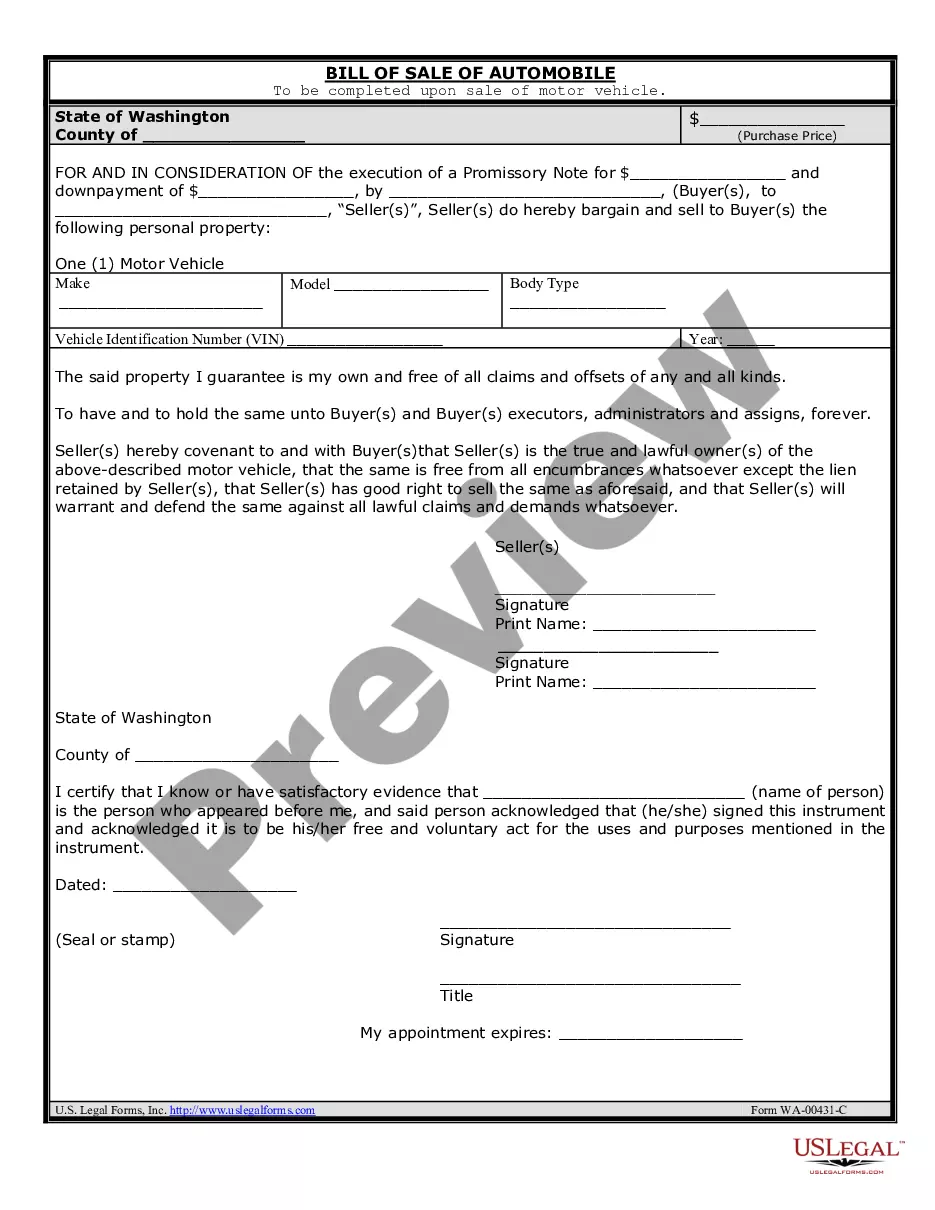

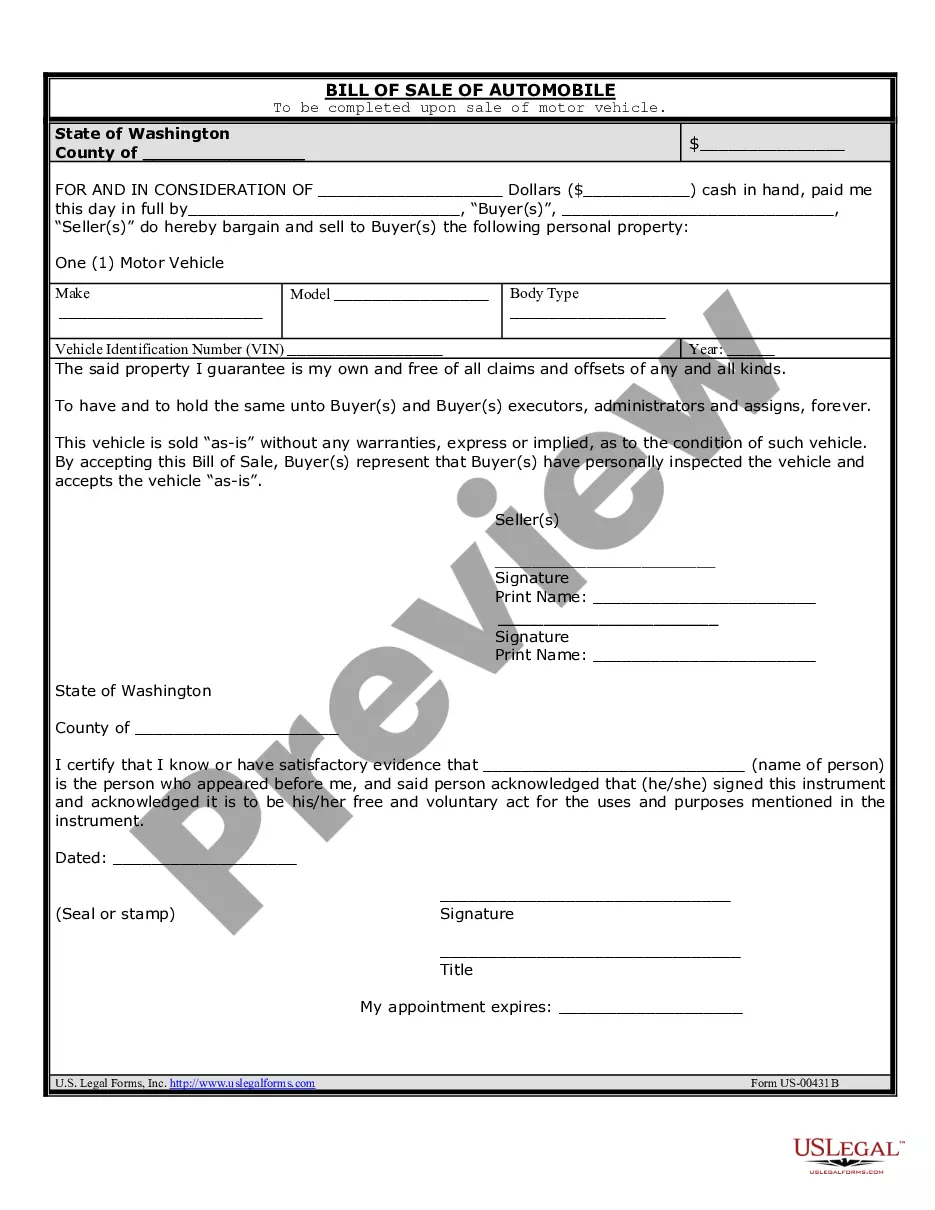

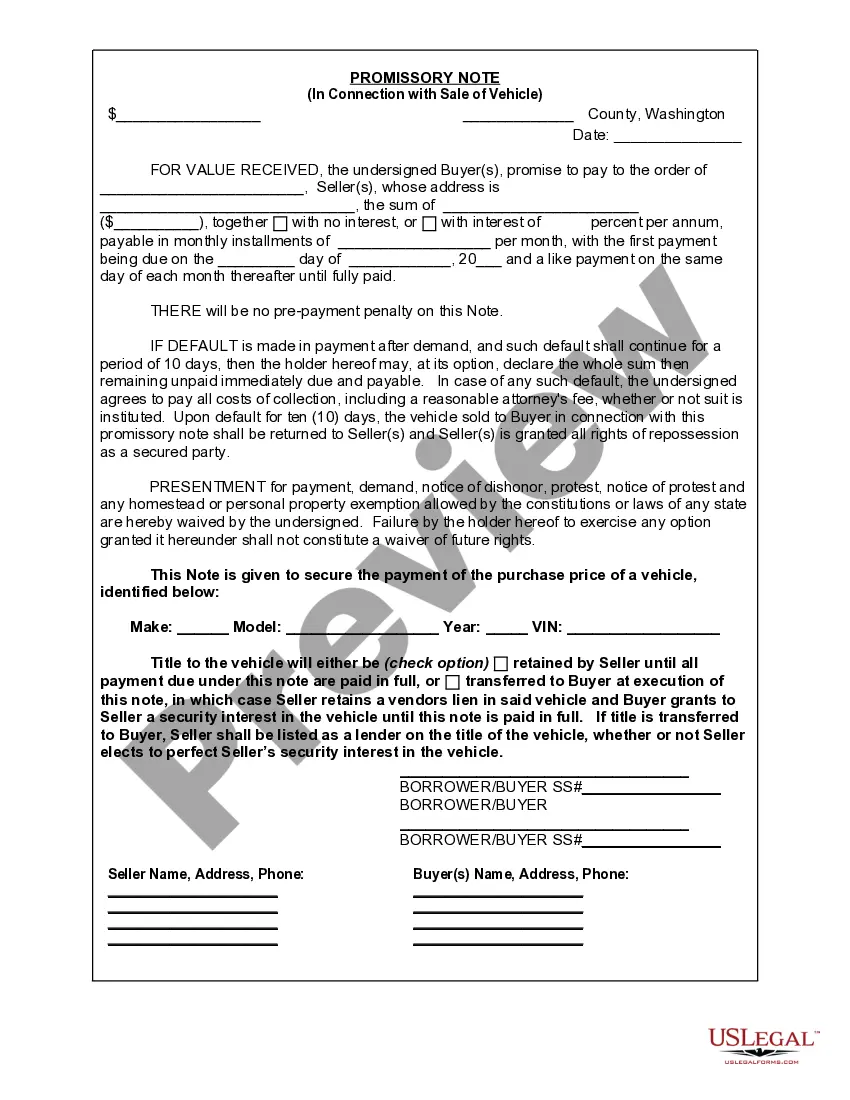

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Seattle Washington promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financial agreement between a buyer and a seller. This note is specifically designed to facilitate the sale of a vehicle while allowing the buyer to repay the purchase amount over a predetermined period of time. The promissory note serves as a written agreement that provides a detailed description of the vehicle being sold, including its make, model, year, and identification number. It also contains the names and contact information of both the buyer and the seller, ensuring that each party is identified within the document. Furthermore, the promissory note in connection with the sale of a vehicle includes vital financial information such as the purchase price, the down payment amount (if any), and the installment terms. These installment terms typically outline the repayment schedule, including the frequency and amount of payments, the interest rate (if applicable), and any late payment penalties or grace periods. It is important to note that Seattle Washington may have various types of promissory notes specific to vehicle or automobile sales. These different types may include: 1. Simple Promissory Note: This is the most common type of promissory note, which outlines the basic terms and conditions of the repayment agreement between the buyer and the seller. 2. Secured Promissory Note: This type of promissory note includes an added layer of security for the seller. It allows the seller to claim ownership of the vehicle if the buyer defaults on their payment obligations. 3. Balloon Payment Promissory Note: In this scenario, the buyer agrees to make fixed installment payments over a specified period. However, the final payment (the balloon payment) is significantly higher than the previous installments, allowing the buyer to pay the remaining balance in one lump sum. 4. Installment Promissory Note: This type of note breaks down the purchase price into equal installments over a predetermined period. Each installment consists of both principal and interest, allowing the buyer to repay the amount in incremental payments. By using relevant keywords such as "Seattle Washington promissory note," "vehicle sale," and "automobile," this description highlights the key aspects and types of promissory notes associated with the sale of a vehicle in Seattle Washington.A Seattle Washington promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financial agreement between a buyer and a seller. This note is specifically designed to facilitate the sale of a vehicle while allowing the buyer to repay the purchase amount over a predetermined period of time. The promissory note serves as a written agreement that provides a detailed description of the vehicle being sold, including its make, model, year, and identification number. It also contains the names and contact information of both the buyer and the seller, ensuring that each party is identified within the document. Furthermore, the promissory note in connection with the sale of a vehicle includes vital financial information such as the purchase price, the down payment amount (if any), and the installment terms. These installment terms typically outline the repayment schedule, including the frequency and amount of payments, the interest rate (if applicable), and any late payment penalties or grace periods. It is important to note that Seattle Washington may have various types of promissory notes specific to vehicle or automobile sales. These different types may include: 1. Simple Promissory Note: This is the most common type of promissory note, which outlines the basic terms and conditions of the repayment agreement between the buyer and the seller. 2. Secured Promissory Note: This type of promissory note includes an added layer of security for the seller. It allows the seller to claim ownership of the vehicle if the buyer defaults on their payment obligations. 3. Balloon Payment Promissory Note: In this scenario, the buyer agrees to make fixed installment payments over a specified period. However, the final payment (the balloon payment) is significantly higher than the previous installments, allowing the buyer to pay the remaining balance in one lump sum. 4. Installment Promissory Note: This type of note breaks down the purchase price into equal installments over a predetermined period. Each installment consists of both principal and interest, allowing the buyer to repay the amount in incremental payments. By using relevant keywords such as "Seattle Washington promissory note," "vehicle sale," and "automobile," this description highlights the key aspects and types of promissory notes associated with the sale of a vehicle in Seattle Washington.