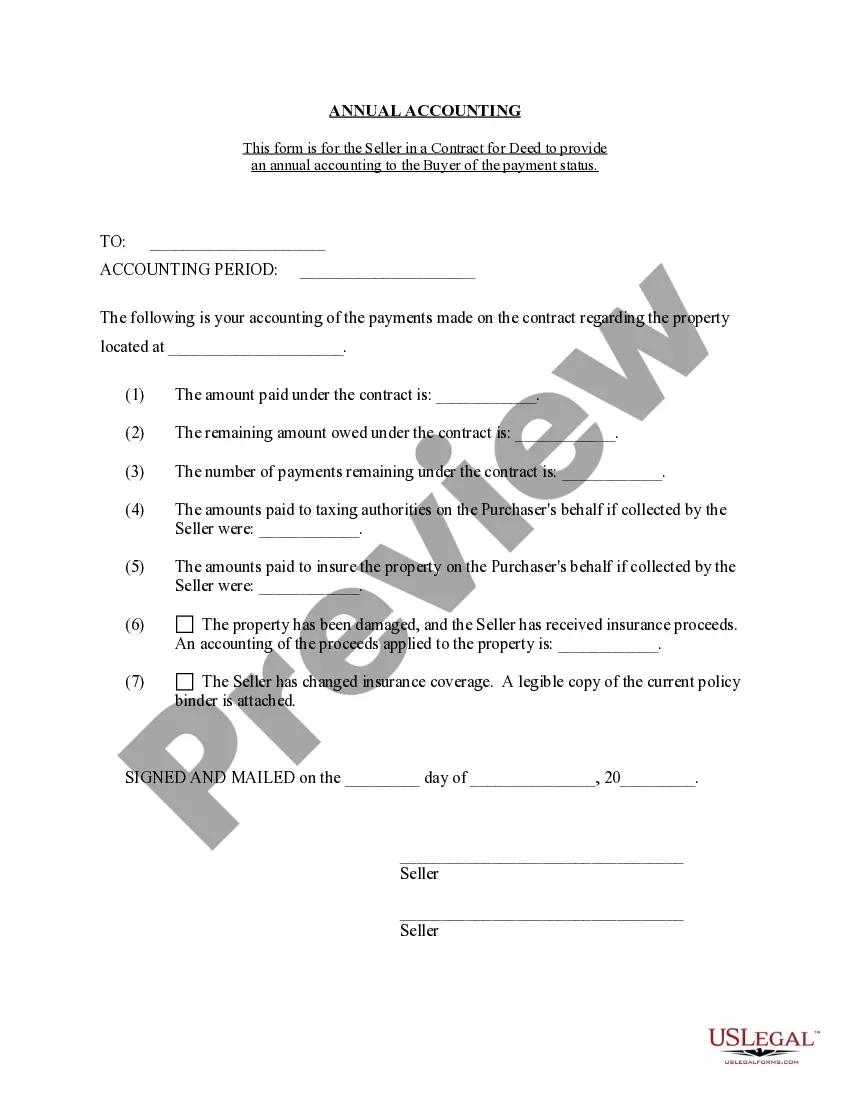

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Vancouver Washington is known for its real estate market, and one commonly used legal document in property transactions is the Contract for Deed. This document provides a detailed description of the agreement between the seller and buyer regarding the sale of a property. Specifically, the Vancouver Washington Contract for Deed Seller's Annual Accounting Statement plays a crucial role in ensuring transparency and financial clarity throughout the transaction process. The Contract for Deed Seller's Annual Accounting Statement is an annual summary of financial records related to the property sold through a contract for deed. It outlines the details of all financial transactions between the seller and buyer during the given year. This document serves as a comprehensive report that itemizes the income, expenses, and any other relevant financial information associated with the property. The primary purpose of the Vancouver Washington Contract for Deed Seller's Annual Accounting Statement is to keep both parties informed of the financial aspects of the agreement. It is an essential tool for the seller to provide an accurate account of their financial activities regarding the property and ensures that the buyer is aware of all financial matters associated with their purchase. The annual accounting statement includes key information such as the total amount received from the buyer, any interest or finance charges, payments made towards taxes, insurance, and maintenance costs, as well as any outstanding balances or credits. Different types of Vancouver Washington Contract for Deed Seller's Annual Accounting Statements may exist depending on the specific terms and conditions agreed upon between the seller and buyer. Some variations may include specific provisions related to the handling of escrow funds, late payment fees, penalty clauses, or additional financial arrangements. By regularly providing the Contract for Deed Seller's Annual Accounting Statement, the seller ensures transparency and accountability throughout the contract period. This statement helps to maintain a healthy relationship between the seller and buyer by fostering trust and open communication regarding the property's financial aspects. In summary, the Vancouver Washington Contract for Deed Seller's Annual Accounting Statement is a crucial document in the real estate market. It offers a detailed overview of the financial transactions between the seller and buyer, ensuring transparency and promoting a healthy relationship between the parties involved. With its comprehensive information and itemized records, this statement acts as a vital tool to maintain clarity and facilitate the success of property transactions in Vancouver, Washington.Vancouver Washington is known for its real estate market, and one commonly used legal document in property transactions is the Contract for Deed. This document provides a detailed description of the agreement between the seller and buyer regarding the sale of a property. Specifically, the Vancouver Washington Contract for Deed Seller's Annual Accounting Statement plays a crucial role in ensuring transparency and financial clarity throughout the transaction process. The Contract for Deed Seller's Annual Accounting Statement is an annual summary of financial records related to the property sold through a contract for deed. It outlines the details of all financial transactions between the seller and buyer during the given year. This document serves as a comprehensive report that itemizes the income, expenses, and any other relevant financial information associated with the property. The primary purpose of the Vancouver Washington Contract for Deed Seller's Annual Accounting Statement is to keep both parties informed of the financial aspects of the agreement. It is an essential tool for the seller to provide an accurate account of their financial activities regarding the property and ensures that the buyer is aware of all financial matters associated with their purchase. The annual accounting statement includes key information such as the total amount received from the buyer, any interest or finance charges, payments made towards taxes, insurance, and maintenance costs, as well as any outstanding balances or credits. Different types of Vancouver Washington Contract for Deed Seller's Annual Accounting Statements may exist depending on the specific terms and conditions agreed upon between the seller and buyer. Some variations may include specific provisions related to the handling of escrow funds, late payment fees, penalty clauses, or additional financial arrangements. By regularly providing the Contract for Deed Seller's Annual Accounting Statement, the seller ensures transparency and accountability throughout the contract period. This statement helps to maintain a healthy relationship between the seller and buyer by fostering trust and open communication regarding the property's financial aspects. In summary, the Vancouver Washington Contract for Deed Seller's Annual Accounting Statement is a crucial document in the real estate market. It offers a detailed overview of the financial transactions between the seller and buyer, ensuring transparency and promoting a healthy relationship between the parties involved. With its comprehensive information and itemized records, this statement acts as a vital tool to maintain clarity and facilitate the success of property transactions in Vancouver, Washington.