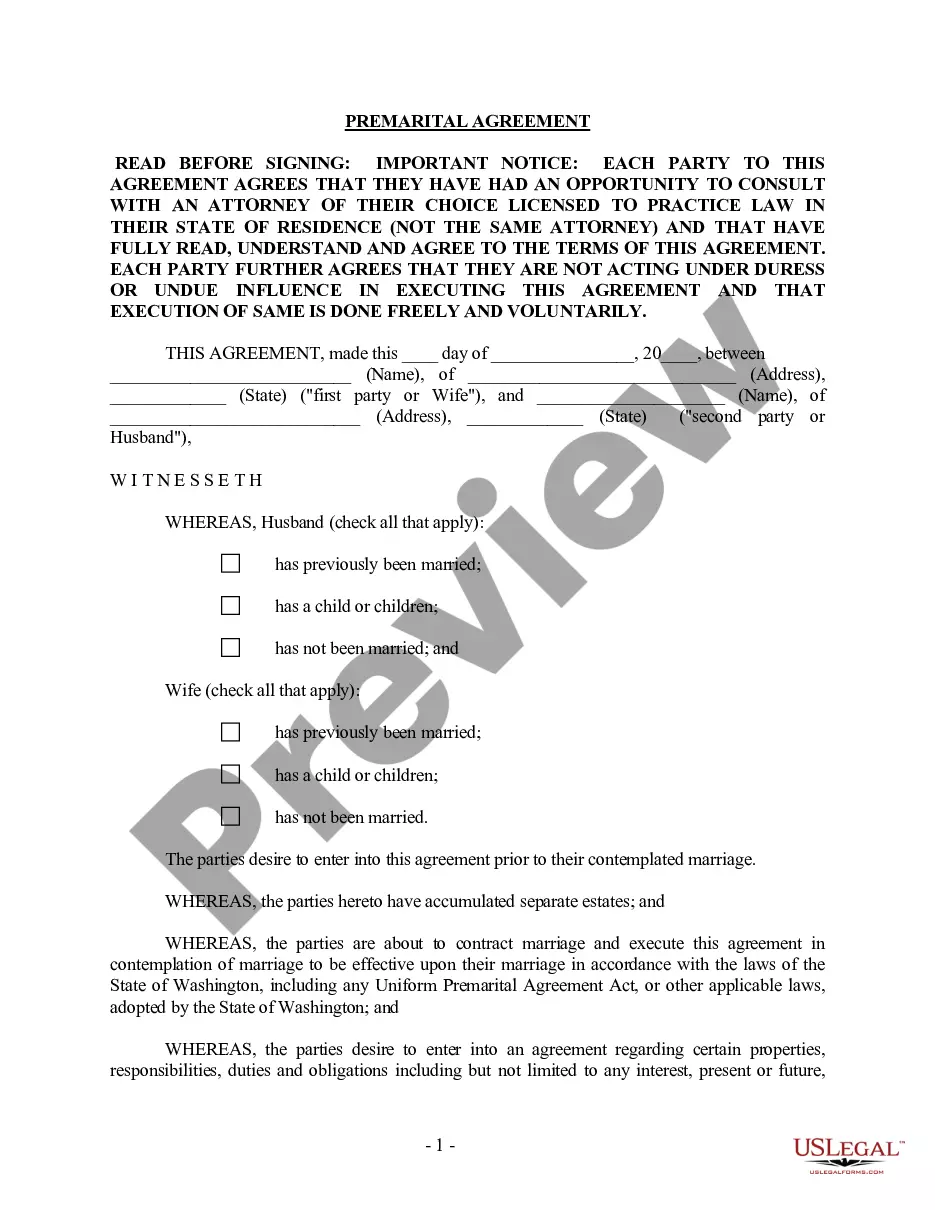

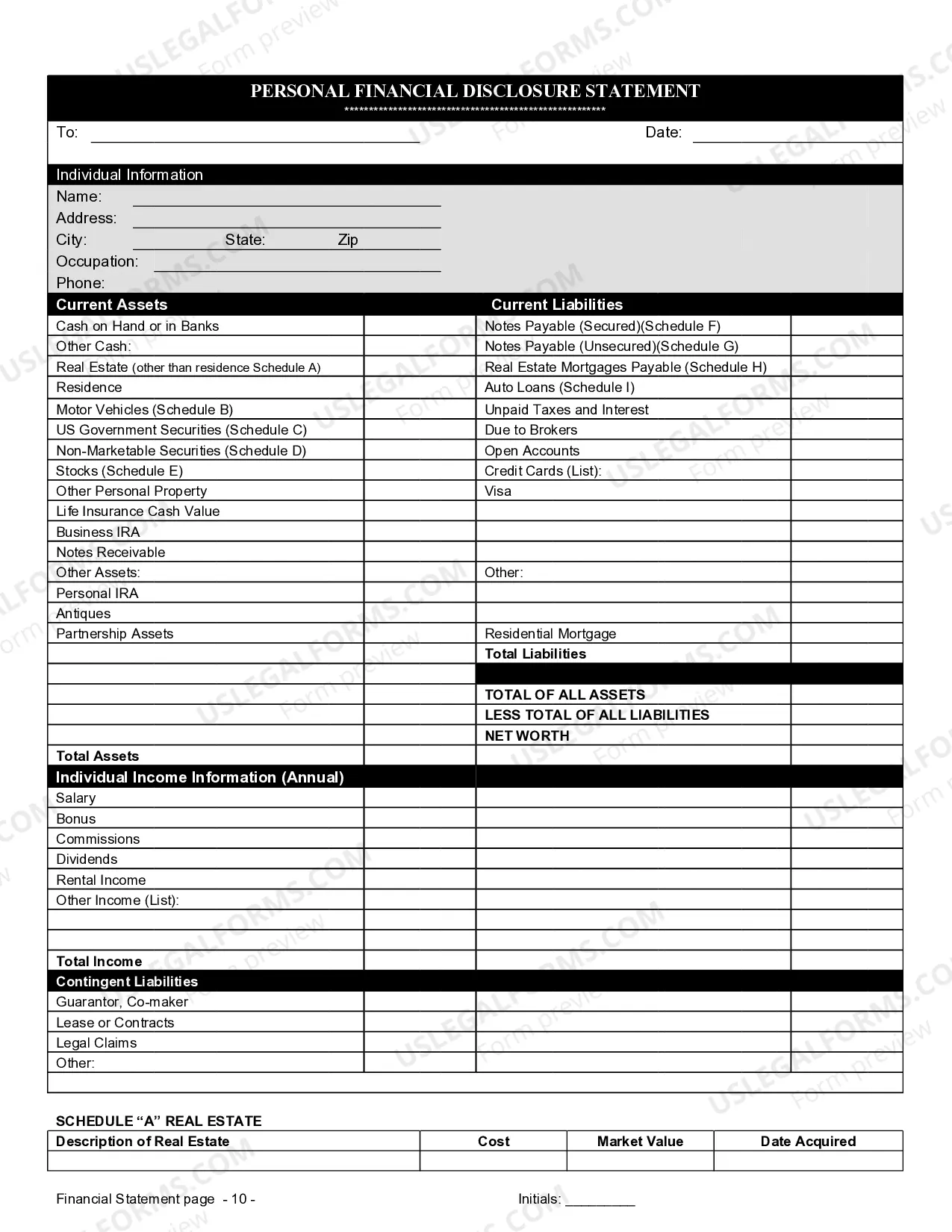

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

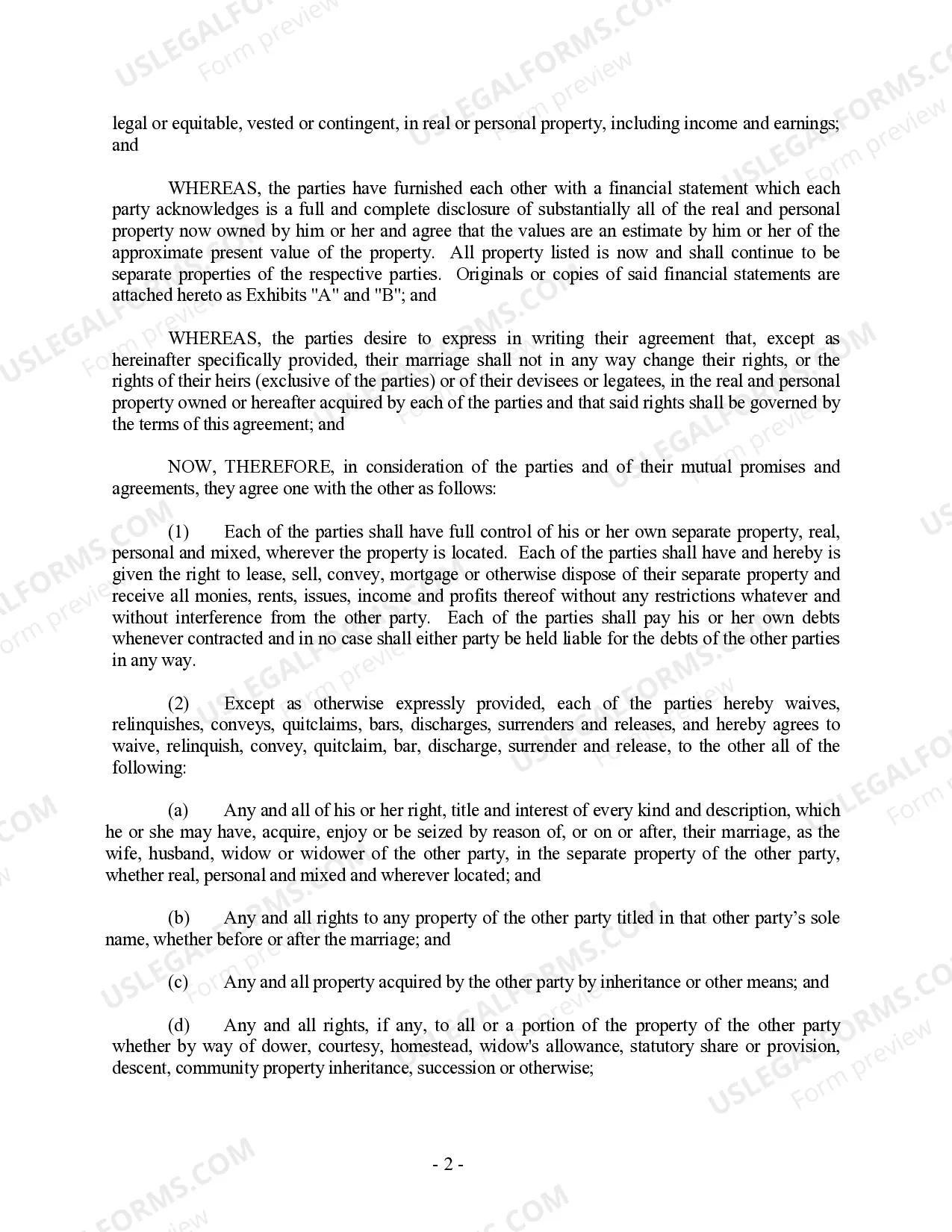

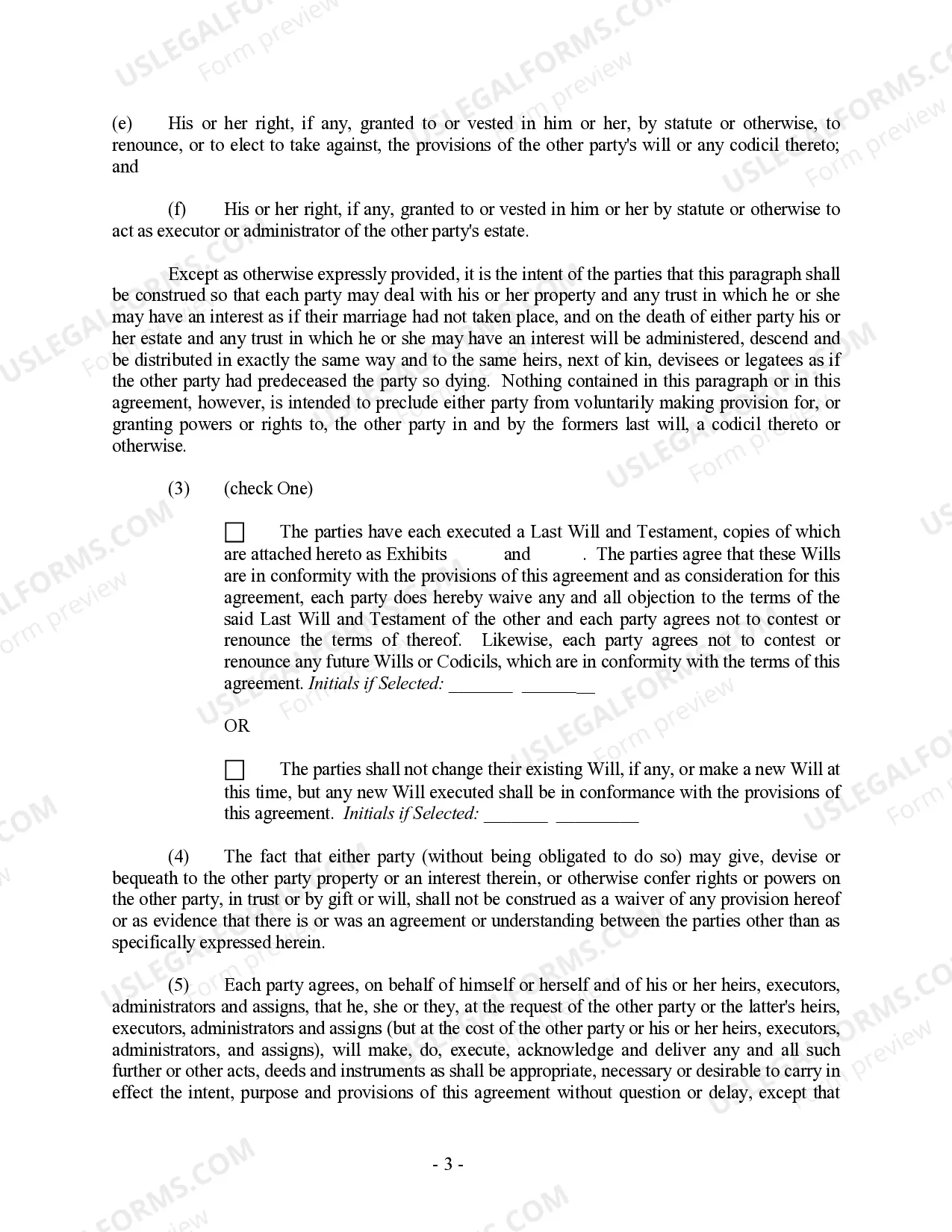

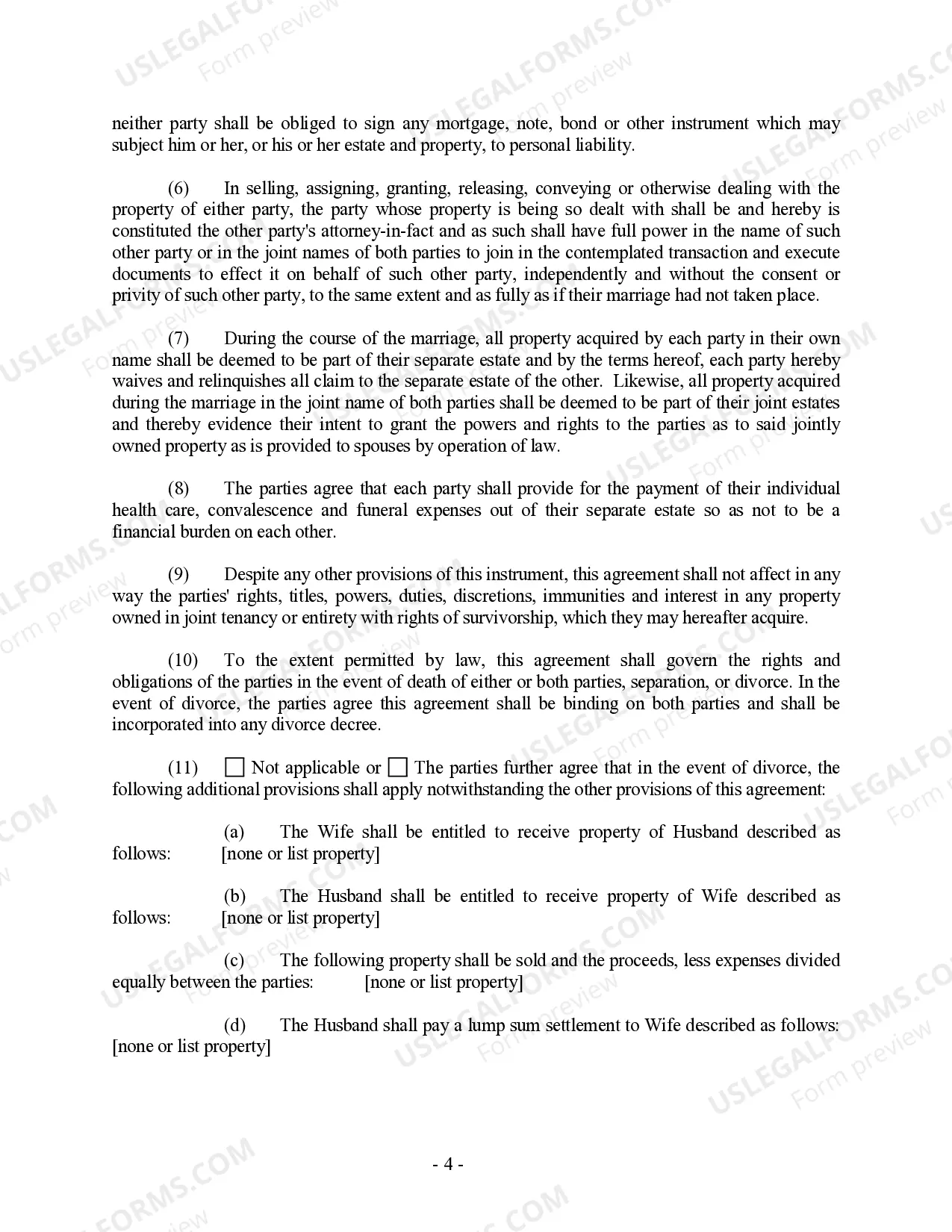

Spokane Valley Washington Prenuptial Premarital Agreement with Financial Statements is a legally binding contract entered into by a couple prior to getting married. This agreement aims to define the division of assets, debts, and other financial matters in the event of a divorce, separation, or death of one of the spouses. It provides a comprehensive framework for managing and protecting each party's financial interests. In Spokane Valley, Washington, there are various types of Prenuptial Premarital Agreements with Financial Statements available to suit different couples' needs. Some different types are: 1. Standard Prenuptial Agreement: This is the most common type of agreement where the couple outlines their financial rights and obligations during the marriage and in case of divorce. It typically covers property division, spousal support, and debt allocation. 2. High-Asset Prenuptial Agreement: This agreement is tailored for couples with substantial assets, businesses, or complex financial portfolios. It provides a detailed plan for asset protection, business interests, real estate holdings, investments, and inheritance matters. 3. Debt Allocation Agreement: Sometimes, couples may want to individually address debt allocation, especially if one partner has substantial debts or liabilities. This type of agreement details how debts will be divided or managed in the event of divorce or separation. 4. Conditional Prenuptial Agreement: This agreement includes specific conditions that must be met for the prenuptial agreement to remain valid. Conditions may include the length of the marriage, fidelity, or specific milestones, allowing changes to be made to the agreement after certain events occur. 5. Estate Planning Prenuptial Agreement: This type of agreement integrates estate planning considerations into a prenuptial agreement. It includes provisions related to inheritance rights, wills, trusts, and other aspects of estate planning. The Spokane Valley Washington Prenuptial Premarital Agreement with Financial Statements is an essential tool that helps couples openly discuss financial matters before marriage and minimize conflicts or disagreements in the future. It ensures that both parties' interests are protected and provides a clear plan for asset division, debt allocation, spousal support, and other financial matters in case the marriage doesn't work out as planned. Consulting with a qualified attorney is highly recommended ensuring the agreement meets all legal requirements and accurately reflects the couple's intentions.Spokane Valley Washington Prenuptial Premarital Agreement with Financial Statements is a legally binding contract entered into by a couple prior to getting married. This agreement aims to define the division of assets, debts, and other financial matters in the event of a divorce, separation, or death of one of the spouses. It provides a comprehensive framework for managing and protecting each party's financial interests. In Spokane Valley, Washington, there are various types of Prenuptial Premarital Agreements with Financial Statements available to suit different couples' needs. Some different types are: 1. Standard Prenuptial Agreement: This is the most common type of agreement where the couple outlines their financial rights and obligations during the marriage and in case of divorce. It typically covers property division, spousal support, and debt allocation. 2. High-Asset Prenuptial Agreement: This agreement is tailored for couples with substantial assets, businesses, or complex financial portfolios. It provides a detailed plan for asset protection, business interests, real estate holdings, investments, and inheritance matters. 3. Debt Allocation Agreement: Sometimes, couples may want to individually address debt allocation, especially if one partner has substantial debts or liabilities. This type of agreement details how debts will be divided or managed in the event of divorce or separation. 4. Conditional Prenuptial Agreement: This agreement includes specific conditions that must be met for the prenuptial agreement to remain valid. Conditions may include the length of the marriage, fidelity, or specific milestones, allowing changes to be made to the agreement after certain events occur. 5. Estate Planning Prenuptial Agreement: This type of agreement integrates estate planning considerations into a prenuptial agreement. It includes provisions related to inheritance rights, wills, trusts, and other aspects of estate planning. The Spokane Valley Washington Prenuptial Premarital Agreement with Financial Statements is an essential tool that helps couples openly discuss financial matters before marriage and minimize conflicts or disagreements in the future. It ensures that both parties' interests are protected and provides a clear plan for asset division, debt allocation, spousal support, and other financial matters in case the marriage doesn't work out as planned. Consulting with a qualified attorney is highly recommended ensuring the agreement meets all legal requirements and accurately reflects the couple's intentions.