This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee is also an individual. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Seattle Washington Transfer on Death Quitclaim Deed from Individual to Individual with Alternate Beneficiary

Description

How to fill out Washington Transfer On Death Quitclaim Deed From Individual To Individual With Alternate Beneficiary?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our helpful website featuring a vast array of document templates enables you to discover and acquire nearly any document sample you may require.

You can download, complete, and endorse the Seattle Washington Transfer on Death Quitclaim Deed from Individual to Individual with Alternate Beneficiary in merely a few minutes rather than spending hours searching online for the suitable template.

Using our catalog is a superb method to enhance the security of your document filing.

Access the page with the form you need. Confirm that it is the document you were looking for: check its title and description, and use the Preview feature when available. Otherwise, use the Search field to find the required one.

Initiate the download process. Click Buy Now and choose the pricing plan that best fits you. Then, register for an account and pay for your order using a credit card or PayPal.

- Our expert legal professionals routinely review all the documents to confirm that the templates are applicable to a specific jurisdiction and adhere to current laws and regulations.

- How can you obtain the Seattle Washington Transfer on Death Quitclaim Deed from Individual to Individual with Alternate Beneficiary.

- If you possess a subscription already, simply Log In to your account. The Download option will be activated for all the documents you view.

- Moreover, you can locate all the previously saved documents in the My documents section.

- If you do not yet have an account, follow the instructions below.

Form popularity

FAQ

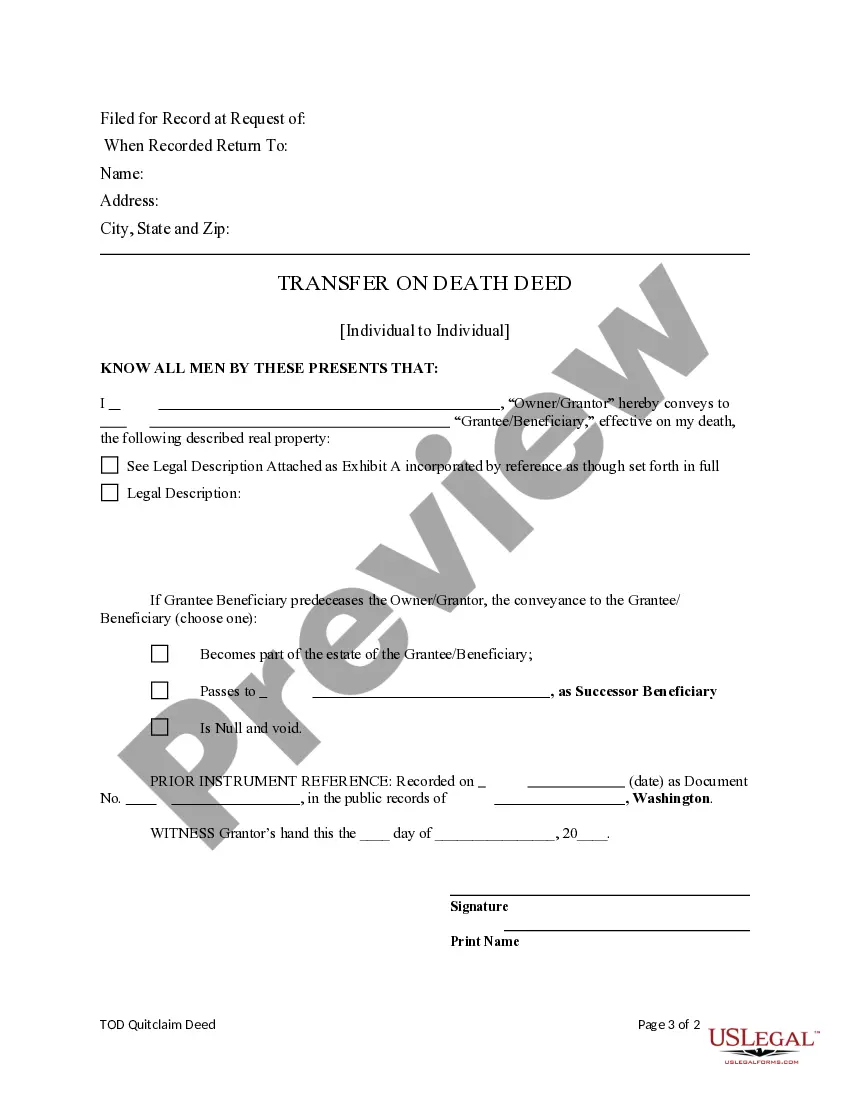

The Washington transfer-on-death deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Transfer-on-Death Deeds in Washington State A TOD deed, also called a beneficiary deed, is a legal method of property transfer first enacted by Washington State legislature on June 12, 2014.

Transfer-on-Death Deeds for Real Estate North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

A transfer on death deed can be a very helpful planning tool when designing an estate plan. Indiana is one of many states that allows the transfer of real property by a transfer on death deed.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

A transfer on death deed, or a TOD Deed, allows for individuals to pass real property to a beneficiary upon their death.

A POD accounts stands for ?payable on death? and is usually used with bank accounts such as checking, savings or Certificates of Deposit. TOD are ?transfer on death? accounts and are usually used with brokerage accounts, stocks, bonds and other investments.

Your beneficiary has the ability to disclaim the property (refuse or renounce their interest in it) if they do not want the property.

There's no probate for life insurance or registered accounts with named beneficiaries such as: registered retirement savings plans (RRSPs) or. tax-free savings accounts (TFSAs).