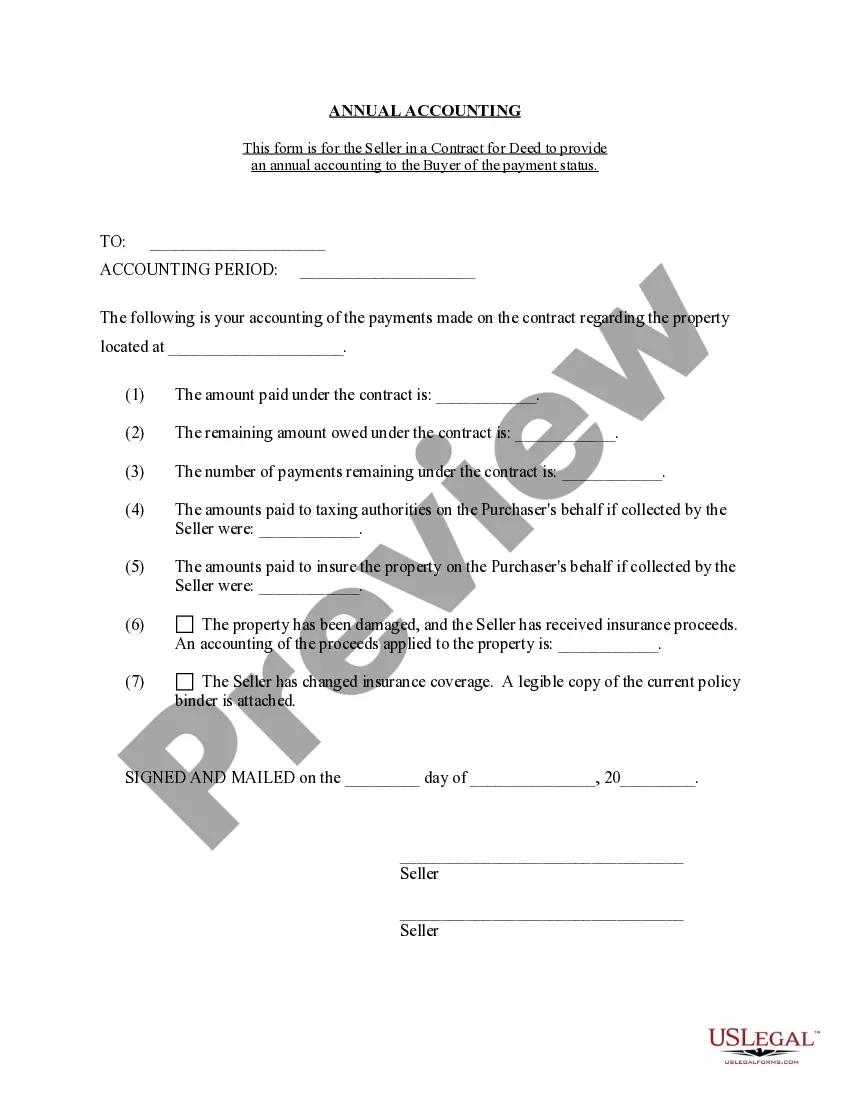

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Bellevue Washington Contract for Deed Seller's Annual Accounting Statement is a detailed financial document that provides an overview of the financial transactions and obligations related to a contract for deed property sale in Bellevue, Washington. This statement is crucial for both the seller and buyer to ensure transparency and accuracy in the financial aspects of the agreement. The annual accounting statement includes several key elements that outline the financial status and activities of the contract for deed property. It consolidates information about the payments received from the buyer, expenses incurred by the seller, and the current balance of the contract. This statement lists relevant financial data, enabling both parties to evaluate the progress of the contract and assess their financial positions accurately. The Bellevue Washington Contract for Deed Seller's Annual Accounting Statement encompasses various categories such as: 1. Payment Summary: This section presents a summary of payments received from the buyer over the past year. It includes the total amount received, the breakdown of principal and interest payments, any late fees or penalties, and the outstanding balance. 2. Expenses: The expenses section itemizes any costs incurred by the seller, such as property taxes, insurance premiums, maintenance or repair expenses, or any other relevant costs associated with the contract for deed property. 3. Escrow Summary: This part details any amounts held in escrow for taxes, insurance, or other purposes. It outlines the escrow contributions made by the buyer and any disbursements made on their behalf by the seller. 4. Interest Calculation: If interest is applicable to the contract for deed agreement, this section presents a breakdown of how the interest is calculated. It may include the interest rate, the method of calculation (e.g., simple interest or amortized), and the accrued interest over the year. 5. Buyer's Credits and Adjustments: In some cases, there may be credits or adjustments applicable to the buyer's account. This section outlines any adjustments made to the buyer's balance, such as repairs performed by the buyer, reimbursements, or credits for timely payments. 6. Statements of Account: This section provides a detailed statement of account, displaying all financial transactions related to the contract for deed property throughout the year. It includes dates, payment amounts, principal and interest breakdowns, and any additional notes regarding specific transactions. Different types of Bellevue Washington Contract for Deed Seller's Annual Accounting Statements may vary in format or additional sections, depending on specific contract terms, property characteristics, or individual preferences. However, the core elements mentioned above are generally included in all such statements to ensure comprehensive financial reporting and tracking of the contract for deed property's financial status.The Bellevue Washington Contract for Deed Seller's Annual Accounting Statement is a detailed financial document that provides an overview of the financial transactions and obligations related to a contract for deed property sale in Bellevue, Washington. This statement is crucial for both the seller and buyer to ensure transparency and accuracy in the financial aspects of the agreement. The annual accounting statement includes several key elements that outline the financial status and activities of the contract for deed property. It consolidates information about the payments received from the buyer, expenses incurred by the seller, and the current balance of the contract. This statement lists relevant financial data, enabling both parties to evaluate the progress of the contract and assess their financial positions accurately. The Bellevue Washington Contract for Deed Seller's Annual Accounting Statement encompasses various categories such as: 1. Payment Summary: This section presents a summary of payments received from the buyer over the past year. It includes the total amount received, the breakdown of principal and interest payments, any late fees or penalties, and the outstanding balance. 2. Expenses: The expenses section itemizes any costs incurred by the seller, such as property taxes, insurance premiums, maintenance or repair expenses, or any other relevant costs associated with the contract for deed property. 3. Escrow Summary: This part details any amounts held in escrow for taxes, insurance, or other purposes. It outlines the escrow contributions made by the buyer and any disbursements made on their behalf by the seller. 4. Interest Calculation: If interest is applicable to the contract for deed agreement, this section presents a breakdown of how the interest is calculated. It may include the interest rate, the method of calculation (e.g., simple interest or amortized), and the accrued interest over the year. 5. Buyer's Credits and Adjustments: In some cases, there may be credits or adjustments applicable to the buyer's account. This section outlines any adjustments made to the buyer's balance, such as repairs performed by the buyer, reimbursements, or credits for timely payments. 6. Statements of Account: This section provides a detailed statement of account, displaying all financial transactions related to the contract for deed property throughout the year. It includes dates, payment amounts, principal and interest breakdowns, and any additional notes regarding specific transactions. Different types of Bellevue Washington Contract for Deed Seller's Annual Accounting Statements may vary in format or additional sections, depending on specific contract terms, property characteristics, or individual preferences. However, the core elements mentioned above are generally included in all such statements to ensure comprehensive financial reporting and tracking of the contract for deed property's financial status.