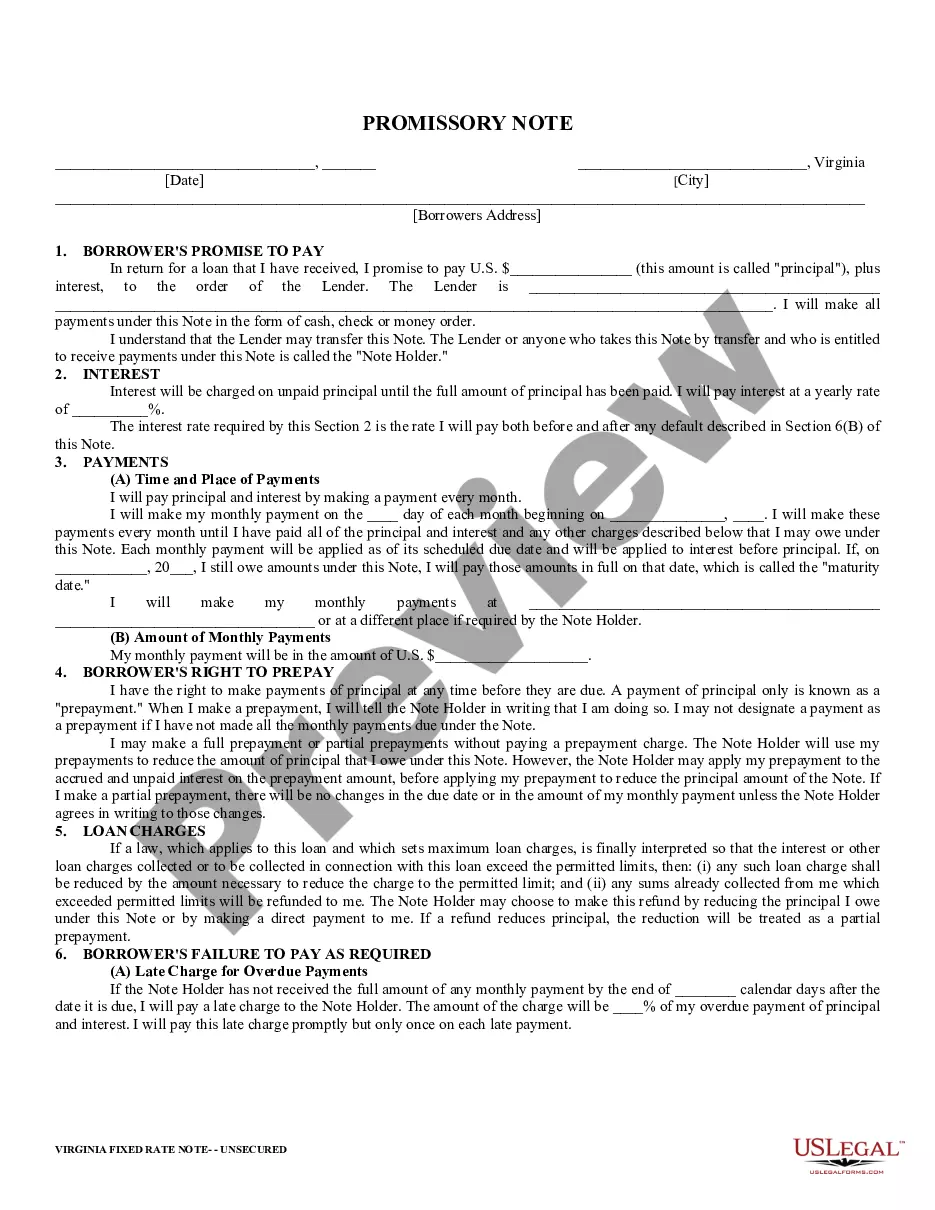

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Fairfax Virginia Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines an agreement between a lender and a borrower in Fairfax, Virginia. This promissory note sets the terms and conditions for the borrower to repay a loan with fixed interest rates through a series of regular installment payments. With the Fairfax Virginia Unsecured Installment Payment Promissory Note for Fixed Rate, both parties can protect their rights and obligations throughout the loan repayment process. Here are some key points to consider: 1. Loan Amount and Interest Rate: The promissory note specifies the loan amount provided by the lender and the fixed interest rate charged on the borrowed amount. This ensures transparency and clarity regarding the financial aspect of the agreement. 2. Installment Payment Schedule: The note outlines a specific payment schedule, detailing the due dates and amounts of each installment. By carefully stating these repayment terms, both parties can avoid confusion or misunderstandings. 3. Late Payment and Default: The promissory note indicates the consequences of late payments or defaults. It may include penalties, such as additional fees or increased interest rates, which encourage prompt repayment and protect the lender's interests in case of default. 4. Prepayment and Early Termination: In case the borrower wishes to pay off the loan before the agreed-upon schedule, the promissory note may include provisions for prepayment or early termination. These conditions specify if any fees or penalties apply in such situations. 5. Default Resolution Process: In the unfortunate event of a borrower's default, the promissory note may outline the steps the lender can take to recover the outstanding amount, such as seeking legal action or engaging in debt collection methods compliant with Fairfax, Virginia laws. Types of Fairfax Virginia Unsecured Installment Payment Promissory Notes for Fixed Rate: 1. Personal Loan Promissory Note: This type of promissory note is used for personal loans where individuals borrow money for various purposes and agree on a fixed interest rate and installment payment plan. 2. Business Loan Promissory Note: This type of promissory note is tailored for business-related loans, whether for startups, expansion, or regular operations. It addresses the specific needs of businesses within Fairfax, Virginia. 3. Educational Loan Promissory Note: This type of promissory note is specifically designed for educational purposes. It outlines the terms and conditions of student loans, including repayment schedules and any agreed-upon deferment or forbearance options. In conclusion, the Fairfax Virginia Unsecured Installment Payment Promissory Note for Fixed Rate is a crucial legal document that ensures a clear understanding between lenders and borrowers in Fairfax, Virginia. Its contents encompass loan details, repayment terms, default consequences, and any additional provisions, safeguarding the rights and obligations of both parties involved.