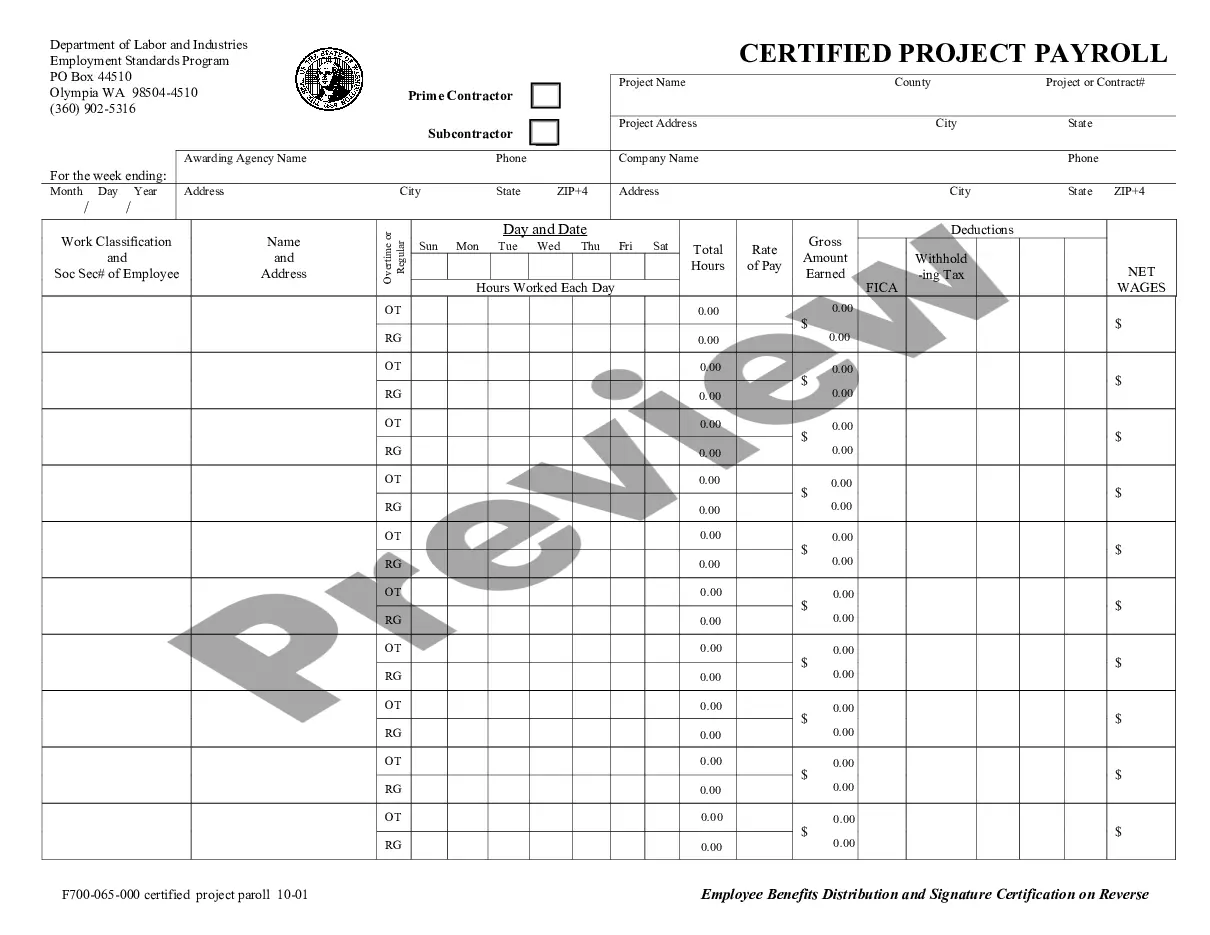

This Washington Weekly Payroll Record allows the contractor to record and track payroll payments made to employees on a particular project. This record may also be certified when required by the state for compliance with Washington law.

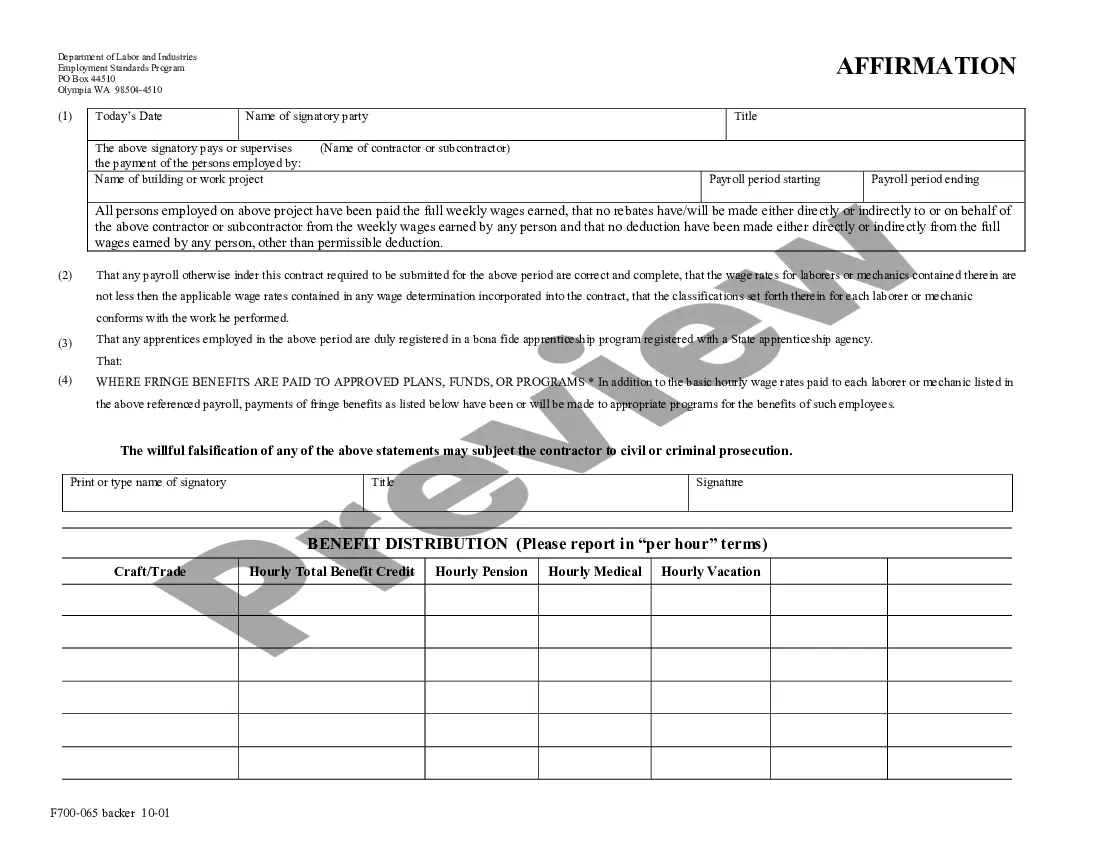

Vancouver Washington Weekly Payroll Record refers to a comprehensive document that outlines the detailed financial information and records related to employee compensation and deductions on a weekly basis in Vancouver, Washington. This payroll record plays a crucial role in maintaining accurate and up-to-date records of employees' salaries, wages, hours worked, and other paycheck details. The Vancouver Washington Weekly Payroll Record includes relevant information such as employee names, identification numbers, job positions, hourly rates, and total hours worked during the week. It also encompasses additional data such as overtime hours worked, if any, and the corresponding rates applied. Furthermore, it records any special allowances, bonuses, or deductions associated with a particular period. By calculating the gross wages earned, taxes withheld, and net pay received, this record provides a clear overview of an employee's compensation for each week. Apart from general employee information, the Vancouver Washington Weekly Payroll Record also exhibits crucial data related to taxation. It includes tax-related information such as federal income tax withholding, state income tax withholding, local taxes, social security contributions, and Medicare contributions. These calculations are necessary for both the employee's personal records and the employer's documentation for tax purposes. In regard to different types of Vancouver Washington Weekly Payroll Records, they can range from manual records maintained by small businesses to computerized payroll systems utilized by larger companies. These systems may involve specialized software that automates the payroll process, making it more efficient and accurate. Some businesses may also integrate time-tracking systems or biometric attendance devices to precisely record employee working hours and streamline the payroll calculation process. In summary, the Vancouver Washington Weekly Payroll Record is an essential document that businesses in Vancouver, Washington utilize to maintain proper financial records of their employees' compensation. It encompasses a wide range of details, such as names, wages, deductions, taxes, and net pay. This record ensures compliance with legal and tax requirements and serves as a valuable resource for both employees and employers.