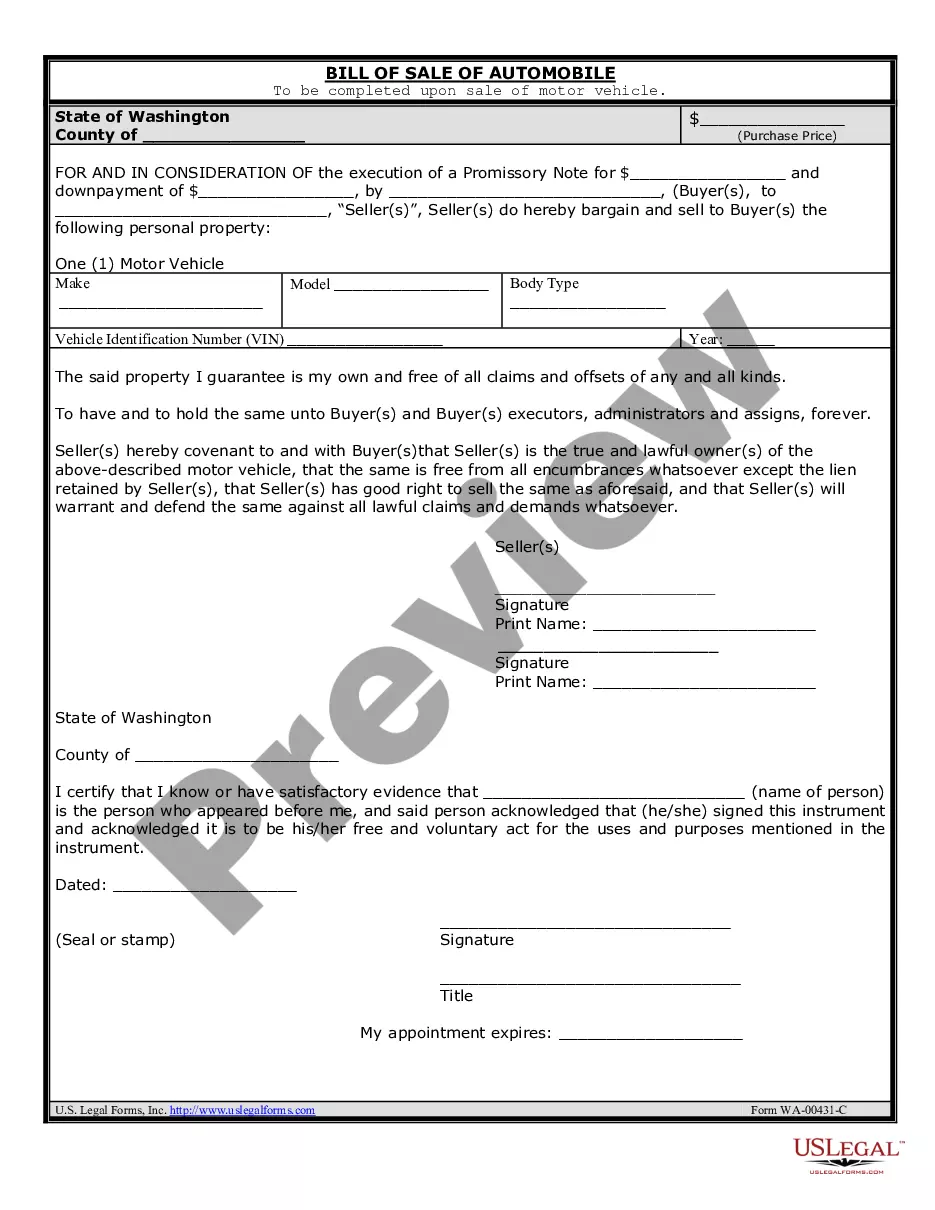

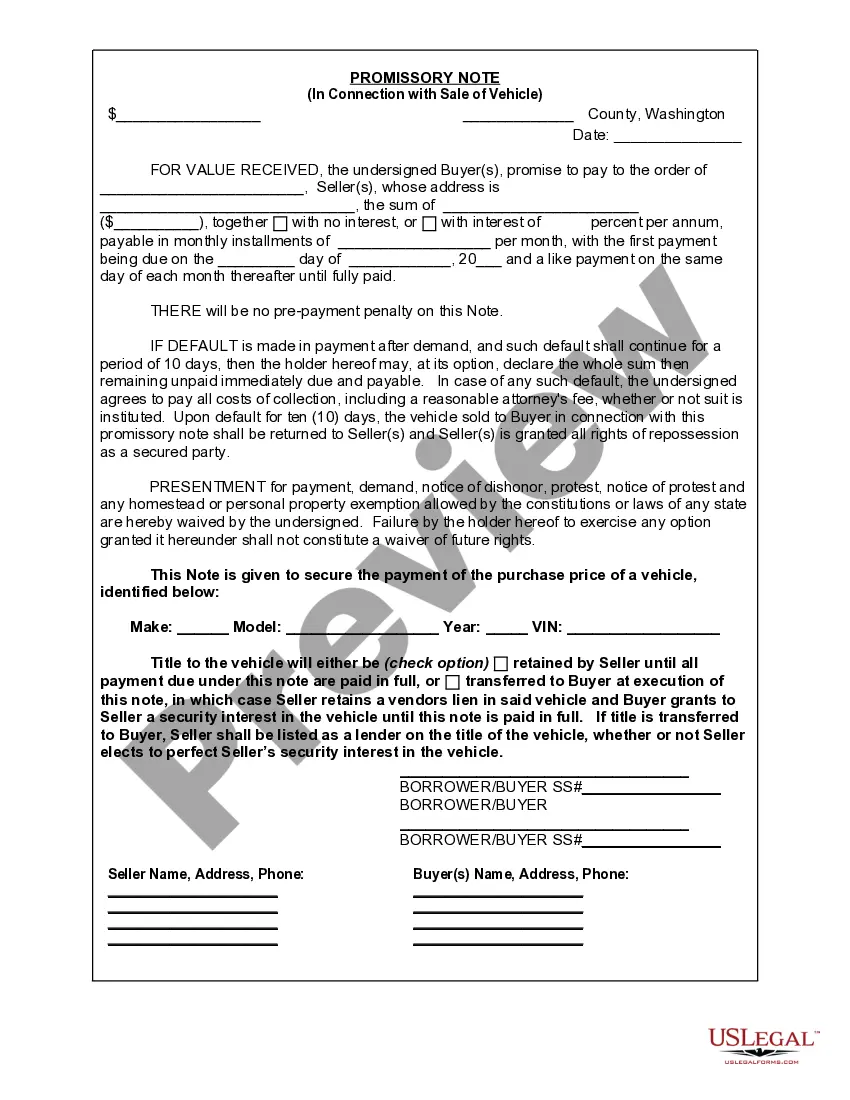

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

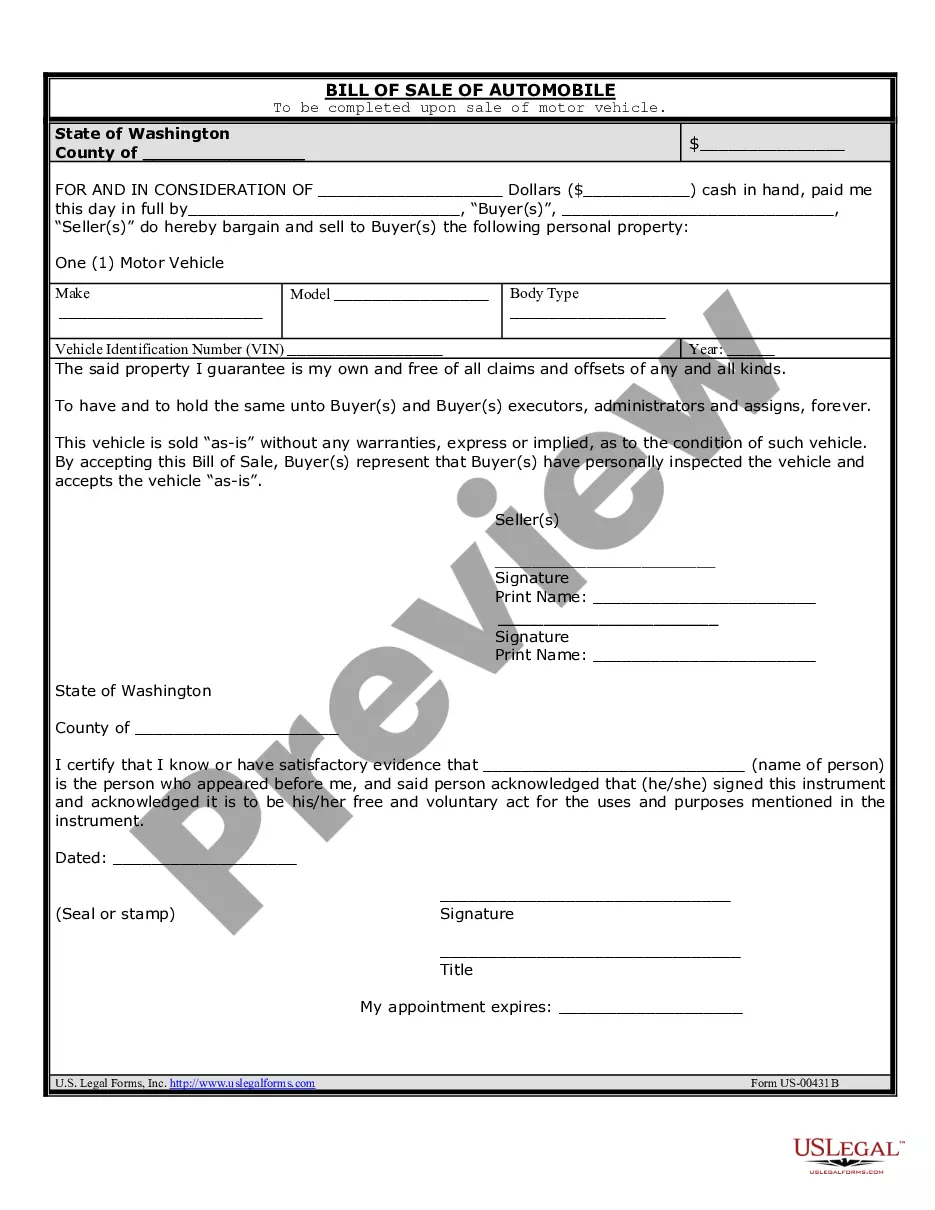

A Tacoma Washington Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a buyer promising to repay the seller for a vehicle purchase in installments. Keywords: Tacoma Washington, promissory note, sale of vehicle, automobile, types of, terms and conditions, buyer, seller, repay, installments. There are two primary types of promissory notes related to the sale of a vehicle in Tacoma, Washington: 1. Simple Promissory Note: A simple promissory note is the most common type of promissory note used in vehicle sales. It details the terms of the sale, such as the purchase price, down payment, interest rate, repayment schedule, and consequences of default. This document is signed by both the buyer and the seller, creating a legally binding agreement for the payment of the vehicle. 2. Secured Promissory Note: A secured promissory note adds a layer of security for the seller. In this type of note, the buyer pledges collateral, usually the vehicle being purchased, which can be repossessed by the seller if the buyer fails to make payments as agreed. This provides the seller with added protection in case of default. In a Tacoma Washington Promissory Note in Connection with the Sale of a Vehicle or Automobile, several key details should be included: 1. Parties Involved: The full legal names and addresses of both the buyer and the seller should be clearly stated. 2. Vehicle Description: Accurate identification of the vehicle being sold, including make, model, year, and Vehicle Identification Number (VIN). 3. Purchase Price: The total purchase price of the vehicle, including any taxes and fees, should be clearly stated. 4. Payment Terms: The repayment schedule, including the amount of down payment, the number of installments, and the due date for each payment, should be clearly outlined. 5. Interest Rate: If applicable, the interest rate charged on the outstanding balance should be specified. This helps determine the total cost of the vehicle if payments are made over an extended period. 6. Default and Repossession: The consequences of default and the conditions under which the seller can repossess the vehicle should be clearly defined. 7. Governing Law: In Tacoma, Washington, the governing law for promissory notes may be specified, ensuring that any legal disputes are resolved accordingly. It is crucial to consult with an attorney to ensure that the Tacoma Washington Promissory Note in Connection with the Sale of a Vehicle or Automobile complies with all state laws and meets the specific needs of the buyer and seller.A Tacoma Washington Promissory Note in Connection with the Sale of a Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a buyer promising to repay the seller for a vehicle purchase in installments. Keywords: Tacoma Washington, promissory note, sale of vehicle, automobile, types of, terms and conditions, buyer, seller, repay, installments. There are two primary types of promissory notes related to the sale of a vehicle in Tacoma, Washington: 1. Simple Promissory Note: A simple promissory note is the most common type of promissory note used in vehicle sales. It details the terms of the sale, such as the purchase price, down payment, interest rate, repayment schedule, and consequences of default. This document is signed by both the buyer and the seller, creating a legally binding agreement for the payment of the vehicle. 2. Secured Promissory Note: A secured promissory note adds a layer of security for the seller. In this type of note, the buyer pledges collateral, usually the vehicle being purchased, which can be repossessed by the seller if the buyer fails to make payments as agreed. This provides the seller with added protection in case of default. In a Tacoma Washington Promissory Note in Connection with the Sale of a Vehicle or Automobile, several key details should be included: 1. Parties Involved: The full legal names and addresses of both the buyer and the seller should be clearly stated. 2. Vehicle Description: Accurate identification of the vehicle being sold, including make, model, year, and Vehicle Identification Number (VIN). 3. Purchase Price: The total purchase price of the vehicle, including any taxes and fees, should be clearly stated. 4. Payment Terms: The repayment schedule, including the amount of down payment, the number of installments, and the due date for each payment, should be clearly outlined. 5. Interest Rate: If applicable, the interest rate charged on the outstanding balance should be specified. This helps determine the total cost of the vehicle if payments are made over an extended period. 6. Default and Repossession: The consequences of default and the conditions under which the seller can repossess the vehicle should be clearly defined. 7. Governing Law: In Tacoma, Washington, the governing law for promissory notes may be specified, ensuring that any legal disputes are resolved accordingly. It is crucial to consult with an attorney to ensure that the Tacoma Washington Promissory Note in Connection with the Sale of a Vehicle or Automobile complies with all state laws and meets the specific needs of the buyer and seller.