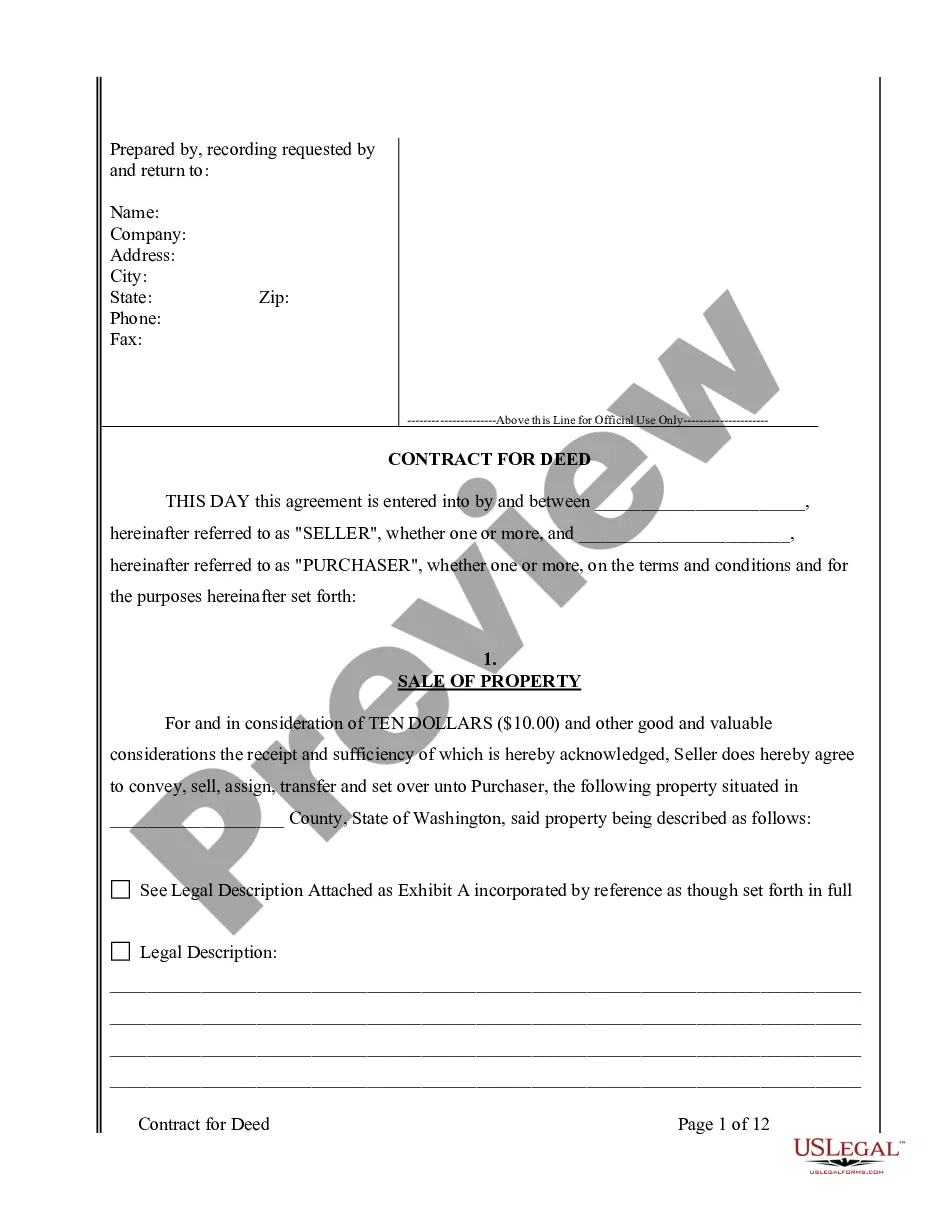

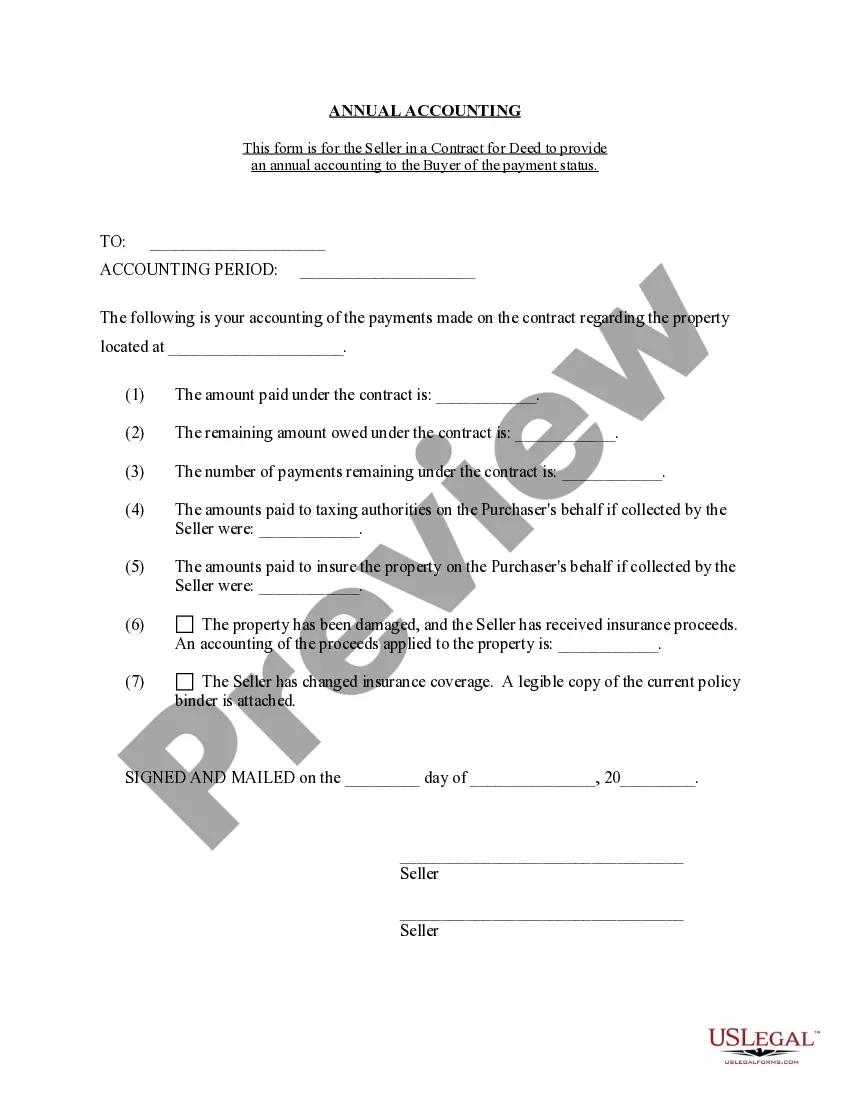

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Everett Washington Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Washington Contract For Deed Seller's Annual Accounting Statement?

We continually work to reduce or avert legal complications when navigating intricate law-related or financial matters.

To accomplish this, we enroll in attorney services that are generally quite expensive.

However, not every legal issue is as convoluted; many can be managed independently.

US Legal Forms is a digital repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you happened to misplace the form, it can easily be re-downloaded from the My documents tab.

- Our platform empowers you to handle your matters without consulting a lawyer.

- We offer access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, greatly simplifying the search process.

- Seize the opportunity with US Legal Forms whenever you need to locate and obtain the Everett Washington Contract for Deed Seller's Annual Accounting Statement or any other document effortlessly and securely.

Form popularity

FAQ

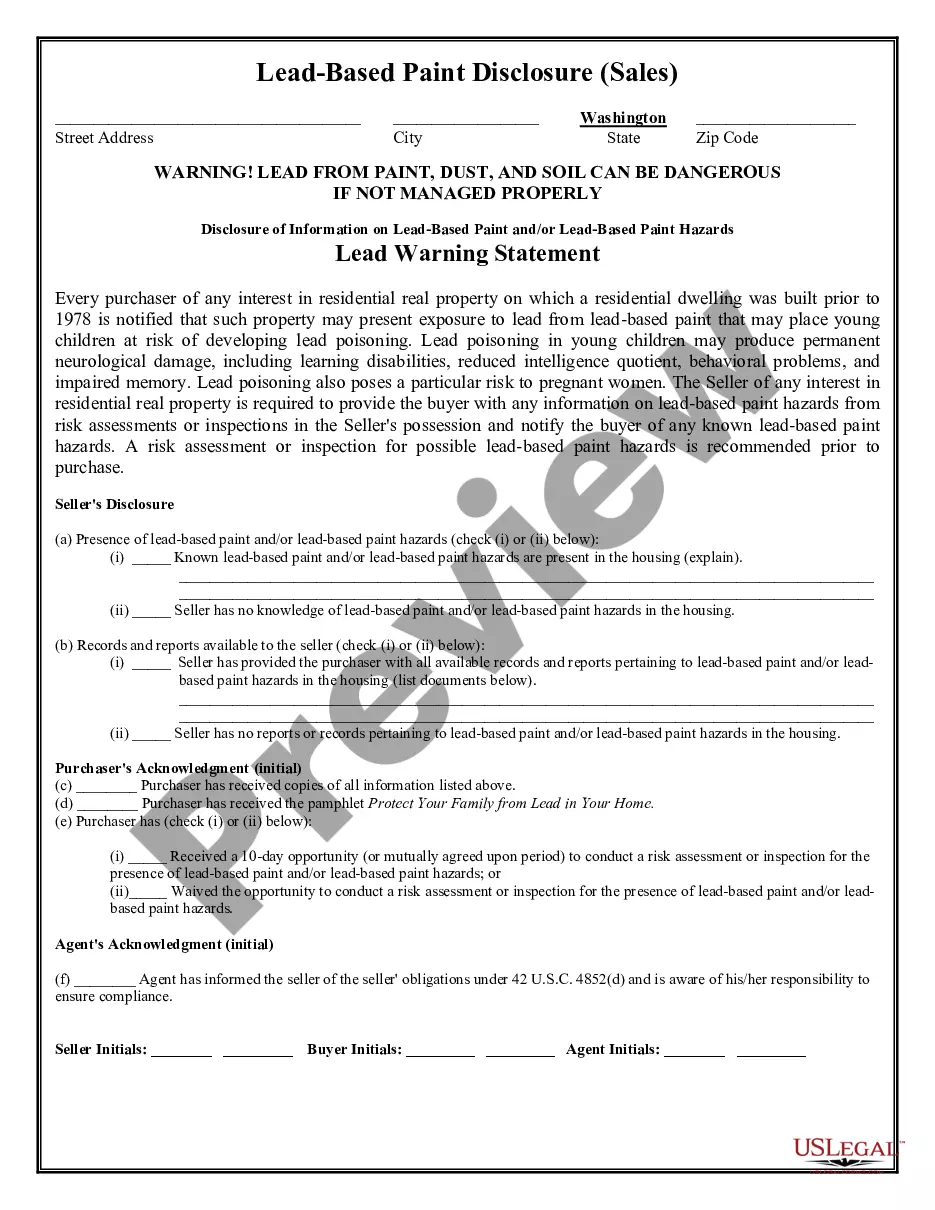

Property sellers are usually required to disclose negative information about a property. It is usually wise to always disclose issues with your home, whether you are legally bound to or not. The seller must follow local, state, and federal laws regarding disclosures when selling their home.

The Michigan land contract process is as follows: Most land contracts will require the buyer to make a down payment of 10% or more of the purchase price. Then, the seller will have to make installment payments for a set period of time. The terms can vary, but most agreements are between two and four years.

The land contract purchaser takes possession of the real estate and agrees to make installment payments of principal and interest, typically on a monthly basis, until the contract is paid in full or balloons. During the term of the contract, the purchaser has ?equitable title? to the property.

Almost all real estate sales in Washington State require a seller disclosure statement to be given to the buyer. Home sales, including condominium units, are included in the types of sales requiring a seller disclosure statement. The statute (RCW 64.06.

Almost all real estate sales in Washington State require a seller disclosure statement to be given to the buyer. Home sales, including condominium units, are included in the types of sales requiring a seller disclosure statement. The statute (RCW 64.06.

While sellers don't have a duty to inspect their home or look for defects, they do have a duty to disclose defects that affect the value, physical condition, or title to the property. Sellers should consider disclosure to be a form of insurance.

In the state of Washington, you, as a residential home seller, are required by law to disclose certain details about a residential property you are trying to sell. These disclosures are important because buyers want to know as much as possible about a property before they make such an important purchase.

A Washington land contract is a formal sale agreement between two parties transferring ownership of vacant real estate. Whether for residential or commercial land/lots, the contract must contain all information pertaining to the transaction, such as the agreed-upon purchase price or any related financial arrangements.

The Transfer Disclosure Statement. The document provided by the seller that described the condition of the property is known as the Transfer Disclosure Statement. As a buyer, you should receive this document during the contract contingency period.

An agreement for deed is often referred to as ?land contract.? This arrangement is where a seller provides owner financing to a buyer. In turn, this allows a buyer to make monthly payments to the seller (instead of a bank). The seller will transfer the property title once receiving a certain amount of money.