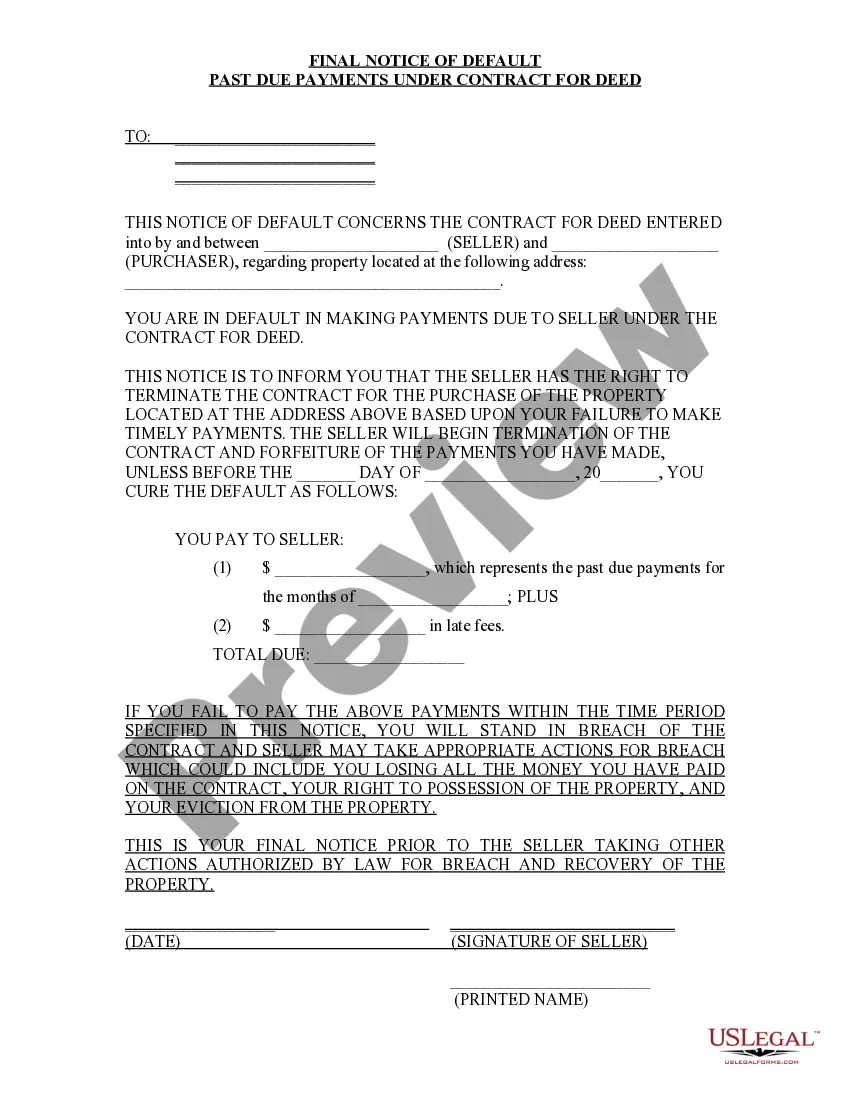

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Everett Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed serves as a formal communication regarding the non-payment of agreed installments or payments associated with a Contract for Deed in Everett, Washington. This legal notice acts as a warning to the defaulting party, alerting them to the potential consequences if immediate action is not taken to rectify the past due payments. The notice generally includes pertinent information such as the parties involved, the contract details, the specific payment(s) in default, and the steps necessary to cure the default. Keywords: Everett Washington, Final Notice of Default, Past Due Payments, Contract for Deed, non-payment, installments, formal communication, warning, defaulting party, consequences, immediate action, rectify, pertinent information, parties involved, contract details, specific payment in default, steps to cure default. Different types of Everett Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed may include the following: 1. Preliminary Notice of Default: This initial notice is often sent as a courtesy reminder to the defaulting party, informing them of the missed payment(s) and providing an opportunity to resolve the issue before initiating stricter actions. 2. Final Notice of Default: If the defaulting party fails to address the outstanding payments within the given timeframe or does not respond to the preliminary notice, a Final Notice of Default is issued. This notice emphasizes the urgency of the situation and warns the defaulting party about the potential legal actions that may follow. 3. Notice of Intent to Foreclose: In cases where the defaulting party continues to neglect their payment obligations, the lender or seller may issue a Notice of Intent to Foreclose. This notice informs the defaulting party that the property may be subject to foreclosure proceedings if the arbitrages are not settled promptly. 4. Notice of Acceleration: When a default occurs and the lender or seller decides to accelerate the payment schedule, a Notice of Acceleration is served to the defaulting party. This notice informs them that the entire remaining balance is due immediately and provides a deadline for payment to avoid further legal action. 5. Notice of Sale: If the defaulting party fails to cure the default or make arrangements with the lender or seller as required, a Notice of Sale can be issued. This notice announces the lender's or seller's intention to sell the property through a foreclosure sale or public auction to recover the debt owed. These different types of Everett Washington Final Notices of Default for Past Due Payments in connection with Contract for Deed serve as important legal documents to ensure transparency, provide notice to the defaulting party, and protect the rights and interests of all involved parties.Everett Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed serves as a formal communication regarding the non-payment of agreed installments or payments associated with a Contract for Deed in Everett, Washington. This legal notice acts as a warning to the defaulting party, alerting them to the potential consequences if immediate action is not taken to rectify the past due payments. The notice generally includes pertinent information such as the parties involved, the contract details, the specific payment(s) in default, and the steps necessary to cure the default. Keywords: Everett Washington, Final Notice of Default, Past Due Payments, Contract for Deed, non-payment, installments, formal communication, warning, defaulting party, consequences, immediate action, rectify, pertinent information, parties involved, contract details, specific payment in default, steps to cure default. Different types of Everett Washington Final Notice of Default for Past Due Payments in connection with Contract for Deed may include the following: 1. Preliminary Notice of Default: This initial notice is often sent as a courtesy reminder to the defaulting party, informing them of the missed payment(s) and providing an opportunity to resolve the issue before initiating stricter actions. 2. Final Notice of Default: If the defaulting party fails to address the outstanding payments within the given timeframe or does not respond to the preliminary notice, a Final Notice of Default is issued. This notice emphasizes the urgency of the situation and warns the defaulting party about the potential legal actions that may follow. 3. Notice of Intent to Foreclose: In cases where the defaulting party continues to neglect their payment obligations, the lender or seller may issue a Notice of Intent to Foreclose. This notice informs the defaulting party that the property may be subject to foreclosure proceedings if the arbitrages are not settled promptly. 4. Notice of Acceleration: When a default occurs and the lender or seller decides to accelerate the payment schedule, a Notice of Acceleration is served to the defaulting party. This notice informs them that the entire remaining balance is due immediately and provides a deadline for payment to avoid further legal action. 5. Notice of Sale: If the defaulting party fails to cure the default or make arrangements with the lender or seller as required, a Notice of Sale can be issued. This notice announces the lender's or seller's intention to sell the property through a foreclosure sale or public auction to recover the debt owed. These different types of Everett Washington Final Notices of Default for Past Due Payments in connection with Contract for Deed serve as important legal documents to ensure transparency, provide notice to the defaulting party, and protect the rights and interests of all involved parties.