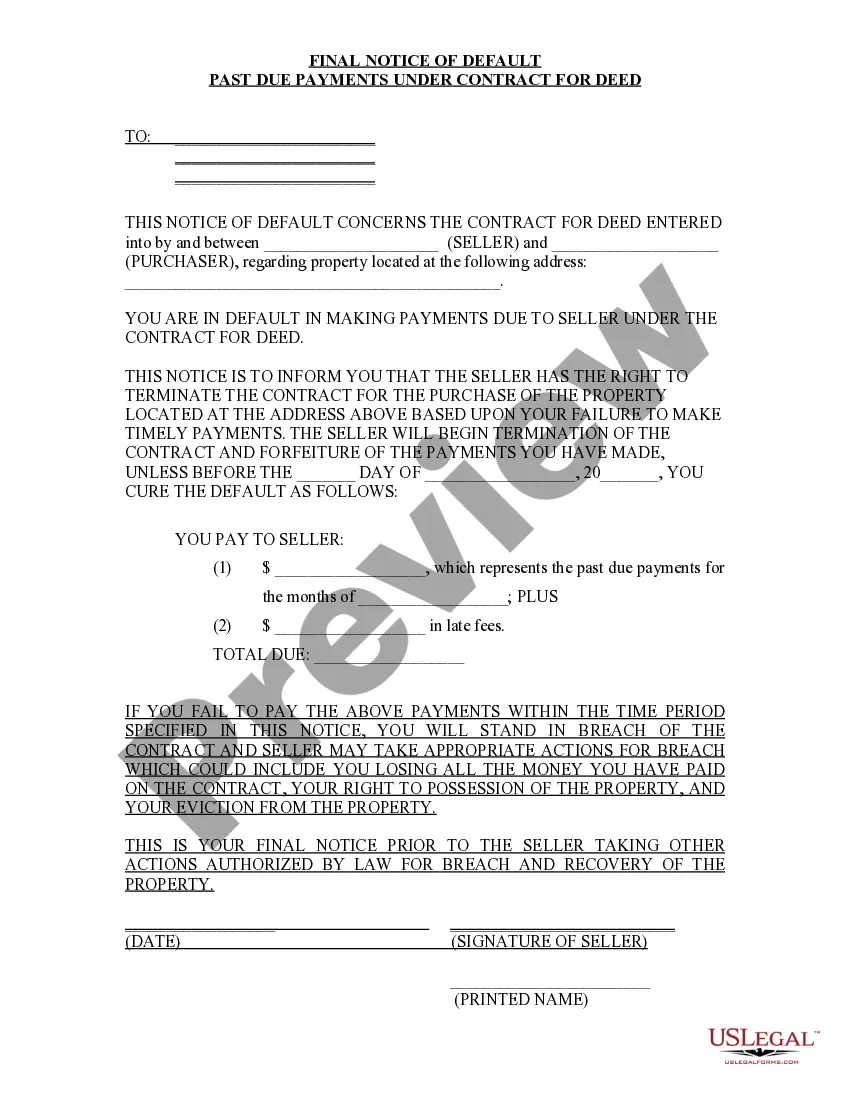

This Final Notice of Default for Past Due Payments in connection with Contract for Deed seller's final notice to Purchaser of failure to make payment toward the purchase price of the contract for deed property. Provides notice to Seller that without making payment by the date set in the notice, the contract for deed will stand in default.

Title: Understanding Tacoma Washington Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Tacoma, Washington, if a buyer fails to make timely payments on a property governed by a Contract for Deed, the seller may issue a notice of default. This legal action serves as a warning to the buyer that their non-payment could lead to termination of the contract. This article provides an in-depth explanation of what a Final Notice of Default entails for past due payments in connection with a Contract for Deed in Tacoma, Washington. 1. Definition of a Contract for Deed in Tacoma, Washington: A Contract for Deed is a real estate transaction in which the seller, also known as a vendor, finances the buyer's purchase instead of using a mortgage lender. It allows buyers with limited access to traditional financing options to secure homeownership by paying the purchase price over time. 2. The Importance of Timely Payments: Timely payments are crucial in a Contract for Deed, as they ensure that the buyer is meeting their financial obligations and maintaining the terms of the agreement. Failure to make payments on time may result in the issuance of a Final Notice of Default. 3. Final Notice of Default: The Final Notice of Default is a legal document issued by the seller notifying the buyer that they have breached the terms of the Contract for Deed by failing to make payments on time. It is the last opportunity given to the buyer to rectify their default before further legal actions are pursued. 4. Consequences of a Final Notice of Default: a. Termination of Contract: If the buyer fails to address the default within a specified timeframe, the seller may terminate the Contract for Deed. This means the buyer loses their rights to the property and may be required to vacate. b. Forfeiture of Equity: Non-payment and subsequent contract termination typically result in the loss of all equity built up by the buyer during the period of their occupancy. c. Legal Actions: In some cases, sellers may choose to pursue legal actions to recover any unpaid amounts, damages, or other costs associated with the buyer's default, such as foreclosure. 5. Types of Final Notices of Default: While the content and language may vary, some potential variations of Final Notices of Default based on circumstances include: a. Final Notice of Default due to missed payments b. Final Notice of Default due to consistent late payments c. Final Notice of Default for non-payment of property taxes or insurance premiums d. Final Notice of Default due to violation of other contract terms, such as property maintenance or alterations. Conclusion: For buyers in Tacoma, Washington, under a Contract for Deed, it is vital to fulfill payment obligations promptly. Understanding the implications of a Final Notice of Default is crucial to prevent contract termination and the potential loss of invested equity. Buyers should consult legal professionals and negotiate with sellers to explore alternative solutions and avoid default situations.Title: Understanding Tacoma Washington Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Tacoma, Washington, if a buyer fails to make timely payments on a property governed by a Contract for Deed, the seller may issue a notice of default. This legal action serves as a warning to the buyer that their non-payment could lead to termination of the contract. This article provides an in-depth explanation of what a Final Notice of Default entails for past due payments in connection with a Contract for Deed in Tacoma, Washington. 1. Definition of a Contract for Deed in Tacoma, Washington: A Contract for Deed is a real estate transaction in which the seller, also known as a vendor, finances the buyer's purchase instead of using a mortgage lender. It allows buyers with limited access to traditional financing options to secure homeownership by paying the purchase price over time. 2. The Importance of Timely Payments: Timely payments are crucial in a Contract for Deed, as they ensure that the buyer is meeting their financial obligations and maintaining the terms of the agreement. Failure to make payments on time may result in the issuance of a Final Notice of Default. 3. Final Notice of Default: The Final Notice of Default is a legal document issued by the seller notifying the buyer that they have breached the terms of the Contract for Deed by failing to make payments on time. It is the last opportunity given to the buyer to rectify their default before further legal actions are pursued. 4. Consequences of a Final Notice of Default: a. Termination of Contract: If the buyer fails to address the default within a specified timeframe, the seller may terminate the Contract for Deed. This means the buyer loses their rights to the property and may be required to vacate. b. Forfeiture of Equity: Non-payment and subsequent contract termination typically result in the loss of all equity built up by the buyer during the period of their occupancy. c. Legal Actions: In some cases, sellers may choose to pursue legal actions to recover any unpaid amounts, damages, or other costs associated with the buyer's default, such as foreclosure. 5. Types of Final Notices of Default: While the content and language may vary, some potential variations of Final Notices of Default based on circumstances include: a. Final Notice of Default due to missed payments b. Final Notice of Default due to consistent late payments c. Final Notice of Default for non-payment of property taxes or insurance premiums d. Final Notice of Default due to violation of other contract terms, such as property maintenance or alterations. Conclusion: For buyers in Tacoma, Washington, under a Contract for Deed, it is vital to fulfill payment obligations promptly. Understanding the implications of a Final Notice of Default is crucial to prevent contract termination and the potential loss of invested equity. Buyers should consult legal professionals and negotiate with sellers to explore alternative solutions and avoid default situations.