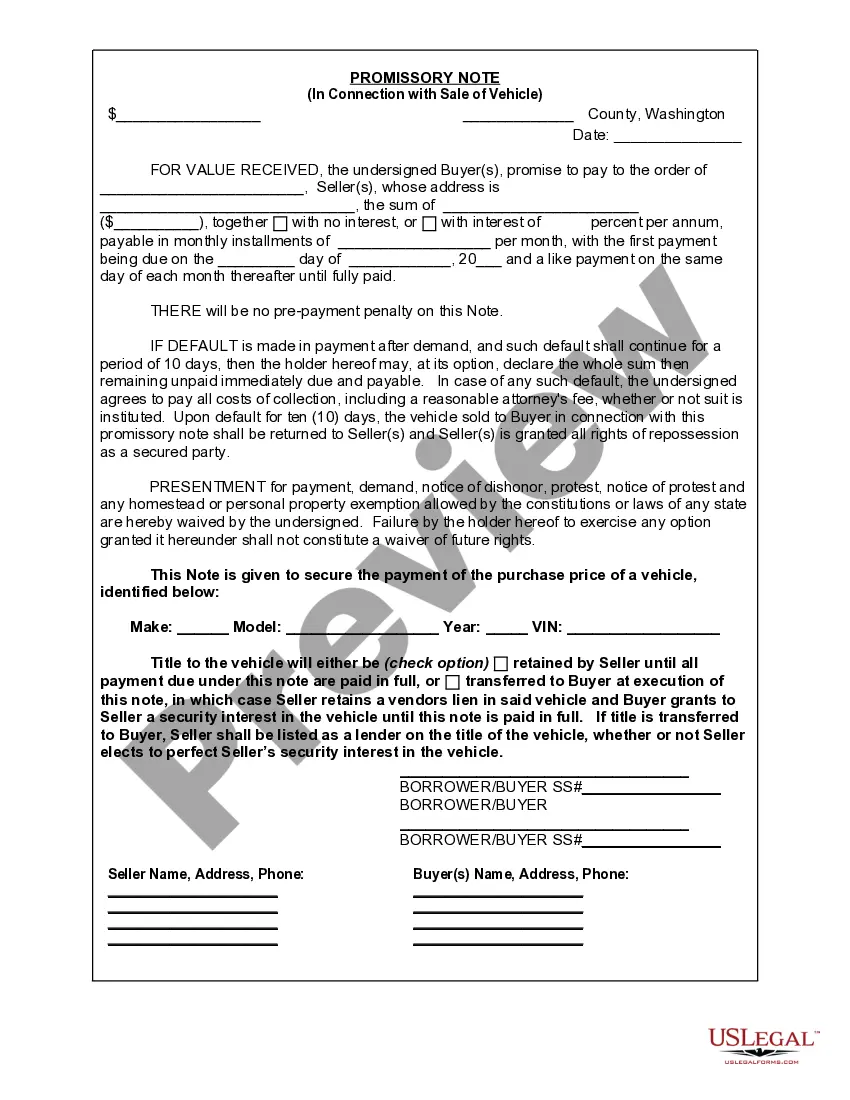

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legally binding document that outlines the terms and conditions for a loan transaction between a lender and a borrower. In the context of vehicle sales, an Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile is a specific type of promissory note used in the state of Washington, particularly in Everett, to facilitate the sale of vehicles. This note serves as evidence of the borrower's promise to repay the loan amount to the lender, covering the purchase price of the vehicle. The Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile typically includes details such as the names and contact information of both the lender and borrower, the date of the agreement, a description of the vehicle being sold (make, model, year, VIN), and the agreed-upon purchase price. Moreover, the note outlines the loan terms, including the interest rate, payment schedule, method of repayment, and any possible late fees or penalties. There are several types of Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile that may be used, depending on the nature of the transaction: 1. Simple Promissory Note: This type of promissory note is the basic agreement between the lender and borrower, outlining only the essential terms of the loan, such as the principal amount, interest rate, and repayment schedule. 2. Secured Promissory Note: In some instances, the lender may require the borrower to provide collateral, such as the vehicle itself, to secure the loan. This type of note includes additional provisions related to the collateral, including the lender's right to repossess the vehicle in case of default. 3. Installment Promissory Note: This variant of the promissory note stipulates that the loan will be repaid in regular installments, typically monthly, until the full amount is repaid. The note specifies the number of installments, the amount due per installment, and their respective due dates. 4. Balloon Promissory Note: In this type of note, the borrower initially makes smaller monthly payments and, at the end of the loan term, is required to repay the outstanding balance in a lump sum. This format is useful for borrowers who believe that their financial circumstances will improve over time. It is important to note that drafting a legally binding Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile requires expertise in contract law and compliance with relevant state regulations. Legal advice or assistance from professionals experienced in loan agreements is highly recommended ensuring the accuracy and enforceability of the note.A promissory note is a legally binding document that outlines the terms and conditions for a loan transaction between a lender and a borrower. In the context of vehicle sales, an Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile is a specific type of promissory note used in the state of Washington, particularly in Everett, to facilitate the sale of vehicles. This note serves as evidence of the borrower's promise to repay the loan amount to the lender, covering the purchase price of the vehicle. The Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile typically includes details such as the names and contact information of both the lender and borrower, the date of the agreement, a description of the vehicle being sold (make, model, year, VIN), and the agreed-upon purchase price. Moreover, the note outlines the loan terms, including the interest rate, payment schedule, method of repayment, and any possible late fees or penalties. There are several types of Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile that may be used, depending on the nature of the transaction: 1. Simple Promissory Note: This type of promissory note is the basic agreement between the lender and borrower, outlining only the essential terms of the loan, such as the principal amount, interest rate, and repayment schedule. 2. Secured Promissory Note: In some instances, the lender may require the borrower to provide collateral, such as the vehicle itself, to secure the loan. This type of note includes additional provisions related to the collateral, including the lender's right to repossess the vehicle in case of default. 3. Installment Promissory Note: This variant of the promissory note stipulates that the loan will be repaid in regular installments, typically monthly, until the full amount is repaid. The note specifies the number of installments, the amount due per installment, and their respective due dates. 4. Balloon Promissory Note: In this type of note, the borrower initially makes smaller monthly payments and, at the end of the loan term, is required to repay the outstanding balance in a lump sum. This format is useful for borrowers who believe that their financial circumstances will improve over time. It is important to note that drafting a legally binding Everett Washington Promissory Note in Connection with Sale of Vehicle or Automobile requires expertise in contract law and compliance with relevant state regulations. Legal advice or assistance from professionals experienced in loan agreements is highly recommended ensuring the accuracy and enforceability of the note.