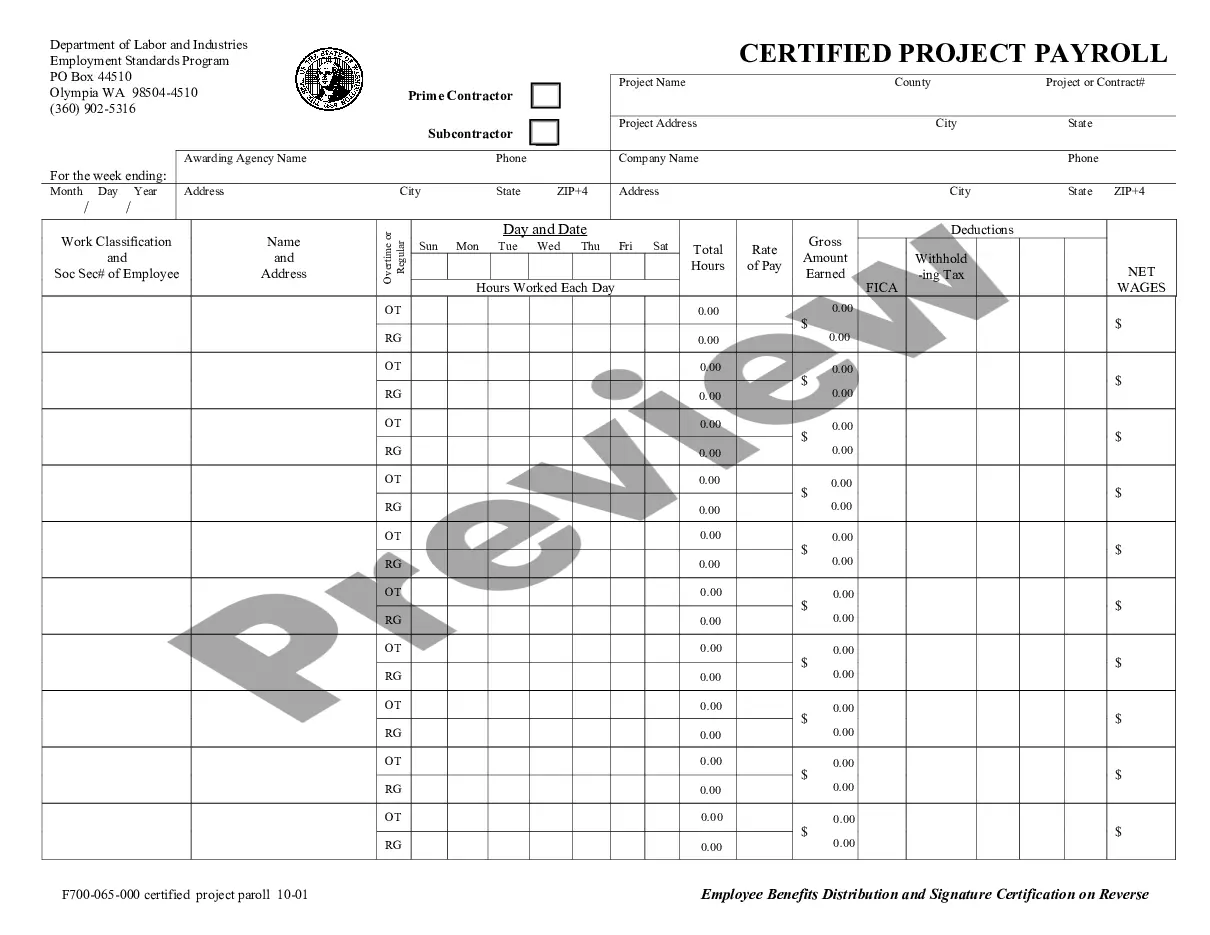

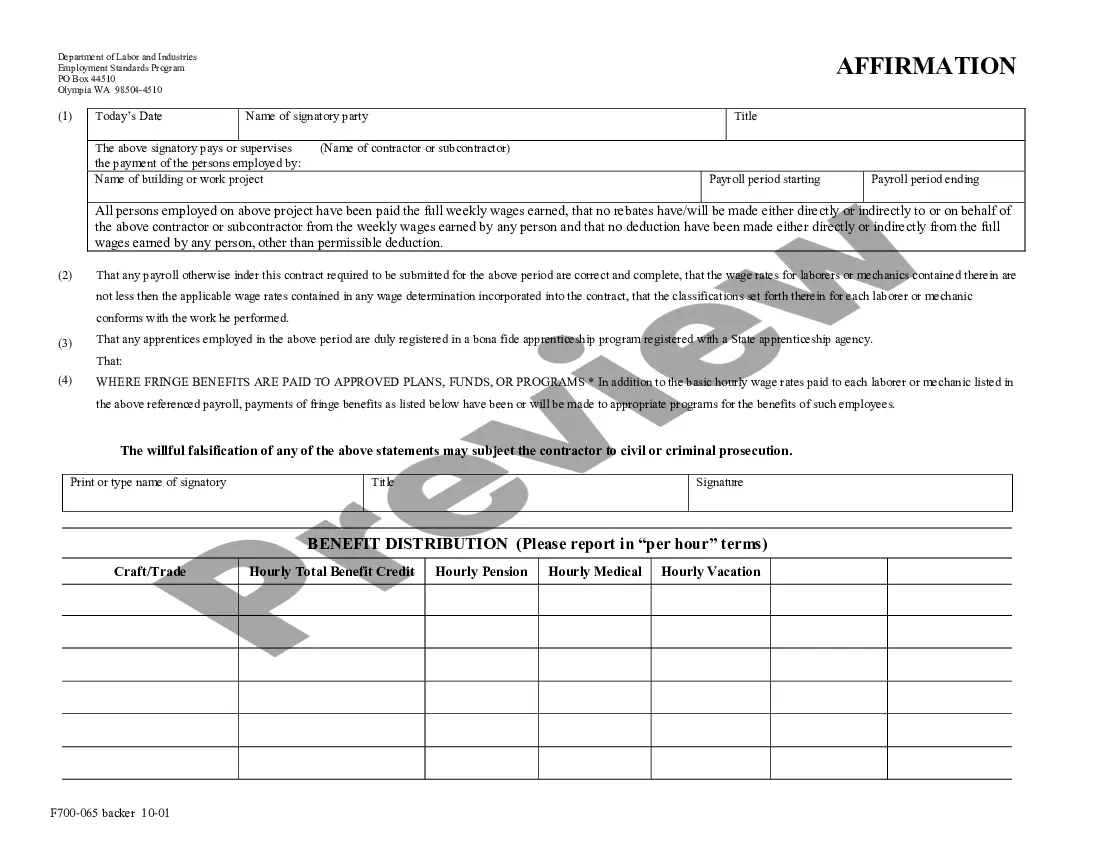

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

The Tacoma Washington Weekly Payroll Record is a crucial document that provides a detailed breakdown of employee wages and salaries within the city of Tacoma, Washington. It serves as an essential tool for businesses, human resource departments, and accounting professionals to accurately record, calculate, and manage payroll on a weekly basis. This comprehensive record includes various information and relevant keywords such as: 1. Employee Information: The Tacoma Washington Weekly Payroll Record contains a comprehensive list of all employees, including their names, employee identification numbers, job titles, and departments. These details are essential for ensuring accurate payment distribution. 2. Hours Worked: The record summarizes the total number of hours each employee has worked during the week. This information is essential for calculating wages and overtime payments. 3. Regular Wages: This section outlines the regular wages earned by each employee, stating the agreed-upon hourly or salaried rate. It is an important aspect of the record for computing the base pay. 4. Overtime Hours: If employees have worked beyond their regular work hours, the Tacoma Washington Weekly Payroll Record includes a dedicated section for tracking overtime hours. This enables employers to accurately calculate and compensate employees for their additional work. 5. Overtime Wages: To ensure compliance with labor laws, the record lists the overtime wages earned by employees due to working additional hours. Overtime pay is typically calculated at one-and-a-half times the regular wages. 6. Deductions: The payroll record includes a section to account for various deductions made from employees' wages, such as income tax withholding, social security contributions, health insurance premiums, and retirement fund contributions. These deductions are vital for ensuring accurate net pay calculations and legal compliance. 7. Total Earnings: This section summarizes the total gross earnings for each employee, including regular wages, overtime wages, and any additional compensation received within the payroll period. 8. Net Pay: The Tacoma Washington Weekly Payroll Record concludes with the net pay calculations, providing the final amount each employee is entitled to after deducting applicable taxes, contributions, and other deductions. Different types of Tacoma Washington Weekly Payroll Record can include variations based on additional factors such as union memberships, specific industry regulations, or benefits provided by the employer. These variations ensure the accurate recording and tracking of specific payments and premiums. Overall, the Tacoma Washington Weekly Payroll Record is an indispensable tool for businesses operating in Tacoma, Washington, allowing them to adequately manage their payroll, ensure compliance with labor laws, and provide employees with accurate compensation for their work.The Tacoma Washington Weekly Payroll Record is a crucial document that provides a detailed breakdown of employee wages and salaries within the city of Tacoma, Washington. It serves as an essential tool for businesses, human resource departments, and accounting professionals to accurately record, calculate, and manage payroll on a weekly basis. This comprehensive record includes various information and relevant keywords such as: 1. Employee Information: The Tacoma Washington Weekly Payroll Record contains a comprehensive list of all employees, including their names, employee identification numbers, job titles, and departments. These details are essential for ensuring accurate payment distribution. 2. Hours Worked: The record summarizes the total number of hours each employee has worked during the week. This information is essential for calculating wages and overtime payments. 3. Regular Wages: This section outlines the regular wages earned by each employee, stating the agreed-upon hourly or salaried rate. It is an important aspect of the record for computing the base pay. 4. Overtime Hours: If employees have worked beyond their regular work hours, the Tacoma Washington Weekly Payroll Record includes a dedicated section for tracking overtime hours. This enables employers to accurately calculate and compensate employees for their additional work. 5. Overtime Wages: To ensure compliance with labor laws, the record lists the overtime wages earned by employees due to working additional hours. Overtime pay is typically calculated at one-and-a-half times the regular wages. 6. Deductions: The payroll record includes a section to account for various deductions made from employees' wages, such as income tax withholding, social security contributions, health insurance premiums, and retirement fund contributions. These deductions are vital for ensuring accurate net pay calculations and legal compliance. 7. Total Earnings: This section summarizes the total gross earnings for each employee, including regular wages, overtime wages, and any additional compensation received within the payroll period. 8. Net Pay: The Tacoma Washington Weekly Payroll Record concludes with the net pay calculations, providing the final amount each employee is entitled to after deducting applicable taxes, contributions, and other deductions. Different types of Tacoma Washington Weekly Payroll Record can include variations based on additional factors such as union memberships, specific industry regulations, or benefits provided by the employer. These variations ensure the accurate recording and tracking of specific payments and premiums. Overall, the Tacoma Washington Weekly Payroll Record is an indispensable tool for businesses operating in Tacoma, Washington, allowing them to adequately manage their payroll, ensure compliance with labor laws, and provide employees with accurate compensation for their work.