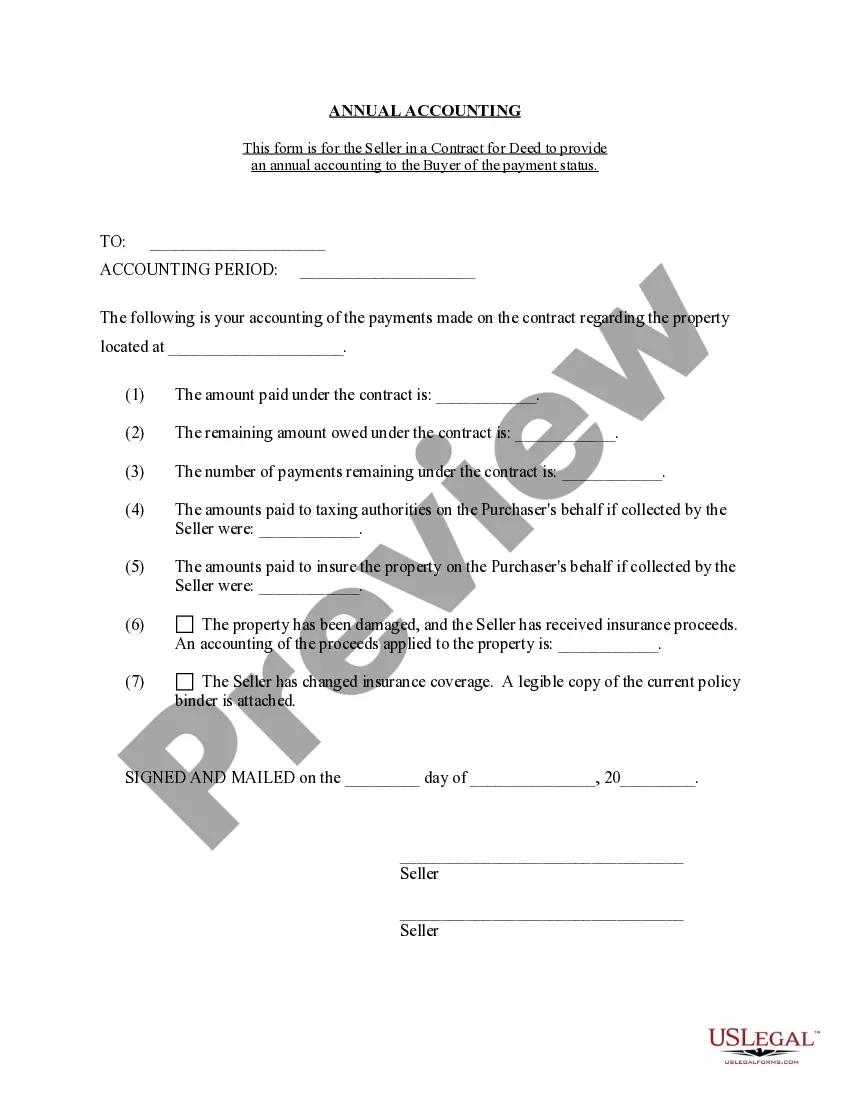

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Seattle Washington Contract for Deed Seller's Annual Accounting Statement is a legal document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement. It serves as a record of the financial activities related to the contract for deed throughout the year. This statement details all payments made by the buyer to the seller and any expenses incurred by the seller in relation to the property. It includes relevant information such as the date and amount of each payment, the purpose of the payment, and any adjustments or deductions applied. The primary purpose of the Seattle Washington Contract for Deed Seller's Annual Accounting Statement is to provide transparency and ensure that both parties have an accurate record of the financial transactions. It helps in maintaining trust and accountability between the seller and buyer. There may be different types of Seattle Washington Contract for Deed Seller's Annual Accounting Statements depending on the specific terms and conditions agreed upon in the contract for deed agreement. For example, there might be separate statements for regular installment payments, late fees, taxes, insurance, or any additional expenses incurred by the seller. It is essential to understand and review the Seattle Washington Contract for Deed Seller's Annual Accounting Statement thoroughly to ensure accuracy and fairness. Both parties should have access to this statement and may refer to it when evaluating their financial obligations and rights as outlined in the contract for deed agreement.The Seattle Washington Contract for Deed Seller's Annual Accounting Statement is a legal document that outlines the financial transactions and obligations between the seller and buyer in a contract for deed agreement. It serves as a record of the financial activities related to the contract for deed throughout the year. This statement details all payments made by the buyer to the seller and any expenses incurred by the seller in relation to the property. It includes relevant information such as the date and amount of each payment, the purpose of the payment, and any adjustments or deductions applied. The primary purpose of the Seattle Washington Contract for Deed Seller's Annual Accounting Statement is to provide transparency and ensure that both parties have an accurate record of the financial transactions. It helps in maintaining trust and accountability between the seller and buyer. There may be different types of Seattle Washington Contract for Deed Seller's Annual Accounting Statements depending on the specific terms and conditions agreed upon in the contract for deed agreement. For example, there might be separate statements for regular installment payments, late fees, taxes, insurance, or any additional expenses incurred by the seller. It is essential to understand and review the Seattle Washington Contract for Deed Seller's Annual Accounting Statement thoroughly to ensure accuracy and fairness. Both parties should have access to this statement and may refer to it when evaluating their financial obligations and rights as outlined in the contract for deed agreement.