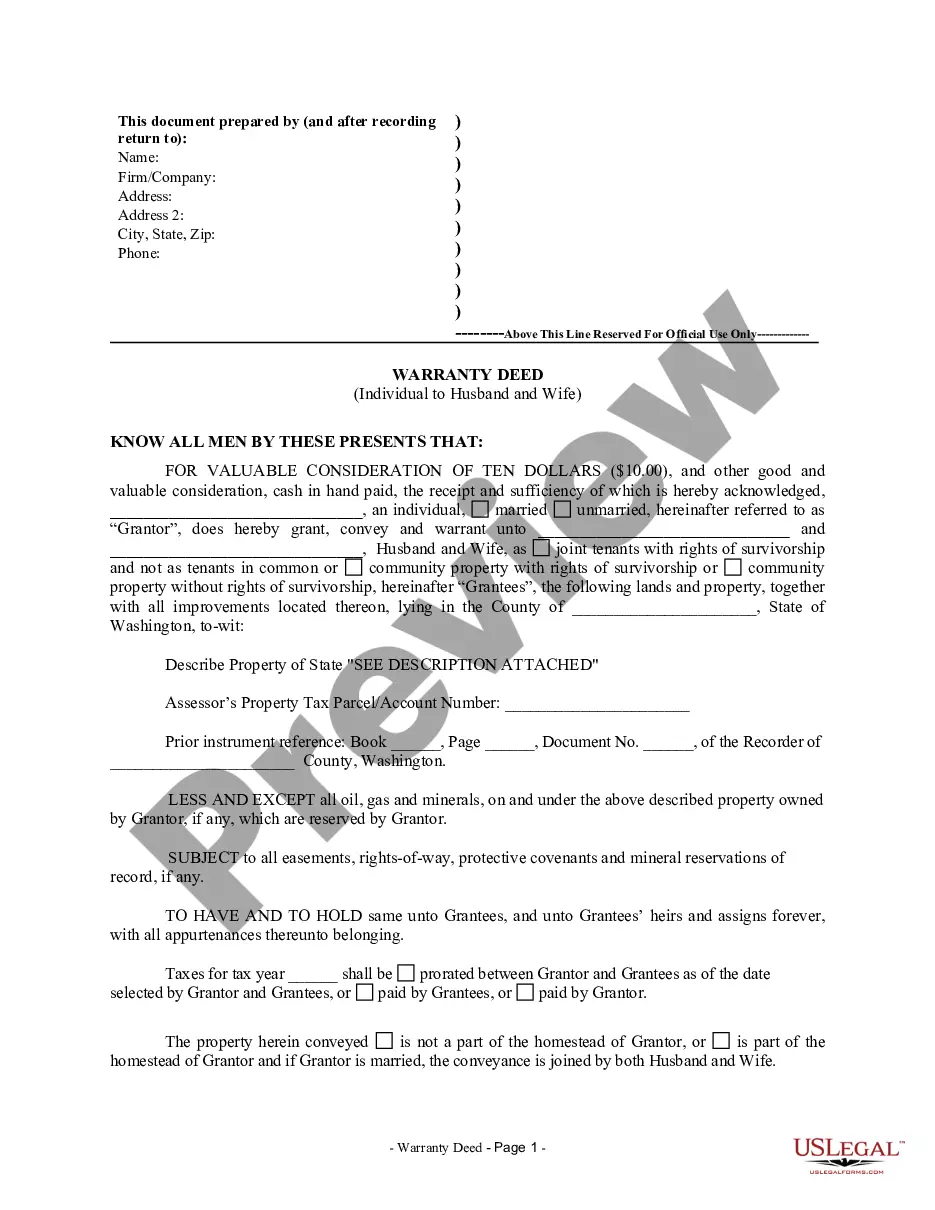

This Warranty Deed from Individual to Husband and Wife form is a Warranty Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and warrants the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Vancouver Washington Warranty Deed from Individual to Husband and Wife is a legal document that transfers real estate ownership from an individual seller to a married couple. This type of deed provides a guarantee or warranty that the property is free from any liens, encumbrances, or claims, and that the seller has the legal right to sell the property. This specific type of warranty deed is commonly used when a property owned by an individual is being transferred to a married couple as joint owners. It ensures that both the husband and wife have equal rights and interests in the property. There are a few different types of Vancouver Washington Warranty Deed from Individual to Husband and Wife, including: 1. General Warranty Deed: This type of warranty deed provides the most protection to the buyers, as it guarantees that the seller will defend the title against any third-party claims. It covers the complete history of the property, including any previous owners. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed only guarantees the title against any claims that may arise during the time the seller owned the property. It does not cover any potential defects or claims that existed prior to the seller's ownership. 3. Quitclaim Deed: While not specifically a warranty deed, a quitclaim deed is also commonly used in transfers between individuals to husband and wife. Unlike a warranty deed, a quitclaim deed does not provide any warranties or guarantees regarding the title. It simply transfers the seller's interest in the property to the buyers. When using a Vancouver Washington Warranty Deed from Individual to Husband and Wife, it's essential to consult with a qualified real estate attorney or title company to ensure that the deed is properly prepared and recorded to protect the interests of both the sellers and buyers. Obtaining title insurance is also recommended providing additional protection against any unforeseen claims or defects in the title.A Vancouver Washington Warranty Deed from Individual to Husband and Wife is a legal document that transfers real estate ownership from an individual seller to a married couple. This type of deed provides a guarantee or warranty that the property is free from any liens, encumbrances, or claims, and that the seller has the legal right to sell the property. This specific type of warranty deed is commonly used when a property owned by an individual is being transferred to a married couple as joint owners. It ensures that both the husband and wife have equal rights and interests in the property. There are a few different types of Vancouver Washington Warranty Deed from Individual to Husband and Wife, including: 1. General Warranty Deed: This type of warranty deed provides the most protection to the buyers, as it guarantees that the seller will defend the title against any third-party claims. It covers the complete history of the property, including any previous owners. 2. Special Warranty Deed: Unlike a general warranty deed, a special warranty deed only guarantees the title against any claims that may arise during the time the seller owned the property. It does not cover any potential defects or claims that existed prior to the seller's ownership. 3. Quitclaim Deed: While not specifically a warranty deed, a quitclaim deed is also commonly used in transfers between individuals to husband and wife. Unlike a warranty deed, a quitclaim deed does not provide any warranties or guarantees regarding the title. It simply transfers the seller's interest in the property to the buyers. When using a Vancouver Washington Warranty Deed from Individual to Husband and Wife, it's essential to consult with a qualified real estate attorney or title company to ensure that the deed is properly prepared and recorded to protect the interests of both the sellers and buyers. Obtaining title insurance is also recommended providing additional protection against any unforeseen claims or defects in the title.