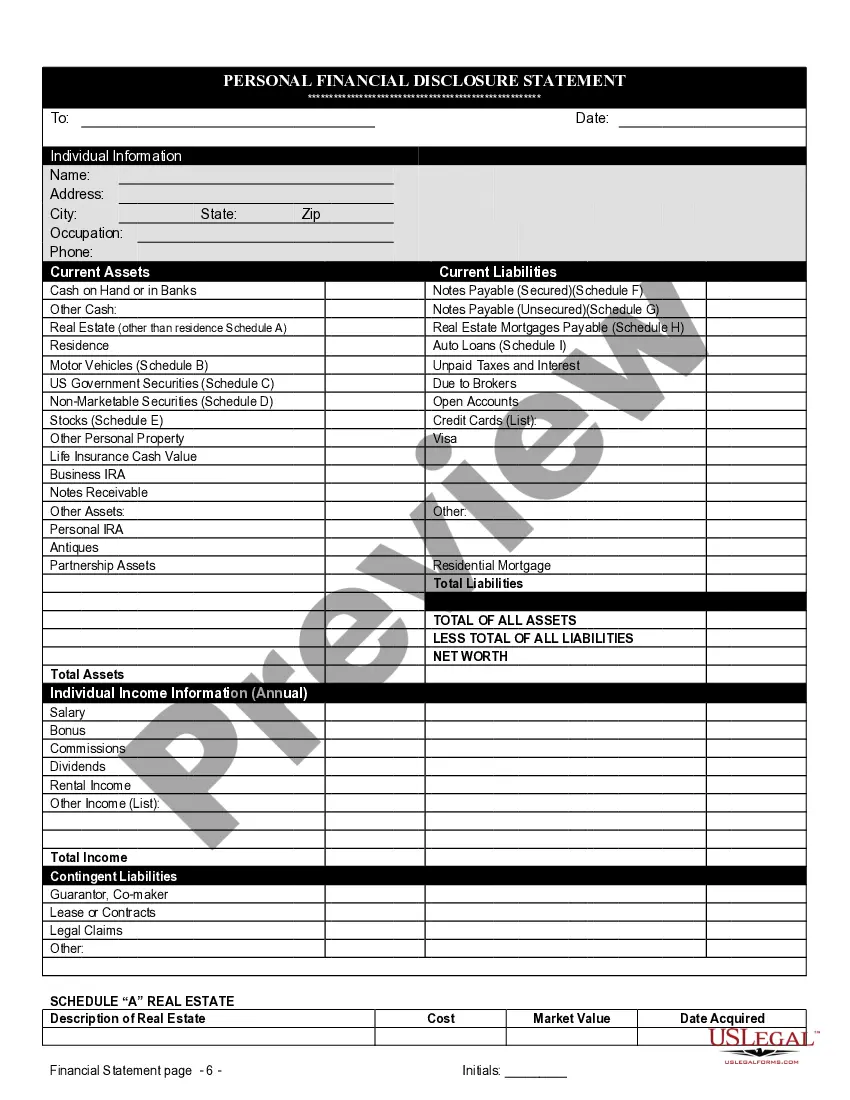

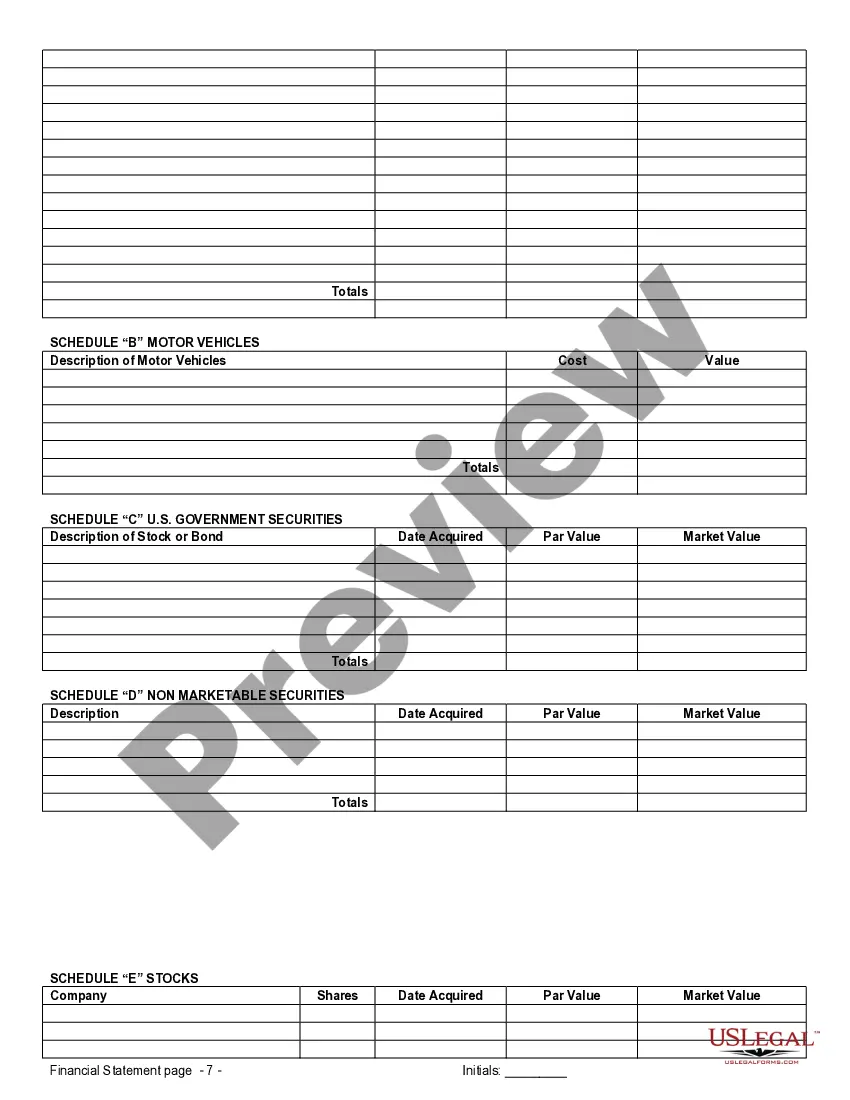

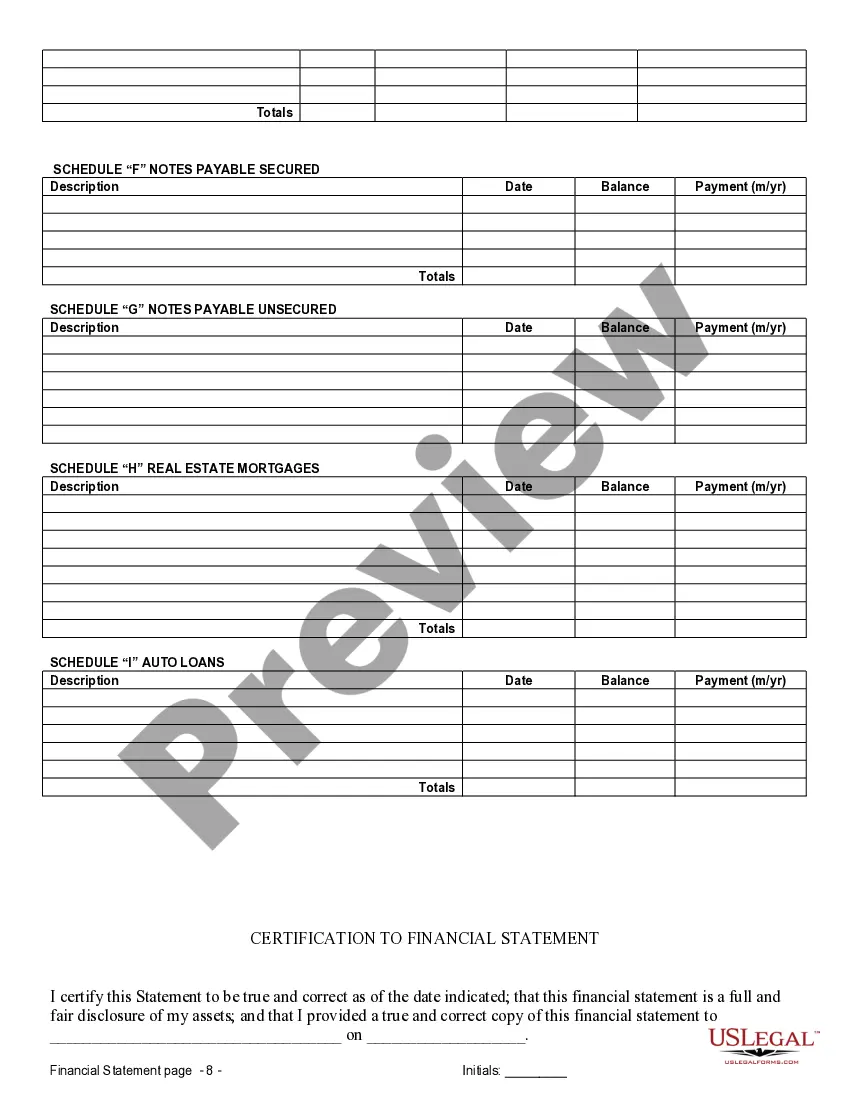

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Washington Financial Statements Only In Connection With Prenuptial Premarital Agreement?

We consistently endeavor to reduce or avert legal harm when addressing intricate legal or financial matters.

To achieve this, we request legal services that are typically quite costly. Nevertheless, not every legal concern is of equal complexity. Many of them can be managed by ourselves.

US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

Our platform empowers you to manage your affairs independently without seeking a lawyer. We offer access to legal document templates that are not always readily accessible. Our templates are tailored to specific states and regions, significantly easing the search process.

Ensure to verify if the Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement complies with the laws and regulations of your state and region.

- Take advantage of US Legal Forms whenever you need to locate and download the Bellevue Washington Financial Statements exclusively in relation to Prenuptial Premarital Agreement or any other document swiftly and securely.

- Simply Log In to your account and click the Get button beside it.

- If you happen to misplace the document, you can always retrieve it again from within the My documents section.

- The procedure is just as uncomplicated if you’re new to the platform!

Form popularity

FAQ

The value of a prenuptial agreement lies in its ability to protect both partners' interests. By clearly defining financial arrangements, a Bellevue Washington Financial Statement only in Connection with Prenuptial Premarital Agreement reduces uncertainty and potential conflict. It empowers couples to communicate openly about finances and build trust within their relationship. Ultimately, a well-crafted prenup strengthens the foundation of a marriage.

Yes, a prenuptial agreement can establish guidelines for keeping finances separate throughout the marriage. By clearly detailing financial responsibilities and asset ownership, a Bellevue Washington Financial Statement only in Connection with Prenuptial Premarital Agreement facilitates this separation. This arrangement protects individual assets and can simplify financial matters in the event of a divorce. Many couples find that clarity from a prenup reduces financial stress.

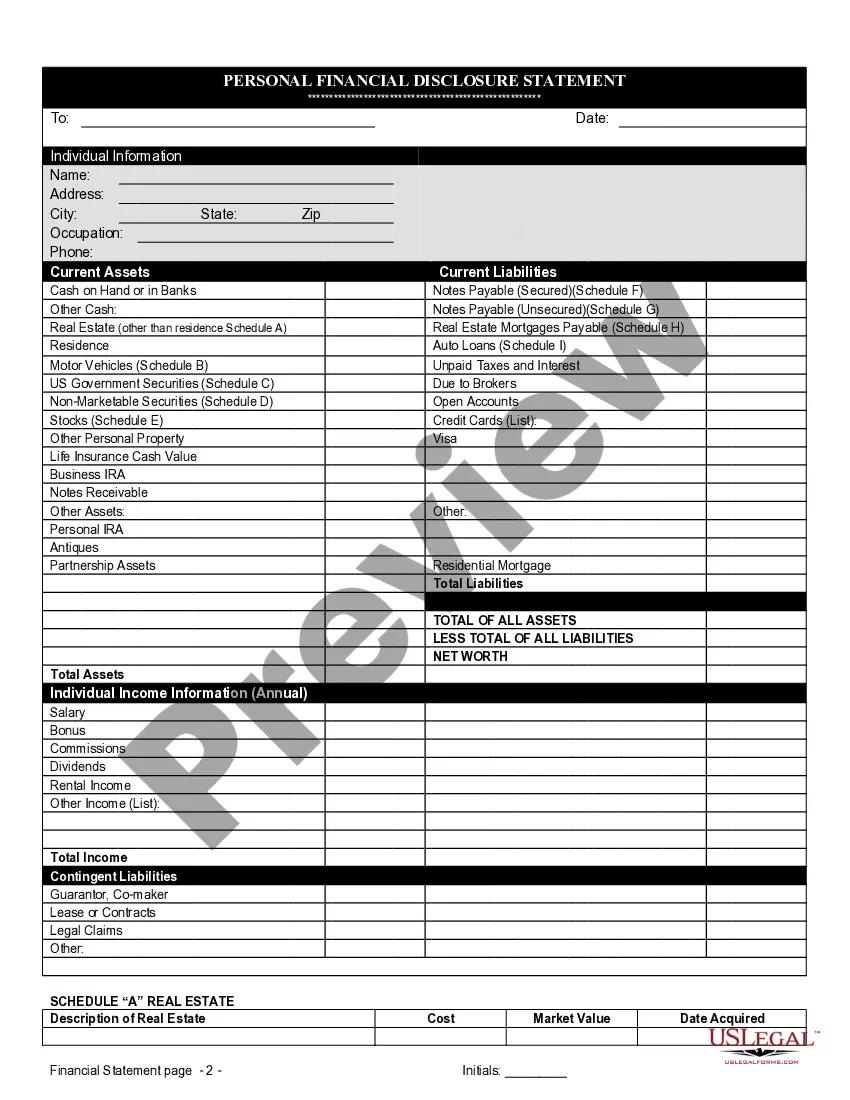

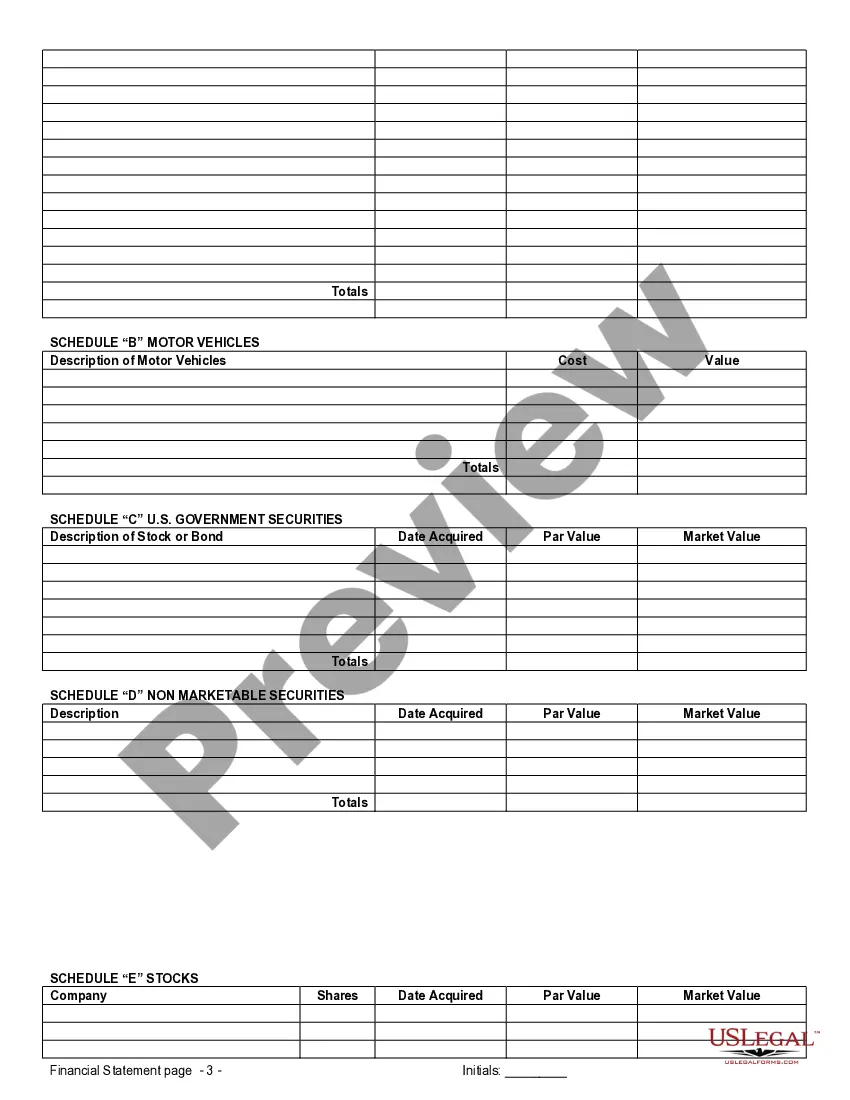

The financial statement in a prenuptial agreement outlines each partner's assets, liabilities, income, and expenses. For anyone considering a Bellevue Washington Financial Statement only in Connection with Prenuptial Premarital Agreement, this documentation is essential for clarity and fairness. It helps ensure both parties understand their financial situation before marriage. Comprehensive financial statements can prevent disputes and provide peace of mind.

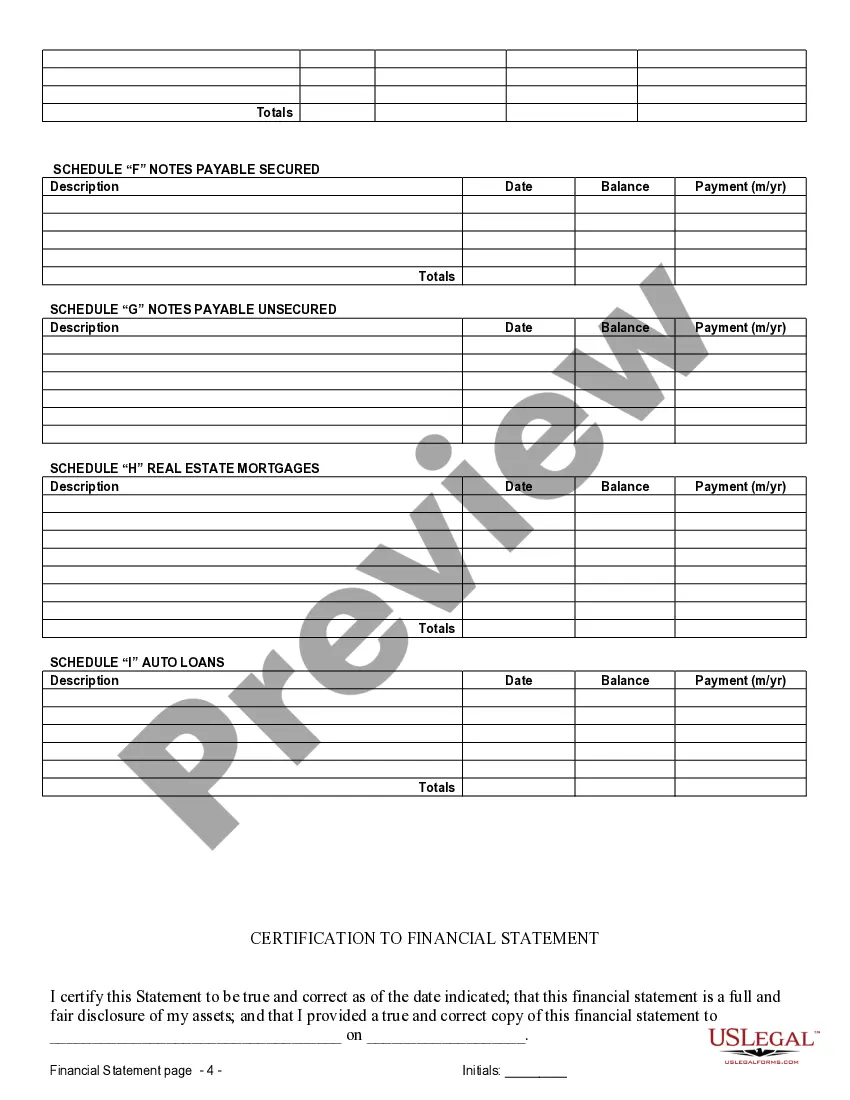

A loophole in a prenuptial agreement can arise when the financial disclosures are incomplete or misleading. This often relates to the Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement, which require full transparency. If one partner does not fully disclose their assets or debts, the court may consider the prenup unenforceable. Thus, it is crucial to ensure that all financial statements are accurate and comprehensive.

No, a prenup is not limited to only premarital assets. While it primarily addresses how assets and debts are handled before marriage, it can also cover future earnings and property acquired during the marriage. In Bellevue Washington, Financial Statements only in Connection with Prenuptial Premarital Agreements play a crucial role in defining the financial landscape for both parties. This ensures clarity and security, reducing potential disputes down the line.

Yes, you can write your own prenup in Washington state. However, it is crucial to ensure that your document complies with state laws and addresses all necessary terms. Keep in mind that including Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement can enhance the validity of your agreement. To avoid potential pitfalls, using a reliable resource like US Legal Forms can help guide you through the process and provide templates that meet legal standards.

A financial statement for a prenuptial agreement is a document that outlines each partner's finances, including income, assets, debts, and expenses. This statement is crucial for ensuring both parties are transparent with each other about their financial situations. By preparing Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement, partners can establish a fair groundwork for their agreement and avoid misunderstandings in the future.

To effectively draft a prenuptial agreement, essential information includes a comprehensive list of assets, liabilities, and income for both parties. Each partner must provide their Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement, which serves as a foundation for transparent and equitable discussions. This information allows for informed decision-making about financial arrangements.

Yes, financial disclosure is fundamental for a prenuptial agreement. Both parties are obligated to present their financial information, including income, debts, and assets. Accurately providing this information, such as Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement, helps prevent future disputes and ensures fairness during the prenup negotiation.

To list assets for a prenuptial agreement, both partners should inventory all properties, bank accounts, and any other relevant financial interests. It is crucial to provide detailed descriptions and values to ensure clarity and accuracy. Including Bellevue Washington Financial Statements only in Connection with Prenuptial Premarital Agreement enhances the credibility of the asset listing, making the agreement more robust.