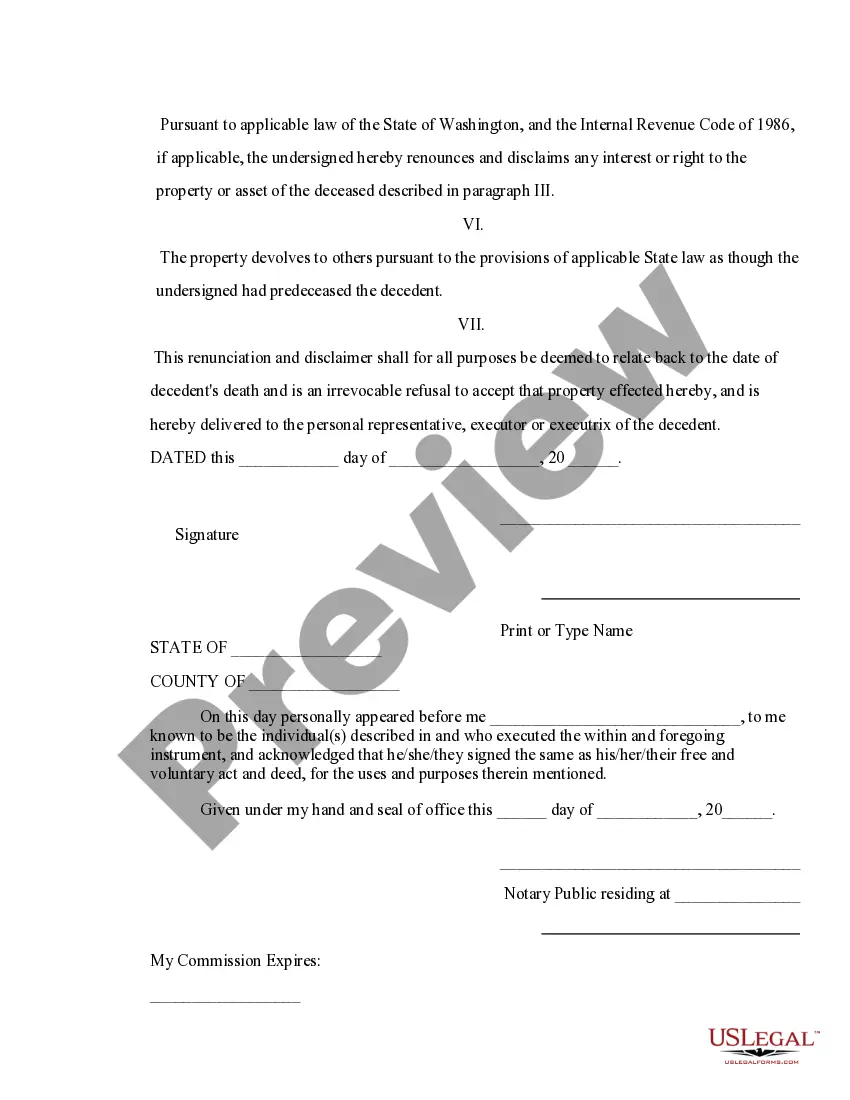

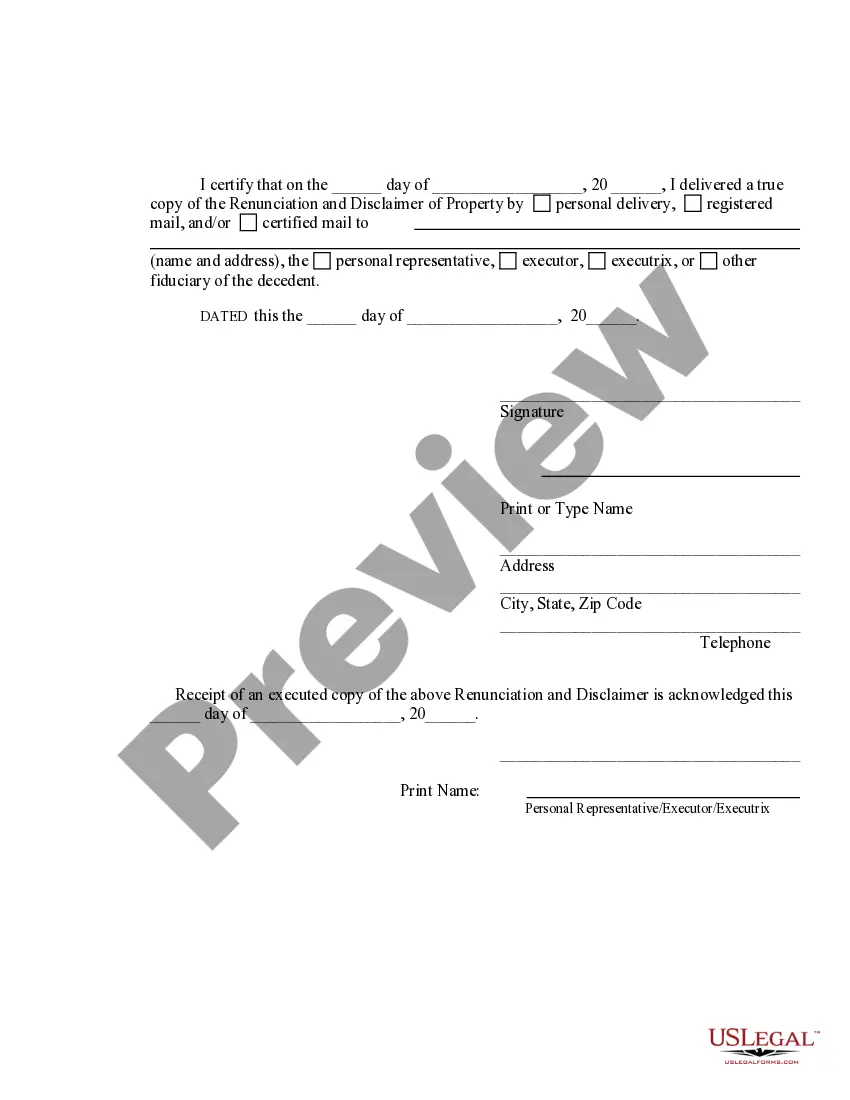

This form is a Renunciation and Disclaimer of Property acquired by Intestate Succession, where the decedent died intestate and the beneficiary gained an interest in the property, but, has chosen to disclaim a portion of or the entire interest in the property pursuant to the Revised Code of Washington, Title 11, Chapter 11.86. The disclaimer will be filed no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the document.

Renton Washington Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to decline the inheritance or assets they are entitled to receive after someone has passed away without leaving a will. This renunciation or disclaimer of property can occur for various reasons, such as personal preferences, tax implications, or to prevent potential conflicts among beneficiaries. By renouncing or disclaiming property received through intestate succession, individuals are essentially stating that they do not wish to accept the inheritance and are willingly giving up their rights to it. This process is typically governed by specific laws and regulations that vary from state to state, including Renton, Washington. In Renton, individuals who wish to renounce or disclaim their entitlement to property received by intestate succession must submit a formal document known as Renton Washington Renunciation And Disclaimer of Property. This legal document provides a clear and official statement that the individual is declining their inheritance rights in a specific estate, and it must adhere to the requirements set forth by the Washington State statutes. It is important to note that there are different types of Renton Washington Renunciation And Disclaimer of Property received by Intestate Succession, depending on the specific circumstances and intentions of the renouncing individual. These may include partial renunciation, complete renunciation, or conditional renunciation. 1. Partial Renunciation: In this type of renunciation, the beneficiary may choose to only decline a portion of their inheritance while accepting the remainder. This could be done due to concerns about managing certain assets, mitigating tax implications, or maintaining eligibility for certain benefits. 2. Complete Renunciation: A complete renunciation involves the beneficiary declining their entire share of the intestate estate. This is often done when the beneficiary has no need or desire for the assets and wants to ensure they are distributed to other heirs or beneficiaries. 3. Conditional Renunciation: A conditional renunciation is when a beneficiary declines their inheritance under specific conditions. For example, they may renounce the property if it comes with certain financial obligations or liabilities that they wish to avoid. Regardless of the type of Renton Washington Renunciation And Disclaimer of Property received by Intestate Succession, it is crucial for individuals considering renunciation to seek legal advice and guidance to ensure that the process is carried out correctly and in accordance with the applicable laws.Renton Washington Renunciation And Disclaimer of Property received by Intestate Succession is a legal process that allows individuals to decline the inheritance or assets they are entitled to receive after someone has passed away without leaving a will. This renunciation or disclaimer of property can occur for various reasons, such as personal preferences, tax implications, or to prevent potential conflicts among beneficiaries. By renouncing or disclaiming property received through intestate succession, individuals are essentially stating that they do not wish to accept the inheritance and are willingly giving up their rights to it. This process is typically governed by specific laws and regulations that vary from state to state, including Renton, Washington. In Renton, individuals who wish to renounce or disclaim their entitlement to property received by intestate succession must submit a formal document known as Renton Washington Renunciation And Disclaimer of Property. This legal document provides a clear and official statement that the individual is declining their inheritance rights in a specific estate, and it must adhere to the requirements set forth by the Washington State statutes. It is important to note that there are different types of Renton Washington Renunciation And Disclaimer of Property received by Intestate Succession, depending on the specific circumstances and intentions of the renouncing individual. These may include partial renunciation, complete renunciation, or conditional renunciation. 1. Partial Renunciation: In this type of renunciation, the beneficiary may choose to only decline a portion of their inheritance while accepting the remainder. This could be done due to concerns about managing certain assets, mitigating tax implications, or maintaining eligibility for certain benefits. 2. Complete Renunciation: A complete renunciation involves the beneficiary declining their entire share of the intestate estate. This is often done when the beneficiary has no need or desire for the assets and wants to ensure they are distributed to other heirs or beneficiaries. 3. Conditional Renunciation: A conditional renunciation is when a beneficiary declines their inheritance under specific conditions. For example, they may renounce the property if it comes with certain financial obligations or liabilities that they wish to avoid. Regardless of the type of Renton Washington Renunciation And Disclaimer of Property received by Intestate Succession, it is crucial for individuals considering renunciation to seek legal advice and guidance to ensure that the process is carried out correctly and in accordance with the applicable laws.