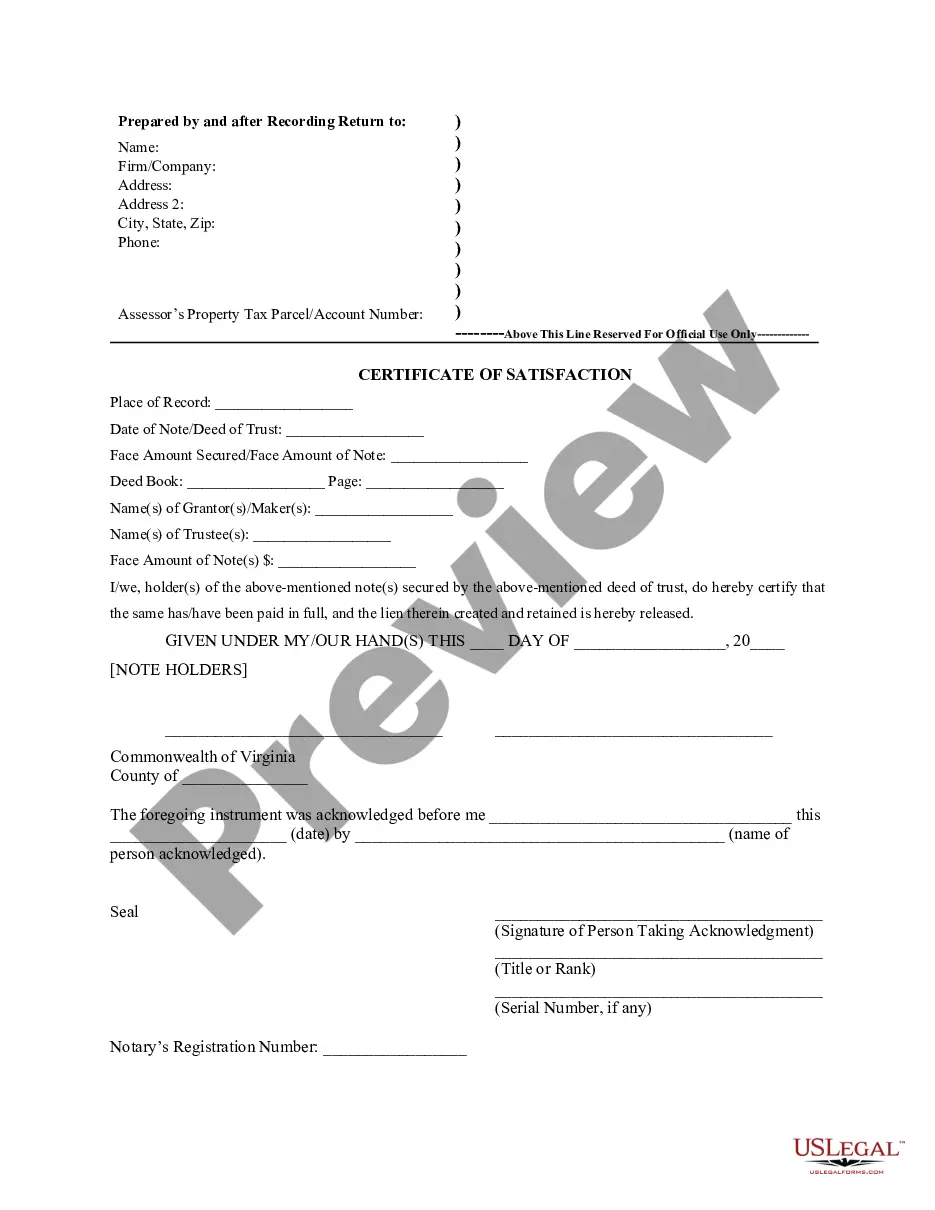

This form is for the satisfaction or release of a deed of trust for the state of Virginia by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual

Description

How to fill out Virginia Satisfaction, Release Or Cancellation Of Deed Of Trust By Individual?

Take advantage of the US Legal Forms and gain immediate access to any form you need.

Our user-friendly platform with a vast collection of documents streamlines the process of locating and acquiring almost any document template you require.

You can quickly save, complete, and sign the Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual in just a few minutes instead of spending hours online searching for a suitable template.

Using our repository is a fantastic way to enhance the security of your document submissions.

Locate the form you need. Ensure it is the correct document: confirm its title and description, and utilize the Preview feature if available. If not, use the Search bar to find the desired one.

Begin the saving procedure. Click Buy Now and select the pricing option you prefer. Then, register for an account and pay for your order using a credit card or PayPal.

- Our experienced attorneys continuously examine all the forms to ensure they are suitable for a specific jurisdiction and adhere to current laws and regulations.

- How can you obtain the Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual.

- If you already possess an account, simply Log In to your account. The Download option will be available for all the templates you review.

- Additionally, you can access all previously saved documents in the My documents section.

- If you haven't created an account yet, follow the instructions below.

Form popularity

FAQ

In Virginia, deeds can be prepared by individuals, attorneys, or qualified professionals familiar with real estate transactions. Ensuring that the preparation process is accurate and follows the legal guidelines is important. Using services like USLegalForms can help you navigate these complexities, making it easier to achieve Fairfax Virginia satisfaction, release, or cancellation of deed of trust by individual.

To release a deed of trust, the lender must provide a release document, sign it, and file it with the local land records office. This document confirms that the debt has been satisfied, effectively canceling the deed of trust. Keeping these records is essential for anyone managing a property in Fairfax, Virginia, to facilitate the satisfaction, release, or cancellation of a deed of trust by individual.

In Virginia, you can prepare a deed of trust yourself or seek assistance from a qualified professional. Many individuals choose to work with title companies, real estate agents, or legal professionals experienced in property transactions. Utilizing platforms like USLegalForms can streamline this process, ensuring your deed of trust meets the requirements for satisfaction, release, or cancellation in Fairfax, Virginia.

You are not required to hire a lawyer to prepare a deed of trust in Fairfax, Virginia. However, consulting with a legal professional can help ensure that the deed complies with state laws and serves your needs. By doing so, you can avoid potential issues related to the satisfaction, release, or cancellation of a deed of trust.

The release on a deed of trust involves formal documentation that confirms the debt has been satisfied. Typically, the lender must prepare this release and file it with the county recorder's office. You can facilitate this process by ensuring all payments are made and using resources like USLegalForms to help navigate the documentation required for the Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual.

The timeframe to be discharged from a trust deed can vary based on the lender and local processing times. Generally, once you complete your payments, the lender may take a few weeks to issue the release. After you receive the release, recording it with the appropriate office might take additional time. It is wise to consult resources like USLegalForms for anticipated timelines specific to Fairfax.

Getting a deed of trust release involves a few simple steps. Start by checking that your debt is settled with the lender. Next, ask your lender to prepare and issue a formal release document. Finally, submit this document to the relevant county office to finalize the Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual.

To obtain a copy of a deed in Fairfax County, you can request it in person at the Clerk's Office or utilize their online services. You will need to provide specific details about the property, including the owner's name or address, to help streamline your request. This process is vital for understanding the Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual implications on your property.

To get a physical copy of your deed, visit your local county clerk's office or check if they provide an online option for obtaining records. Ensure you provide the necessary information about the property and its history. By securing a copy of your deed, you can easily manage your historical documents related to the Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual.

To obtain a copy of your deed in Fairfax County, you can visit the Fairfax County Clerk's Office or access their online records. It's important to have the relevant property information, such as the property address or the owner's name, to help staff assist you. Additionally, many documents, including those for the Fairfax Virginia Satisfaction, Release or Cancellation of Deed of Trust by Individual, are accessible online, making it convenient to retrieve what you need.