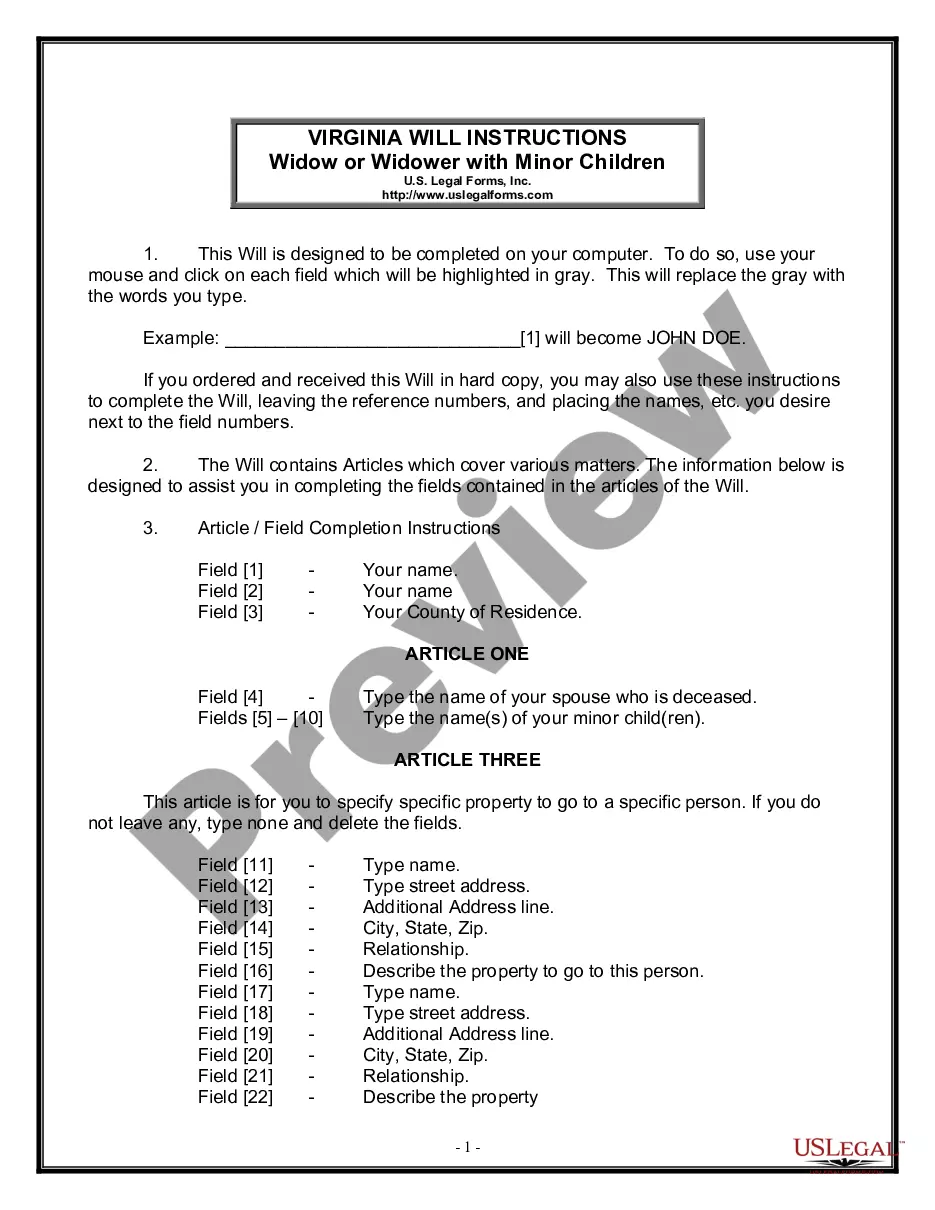

The Legal Last Will and Testament Form with Instructions you have found, is for a widow or widower with minor children. It provides for the appointment of a personal representative or executor, designation of who will receive your property and other provisions. It also provides for the appointment of a trustee for assets left to the minor children.

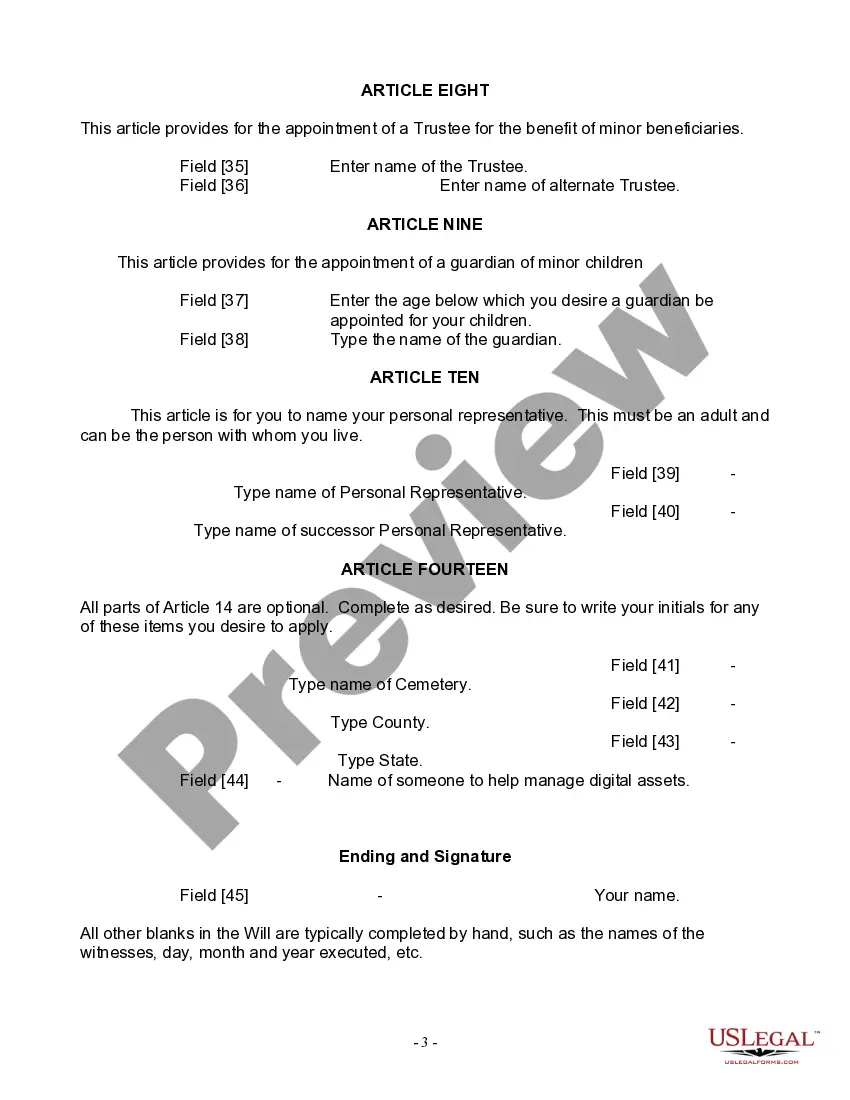

This Will must be signed in the presence of two witnesses, not related to you or named in your Will. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the Will.

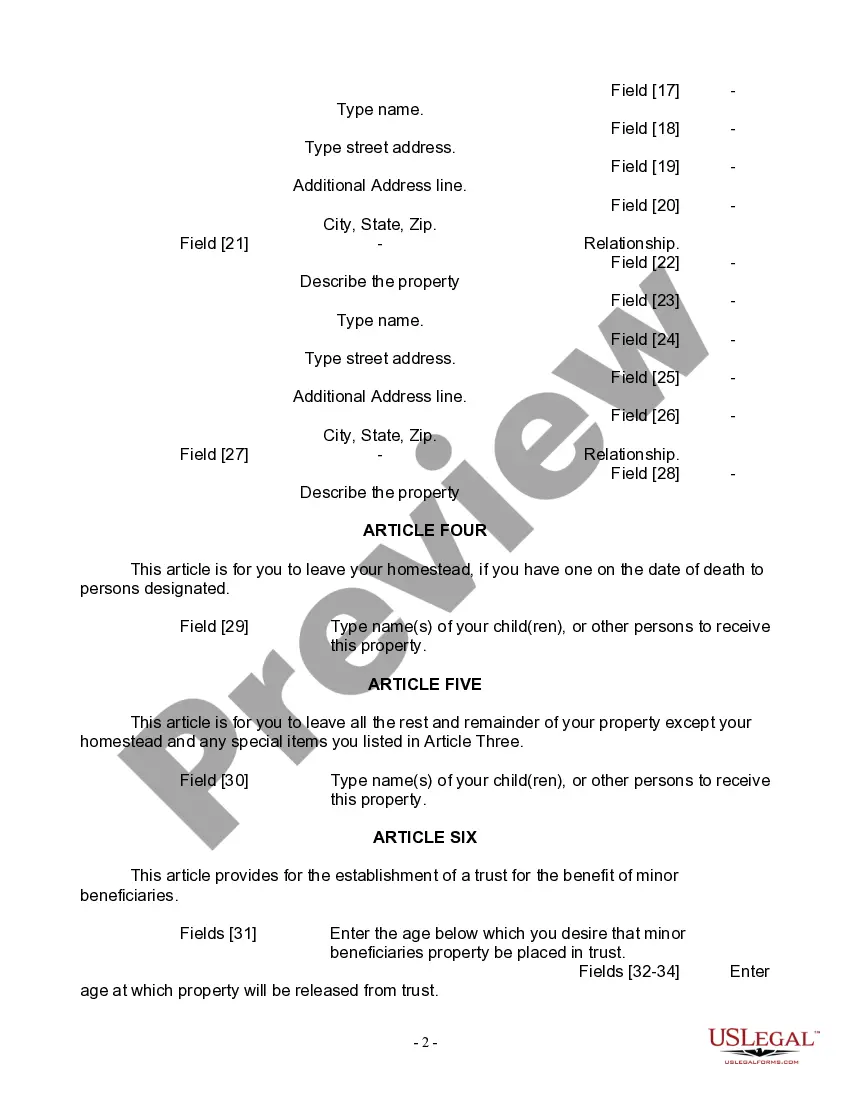

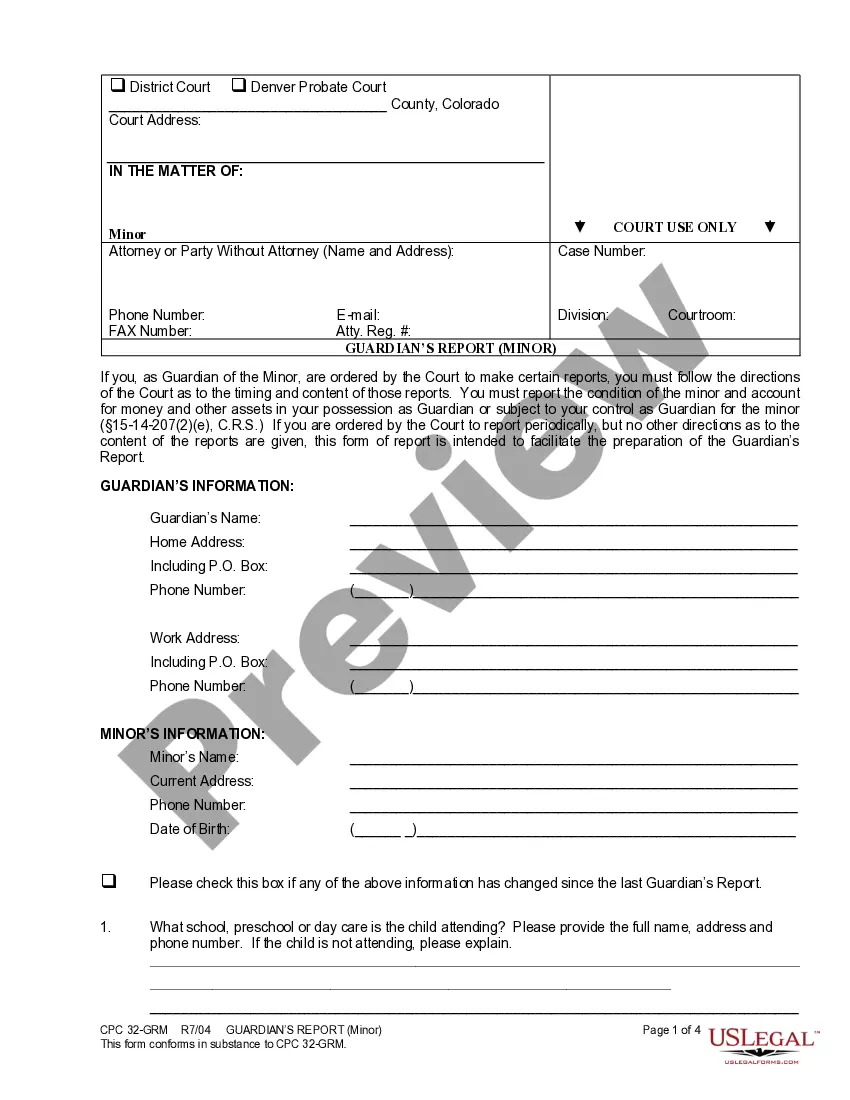

Fairfax Virginia Legal Last Will and Testament Form for Widow or Widower with Minor Children is a legally binding document that allows a widow or widower residing in Fairfax, Virginia, to outline their final wishes regarding the distribution of their assets and the care and guardianship of their minor children after their demise. This comprehensive legal form ensures that all necessary provisions are made to protect the interests of the widow or widower and their children. The Fairfax Virginia Legal Last Will and Testament Form for Widow or Widower with Minor Children addresses various aspects that may arise in such a situation. It includes provisions for naming a personal representative, also known as an executor, who will be responsible for administering the estate and ensuring that the instructions specified in the will are carried out. Furthermore, it enables the widow or widower to appoint a guardian for their minor children. This critical decision ensures that the children will be cared for by a trusted individual who will provide love, support, and guidance in the absence of the parent. Additionally, the form provides an opportunity to outline the specific distribution of assets among beneficiaries. It allows the widow or widower to specify who will inherit their property, assets, personal belongings, financial accounts, and investments. By explicitly stating their intentions, the testator can help prevent potential conflicts and ensure that their assets are distributed according to their wishes. There may be variations of the Fairfax Virginia Legal Last Will and Testament Form for Widow or Widower with Minor Children, tailored to different individual circumstances. Some potential variations include: 1. Fairfax Virginia Legal Last Will and Testament Form for Widow or Widower with Sole Custody: This version is appropriate for those in sole custody of their minor children. It allows the testator to appoint a guardian for the children in case of their demise since there is no co-parent involved. 2. Fairfax Virginia Legal Last Will and Testament Form for Widow or Widower in a Blended Family: This variation is suitable for individuals who have entered into a second marriage or have stepchildren. It allows the testator to address the specific complexities of a blended family, ensuring fair distribution of assets and outlining guardianship arrangements for both biological and stepchildren. 3. Fairfax Virginia Legal Last Will and Testament Form for Widow or Widower with Special Needs Children: This specific form takes into account the unique circumstances of having minor children with special needs. It provides an opportunity to appoint a guardian who has the necessary knowledge and understanding to care for children with disabilities or special requirements. Overall, the Fairfax Virginia Legal Last Will and Testament Form for Widow or Widower with Minor Children is a crucial document for individuals residing in Fairfax, Virginia, who want to safeguard their children's well-being and ensure their assets are distributed according to their wishes upon their passing.