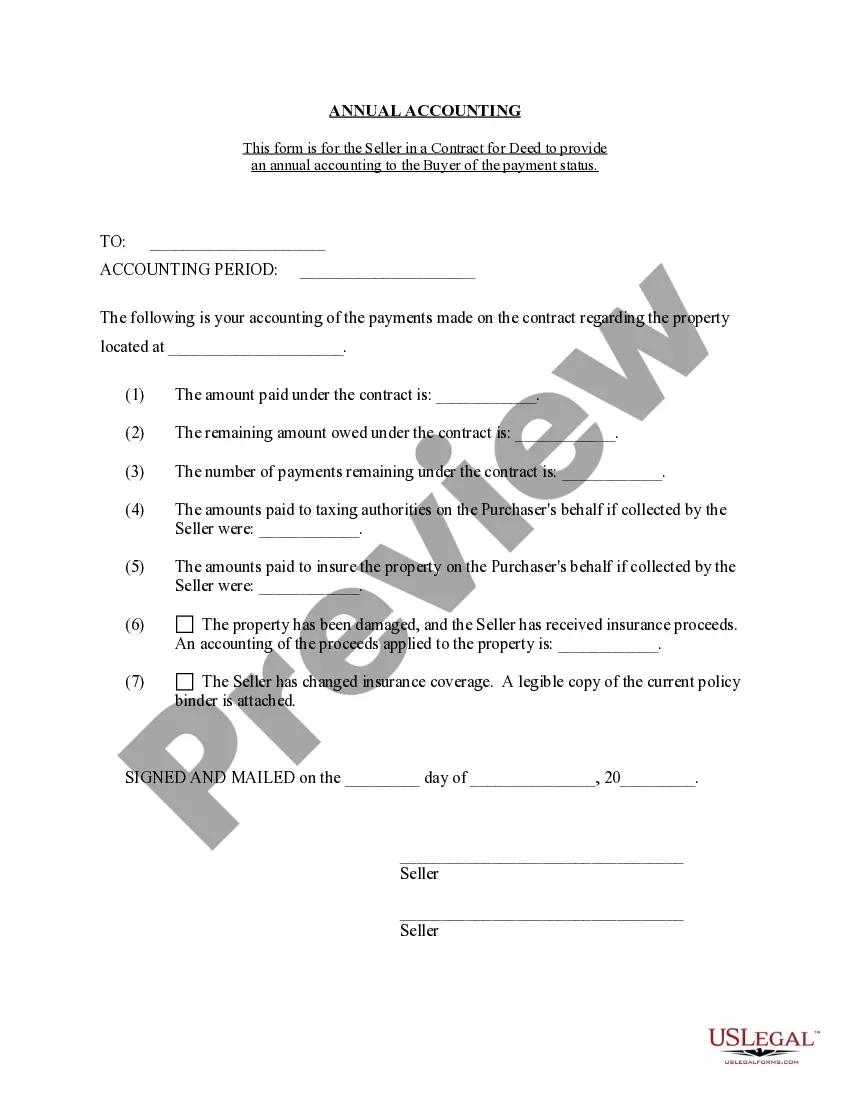

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Tacoma Washington Contract for Deed Seller's Annual Accounting Statement is a legal document that outlines the financial records and transactions between a seller and buyer involved in a contract for deed agreement in Tacoma, Washington. It serves as a comprehensive record of the seller's annual financial activities related to the contract for deed, providing transparency and accountability. The Annual Accounting Statement includes a detailed breakdown of all revenue received by the seller and expenses incurred during the specified accounting period. It includes information about the amount of monthly payments received from the buyer, any late fees assessed, interest charges, property taxes paid, insurance premiums, and any other financial transactions relevant to the contract for deed. This statement serves as an essential tool for both the seller and buyer. The seller can use it to keep track of their financial performance and ensure all payments and expenses are accurately recorded. The buyer, on the other hand, can review the document to verify that payments were correctly applied and accounted for. In Tacoma, Washington, there may be different types of Contract for Deed Seller's Annual Accounting Statements, varying based on specific contractual terms and conditions. These may include: 1. Standard Annual Accounting Statement: This type of statement is used for typical contract for deed agreements and includes a comprehensive record of all financial activities related to the contract. 2. Delinquency Annual Accounting Statement: If a buyer falls behind on their monthly payments or fails to fulfill certain obligations, a separate delinquency annual accounting statement may be prepared. This statement would detail the outstanding balance, fees charged, and any efforts made to address the delinquency. 3. Modification Annual Accounting Statement: In cases where the contract for deed is modified to accommodate changes in payment terms, interest rates, or other contractual elements, a modification annual accounting statement is created. This statement would outline the adjustments made and their impact on the financial transactions. 4. Termination Annual Accounting Statement: When the contract for deed reaches its termination or completion, a termination annual accounting statement is prepared. This statement summarizes the final financial position, including any remaining payments, outstanding balances, and final financial obligations. It is crucial for both sellers and buyers involved in a Tacoma Washington contract for deed agreement to familiarize themselves with the specifics of their accounting statements to ensure compliance and transparency in their financial dealings.The Tacoma Washington Contract for Deed Seller's Annual Accounting Statement is a legal document that outlines the financial records and transactions between a seller and buyer involved in a contract for deed agreement in Tacoma, Washington. It serves as a comprehensive record of the seller's annual financial activities related to the contract for deed, providing transparency and accountability. The Annual Accounting Statement includes a detailed breakdown of all revenue received by the seller and expenses incurred during the specified accounting period. It includes information about the amount of monthly payments received from the buyer, any late fees assessed, interest charges, property taxes paid, insurance premiums, and any other financial transactions relevant to the contract for deed. This statement serves as an essential tool for both the seller and buyer. The seller can use it to keep track of their financial performance and ensure all payments and expenses are accurately recorded. The buyer, on the other hand, can review the document to verify that payments were correctly applied and accounted for. In Tacoma, Washington, there may be different types of Contract for Deed Seller's Annual Accounting Statements, varying based on specific contractual terms and conditions. These may include: 1. Standard Annual Accounting Statement: This type of statement is used for typical contract for deed agreements and includes a comprehensive record of all financial activities related to the contract. 2. Delinquency Annual Accounting Statement: If a buyer falls behind on their monthly payments or fails to fulfill certain obligations, a separate delinquency annual accounting statement may be prepared. This statement would detail the outstanding balance, fees charged, and any efforts made to address the delinquency. 3. Modification Annual Accounting Statement: In cases where the contract for deed is modified to accommodate changes in payment terms, interest rates, or other contractual elements, a modification annual accounting statement is created. This statement would outline the adjustments made and their impact on the financial transactions. 4. Termination Annual Accounting Statement: When the contract for deed reaches its termination or completion, a termination annual accounting statement is prepared. This statement summarizes the final financial position, including any remaining payments, outstanding balances, and final financial obligations. It is crucial for both sellers and buyers involved in a Tacoma Washington contract for deed agreement to familiarize themselves with the specifics of their accounting statements to ensure compliance and transparency in their financial dealings.