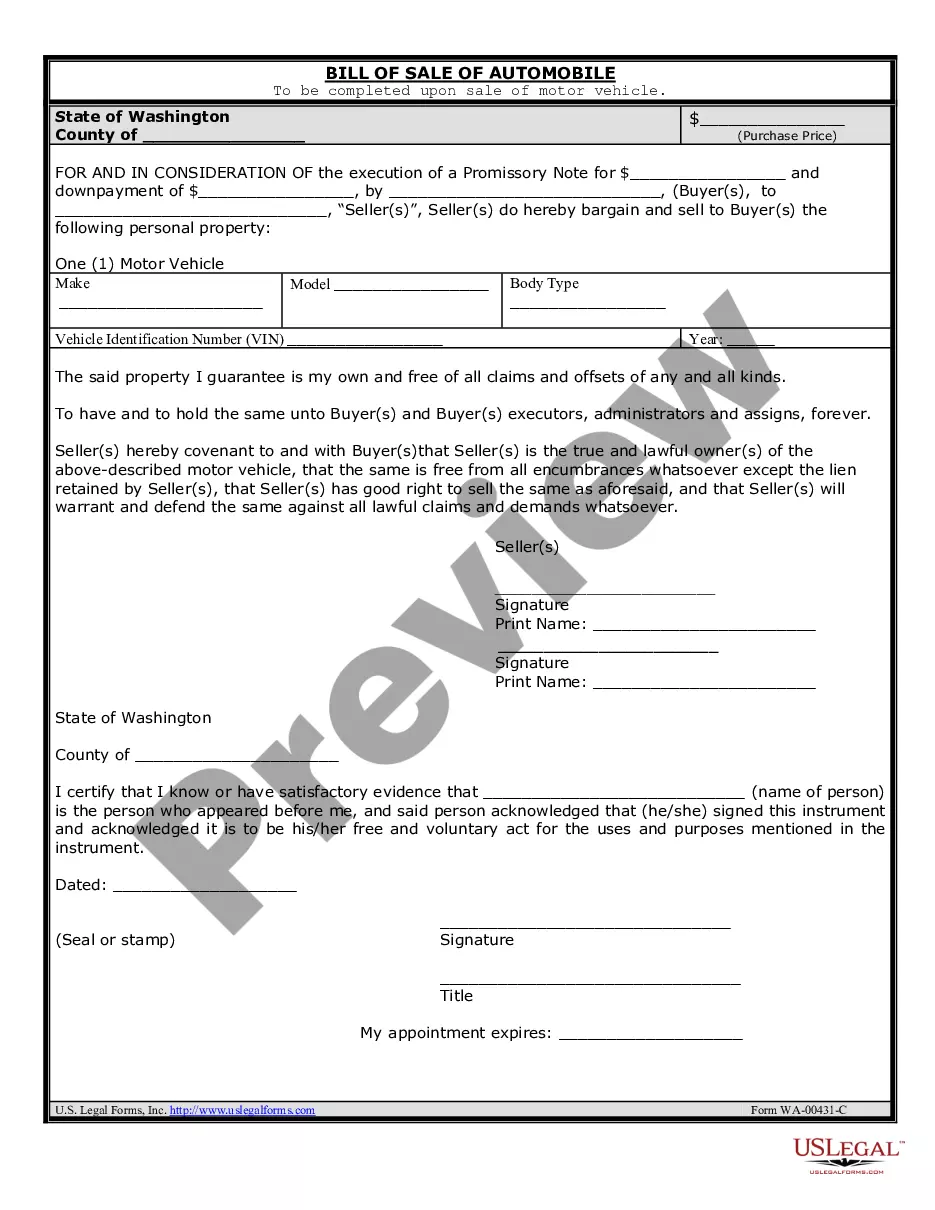

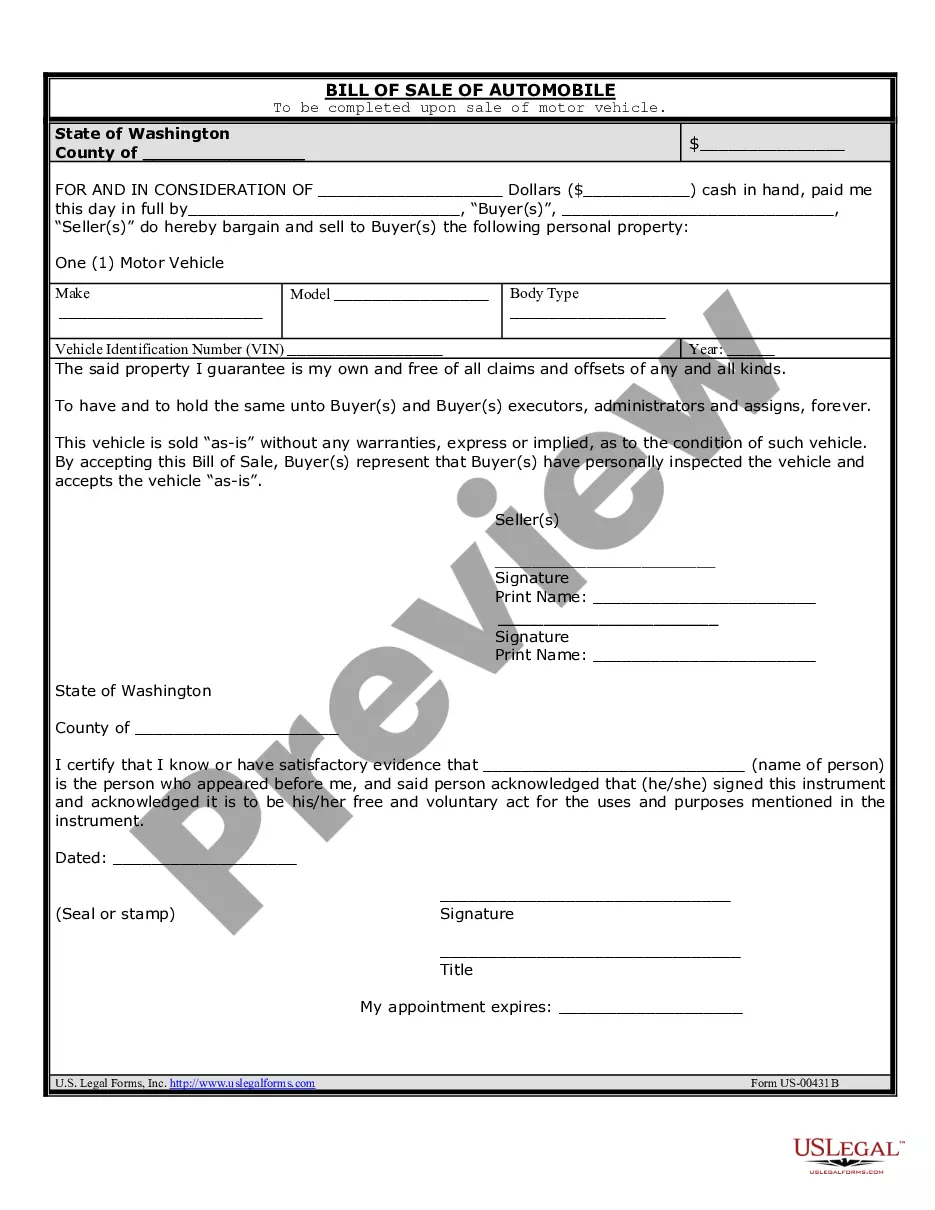

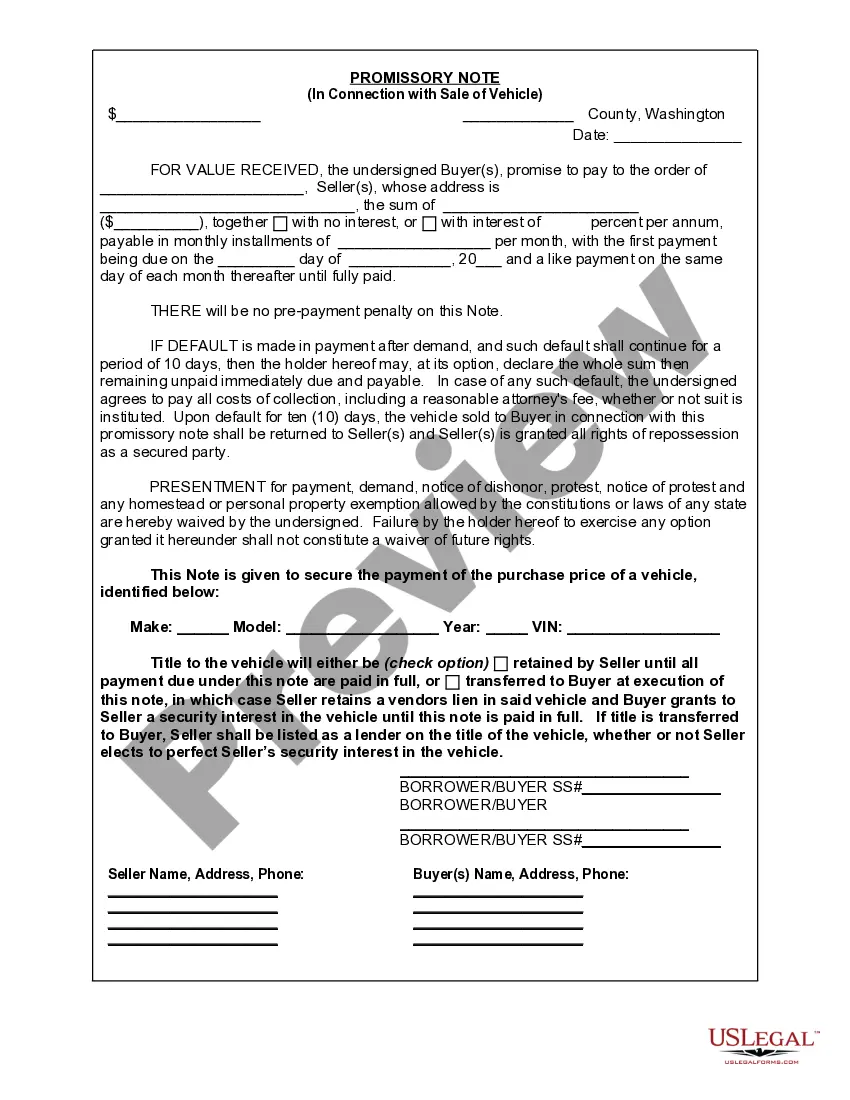

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Vancouver Washington Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a payment agreement between the buyer and seller. It serves as evidence of the loan and records the promise to repay the loan amount along with any accrued interest within a specified period. This type of promissory note is commonly used in private vehicle sales, where the buyer needs financial assistance from the seller to complete the purchase. By signing the promissory note, both parties agree to the terms of the loan, including the repayment schedule, interest rate, and any additional conditions. Key components of a Vancouver Washington Promissory Note in connection with the sale of a vehicle or automobile include: 1. Parties and Vehicle Information: The note should clearly identify the buyer and seller, along with their contact information. It should also include details about the vehicle being sold, such as make, model, year, and Vehicle Identification Number (VIN). 2. Loan Amount and Interest Rate: The promissory note should state the total loan amount borrowed by the buyer from the seller. Additionally, the interest rate (if any) that the buyer agrees to pay on the loan should be clearly specified. 3. Repayment Schedule: The note should outline the repayment schedule, indicating the agreed-upon frequency of payments (e.g., monthly, bi-weekly), the due date of each payment, and the total number of payments required. 4. Late Payment Penalties: It's crucial to include provisions concerning late payments. These may involve specifying the grace period, penalties for late payments (e.g., a fixed fee or percentage of the outstanding balance), or any other consequences for defaulting on the loan. 5. Collateral and Security Interest: If the buyer fails to make timely payments, the promissory note may provide details on the collateral that the seller can seize to fulfill the outstanding debt. Often, the collateral is the vehicle being sold. 6. Governing Law and Venue: It's important to specify that the promissory note is governed by the laws of Vancouver, Washington. The note should also mention the county or court where any disputes will be resolved. 7. Signatures and Witnesses: Both the buyer and seller must sign the promissory note to make it legally binding. It may be wise to have witnesses present during the signing process to strengthen the document's legitimacy. Different types of Vancouver Washington Promissory Notes in connection with the sale of a vehicle or automobile may differentiate based on their specific terms, conditions, or clauses. However, the core elements mentioned above generally apply to all such promissory notes.A Vancouver Washington Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a payment agreement between the buyer and seller. It serves as evidence of the loan and records the promise to repay the loan amount along with any accrued interest within a specified period. This type of promissory note is commonly used in private vehicle sales, where the buyer needs financial assistance from the seller to complete the purchase. By signing the promissory note, both parties agree to the terms of the loan, including the repayment schedule, interest rate, and any additional conditions. Key components of a Vancouver Washington Promissory Note in connection with the sale of a vehicle or automobile include: 1. Parties and Vehicle Information: The note should clearly identify the buyer and seller, along with their contact information. It should also include details about the vehicle being sold, such as make, model, year, and Vehicle Identification Number (VIN). 2. Loan Amount and Interest Rate: The promissory note should state the total loan amount borrowed by the buyer from the seller. Additionally, the interest rate (if any) that the buyer agrees to pay on the loan should be clearly specified. 3. Repayment Schedule: The note should outline the repayment schedule, indicating the agreed-upon frequency of payments (e.g., monthly, bi-weekly), the due date of each payment, and the total number of payments required. 4. Late Payment Penalties: It's crucial to include provisions concerning late payments. These may involve specifying the grace period, penalties for late payments (e.g., a fixed fee or percentage of the outstanding balance), or any other consequences for defaulting on the loan. 5. Collateral and Security Interest: If the buyer fails to make timely payments, the promissory note may provide details on the collateral that the seller can seize to fulfill the outstanding debt. Often, the collateral is the vehicle being sold. 6. Governing Law and Venue: It's important to specify that the promissory note is governed by the laws of Vancouver, Washington. The note should also mention the county or court where any disputes will be resolved. 7. Signatures and Witnesses: Both the buyer and seller must sign the promissory note to make it legally binding. It may be wise to have witnesses present during the signing process to strengthen the document's legitimacy. Different types of Vancouver Washington Promissory Notes in connection with the sale of a vehicle or automobile may differentiate based on their specific terms, conditions, or clauses. However, the core elements mentioned above generally apply to all such promissory notes.