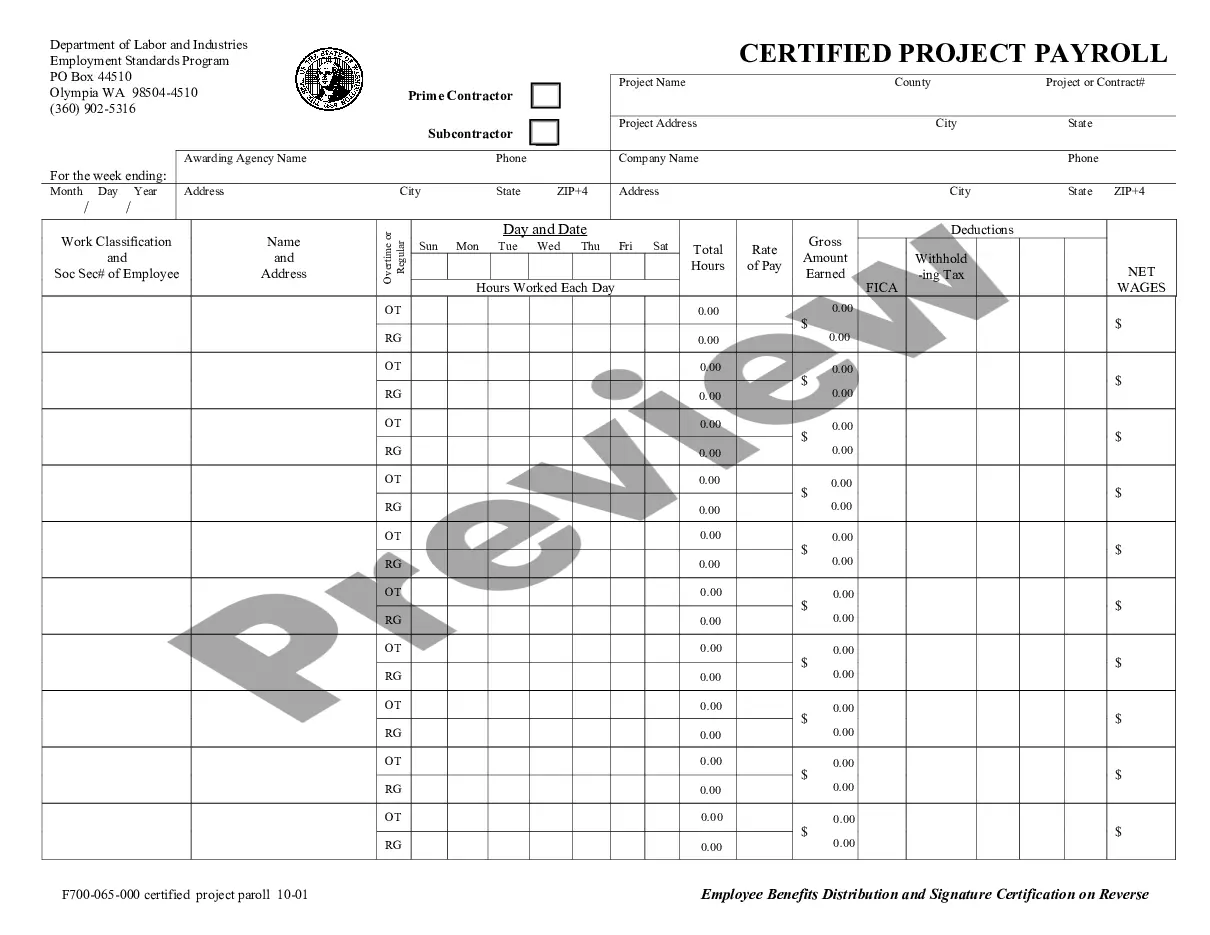

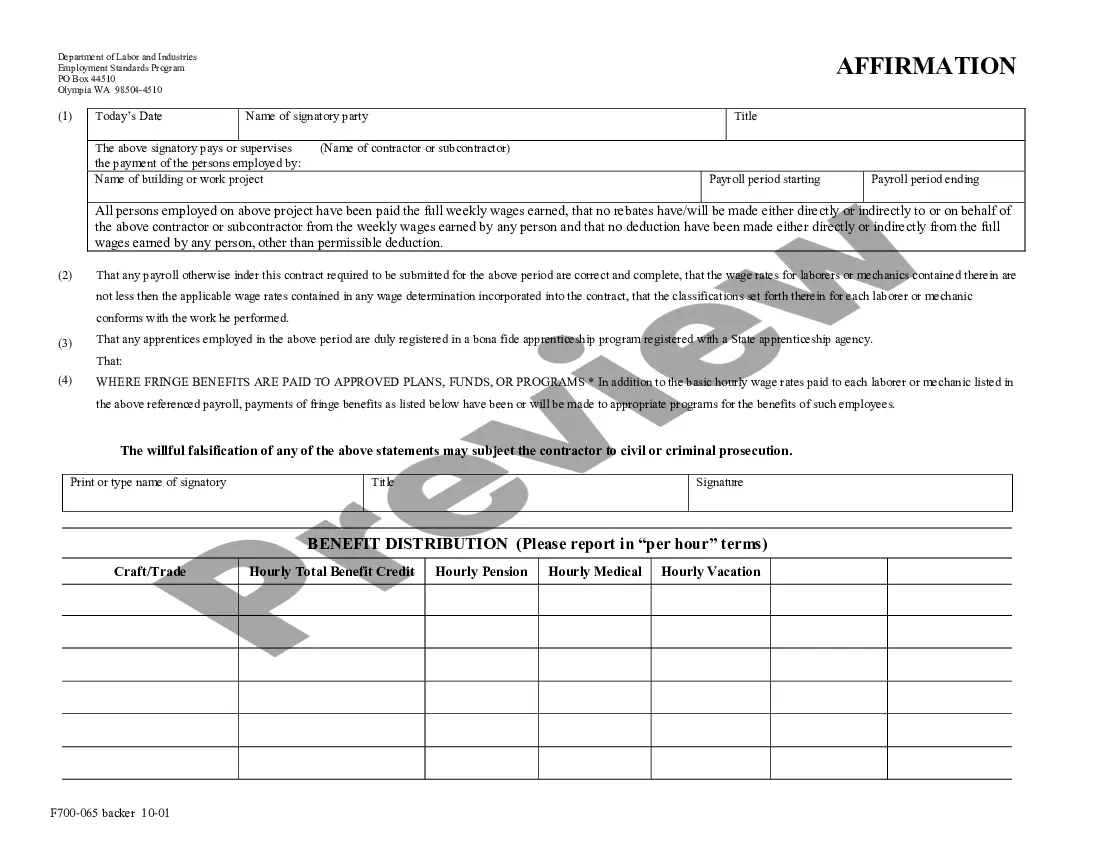

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

King Washington Weekly Payroll Record is a comprehensive and detailed document that records and tracks the financial information related to the payment of employees on a weekly basis in the region of Washington state. This record contains crucial data and serves as a vital resource for businesses, organizations, and institutions in managing their payroll operations efficiently. The King Washington Weekly Payroll Record includes various relevant keywords to enhance its relevance and visibility. These keywords encompass terms related to both its purpose and location. Here are some relevant keywords: 1. King Washington: This keyword refers to the specific region where the payroll record is relevant, indicating the geographical location for which the record has been designed. It identifies the jurisdiction and laws governing the payroll process. 2. Weekly Payroll: This keyword denotes the frequency at which the payrolls are processed and issued. It emphasizes that the record specifically tracks employee wages on a weekly basis, enabling regular and timely compensation. 3. Payroll Record: This keyword indicates that the document is a comprehensive record that maintains complete and accurate information about employee compensation, including earnings, deductions, taxes, and net pay. It signifies the importance of maintaining a solid record for financial and legal purposes. There may be different types of King Washington Weekly Payroll Records, depending on the nature of the organization or industry. Some possible variations could include: 1. King Washington Government Weekly Payroll Record: This type refers to the payroll record specifically designed for government agencies and departments operating within King Washington. It adheres to specific regulations and guidelines mandated for public sector employees. 2. King Washington Corporate Weekly Payroll Record: This type is tailored for corporations and private companies in King Washington, focusing on tracking employee wages, benefits, and deductions, while also complying with corporate financial reporting standards. 3. King Washington Nonprofit Weekly Payroll Record: This version of the payroll record is dedicated to nonprofit organizations operating in King Washington. It considers specific requirements such as specialized exemptions, grants, and funding sources relevant to the nonprofit sector. 4. King Washington Education Weekly Payroll Record: This type caters to educational institutions, including schools, colleges, and universities in King Washington. It may incorporate additional elements such as faculty tenure, benefits for teachers, and special funding or reimbursement programs. In conclusion, the King Washington Weekly Payroll Record is an essential document designed to track and manage employee compensation in the King Washington region. By utilizing relevant keywords and recognizing potential variations, businesses and organizations can effectively navigate their payroll processes while adhering to relevant regulations and requirements.