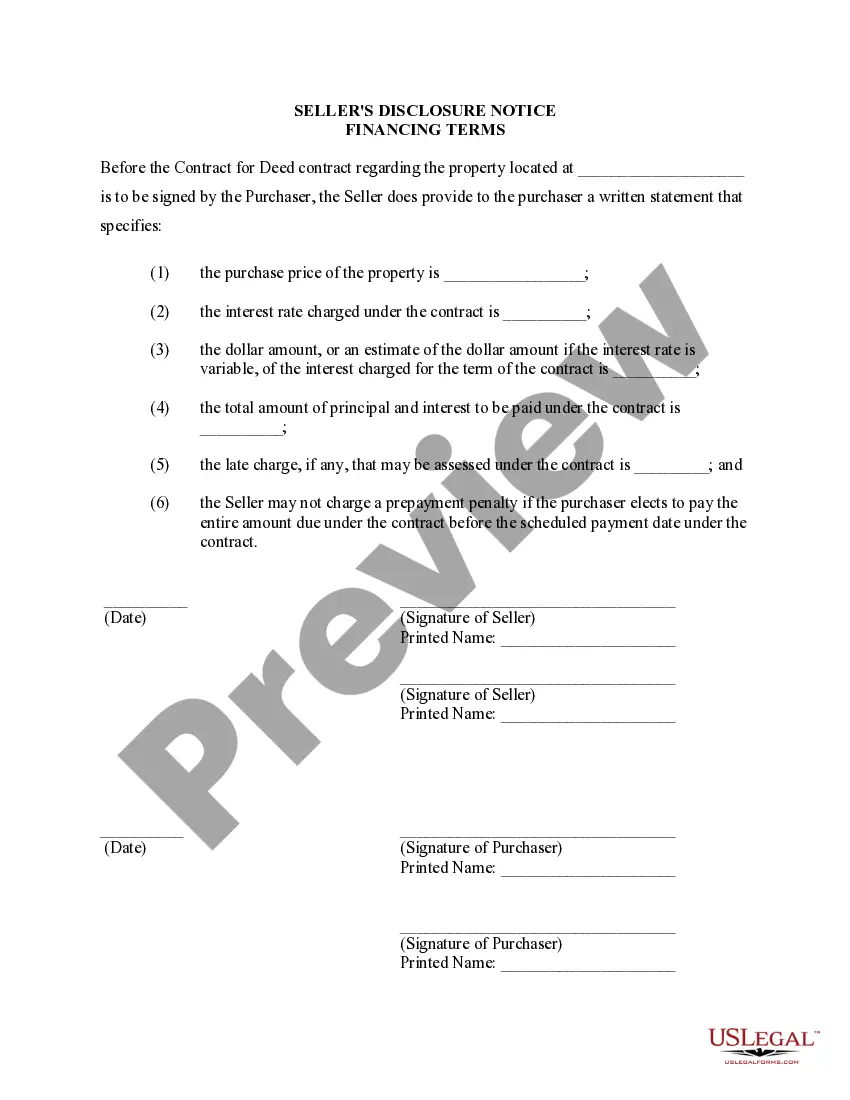

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Renton Washington Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the terms and conditions of the financing for purchasing a residential property in Renton, Washington. This document serves as a disclosure statement for the seller to inform the buyer about the specifics of the financing arrangement. It is required by law to ensure transparency and protect the interests of both parties involved in the transaction. The Renton Washington Seller's Disclosure of Financing Terms typically includes the following information: 1. Purchase Price: This section specifies the agreed-upon price for the property and states whether the purchase price includes any personal property or fixtures. 2. Down Payment: The disclosure document will detail the amount of the down payment required by the seller. It may also specify whether the down payment needs to be made in cash or if other forms of payment are acceptable. 3. Monthly Payment: This section outlines the amount that the buyer has to pay each month to the seller as part of the financing agreement. It may include the principal and interest amounts, as well as any additional charges. 4. Interest Rate: The disclosure will specify the interest rate that will be applied to the outstanding balance of the purchase price. It may be a fixed or adjustable rate. 5. Loan Term: This section defines the duration of the financing agreement between the buyer and the seller, usually stating the number of years or months for repaying the total amount. 6. Late Payment Charges: The disclosure will outline any fees or penalties that may be incurred by the buyer in the event of late or missed payments. 7. Default/Foreclosure Terms: In case of default on the agreement, this section explains the possible actions the seller can take, including foreclosure or repossession of the property. It may also outline the buyer's rights in these situations. 8. Assignment and Assumption: This part addresses whether the buyer is allowed to transfer or assign their interest in the property or the financing agreement to another party. 9. Taxes and Insurance: The seller's disclosure may state whether the buyer is responsible for paying property taxes and insurance premiums directly or if they are included in the monthly payment to the seller. 10. Additional Terms: This section covers any other specific terms and conditions related to the financing agreement that the buyer and seller have agreed upon. Different types of Renton Washington Seller's Disclosures of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may include variations in language or format, but the essential content remains the same. It is crucial for both parties to thoroughly review and understand the document before entering into the land contract or agreement for deed, as it sets the guidelines for the financing arrangement and protects their respective rights and obligations.The Renton Washington Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is a legal document that outlines the terms and conditions of the financing for purchasing a residential property in Renton, Washington. This document serves as a disclosure statement for the seller to inform the buyer about the specifics of the financing arrangement. It is required by law to ensure transparency and protect the interests of both parties involved in the transaction. The Renton Washington Seller's Disclosure of Financing Terms typically includes the following information: 1. Purchase Price: This section specifies the agreed-upon price for the property and states whether the purchase price includes any personal property or fixtures. 2. Down Payment: The disclosure document will detail the amount of the down payment required by the seller. It may also specify whether the down payment needs to be made in cash or if other forms of payment are acceptable. 3. Monthly Payment: This section outlines the amount that the buyer has to pay each month to the seller as part of the financing agreement. It may include the principal and interest amounts, as well as any additional charges. 4. Interest Rate: The disclosure will specify the interest rate that will be applied to the outstanding balance of the purchase price. It may be a fixed or adjustable rate. 5. Loan Term: This section defines the duration of the financing agreement between the buyer and the seller, usually stating the number of years or months for repaying the total amount. 6. Late Payment Charges: The disclosure will outline any fees or penalties that may be incurred by the buyer in the event of late or missed payments. 7. Default/Foreclosure Terms: In case of default on the agreement, this section explains the possible actions the seller can take, including foreclosure or repossession of the property. It may also outline the buyer's rights in these situations. 8. Assignment and Assumption: This part addresses whether the buyer is allowed to transfer or assign their interest in the property or the financing agreement to another party. 9. Taxes and Insurance: The seller's disclosure may state whether the buyer is responsible for paying property taxes and insurance premiums directly or if they are included in the monthly payment to the seller. 10. Additional Terms: This section covers any other specific terms and conditions related to the financing agreement that the buyer and seller have agreed upon. Different types of Renton Washington Seller's Disclosures of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed may include variations in language or format, but the essential content remains the same. It is crucial for both parties to thoroughly review and understand the document before entering into the land contract or agreement for deed, as it sets the guidelines for the financing arrangement and protects their respective rights and obligations.