Satisfaction, Release or Cancellation of Deed of Trust by Corporation

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor. To effectuate an assignment, the general rules is that the assignment must be in proper written format and recorded to provide notice of the assignment.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property. The general rule is that the satisfaction must be in proper written format and recorded to provide notice of the satisfaction. If the lender fails to record a satisfaction within set time limits, the lender may be responsible for damages set by statute for failure to timely cancel the lien. Depending on your state, a satisfaction may be called a Satisfaction, Cancellation, or Reconveyance. Some states still recognize marginal satisfaction but this is slowly being phased out. A marginal satisfaction is where the holder of the mortgage physically goes to the recording office and enters a satisfaction on the face of the the recorded mortgage, which is attested by the clerk.

Virginia Law

Assignment: It is recommended that an assignment be in writing and recorded.

Demand to Satisfy: Upon full payoff, borrower must provide written demand for satisfaction to lender, whereupon lender is obligated to record satisfaction of the deed of trust within 90 days or face liability.

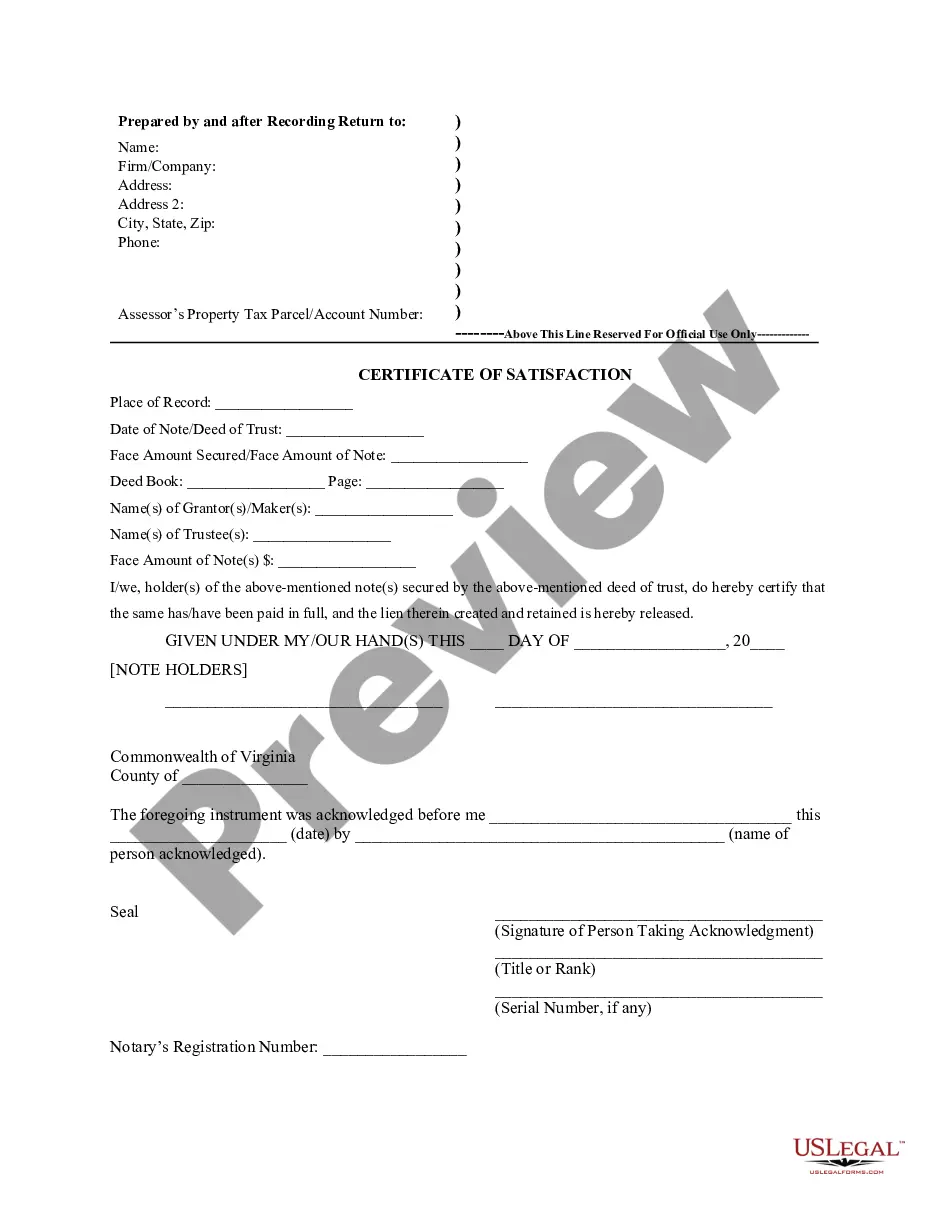

Recording Satisfaction: Certificate of satisfaction shall be signed by the lender along with an affidavit of full payment and these filed with the clerk of the recording office.

Penalty: Any lien creditor who fails to record satisfaction within the ninety-day period shall forfeit $500 to the lien obligor. Following the ninety-day period, if the amount forfeited is not paid within ten business days after demand for payment, the lien creditor shall pay any court costs and reasonable attorney's fees incurred by the obligor in collecting the forfeiture.

Acknowledgment: An assignment or satisfaction must contain a proper Virginia acknowledgment, or other acknowledgment approved by Statute.

Virginia Statutes

§ 55-66.3. Release of deed of trust or other lien.

A. 1. Except as provided in Article 2.1 of this chapter, after full or partial payment or satisfaction has been made of a debt secured by a deed of trust, vendor's lien, or other lien, or any one or more obligations representing at least 25 percent of the total amount secured by such lien, but less than the total number of the obligations so secured, or the debt secured is evidenced by two or more separate written obligations sufficiently described in the instrument creating the lien, has been fully paid, the lien creditor shall issue a certificate of satisfaction or certificate of partial satisfaction in a form sufficient for recordation reflecting such payment and release of lien. This requirement shall apply to a credit line deed of trust prepared pursuant to § 55-58.2 only when the obligor or the settlement agent has paid the debt in full and requested that the instrument be released.

If the lien creditor receives notice from a settlement agent at the address identified in its payoff statement requesting that the certificate be sent to such settlement agent, the lien creditor shall provide the certificate, within 90 days after receipt of such notice, to the settlement agent at the address specified in the notice received from the settlement agent.

If the notice is not received from a settlement agent, the lien creditor shall deliver, within 90 days after such payment, the certificate to the appropriate clerk's office with the necessary fee for recording by certified mail, return receipt requested, or when there is written proof of receipt from the clerk's office, by hand delivery or by courier hand delivery.

If the lien creditor has already delivered the certificate to the clerk's office by the time it receives notice from the settlement agent, the lien creditor shall deliver a copy of the certificate to the settlement agent within 90 days of the receipt of the notice at the address for notification set forth in the payoff statement.

If the lien creditor has not, within 90 days after payment, either provided the certificate of satisfaction to the settlement agent or delivered it to the clerk's office with the necessary fee for filing, the lien creditor shall forfeit $500 to the lien obligor. No settlement agent or attorney may take an assignment of the right to the $500 penalty or facilitate such an assignment to any third party designated by the settlement agent or attorney. Following the 90-day period, if the amount forfeited is not paid within 10 business days after written demand for payment is sent to the lien creditor by certified mail at the address for notification set forth in the payoff statement, the lien creditor shall pay any court costs and reasonable attorney's fees incurred by the obligor in collecting the forfeiture.

2. If the note, bond or other evidence of debt secured by such deed of trust, vendor's lien or other lien referred to in subdivision 1 or any interest therein, has been assigned or transferred to a party other than the original lien creditor, the subsequent holder shall be subject to the same requirements as a lien creditor for failure to comply with this subsection, as set forth in subdivision 1.

B. The certificate of satisfaction shall be signed by the creditor or his duly authorized agent, attorney or attorney-in-fact, or any person to whom the instrument evidencing the indebtedness has been endorsed or assigned for the purpose of effecting such release. An affidavit shall be filed or recorded with the certificate of satisfaction, by the creditor, or his duly authorized agent, attorney or attorney-in-fact, with such clerk, stating that the debt therein secured and intended to be released or discharged has been paid to such creditor, his agent, attorney or attorney-in-fact, who was, when the debt was satisfied, entitled and authorized to receive the same.

C. And when so signed and the affidavit hereinbefore required has been duly filed or recorded with the certificate of satisfaction with such clerk, the certificate of satisfaction shall operate as a release of the encumbrance as to which such payment or satisfaction is entered and, if the encumbrance be by deed of trust, as a reconveyance of the legal title as fully and effectually as if such certificate of satisfaction were a formal deed of release duly executed and recorded.<br />

<br />

D. As used in this section:<br />

<br />

“CRESPA” means Chapter 27.3 (§ 55-525.16 et seq.) of Title 55.<br />

<br />

“Deed of trust” means any mortgage, deed of trust or vendor’s lien.<br />

<br />

“Lien creditor” and “creditor” shall be construed as synonymous and mean the holder, payee or obligee of a note, bond or other evidence of debt and shall embrace the lien creditor or his successor in interest as evidenced by proper endorsement or assignment, general or restrictive, upon the note, bond or other evidence of debt.<br />

<br />

“Payoff letter” means a written communication from the lien creditor or servicer stating, at a minimum, the amount outstanding and required to be paid to satisfy the obligation.<br />

<br />

“Satisfactory evidence of the payment of the obligation secured by the deed of trust” means (i) any one of (a) the original canceled check or a copy of the canceled check, showing all endorsements, payable to the lien creditor or servicer, as applicable, (b) confirmation in written or electronic form of a wire transfer to the bank account of the lien creditor or servicer, as applicable, or (c) a bank statement in written or electronic form reflecting completion of the wire transfer or negotiation of the check, as applicable; and (ii) a payoff letter or other reasonable documentary evidence that the payment was to effect satisfaction of the obligation secured or evidenced by the deed of trust.<br />

<br />

“Satisfied by payment” includes obtaining written confirmation from the lien creditor that the underlying obligation has a zero balance.<br />

<br />

“Servicer” means a person or entity that collects loan payments on behalf of a lien creditor.<br />

<br />

“Settlement agent” has the same meaning ascribed thereto in § 55-525.16, provided that a person shall not be a settlement agent unless he is registered pursuant to § 55-525.30 and otherwise fully in compliance with the applicable provisions of Chapter 27.3 (§ 55-525.16 et seq.) of Title 55.<br />

<br />

“Title insurance company” has the same meaning ascribed thereto in § 38.2-4601, provided that the title insurance company seeking to release a lien by the process described in subsection E issued a policy of title insurance, through a title insurance agency or agent as defined in § 38.2-4601.1, for a real estate transaction wherein the loan secured by the lien was satisfied by payment made by the title insurance agency or agent also acting as the settlement agent.<br />

<br />

E. Release of lien by settlement agent or title insurance company.<br />

<br />

A settlement agent or title insurance company may release a deed of trust in accordance with the provisions of this subsection (i) if the obligation secured by the deed of trust has been satisfied by payment made by the settlement agent and (ii) whether or not the settlement agent or title insurance company is named as a trustee under the deed of trust or otherwise has received the authority to release the lien.<br />

<br />

1. Notice to lienholder.<br />

<br />

a. After or accompanying payment in full of the obligation secured by a deed of trust, a settlement agent or title insurance company intending to release a deed of trust pursuant to this subsection shall deliver to the lien creditor by certified mail or guaranteed overnight delivery service a notice of intent to release the deed of trust with a copy of the payoff letter and a copy of the release to be recorded as provided in this subsection.<br />

<br />

b. The notice of intent to release shall contain (i) the name of the lien creditor, the name of the servicer if loan payments on the deed of trust are collected by a servicer, or both names, (ii) the name of the settlement agent, (iii) the name of the title insurance company if the title insurance company intends to release the lien, and (iv) the date of the notice. The notice of intent to release shall conform substantially to the following form:<br />

<br />

NOTICE OF INTENT TO RELEASE<br />

<br />

Notice is hereby given to you concerning the deed of trust described on the certificate of satisfaction, a copy of which is attached to this notice, as follows:<br />

<br />

1. The settlement agent identified below has paid the obligation secured by the deed of trust described herein or obtained written confirmation from you that such obligation has a zero balance.<br />

<br />

2. The undersigned will release the deed of trust described in this notice unless, within 90 days from the date this notice is mailed by certified mail or guaranteed overnight delivery service, the undersigned has received by certified mail or guaranteed overnight delivery service a notice stating that a release of the deed of trust has been recorded in the clerk’s office or that the obligation secured by the deed of trust described herein has not been paid, or the lien creditor or servicer otherwise objects to the release of the deed of trust. Notice shall be sent to the address stated on this form.<br />

<br />

(Name of settlement agent)<br />

<br />

(Signature of settlement agent or title insurance company)<br />

<br />

(Address of settlement agent or title insurance company)<br />

<br />

(Telephone number of settlement agent or title insurance company)<br />

<br />

(Virginia CRESPA registration number of settlement agent at the time the obligation was paid or confirmed to have a zero balance)<br />

<br />

2. Certificate of satisfaction and affidavit of settlement agent or title insurance company.<br />

<br />

a. If, within 90 days following the day on which the settlement agent or title insurance company mailed or delivered the notice of intent to release in accordance with this subsection, the lien creditor or servicer does not send by certified mail or guaranteed overnight delivery service to the settlement agent or title insurance company a notice stating that a release of the deed of trust has been recorded in the clerk’s office or that the obligation secured by the deed of trust has not been paid in full or that the lien creditor or servicer otherwise objects to the release of the deed of trust, the settlement agent or title insurance company may execute, acknowledge and file with the clerk of court of the jurisdiction wherein the deed of trust is recorded a certificate of satisfaction, which shall include (i) the affidavit described in subdivision 2 b of this subsection and (ii) a copy of the notice of intent to release that was sent to the lender, the servicer, or both. The certificate of satisfaction shall include the settlement agent’s CRESPA registration number, issued by the Virginia State Bar or the Virginia State Corporation Commission, that was in effect at the time the settlement agent paid the obligation secured by the deed of trust or obtained written confirmation from the lien creditor that such obligation has a zero balance. The certificate of satisfaction shall note that the individual executing the certificate of satisfaction is doing so pursuant to the authority granted by this subsection. After filing or recording the certificate of satisfaction, the settlement agent or title insurance company shall mail a copy of the certificate of satisfaction to the lien creditor or servicer. The validity of a certificate of satisfaction otherwise satisfying the requirements of this subsection shall not be affected by the inaccuracy of the CRESPA registration number placed thereon or the failure to mail a copy of the recorded certificate of satisfaction to the lien creditor or servicer and shall nevertheless release the deed of trust described therein as provided in this subsection.<br />

<br />

b. The certificate of satisfaction used by the settlement agent or title insurance company shall include an affidavit certifying (i) that the settlement agent has satisfied the obligation secured by the deed of trust described in the certificate; (ii) that the settlement agent or title insurance company possesses satisfactory evidence of payment of the obligation secured by the deed of trust described in the certificate or written confirmation from the lien creditor that such obligation has a zero balance; (iii) that the lien of the deed of trust may be released; (iv) that the person executing the certificate is the settlement agent, the title insurance company, or is duly authorized to act on behalf of the settlement agent or title insurance company; and (v) that the notice of intent to release was delivered to the lien creditor or servicer and the settlement agent or title insurance company received evidence of receipt of such notice by the lien creditor or servicer. The affidavit shall be substantially in the following form:<br />

<br />

AFFIDAVIT OF SETTLEMENT AGENT OR TITLE INSURANCE COMPANY<br />

<br />

The undersigned hereby certifies that, in accordance with the provisions § 55-66.3 of the Code of Virginia of 1950, as amended and in force on the date hereof (the Code) (a) the undersigned is a settlement agent or title insurance company as defined in subsection D of § 55-66.3 of the Code or a duly authorized officer, director, member, partner or employee of such settlement agent or title insurance company; (b) the settlement agent has satisfied the obligation secured by the deed of trust; (c) the settlement agent or title insurance company possesses satisfactory evidence of the payment of the obligation secured by the deed of trust described in the certificate recorded herewith or written confirmation from the lien creditor that such obligation has a zero balance; (d) the settlement agent or title insurance company delivered to the lien creditor or servicer in the manner specified in subdivision E 1 of § 55-66.3 of the Code the notice of intent to release and possesses evidence of receipt of such notice by the lien creditor or servicer; and (e) the lien of the deed of trust is hereby released.<br />

<br />

________________________________________<br />

(Authorized signer)<br />

<br />

3. Effect of filing.<br />

<br />

When filed or recorded with the clerk’s office, a certificate of satisfaction that is executed and notarized as provided in this subsection, and accompanied by (i) the affidavit described in subdivision 2 b of this subsection, and (ii) a copy of the notice of intent to release that was sent to the lender, lien creditor or servicer shall operate as a release of the encumbrance described therein and, if the encumbrance is by deed of trust, as a reconveyance of the legal title as fully and effectively as if such certificate of satisfaction were a formal deed of release duly executed and recorded.<br />

<br />

4. Effect of wrongful or erroneous certificate; damages.<br />

<br />

a. The execution and filing or recording of a wrongful or erroneous certificate of satisfaction by a settlement agent or title insurance agent does not relieve the party obligated to repay the debt, or anyone succeeding to or assuming the responsibility of the obligated party as to the debt, from any liability for the debt or other obligations secured by the deed of trust that is the subject of the wrongful or erroneous certificate of satisfaction.<br />

<br />

b. A settlement agent or title insurance agent that wrongfully or erroneously executes and files or records a certificate of satisfaction is liable to the lien creditor for actual damages sustained due to the recording of a wrongful or erroneous certificate of satisfaction.<br />

<br />

c. The procedure authorized by this subsection for the release of a deed of trust shall constitute an optional method of accomplishing a release of a deed of trust secured by property in the Commonwealth. The nonuse of the procedure authorized by this subsection for the release of a deed of trust shall not give rise to any liability or any cause of action whatsoever against a settlement agent or any title insurance company by any obligated party or anyone succeeding to or assuming the interest of the obligated party.<br />

<br />

5. Applicability.<br />

<br />

a. The procedure authorized by this subsection for the release of a deed of trust may be used to effect the release of a deed of trust after July 1, 2002, regardless of when the deed of trust was created, assigned or satisfied by payment made by the settlement agent.<br />

<br />

b. This subsection applies only to transactions involving the purchase of or lending on the security of real estate located in the Commonwealth that is either (i) unimproved real estate with a lien to be released of $1 million or less or (ii) real estate containing at least one but not more than four residential dwelling units.<br />

<br />

c. The procedure authorized by this subsection applies only to the full and complete release of a deed of trust. Nothing in this subsection shall be construed to authorize the partial release of property from a deed of trust or otherwise permit the execution or recordation of a certificate of partial satisfaction.<br />

<br />

§ 55-66.4. Partial satisfaction or release.<br />

<br />

It shall be lawful for any such lienor to make a marginal release or record a certificate of partial satisfaction of any one or more of the separate pieces or parcels of property covered by such lien. It shall also be lawful for any such lienor to make a marginal release or record a certificate of partial satisfaction of any part of the real estate covered by such lien if a plat of such part or a deed of such part is recorded in the clerk’s office and a cross reference is made in the marginal release or certificate of partial satisfaction to the book and page where the plat or deed of such part is recorded. Such marginal partial release or satisfaction or certificate of partial satisfaction may be accomplished in manner and form hereinbefore in this chapter provided for making marginal releases or certificates of satisfaction, except that the creditor, or his duly authorized agent, shall make an affidavit to the clerk or in such certificate that such creditor is at the time of making such release the legal holder of the obligation, note, bond or other evidence of debt, secured by such lien, and when made in conformity therewith and as provided herein such partial satisfaction or release shall be as valid and binding as a proper release deed duly executed for the same purpose.<br />

<br />

Any and all partial marginal releases made prior to July 1, 1966, in any county or city of this Commonwealth, in conformity with the provisions of this chapter, either of one or more separate pieces or parcels of real estate or any part of the real estate covered by such lien, or as to one or more of the obligations secured by any such lien, or as to all of the real estate covered by such lien instrument, are hereby validated and declared to be binding upon all parties in interest; but this provision shall not be construed as intended to disturb or impair any vested right.