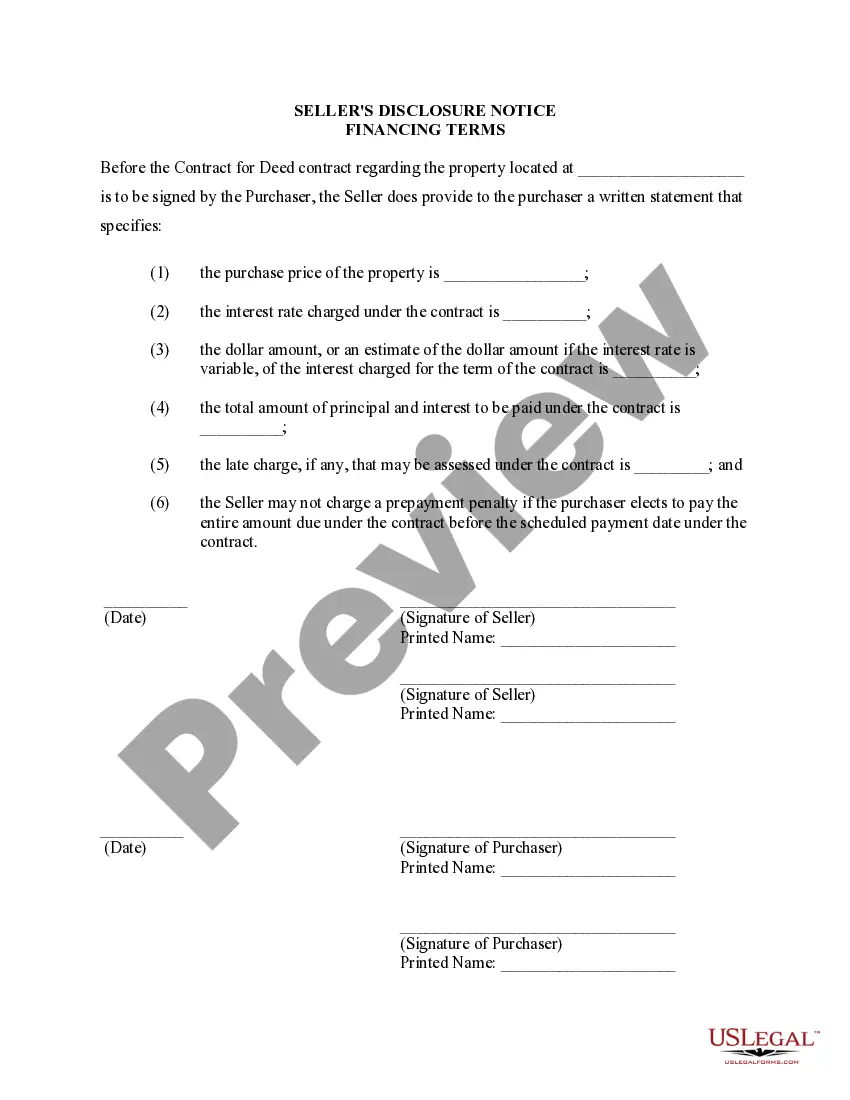

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The King Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the terms and conditions of financing for the purchase of a residential property. This disclosure offers crucial information to potential buyers regarding their financial obligations and rights. It helps facilitate transparency and protects both the seller and the buyer throughout the transaction process. The Seller's Disclosure of Financing Terms for Residential Property typically includes various key components such as: 1. Purchase Price: This section specifies the agreed-upon purchase price for the property, ensuring clarity and transparency between the buyer and seller. 2. Down Payment: The disclosure outlines the required down payment amount that the buyer needs to make at the time of signing the agreement. It may vary depending on the negotiated terms. 3. Interest Rate: This section highlights the interest rate the buyer will be charged throughout the duration of the contract. The interest rate may be fixed or adjustable, and it should be clearly mentioned in the disclosure. 4. Payment Schedule: The seller's disclosure provides a detailed payment schedule, specifying the amount due, due dates, and the method of payment. It ensures clear communication regarding the buyer's obligations and helps the buyer plan their finances accordingly. 5. Term of the Contract: This section defines the duration of the contract or agreement for deed. It states the start and end date, allowing both the buyer and seller to understand the timeframe of the financing arrangement. 6. Late Payment Penalties: The disclosure may include information on the penalties or fees that the buyer will incur for late or missed payments. This helps in avoiding any ambiguity and encourages timely payment. 7. Default and Termination: The disclosure outlines the consequences of defaulting on the agreement, including possible remedies or legal actions that the seller may pursue. This section is crucial to ensure both parties understand the potential outcomes in case of non-compliance. 8. Prepayment Options: In certain agreements, the seller's disclosure may include information on prepayment options for the buyer. It outlines if there are any penalties or restrictions on early repayment and provides clarity for the buyer's financial planning. It is important to note that the name and specific details of the Seller's Disclosure of Financing Terms may vary based on local regulations or contractual agreements. However, the fundamental purpose remains the same — to provide transparency and protection to both the seller and the buyer during the financing process of a residential property.