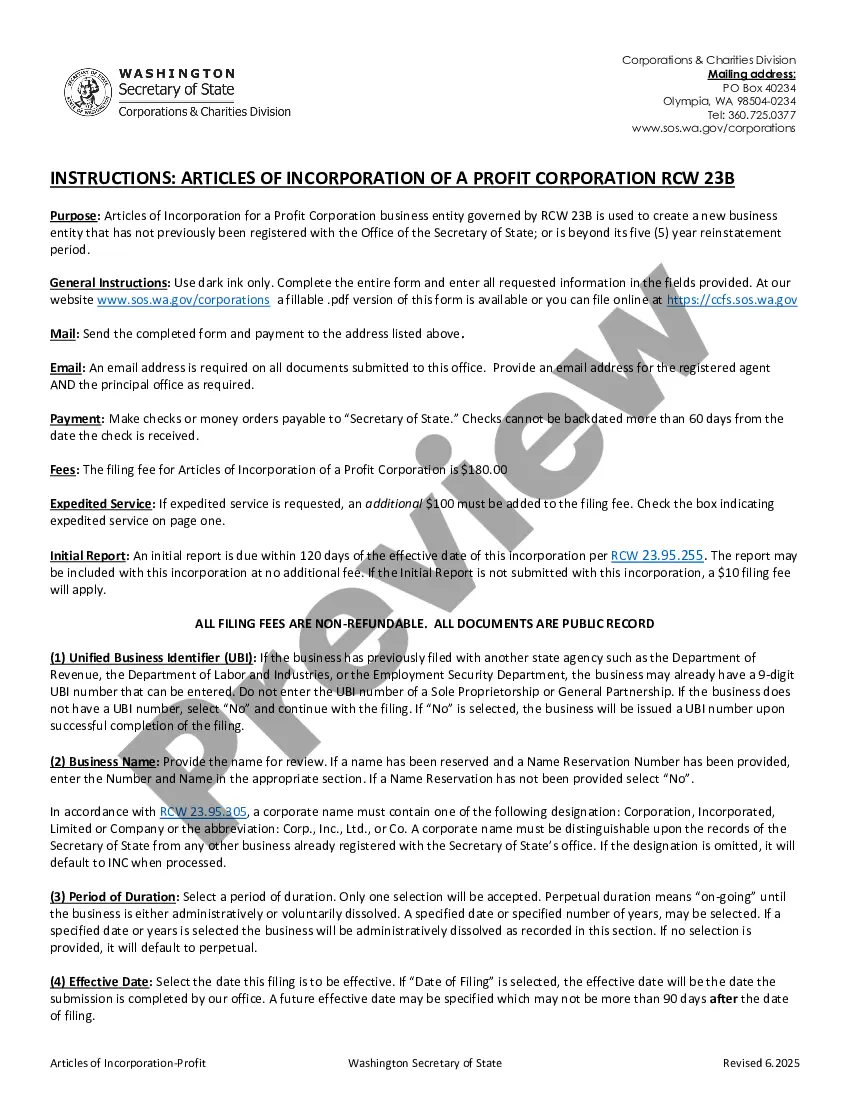

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

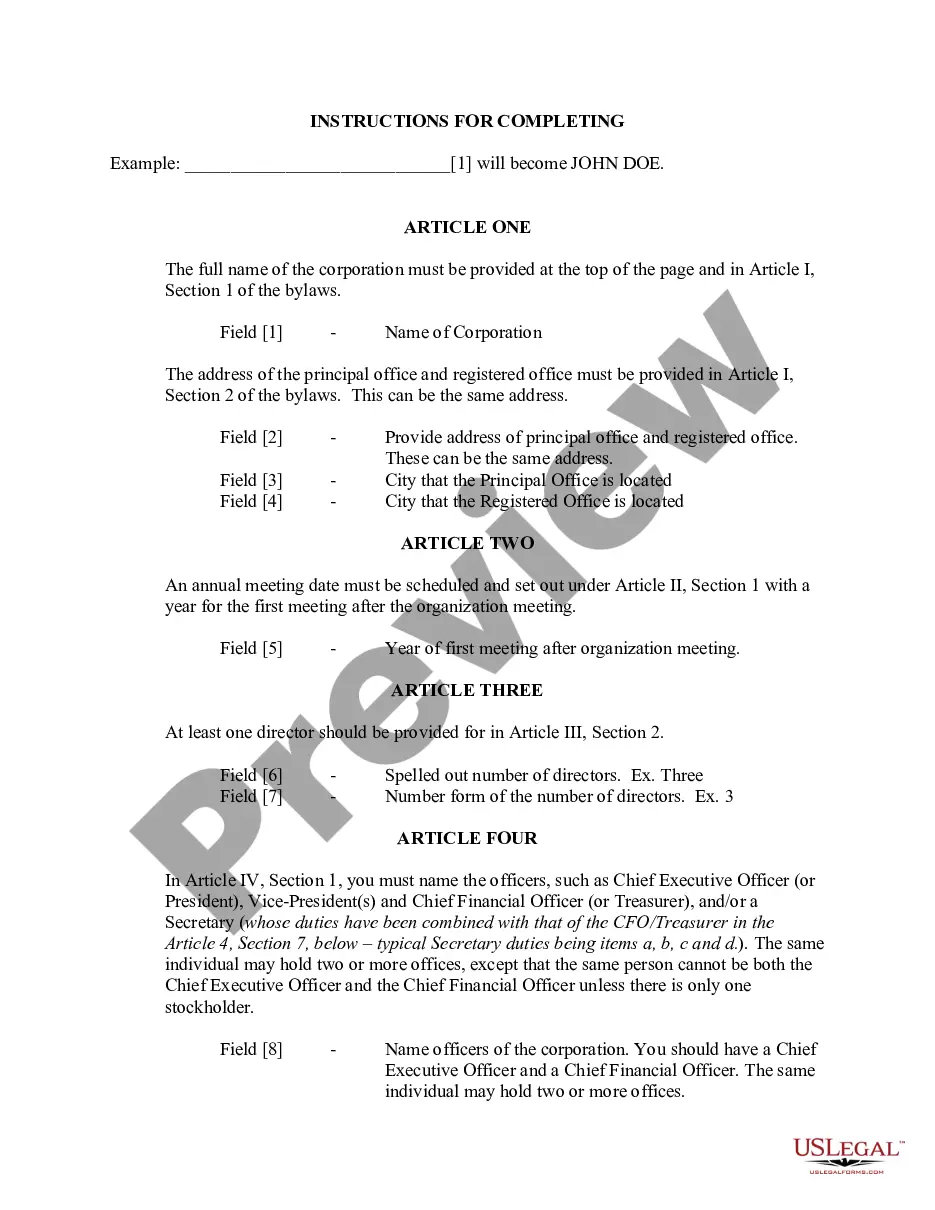

Everett Washington Articles of Incorporation for Domestic Nonprofit Corporation In Everett, Washington, the Articles of Incorporation for Domestic Nonprofit Corporation are essential legal documents filed with the Secretary of State to establish a nonprofit entity. These documents detail important information about the organization's purpose, structure, and operational guidelines. By incorporating as a domestic nonprofit corporation, an organization can qualify for certain tax-exempt privileges and gain increased credibility and transparency. The Everett Washington Articles of Incorporation for Domestic Nonprofit Corporation typically include the following key components: 1. Name of the Organization: The Articles should state the chosen name of the nonprofit corporation, ensuring it complies with state regulations, is distinguishable from other entities, and includes terms like "nonprofit" or "corporation." 2. Registered Agent: An identified individual or an entity responsible for receiving official communications and legal notices on behalf of the nonprofit corporation within Washington state. The registered agent maintains a physical address in the state and should be available during business hours. 3. Purpose of the Organization: A clear and concise explanation of the nonprofit's mission, activities, and objectives. This section should emphasize the organization's dedication to promoting social welfare, religious, educational, or charitable endeavors. 4. Duration: Specifying the duration of the organization's existence is necessary; most nonprofits are formed with a perpetual duration, meaning their existence continues indefinitely. 5. Members and Directors: The Articles may outline who will be eligible for membership within the nonprofit corporation and the procedures for electing directors or trustees responsible for managing its affairs and decision-making processes. 6. Dissolution Clause: This section states the processes and procedures to be followed in the event of the nonprofit corporation's dissolution. It outlines how the assets will be distributed, typically ensuring they are used for exempt purposes or transferred to another tax-exempt organization. It is important to note that the above description outlines the typical content found in Everett Washington Articles of Incorporation for Domestic Nonprofit Corporation. However, variations may exist depending on the specific requirements of different organizations operating in Everett. Some nonprofits may have additional clauses or provisions tailored to their particular needs and objectives. By filing these Articles, a nonprofit corporation in Everett gains legal recognition and protection, allowing it to pursue its charitable objectives and engage in vital community-focused activities, with the added benefit of potential tax-exempt status.Everett Washington Articles of Incorporation for Domestic Nonprofit Corporation In Everett, Washington, the Articles of Incorporation for Domestic Nonprofit Corporation are essential legal documents filed with the Secretary of State to establish a nonprofit entity. These documents detail important information about the organization's purpose, structure, and operational guidelines. By incorporating as a domestic nonprofit corporation, an organization can qualify for certain tax-exempt privileges and gain increased credibility and transparency. The Everett Washington Articles of Incorporation for Domestic Nonprofit Corporation typically include the following key components: 1. Name of the Organization: The Articles should state the chosen name of the nonprofit corporation, ensuring it complies with state regulations, is distinguishable from other entities, and includes terms like "nonprofit" or "corporation." 2. Registered Agent: An identified individual or an entity responsible for receiving official communications and legal notices on behalf of the nonprofit corporation within Washington state. The registered agent maintains a physical address in the state and should be available during business hours. 3. Purpose of the Organization: A clear and concise explanation of the nonprofit's mission, activities, and objectives. This section should emphasize the organization's dedication to promoting social welfare, religious, educational, or charitable endeavors. 4. Duration: Specifying the duration of the organization's existence is necessary; most nonprofits are formed with a perpetual duration, meaning their existence continues indefinitely. 5. Members and Directors: The Articles may outline who will be eligible for membership within the nonprofit corporation and the procedures for electing directors or trustees responsible for managing its affairs and decision-making processes. 6. Dissolution Clause: This section states the processes and procedures to be followed in the event of the nonprofit corporation's dissolution. It outlines how the assets will be distributed, typically ensuring they are used for exempt purposes or transferred to another tax-exempt organization. It is important to note that the above description outlines the typical content found in Everett Washington Articles of Incorporation for Domestic Nonprofit Corporation. However, variations may exist depending on the specific requirements of different organizations operating in Everett. Some nonprofits may have additional clauses or provisions tailored to their particular needs and objectives. By filing these Articles, a nonprofit corporation in Everett gains legal recognition and protection, allowing it to pursue its charitable objectives and engage in vital community-focused activities, with the added benefit of potential tax-exempt status.