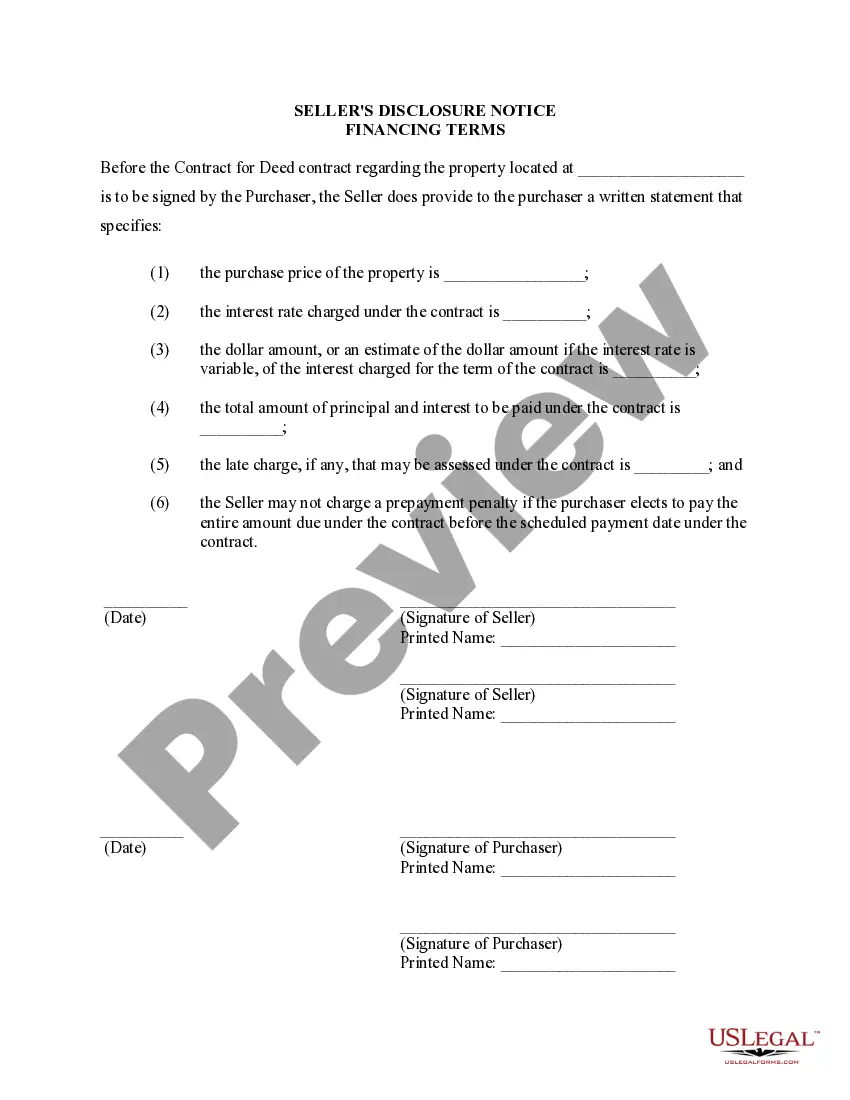

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Spokane Valley Washington Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Washington Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

Locating authenticated templates pertinent to your regional regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world scenarios.

All the paperwork is correctly organized by area of use and jurisdictional territories, so finding the Spokane Valley Washington Seller's Disclosure of Financing Terms for Residential Property related to a Contract or Agreement for Deed also known as Land Contract becomes as simple and straightforward as ABC.

Maintaining organized documentation that complies with legal requirements is critically important. Utilize the US Legal Forms library to always possess vital document templates for any needs right at your fingertips!

- Check the Preview mode and document description.

- Ensure you’ve chosen the correct one that aligns with your prerequisites and fully adheres to your local jurisdictional specifications.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the right one. If it meets your needs, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

While sellers don't have a duty to inspect their home or look for defects, they do have a duty to disclose defects that affect the value, physical condition, or title to the property. Sellers should consider disclosure to be a form of insurance.

Example of Seller Financing Terms Typically, the seller will pay property taxes monthly to the buyer, who will then pay them either annually or semi-annually. Also, if there's an existing mortgage on the property, it's possible that part of the monthly mortgage payment is an escrow that covers taxes and insurance.

Must-have contract financing terms such as loan payment amounts, interest, taxes, insurance, and additional fees....Spell out the big numbers: How much are you willing to lend? The agreed-upon sales price. The non-refundable deposit amount. The remaining loan balance.

Seller disclosures are an important part of the typical home sale in Washington State. Unless the buyer has specifically waived receiving the form (which rarely happens), the statement is almost always required.

Property sellers are usually required to disclose negative information about a property. It is usually wise to always disclose issues with your home, whether you are legally bound to or not. The seller must follow local, state, and federal laws regarding disclosures when selling their home.

A seller financing agreement is usually fairly short-term and typically lasts no longer than 5 years with a balloon payment at the end. And just like in a conventional real estate transaction, a seller financing arrangement begins with a down payment.

Most Common Disclosures in Real Estate Natural Hazards Disclosure. First on the list is the natural hazards disclosure.Market Conditions Advisory (MCA) Market Conditions Advisory, also known as MCA, covers items more financial in nature.State Transfer Disclosure.Local Transfer Disclosure.Megan's Law Disclosures.

Any ongoing problems with neighbours, including boundary disputes. Any neighbours known to have been served an Anti Social Behaviour Order (ASBO) Whether there have been any known burglaries in the neighbourhood recently. Whether any murders or suicides have occurred in the property recently.

Almost all real estate sales in Washington State require a seller disclosure statement to be given to the buyer. Home sales, including condominium units, are included in the types of sales requiring a seller disclosure statement. The statute (RCW 64.06.

Things you should disclose to prospective buyers It's best to provide receipts and insurance claim information so buyers can see how you addressed the issue. Lead paint. Federal law requires homeowners to disclose any known lead-based paint if you're selling a home built before 1978. Hazardous conditions.