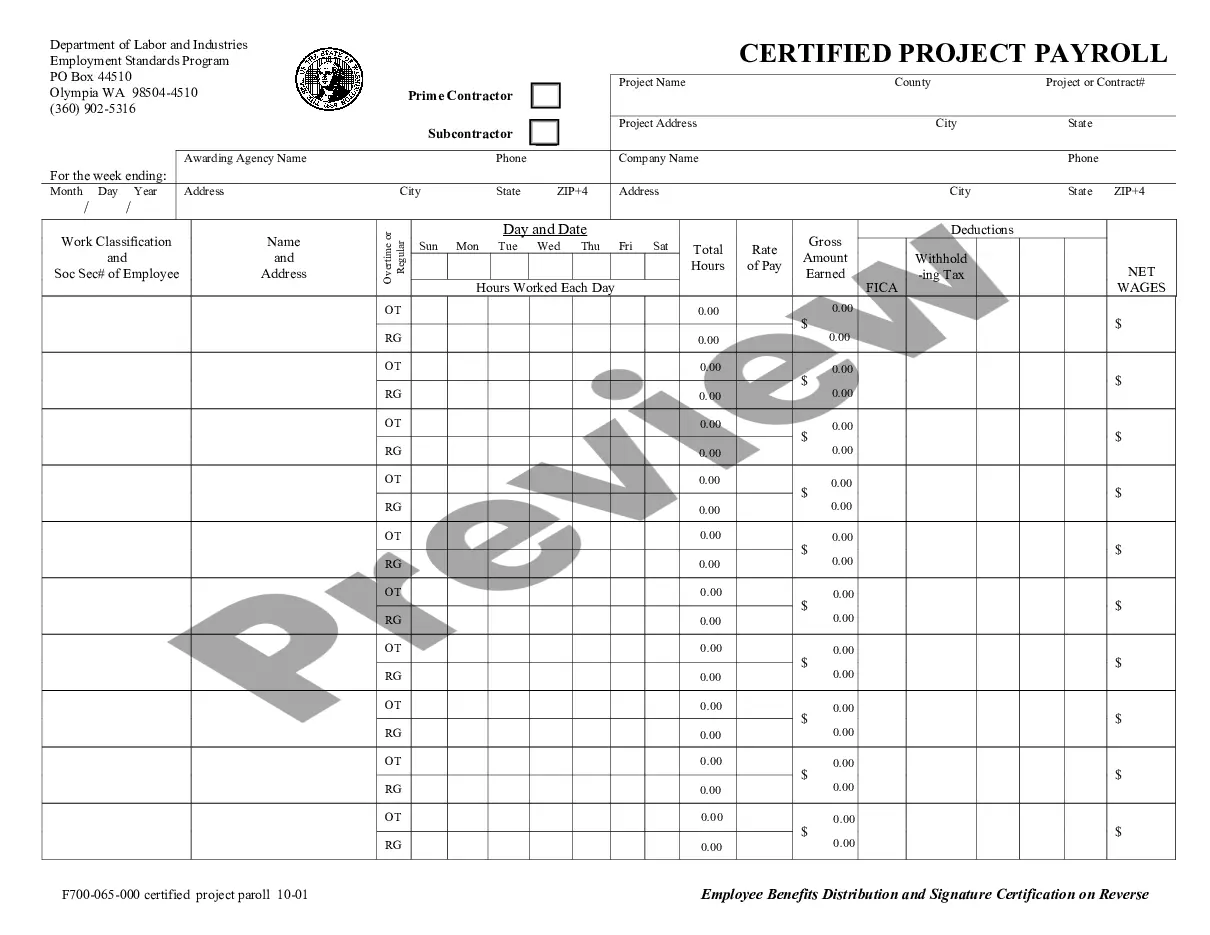

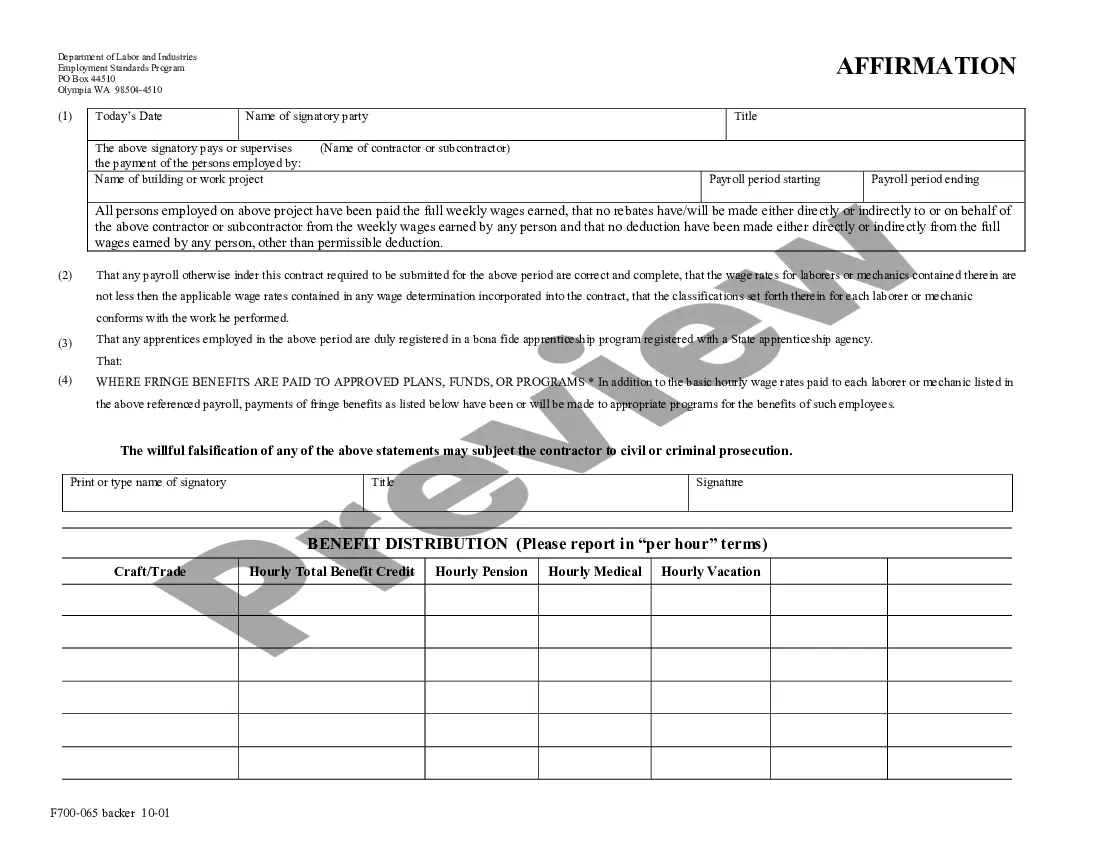

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

Everett Washington Weekly Payroll Record is a comprehensive document that records the financial transactions related to employee compensations in the city of Everett, Washington. This record includes relevant information such as employee details, salary, wages, deductions, bonuses, and any other financial benefits distributed on a weekly basis. The Everett Washington Weekly Payroll Record serves as a crucial resource for employers, accountants, and human resources departments. It ensures accurate tracking of employee earnings, taxes, and other withholding, aiding in maintaining financial transparency and compliance with local labor laws and tax regulations. Keywords: Everett, Washington, weekly payroll record, employee compensations, financial transactions, salary, wages, deductions, bonuses, financial benefits, employers, accountants, human resources, tracking, employee earnings, taxes, withholding, financial transparency, compliance, local labor laws, tax regulations. Types of Everett Washington Weekly Payroll Records: 1. Regular Payroll Record: This type of record includes the information on regular salary or wages paid to employees on a weekly basis. It encompasses details such as hours worked, rate of pay, gross pay, and any deductions. 2. Overtime Payroll Record: For employees who work beyond their scheduled hours, an overtime payroll record is maintained. This record includes overtime hours worked, the rate paid for overtime, and the additional compensation earned. 3. Bonus Payroll Record: In case of any special bonuses or incentives provided to employees on a weekly basis, a bonus payroll record is generated. It outlines the specific bonus amount given, reasons for the bonus, and any associated deductions or taxes. 4. Deduction Payroll Record: Deduction payroll record includes details of various deductions made from an employee's wages, such as tax withholding, insurance premiums, retirement contributions, and other authorized payroll deductions. 5. Vacation and Sick Leave Payroll Record: This record tracks the accumulation and utilization of vacation and sick leave hours for each employee. It includes the number of hours taken, the rate paid for such time off, and any adjustments made to the employee's pay. 6. Payroll Tax Record: This specialized payroll record focuses on the various taxes withheld from employee wages. It includes details such as federal, state, and local income tax withholding, Social Security and Medicare taxes, unemployment taxes, and any other relevant payroll taxes. By maintaining different types of Everett Washington Weekly Payroll Records, employers can ensure accurate and organized documentation of employee compensation, deductions, and benefits. This facilitates efficient financial management, budgeting, and tax compliance, while fostering transparency and fairness in the workplace.Everett Washington Weekly Payroll Record is a comprehensive document that records the financial transactions related to employee compensations in the city of Everett, Washington. This record includes relevant information such as employee details, salary, wages, deductions, bonuses, and any other financial benefits distributed on a weekly basis. The Everett Washington Weekly Payroll Record serves as a crucial resource for employers, accountants, and human resources departments. It ensures accurate tracking of employee earnings, taxes, and other withholding, aiding in maintaining financial transparency and compliance with local labor laws and tax regulations. Keywords: Everett, Washington, weekly payroll record, employee compensations, financial transactions, salary, wages, deductions, bonuses, financial benefits, employers, accountants, human resources, tracking, employee earnings, taxes, withholding, financial transparency, compliance, local labor laws, tax regulations. Types of Everett Washington Weekly Payroll Records: 1. Regular Payroll Record: This type of record includes the information on regular salary or wages paid to employees on a weekly basis. It encompasses details such as hours worked, rate of pay, gross pay, and any deductions. 2. Overtime Payroll Record: For employees who work beyond their scheduled hours, an overtime payroll record is maintained. This record includes overtime hours worked, the rate paid for overtime, and the additional compensation earned. 3. Bonus Payroll Record: In case of any special bonuses or incentives provided to employees on a weekly basis, a bonus payroll record is generated. It outlines the specific bonus amount given, reasons for the bonus, and any associated deductions or taxes. 4. Deduction Payroll Record: Deduction payroll record includes details of various deductions made from an employee's wages, such as tax withholding, insurance premiums, retirement contributions, and other authorized payroll deductions. 5. Vacation and Sick Leave Payroll Record: This record tracks the accumulation and utilization of vacation and sick leave hours for each employee. It includes the number of hours taken, the rate paid for such time off, and any adjustments made to the employee's pay. 6. Payroll Tax Record: This specialized payroll record focuses on the various taxes withheld from employee wages. It includes details such as federal, state, and local income tax withholding, Social Security and Medicare taxes, unemployment taxes, and any other relevant payroll taxes. By maintaining different types of Everett Washington Weekly Payroll Records, employers can ensure accurate and organized documentation of employee compensation, deductions, and benefits. This facilitates efficient financial management, budgeting, and tax compliance, while fostering transparency and fairness in the workplace.