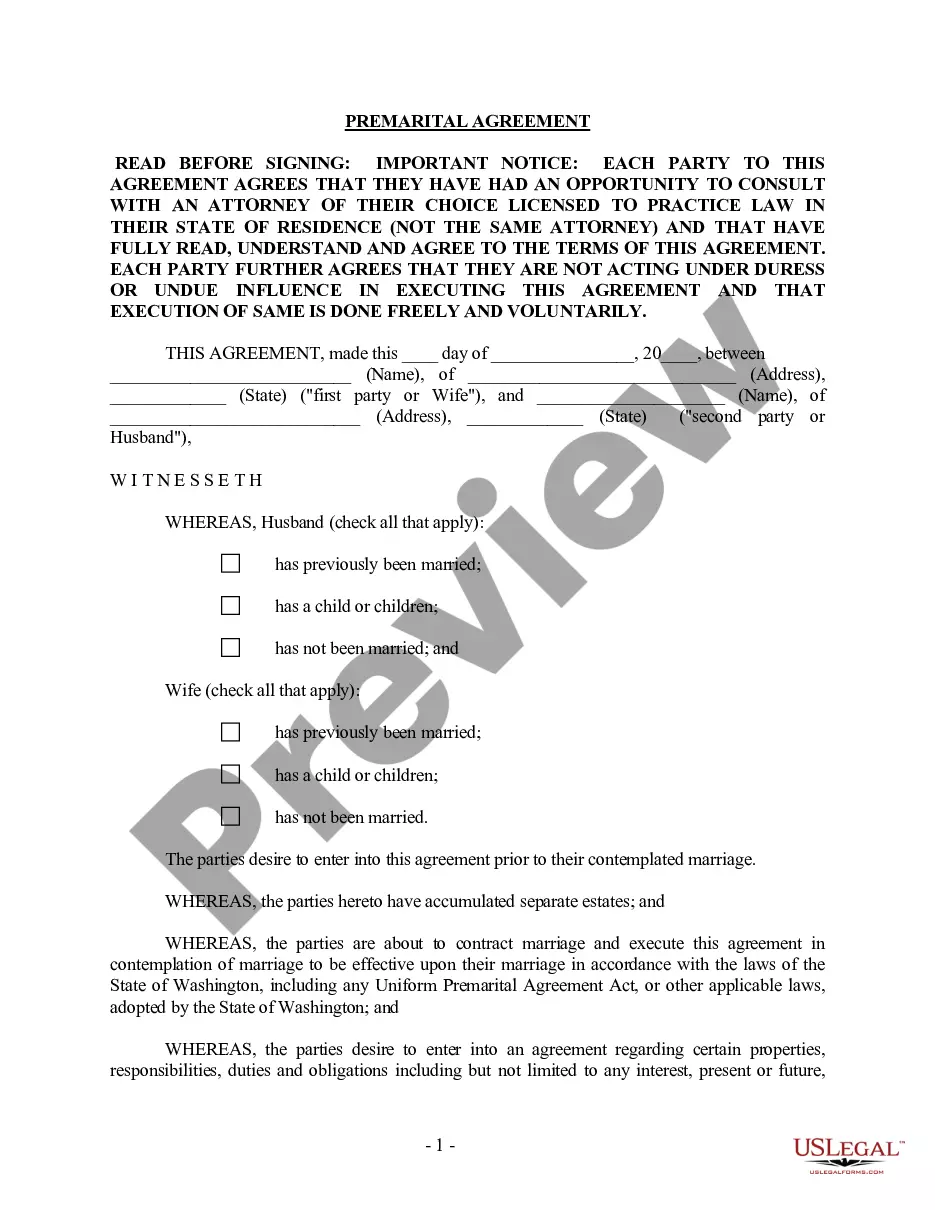

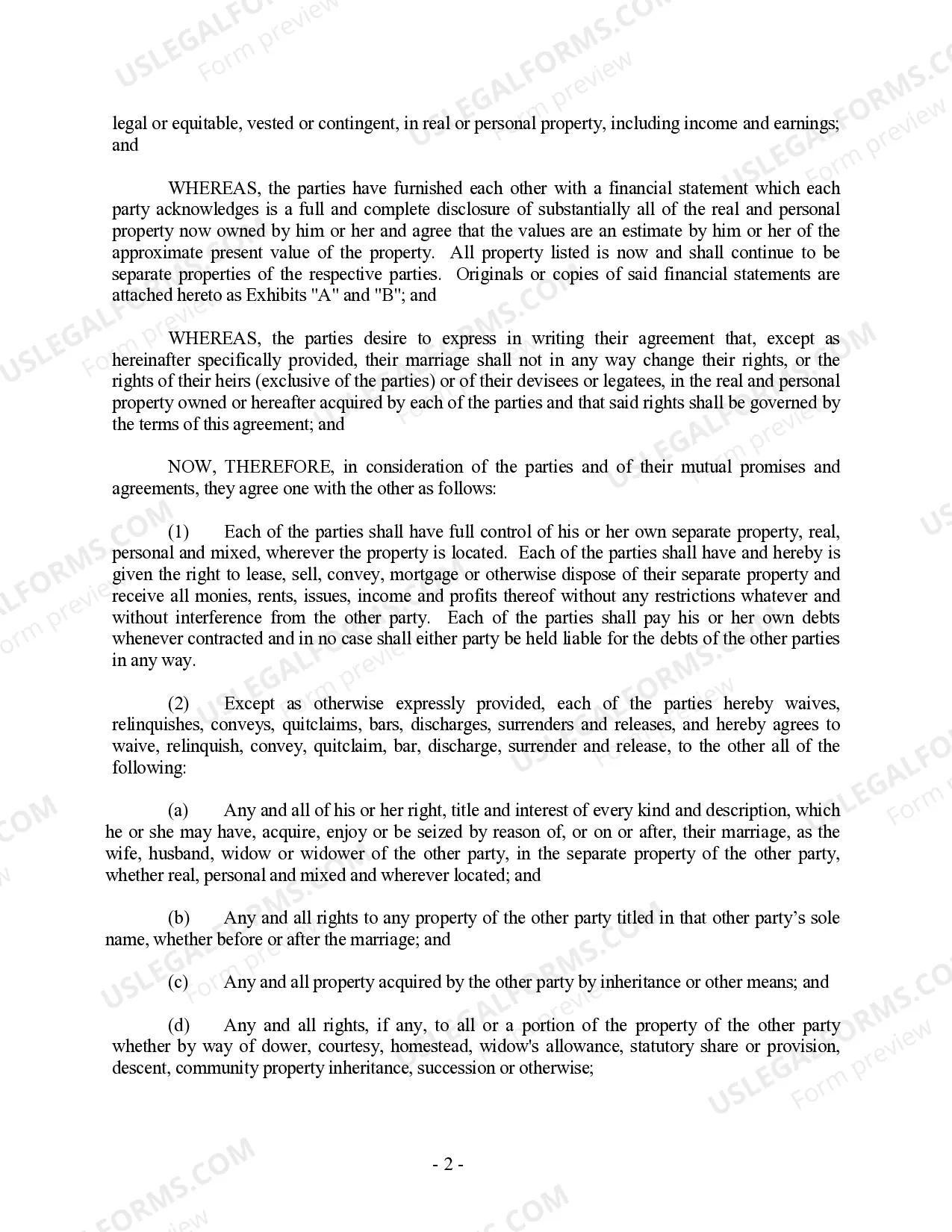

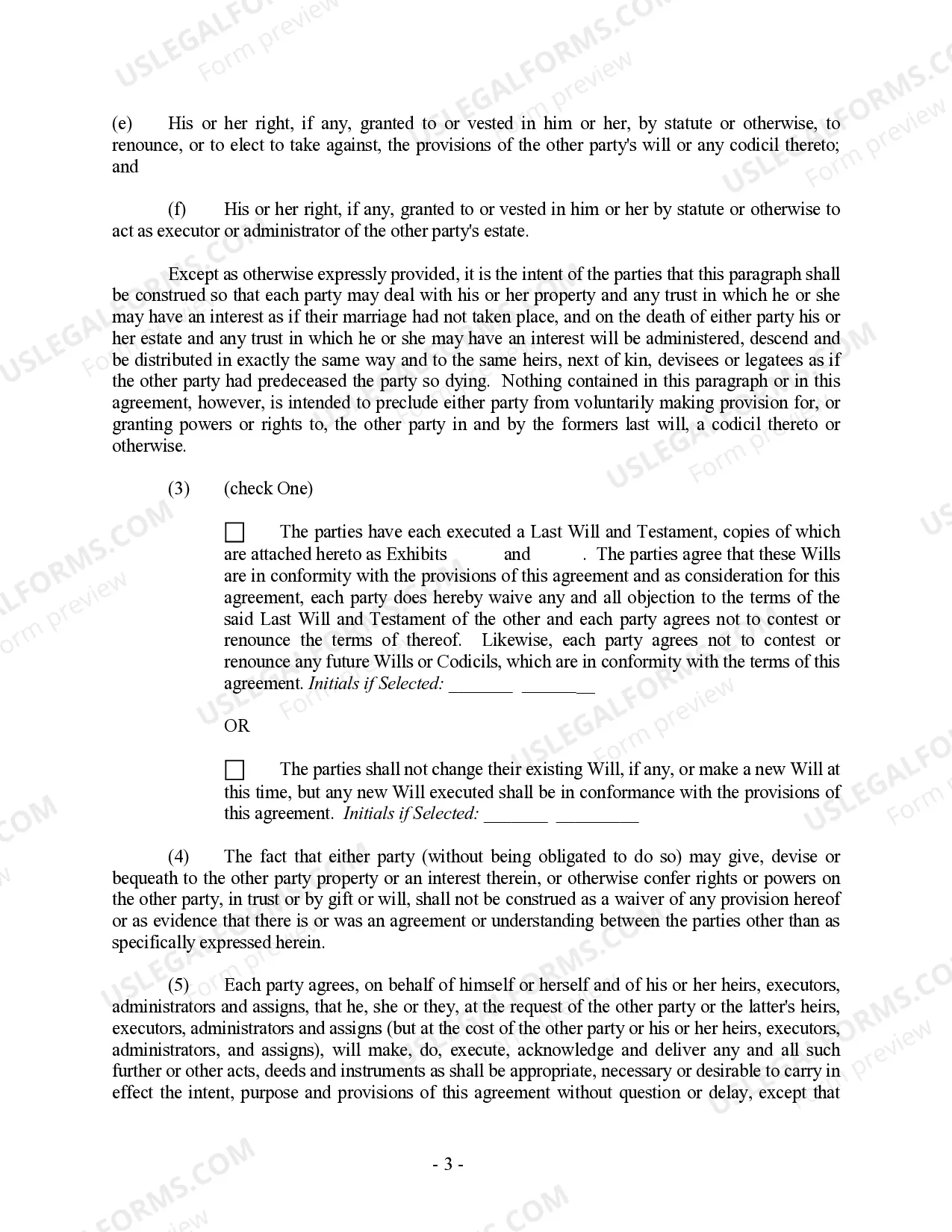

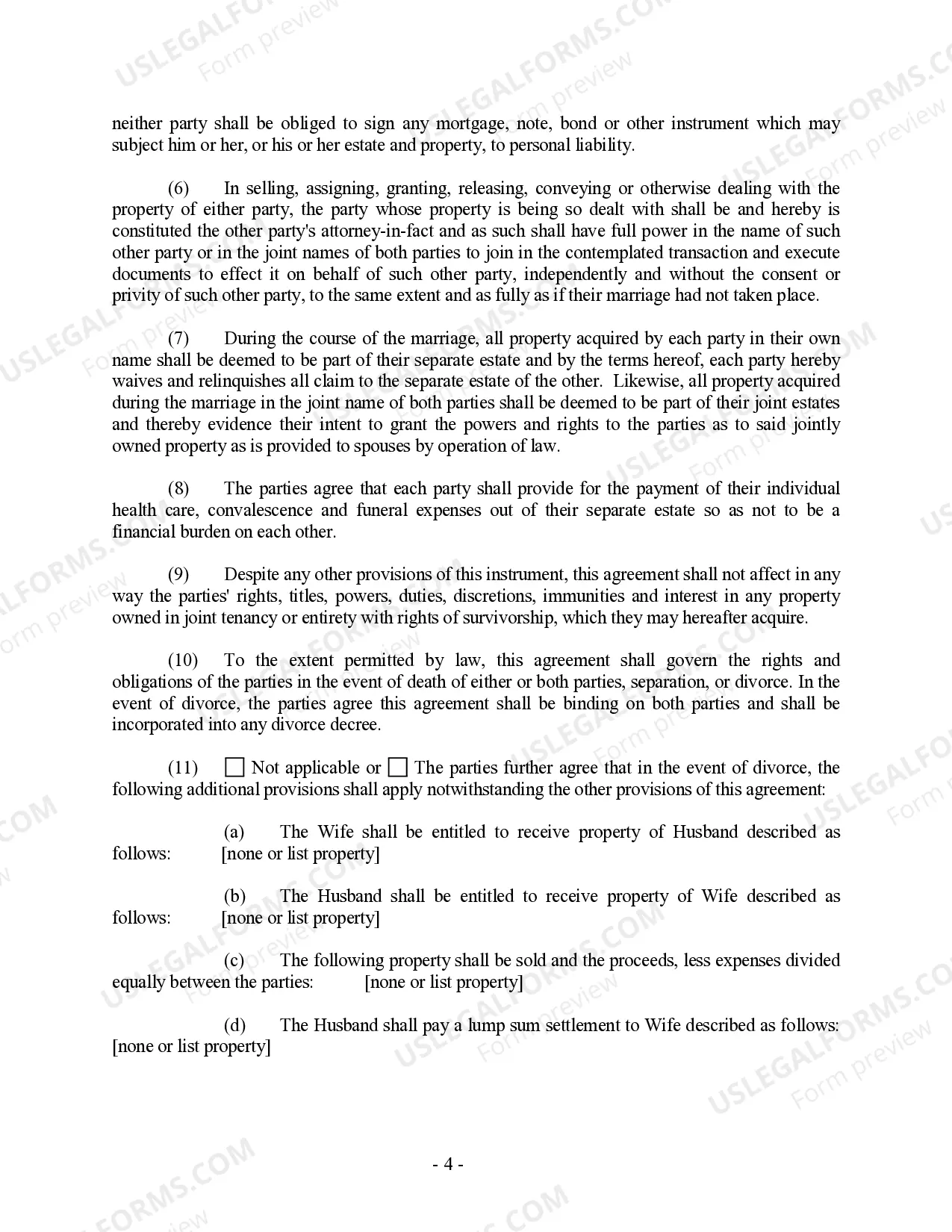

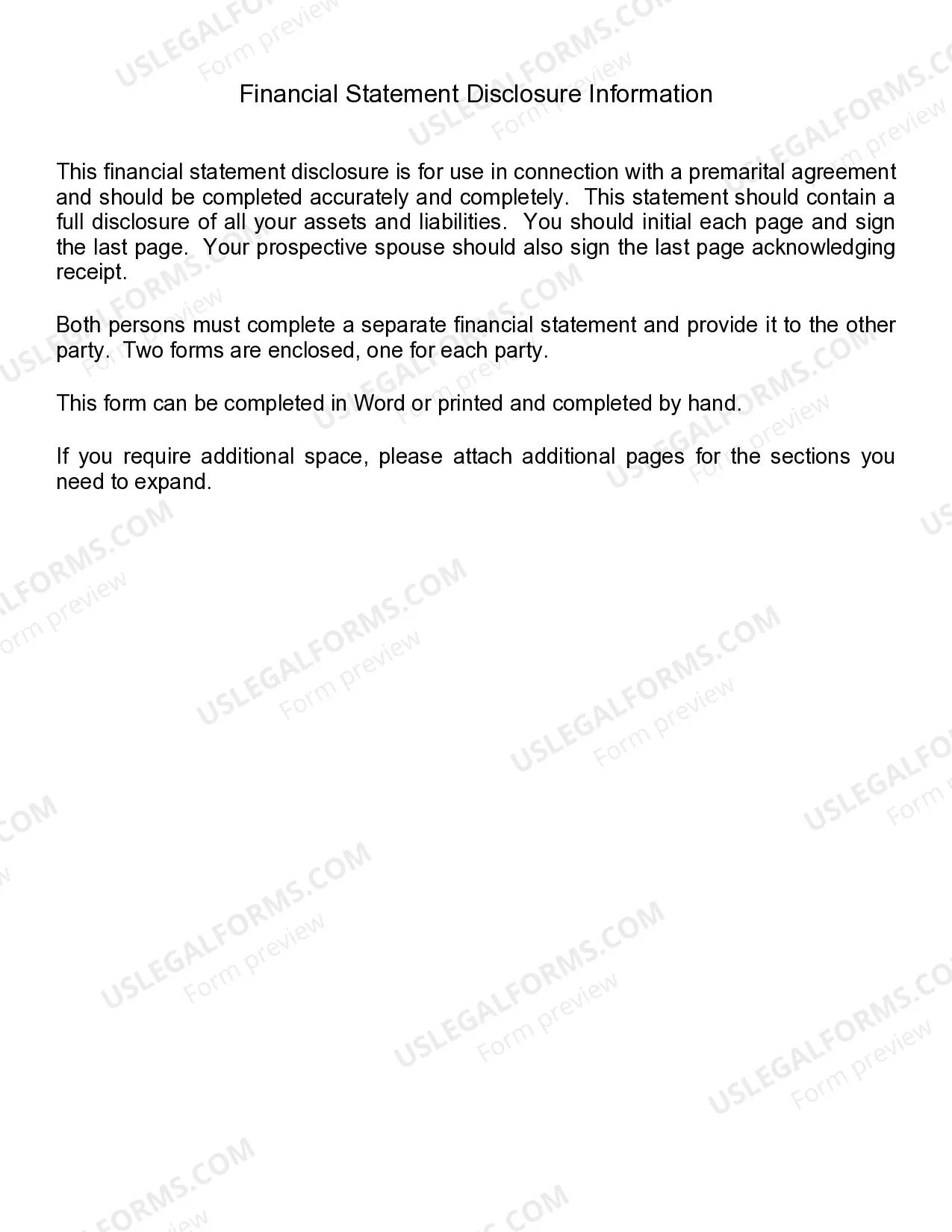

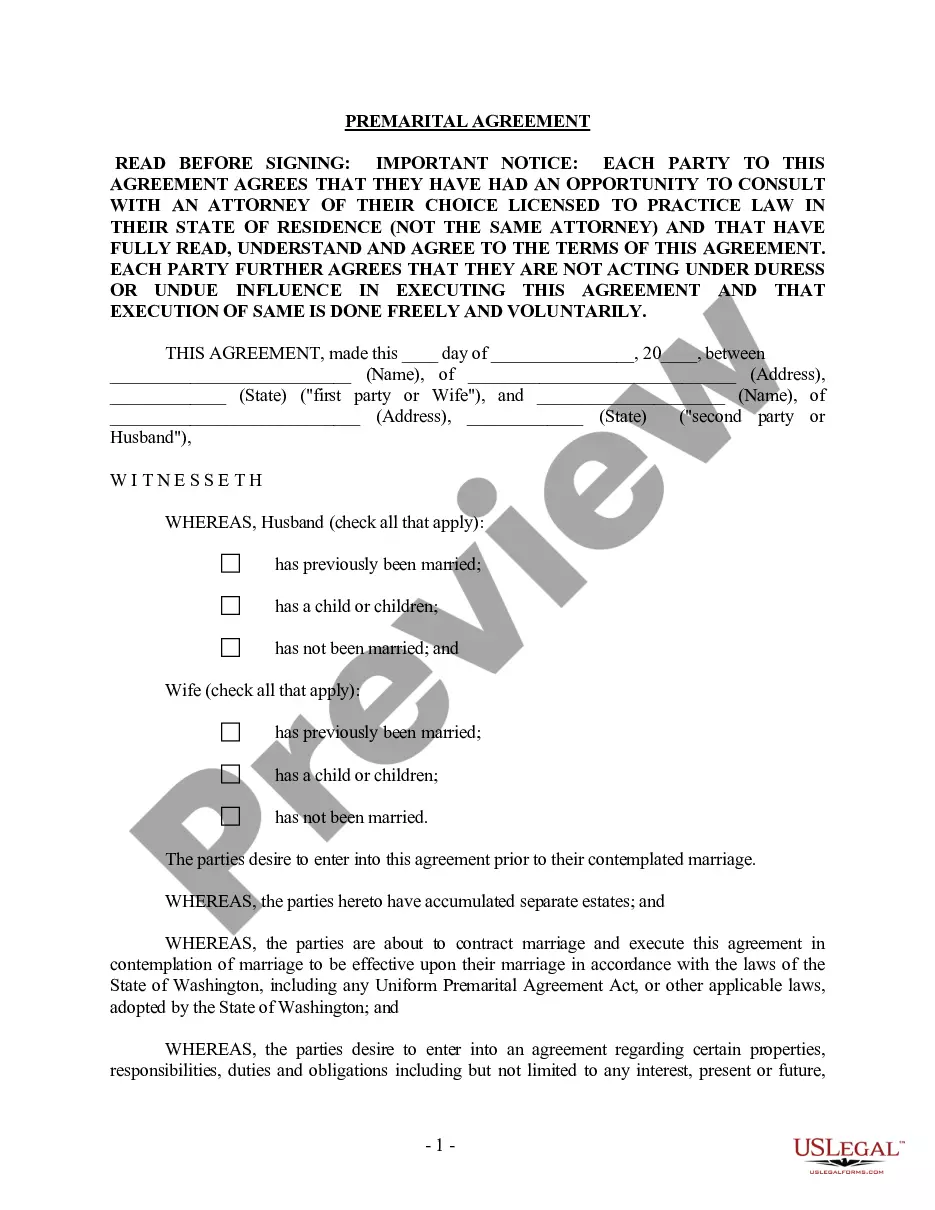

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

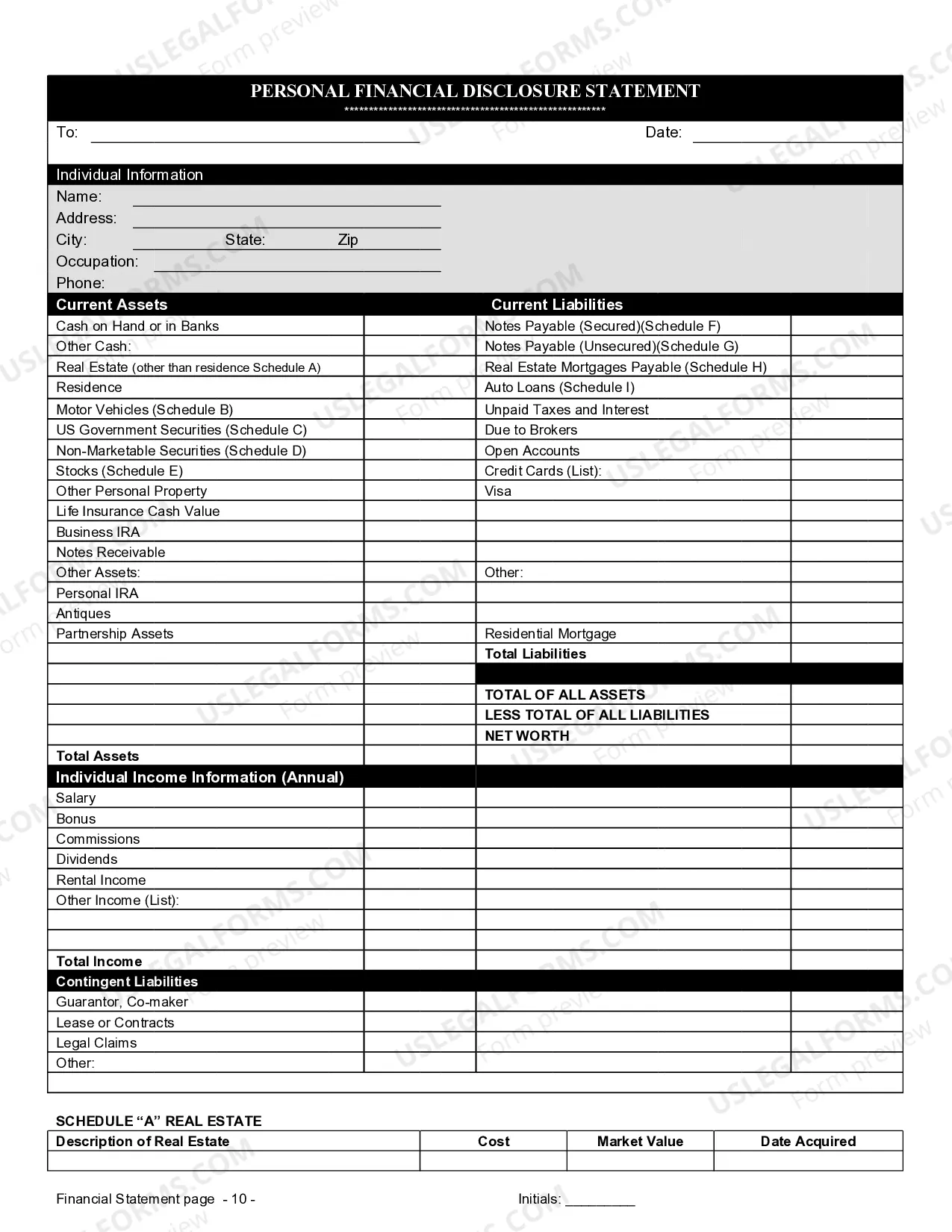

A Renton Washington Prenuptial Premarital Agreement with Financial Statements is a legally binding contract that is signed by a couple before they enter into marriage or a civil partnership. This document outlines the financial arrangements, obligations, and rights of each party in the event of a divorce, separation, or death. Renton, Washington is located in King County and is a suburb of Seattle. The laws regarding prenuptial agreements can vary from state to state, so it is important to understand how they apply specifically in Renton, Washington. Obtaining legal advice from a family law attorney who is knowledgeable about the local regulations is crucial to ensure that the agreement complies with all relevant laws. The Renton Washington Prenuptial Premarital Agreement with Financial Statements typically includes a variety of detailed financial information. This can include but is not limited to: 1. Assets and Debts: The agreement will outline the assets and debts that each party owns individually or jointly at the time of the agreement. This can include properties, bank accounts, investments, vehicles, loans, credit card debts, and any other financial obligations. 2. Income and Earnings: The document will state the current income of each party and may include provisions for the future sharing of earnings during the marriage. Spousal support or alimony may also be addressed in the agreement. 3. Property Division: This section will specify how the property will be divided in the case of a divorce or separation. It may mention the division of real estate, personal belongings, and other valuable assets. 4. Inheritance and Estate Planning: The agreement can address how the parties' inheritance and estate planning decisions will be affected by the marriage. This may involve the allocation of assets to children from previous relationships or specific provisions for future inheritances. 5. Business Ownership: If either party owns or operates a business, the prenuptial agreement may outline the rights and obligations concerning the business in case of a divorce or separation. Different types of Renton Washington Prenuptial Premarital Agreements with Financial Statements can be tailored to the specific needs and circumstances of the couple. Some additional variations may include: 1. Simple Prenuptial Agreement: This type of agreement typically focuses on basic asset and debt division without extensive detail on other financial aspects. 2. Complex Prenuptial Agreement: In cases involving significant assets or complex financial arrangements, a more detailed agreement may be necessary. This type of agreement may include provisions for investments, shared businesses, or multiple properties. 3. One-Sided Prenuptial Agreement: Sometimes referred to as a "Waiver Agreement," this type of agreement is designed to protect one spouse's assets more than the other. It is essential that both parties seek independent legal counsel to ensure fairness and legality. 4. Postnuptial Agreement: Although not technically a prenuptial agreement, a postnuptial agreement can serve a similar purpose. It allows couples to establish or modify financial arrangements after they have already entered into marriage or a civil partnership. In conclusion, a Renton Washington Prenuptial Premarital Agreement with Financial Statements is a comprehensive legal document that outlines the financial rights, responsibilities, and division of assets between spouses in the event of a divorce, separation, or death. It is essential for couples in Renton, Washington, to understand the local laws, seek legal counsel, and tailor the agreement to their specific circumstances.A Renton Washington Prenuptial Premarital Agreement with Financial Statements is a legally binding contract that is signed by a couple before they enter into marriage or a civil partnership. This document outlines the financial arrangements, obligations, and rights of each party in the event of a divorce, separation, or death. Renton, Washington is located in King County and is a suburb of Seattle. The laws regarding prenuptial agreements can vary from state to state, so it is important to understand how they apply specifically in Renton, Washington. Obtaining legal advice from a family law attorney who is knowledgeable about the local regulations is crucial to ensure that the agreement complies with all relevant laws. The Renton Washington Prenuptial Premarital Agreement with Financial Statements typically includes a variety of detailed financial information. This can include but is not limited to: 1. Assets and Debts: The agreement will outline the assets and debts that each party owns individually or jointly at the time of the agreement. This can include properties, bank accounts, investments, vehicles, loans, credit card debts, and any other financial obligations. 2. Income and Earnings: The document will state the current income of each party and may include provisions for the future sharing of earnings during the marriage. Spousal support or alimony may also be addressed in the agreement. 3. Property Division: This section will specify how the property will be divided in the case of a divorce or separation. It may mention the division of real estate, personal belongings, and other valuable assets. 4. Inheritance and Estate Planning: The agreement can address how the parties' inheritance and estate planning decisions will be affected by the marriage. This may involve the allocation of assets to children from previous relationships or specific provisions for future inheritances. 5. Business Ownership: If either party owns or operates a business, the prenuptial agreement may outline the rights and obligations concerning the business in case of a divorce or separation. Different types of Renton Washington Prenuptial Premarital Agreements with Financial Statements can be tailored to the specific needs and circumstances of the couple. Some additional variations may include: 1. Simple Prenuptial Agreement: This type of agreement typically focuses on basic asset and debt division without extensive detail on other financial aspects. 2. Complex Prenuptial Agreement: In cases involving significant assets or complex financial arrangements, a more detailed agreement may be necessary. This type of agreement may include provisions for investments, shared businesses, or multiple properties. 3. One-Sided Prenuptial Agreement: Sometimes referred to as a "Waiver Agreement," this type of agreement is designed to protect one spouse's assets more than the other. It is essential that both parties seek independent legal counsel to ensure fairness and legality. 4. Postnuptial Agreement: Although not technically a prenuptial agreement, a postnuptial agreement can serve a similar purpose. It allows couples to establish or modify financial arrangements after they have already entered into marriage or a civil partnership. In conclusion, a Renton Washington Prenuptial Premarital Agreement with Financial Statements is a comprehensive legal document that outlines the financial rights, responsibilities, and division of assets between spouses in the event of a divorce, separation, or death. It is essential for couples in Renton, Washington, to understand the local laws, seek legal counsel, and tailor the agreement to their specific circumstances.