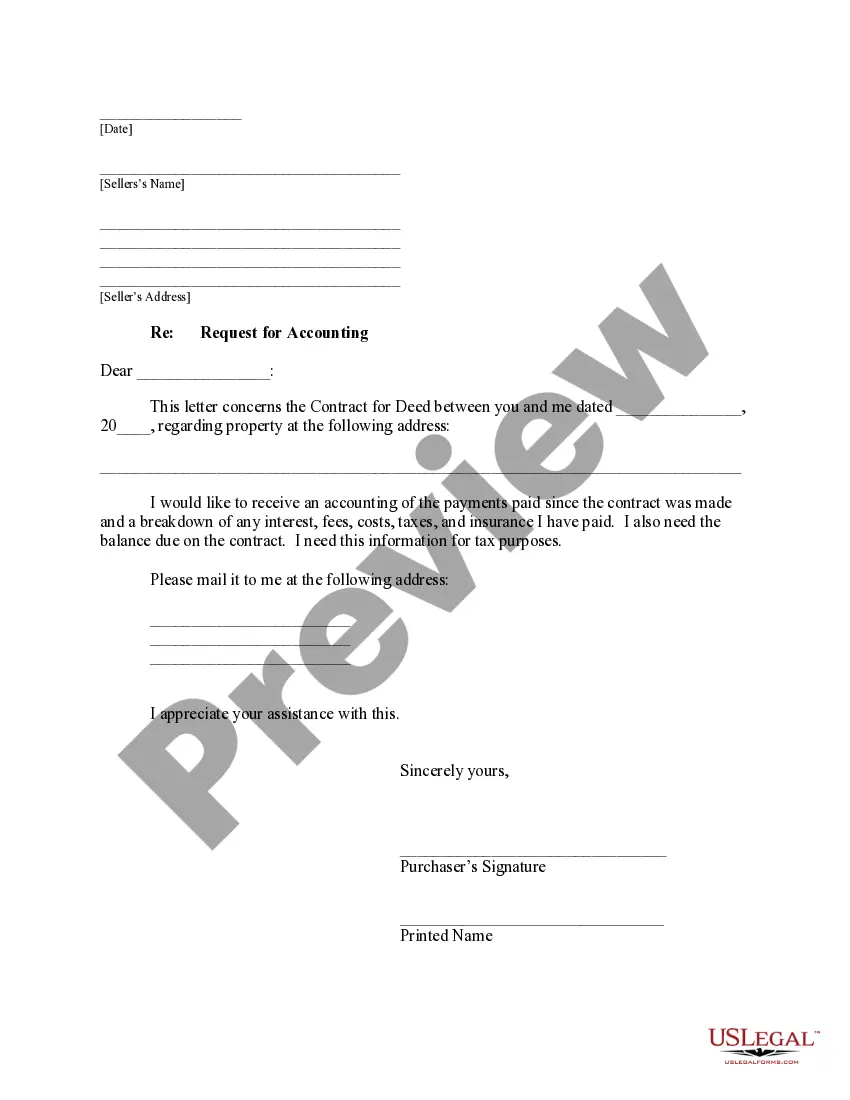

This is a Purchaser's Request of Accounting Statement from Seller. It is a request in writing to receive an accounting of the payments paid since the contract was made and a breakdown of any interest, fees, costs, taxes and insurance paid. It is also a request for the balance due on the contract.

Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed is a legal document initiated by the buyer to request a detailed accounting of financial transactions related to a property purchased under a contract for deed arrangement. This request aims to ensure transparency and clarity regarding payments made, disbursements, and other relevant financial matters. Under the Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed, the buyer seeks a comprehensive breakdown of all financial transactions associated with the property. The document may include the following key details: 1. Purchase Price: The buyer requests a breakdown of the total purchase price, including any down payment made and principal balance remaining. 2. Payment History: The buyer seeks a detailed record of all payments made towards the property, including dates, amounts, and specific accounts credited. 3. Interest Calculation: If interest is being charged on the contract for deed, the buyer requests a transparent calculation method used to determine the amount of interest applied to each payment. 4. Principal Reduction: The buyer may inquire about the reduction of the principal balance and how it has been reflected in the accounting statements. 5. Special Assessments or Taxes: Any additional charges or assessments related to the property, such as property taxes or special levies, should be clearly outlined and explained. 6. Application of Payments: The buyer requests information on how payments have been applied, whether they were credited to principal, interest, or any other specific account. 7. Escrow Account Statements: If an escrow account is utilized for property-related expenses, the buyer may ask for statements detailing how funds in this account have been used. 8. Documentation of Expenses: The buyer may seek specific documentation for expenses related to the property, such as repairs, maintenance, or insurance premiums, to validate their inclusion in the accounting statements. Different types of Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed may vary based on the specific requirements of the buyer or the complexities involved in the property transaction. For example, a buyer may request more detailed documentation on property-related expenses or specific calculations of interest. In conclusion, the Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed is a legal instrument enabling the buyer to obtain a comprehensive understanding of the financial aspects associated with the purchase of a property under a contract for deed arrangement. By requesting this accounting, the buyer aims to ensure transparency, accuracy, and accountability throughout the transaction process.Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed is a legal document initiated by the buyer to request a detailed accounting of financial transactions related to a property purchased under a contract for deed arrangement. This request aims to ensure transparency and clarity regarding payments made, disbursements, and other relevant financial matters. Under the Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed, the buyer seeks a comprehensive breakdown of all financial transactions associated with the property. The document may include the following key details: 1. Purchase Price: The buyer requests a breakdown of the total purchase price, including any down payment made and principal balance remaining. 2. Payment History: The buyer seeks a detailed record of all payments made towards the property, including dates, amounts, and specific accounts credited. 3. Interest Calculation: If interest is being charged on the contract for deed, the buyer requests a transparent calculation method used to determine the amount of interest applied to each payment. 4. Principal Reduction: The buyer may inquire about the reduction of the principal balance and how it has been reflected in the accounting statements. 5. Special Assessments or Taxes: Any additional charges or assessments related to the property, such as property taxes or special levies, should be clearly outlined and explained. 6. Application of Payments: The buyer requests information on how payments have been applied, whether they were credited to principal, interest, or any other specific account. 7. Escrow Account Statements: If an escrow account is utilized for property-related expenses, the buyer may ask for statements detailing how funds in this account have been used. 8. Documentation of Expenses: The buyer may seek specific documentation for expenses related to the property, such as repairs, maintenance, or insurance premiums, to validate their inclusion in the accounting statements. Different types of Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed may vary based on the specific requirements of the buyer or the complexities involved in the property transaction. For example, a buyer may request more detailed documentation on property-related expenses or specific calculations of interest. In conclusion, the Renton Washington Buyer's Request for Accounting from Seller under Contract for Deed is a legal instrument enabling the buyer to obtain a comprehensive understanding of the financial aspects associated with the purchase of a property under a contract for deed arrangement. By requesting this accounting, the buyer aims to ensure transparency, accuracy, and accountability throughout the transaction process.