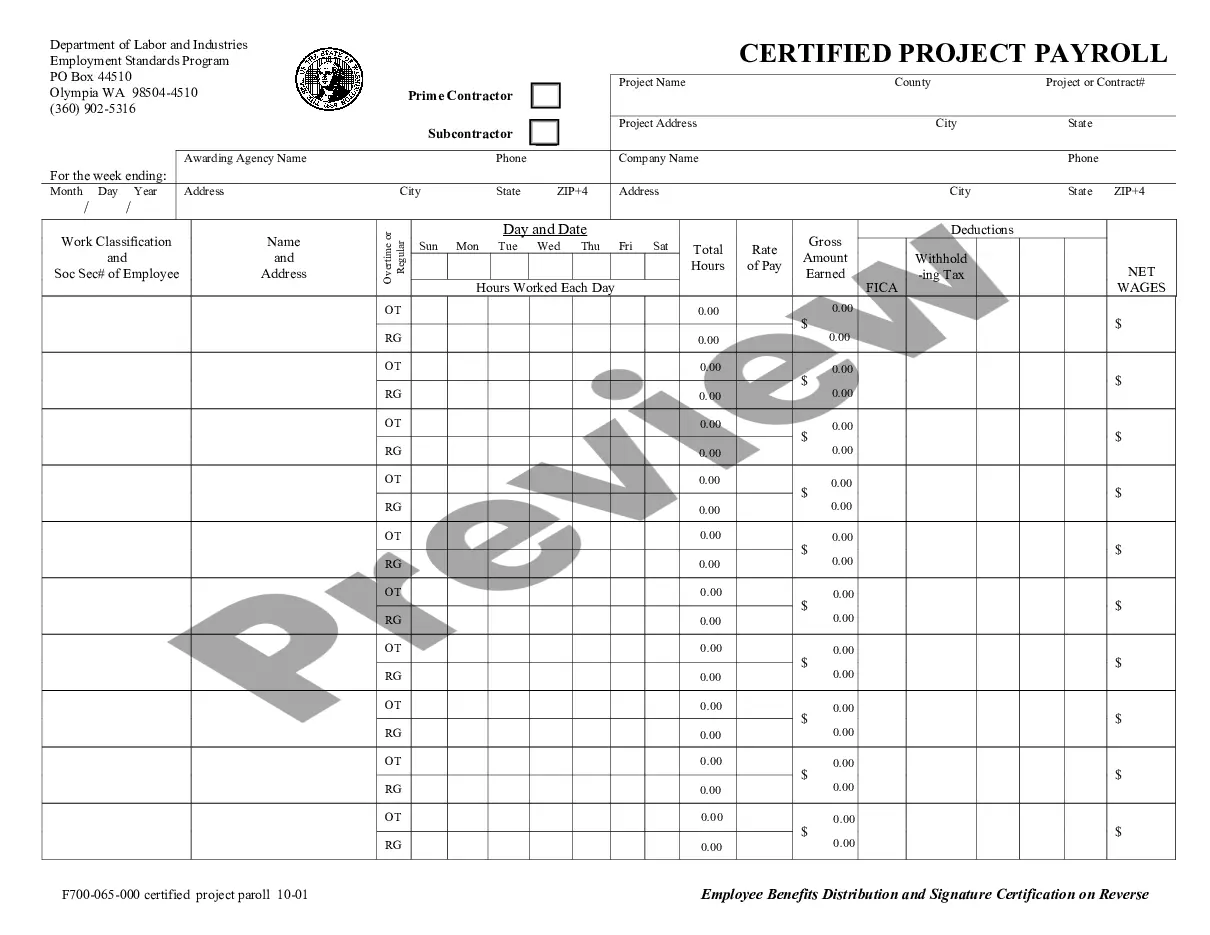

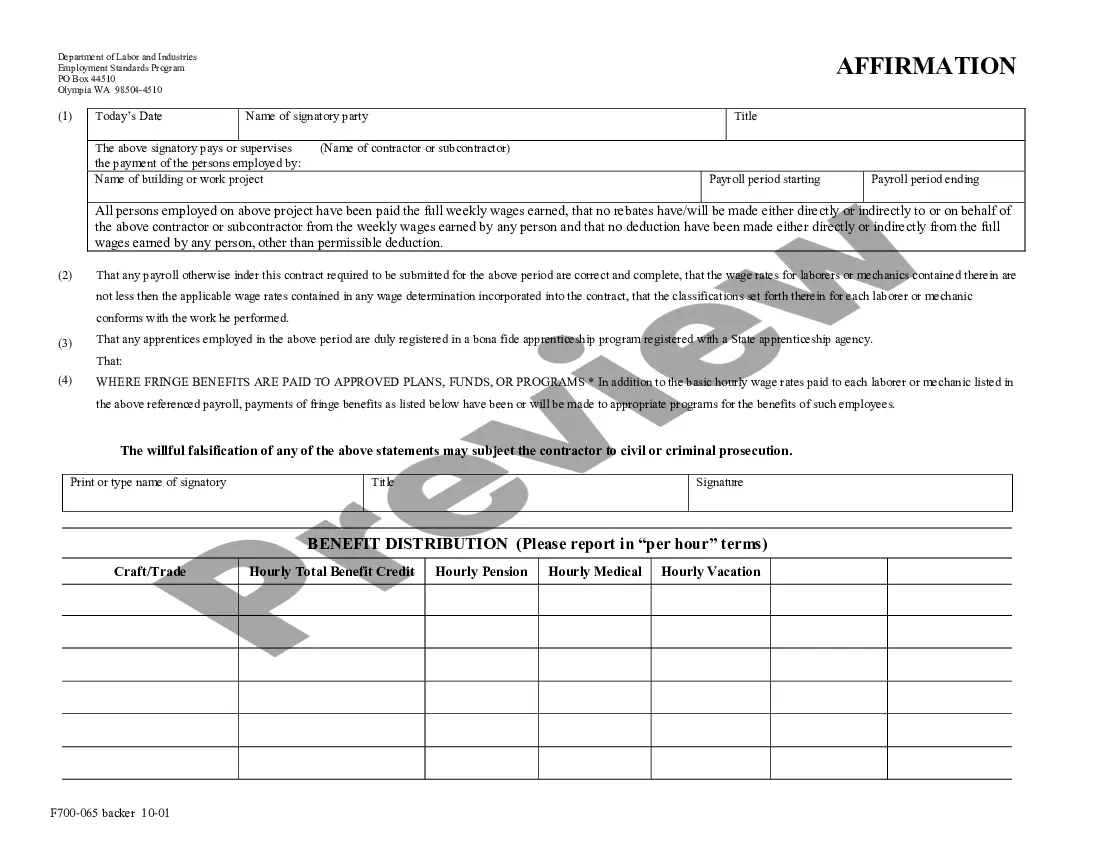

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

The Seattle Washington Weekly Payroll Record is a comprehensive document that serves as a record of all employee payments and wages for a particular week in Seattle, Washington. This record contains crucial information related to compensation and is an essential tool for both employers and employees. The Weekly Payroll Record includes relevant details such as the employee's name, employee identification number, job title, dates of the payroll week, and the number of hours worked. It also provides a breakdown of earnings, including regular pay rates, overtime pay, holiday pay, and any other additional allowances or bonuses earned during the week. Moreover, employee deductions are also documented in the Weekly Payroll Record. These deductions can include various taxes, such as federal income tax, state income tax, Social Security tax, Medicare tax, and any other relevant local taxes specific to Seattle, Washington. There may also be deductions for employee benefits such as health insurance premiums, retirement contributions, and any other voluntary deductions authorized by the employee. The purpose of the Seattle Washington Weekly Payroll Record is to maintain accurate records of employee compensation, ensuring transparency and compliance with labor laws and regulations. Employers use this record as evidence of payment and as a reference to calculate taxes and other payroll obligations. For employees, the record serves as proof of income and aids in verifying wage accuracy and the calculation of tax liabilities. In terms of specific types of Seattle Washington Weekly Payroll Records, there may be variations based on the industry, nature of employment, or specific company policies. For example, there could be separate payroll records for full-time and part-time employees, hourly workers, salaried employees, or employees with different job positions. Additionally, there may be separate records for different departments or divisions within an organization. Overall, the Seattle Washington Weekly Payroll Record is a vital financial document that ensures accurate, transparent, and compliant payment processes between employers and employees in the Seattle, Washington area. It is an essential component of effective payroll management and helps maintain trust, fairness, and legal compliance within the workforce.The Seattle Washington Weekly Payroll Record is a comprehensive document that serves as a record of all employee payments and wages for a particular week in Seattle, Washington. This record contains crucial information related to compensation and is an essential tool for both employers and employees. The Weekly Payroll Record includes relevant details such as the employee's name, employee identification number, job title, dates of the payroll week, and the number of hours worked. It also provides a breakdown of earnings, including regular pay rates, overtime pay, holiday pay, and any other additional allowances or bonuses earned during the week. Moreover, employee deductions are also documented in the Weekly Payroll Record. These deductions can include various taxes, such as federal income tax, state income tax, Social Security tax, Medicare tax, and any other relevant local taxes specific to Seattle, Washington. There may also be deductions for employee benefits such as health insurance premiums, retirement contributions, and any other voluntary deductions authorized by the employee. The purpose of the Seattle Washington Weekly Payroll Record is to maintain accurate records of employee compensation, ensuring transparency and compliance with labor laws and regulations. Employers use this record as evidence of payment and as a reference to calculate taxes and other payroll obligations. For employees, the record serves as proof of income and aids in verifying wage accuracy and the calculation of tax liabilities. In terms of specific types of Seattle Washington Weekly Payroll Records, there may be variations based on the industry, nature of employment, or specific company policies. For example, there could be separate payroll records for full-time and part-time employees, hourly workers, salaried employees, or employees with different job positions. Additionally, there may be separate records for different departments or divisions within an organization. Overall, the Seattle Washington Weekly Payroll Record is a vital financial document that ensures accurate, transparent, and compliant payment processes between employers and employees in the Seattle, Washington area. It is an essential component of effective payroll management and helps maintain trust, fairness, and legal compliance within the workforce.