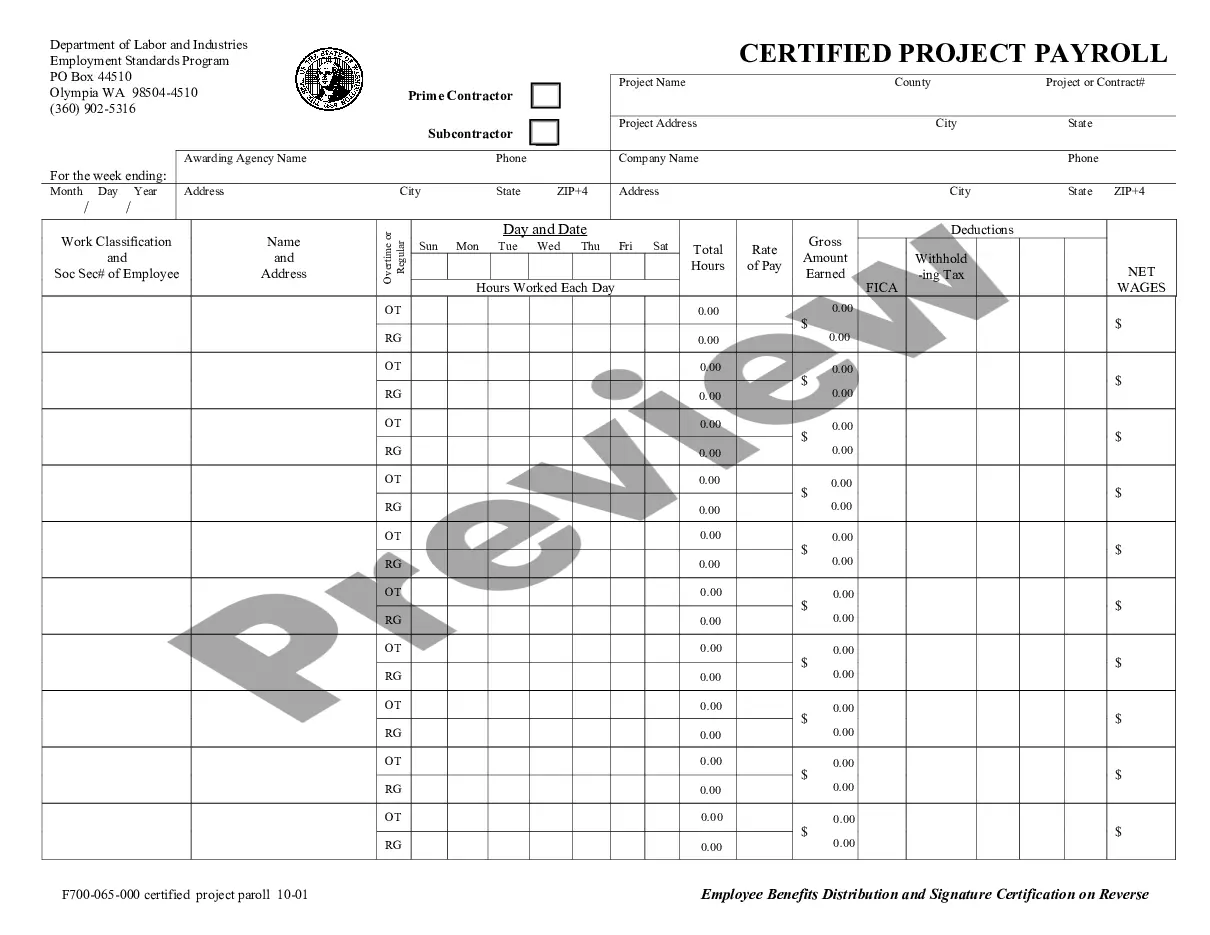

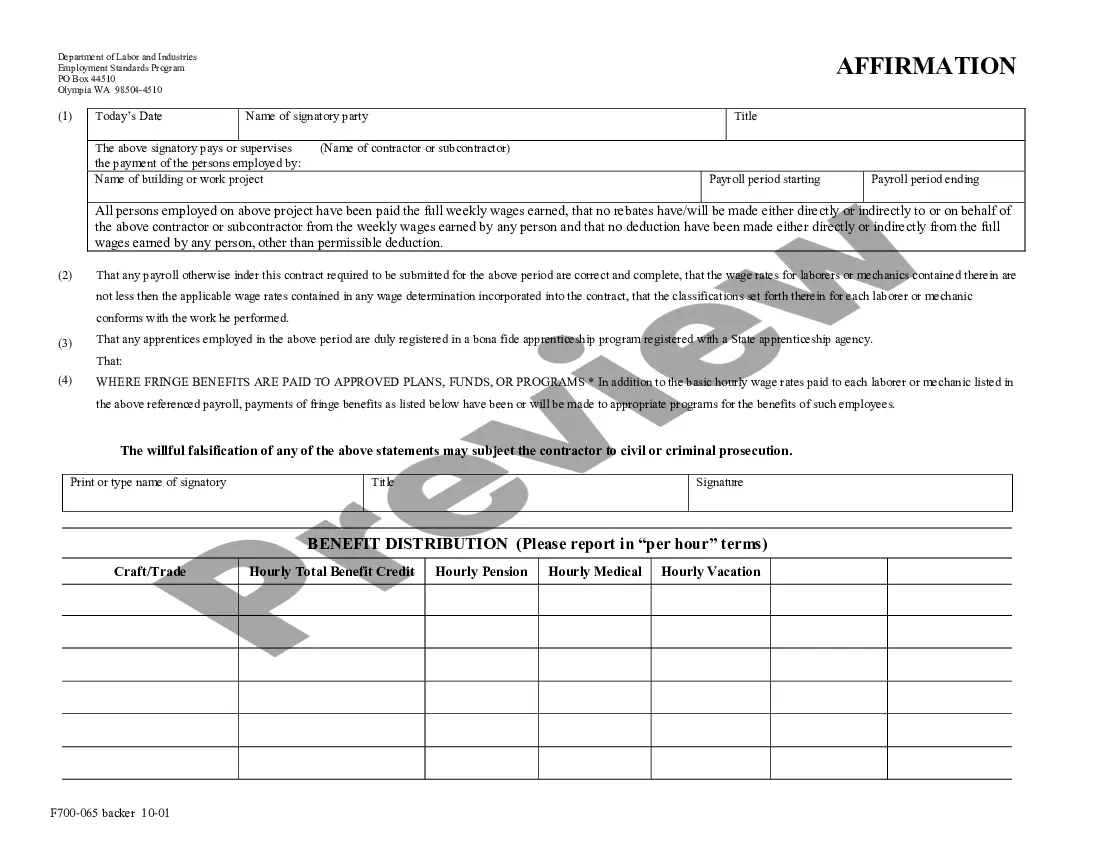

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

Bellevue Washington Weekly Payroll Record is a comprehensive document that provides a detailed overview of the weekly payroll activities of businesses or organizations based in Bellevue, Washington. This record serves as an essential tool for tracking and managing employee wages, hours worked, and related financial information. The Bellevue Washington Weekly Payroll Record typically includes key data such as employee names, employee identification numbers, work hours, rate of pay, gross pay, deductions, net pay, and payment dates. This information is critical for ensuring accurate compensation and compliance with legal obligations, including tax regulations and labor laws. There are different types of Bellevue Washington Weekly Payroll Record that businesses may use, depending on their specific requirements. These can include: 1. Hourly Employee Payroll Record: This type of record is designed for businesses that employ hourly workers. It encompasses details about the number of hours worked by each employee, including regular hours, overtime, and any other relevant information for calculating their wages accurately. 2. Salaried Employee Payroll Record: This record is dedicated to salaried employees who receive a fixed monthly or annual pay. It outlines their basic salary, any additional bonuses or commissions, and any applicable deductions. 3. Contractor Payroll Record: Contractors typically work on a project basis and are responsible for handling their own taxes and benefits. However, organizations that engage contractors may keep a record of the payments made to them, including project details, hourly or flat rates, and the total amount paid. 4. Vacation and Sick Leave Payroll Record: This type of record caters to the payout calculation of accrued vacation and sick leave balances for employees who are entitled to these benefits. It ensures transparency and simplifies the tracking of leave balances and respective payouts. 5. Payroll Deduction Record: This record encompasses details of various deductions made from employees' wages, such as taxes, insurance premiums, retirement contributions, and any other authorized deductions. It helps maintain accurate records and facilitates compliance with legal requirements. Bellevue Washington Weekly Payroll Record acts as a crucial financial tool for businesses, ensuring payroll accuracy, tax compliance, and maintaining transparent employee wage management. By utilizing these records, businesses can effectively track and manage their financial obligations while ensuring employee satisfaction and adherence to legal regulations.Bellevue Washington Weekly Payroll Record is a comprehensive document that provides a detailed overview of the weekly payroll activities of businesses or organizations based in Bellevue, Washington. This record serves as an essential tool for tracking and managing employee wages, hours worked, and related financial information. The Bellevue Washington Weekly Payroll Record typically includes key data such as employee names, employee identification numbers, work hours, rate of pay, gross pay, deductions, net pay, and payment dates. This information is critical for ensuring accurate compensation and compliance with legal obligations, including tax regulations and labor laws. There are different types of Bellevue Washington Weekly Payroll Record that businesses may use, depending on their specific requirements. These can include: 1. Hourly Employee Payroll Record: This type of record is designed for businesses that employ hourly workers. It encompasses details about the number of hours worked by each employee, including regular hours, overtime, and any other relevant information for calculating their wages accurately. 2. Salaried Employee Payroll Record: This record is dedicated to salaried employees who receive a fixed monthly or annual pay. It outlines their basic salary, any additional bonuses or commissions, and any applicable deductions. 3. Contractor Payroll Record: Contractors typically work on a project basis and are responsible for handling their own taxes and benefits. However, organizations that engage contractors may keep a record of the payments made to them, including project details, hourly or flat rates, and the total amount paid. 4. Vacation and Sick Leave Payroll Record: This type of record caters to the payout calculation of accrued vacation and sick leave balances for employees who are entitled to these benefits. It ensures transparency and simplifies the tracking of leave balances and respective payouts. 5. Payroll Deduction Record: This record encompasses details of various deductions made from employees' wages, such as taxes, insurance premiums, retirement contributions, and any other authorized deductions. It helps maintain accurate records and facilitates compliance with legal requirements. Bellevue Washington Weekly Payroll Record acts as a crucial financial tool for businesses, ensuring payroll accuracy, tax compliance, and maintaining transparent employee wage management. By utilizing these records, businesses can effectively track and manage their financial obligations while ensuring employee satisfaction and adherence to legal regulations.