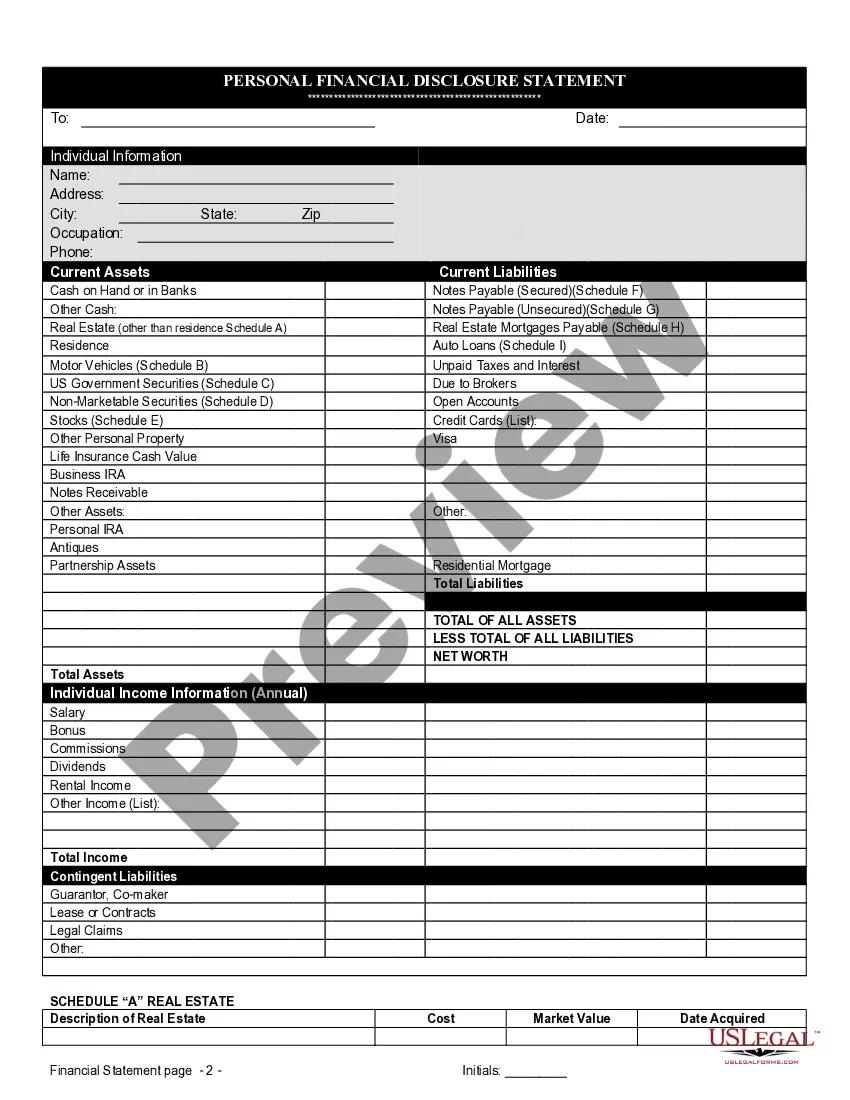

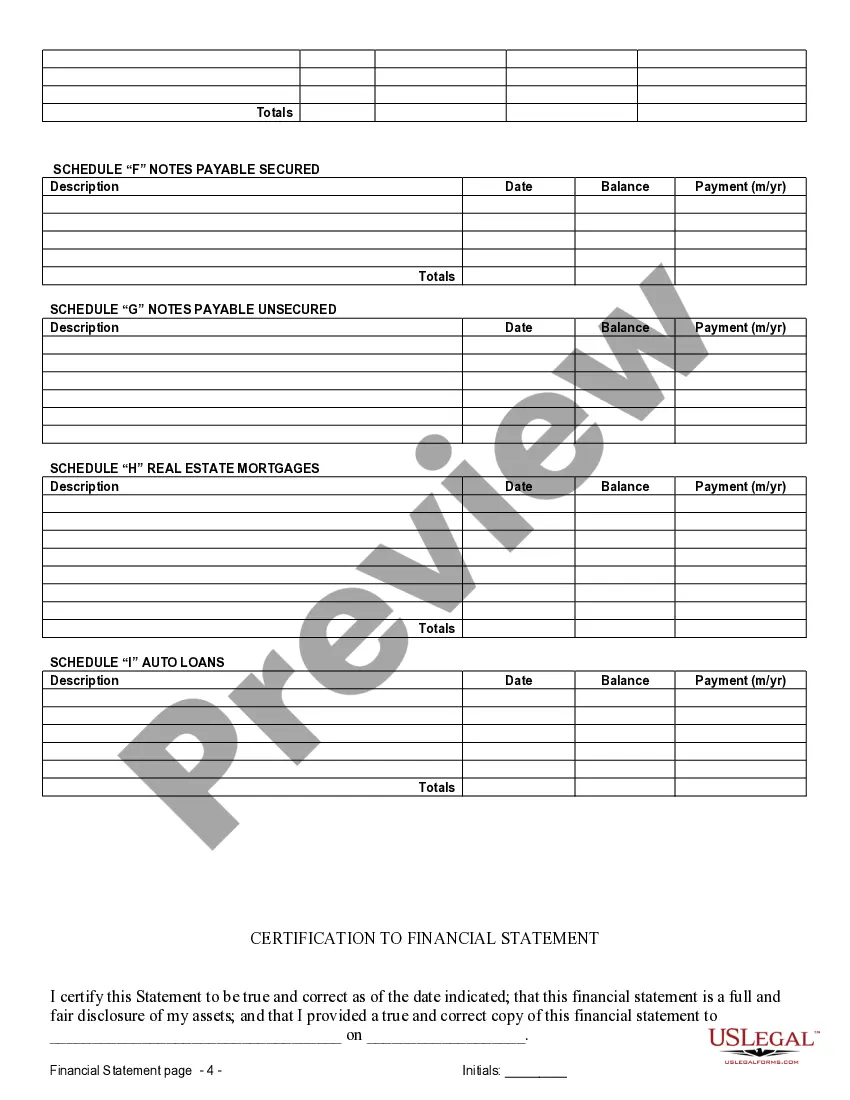

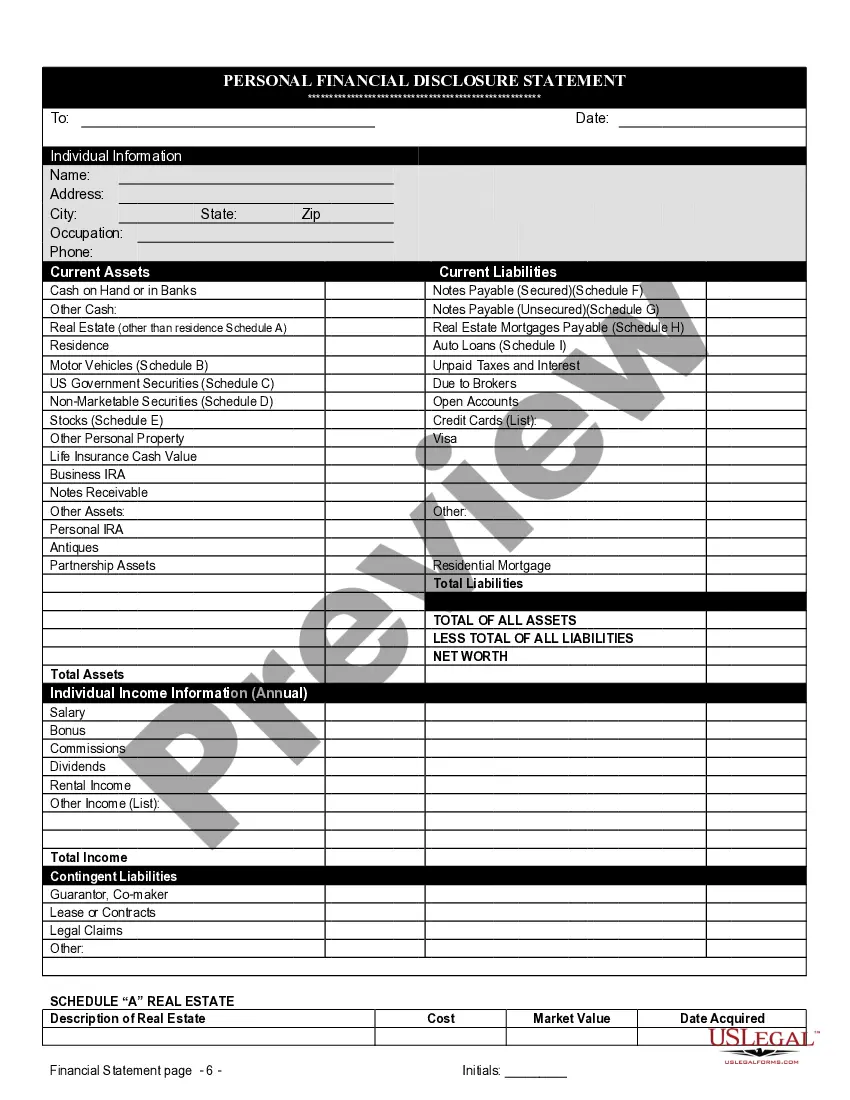

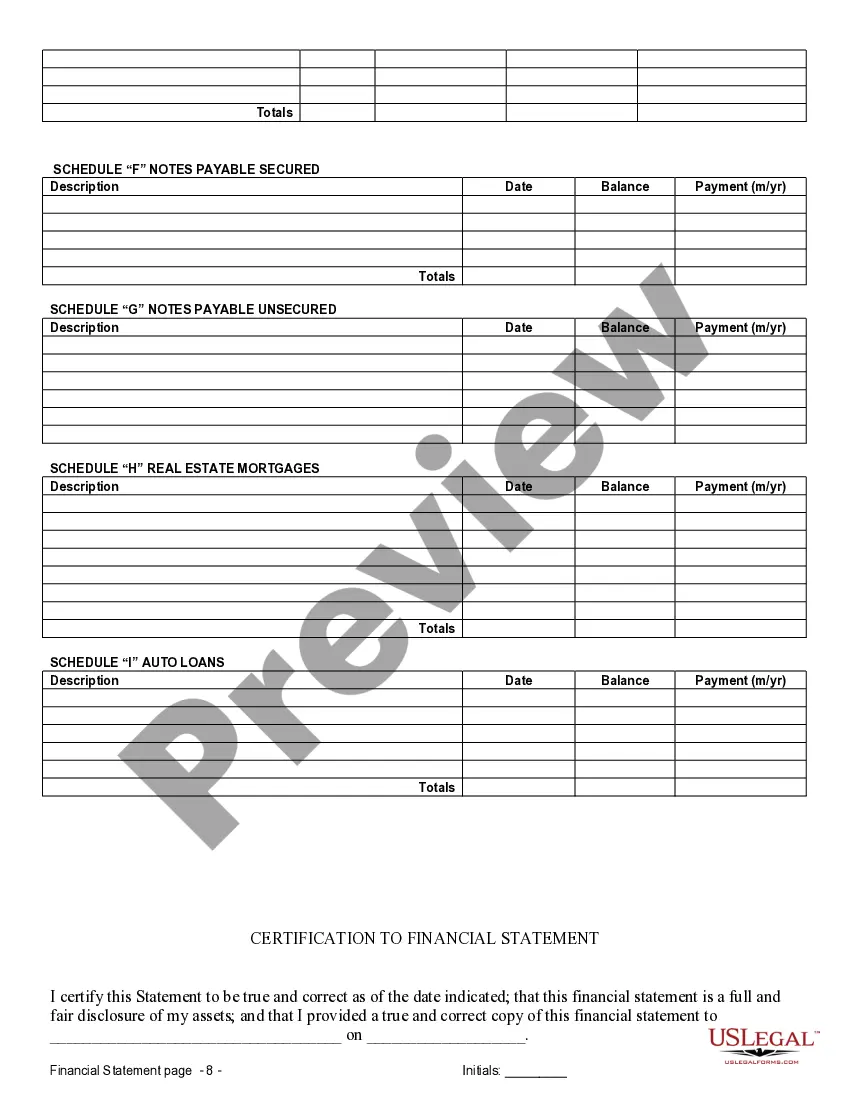

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

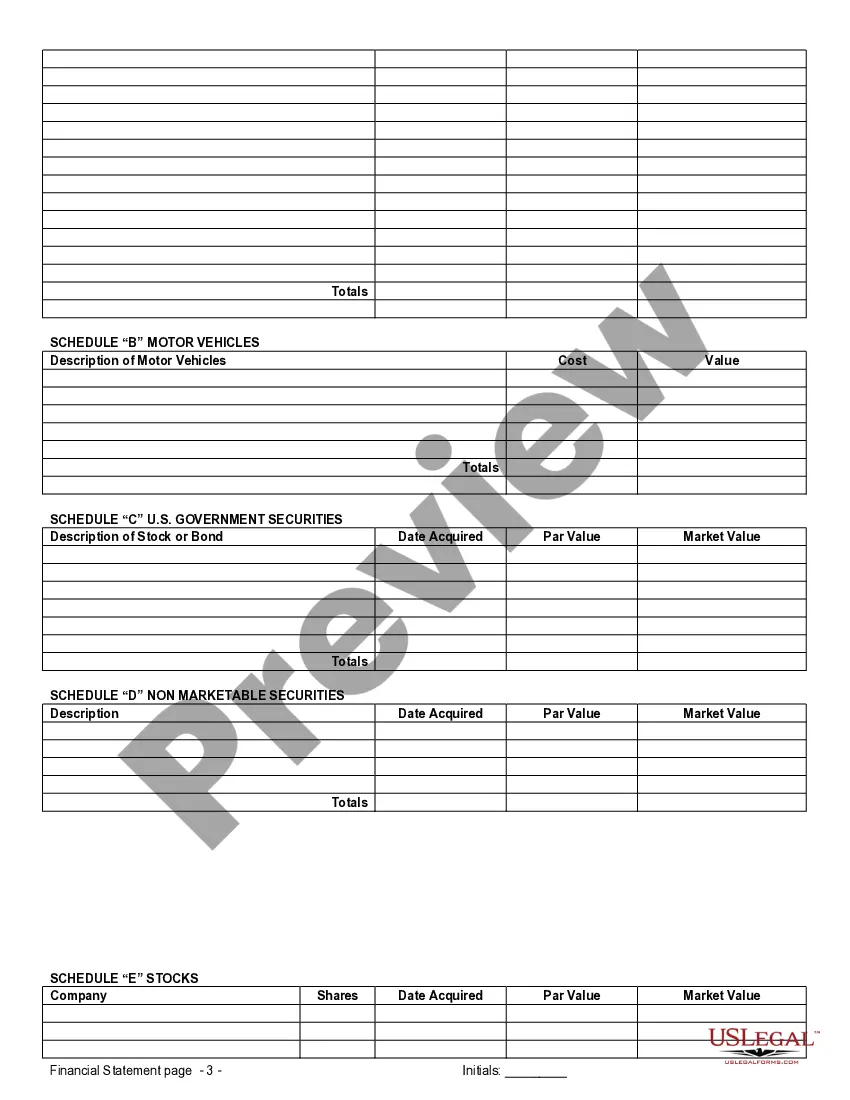

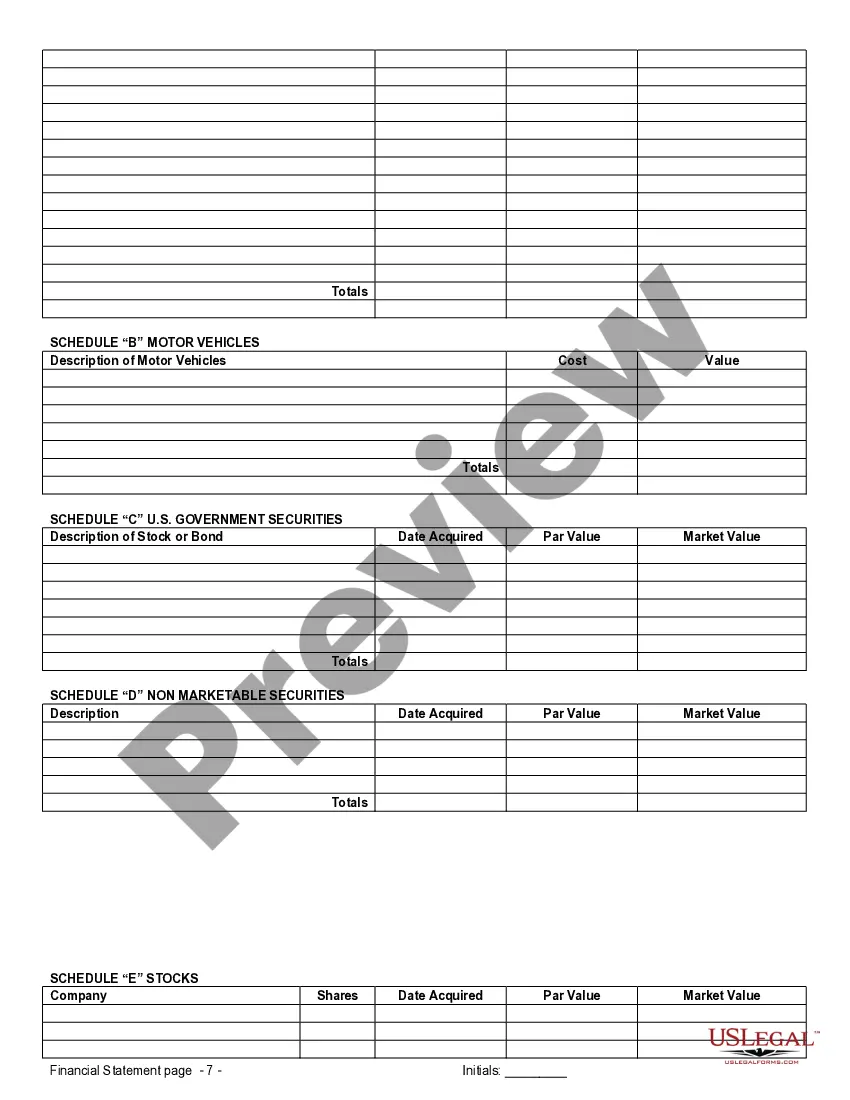

Spokane Valley, Washington Financial Statements in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role in prenuptial or premarital agreements in Spokane Valley, Washington. These statements offer a comprehensive view of each party's financial situation, ensuring transparency and protection of assets in case of divorce or separation. It is necessary for individuals to understand the different types of financial statements used in these agreements to make informed decisions. 1. Income Statement: An income statement provides a detailed overview of the individual's income sources, including employment, investments, and any other sources of income. It outlines both parties' earnings, ensuring a clear understanding of their financial capacities and commitments. 2. Balance Sheet: A balance sheet summarizes an individual's assets, liabilities, and equity. It provides an accurate snapshot of each party's net worth, including real estate properties, vehicles, financial accounts, and outstanding debts. This statement helps establish an equitable distribution of assets and liabilities in case of dissolution. 3. Cash Flow Statement: A cash flow statement tracks the movement of cash in and out of an individual's accounts. It outlines income and expenses, enabling a comprehensive understanding of each party's spending habits and financial responsibilities. This statement is particularly helpful in evaluating financial stability and financial commitments. 4. Tax Returns: Tax returns are vital financial documents that provide detailed information about an individual's income, deductions, and any potential tax liabilities. They offer a transparent view of each party's tax situation, ensuring an accurate assessment of their financial circumstances. 5. Bank Statements: Bank statements outline all financial transactions, including deposits, withdrawals, and transfers, within a specified period. They provide detailed information about an individual's cash inflows and outflows, helping to identify any potential sources of undisclosed income or hidden debts. It is essential for individuals seeking a prenuptial or premarital agreement in Spokane Valley, Washington, to provide accurate and up-to-date financial statements. These statements need to be comprehensive, transparent, and verified by reputable financial institutions or professionals to maintain the integrity and enforceability of the agreement. Please note that this is general information on common types of financial statements used in prenuptial or premarital agreements. It is advisable to consult with a qualified attorney specializing in family law and estate planning to ensure compliance with local laws, specific requirements, and individual circumstances.Spokane Valley, Washington Financial Statements in Connection with Prenuptial Premarital Agreement Financial statements play a crucial role in prenuptial or premarital agreements in Spokane Valley, Washington. These statements offer a comprehensive view of each party's financial situation, ensuring transparency and protection of assets in case of divorce or separation. It is necessary for individuals to understand the different types of financial statements used in these agreements to make informed decisions. 1. Income Statement: An income statement provides a detailed overview of the individual's income sources, including employment, investments, and any other sources of income. It outlines both parties' earnings, ensuring a clear understanding of their financial capacities and commitments. 2. Balance Sheet: A balance sheet summarizes an individual's assets, liabilities, and equity. It provides an accurate snapshot of each party's net worth, including real estate properties, vehicles, financial accounts, and outstanding debts. This statement helps establish an equitable distribution of assets and liabilities in case of dissolution. 3. Cash Flow Statement: A cash flow statement tracks the movement of cash in and out of an individual's accounts. It outlines income and expenses, enabling a comprehensive understanding of each party's spending habits and financial responsibilities. This statement is particularly helpful in evaluating financial stability and financial commitments. 4. Tax Returns: Tax returns are vital financial documents that provide detailed information about an individual's income, deductions, and any potential tax liabilities. They offer a transparent view of each party's tax situation, ensuring an accurate assessment of their financial circumstances. 5. Bank Statements: Bank statements outline all financial transactions, including deposits, withdrawals, and transfers, within a specified period. They provide detailed information about an individual's cash inflows and outflows, helping to identify any potential sources of undisclosed income or hidden debts. It is essential for individuals seeking a prenuptial or premarital agreement in Spokane Valley, Washington, to provide accurate and up-to-date financial statements. These statements need to be comprehensive, transparent, and verified by reputable financial institutions or professionals to maintain the integrity and enforceability of the agreement. Please note that this is general information on common types of financial statements used in prenuptial or premarital agreements. It is advisable to consult with a qualified attorney specializing in family law and estate planning to ensure compliance with local laws, specific requirements, and individual circumstances.