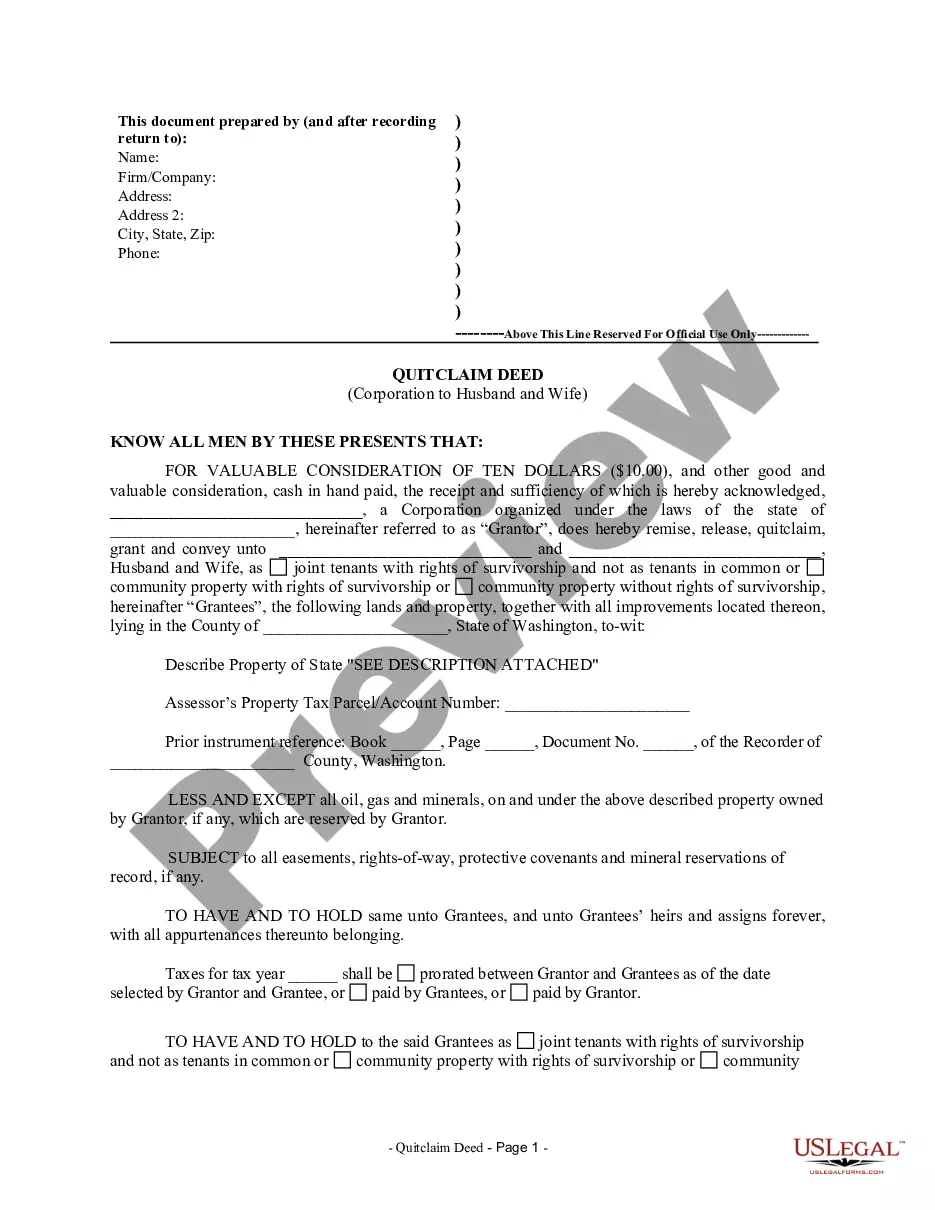

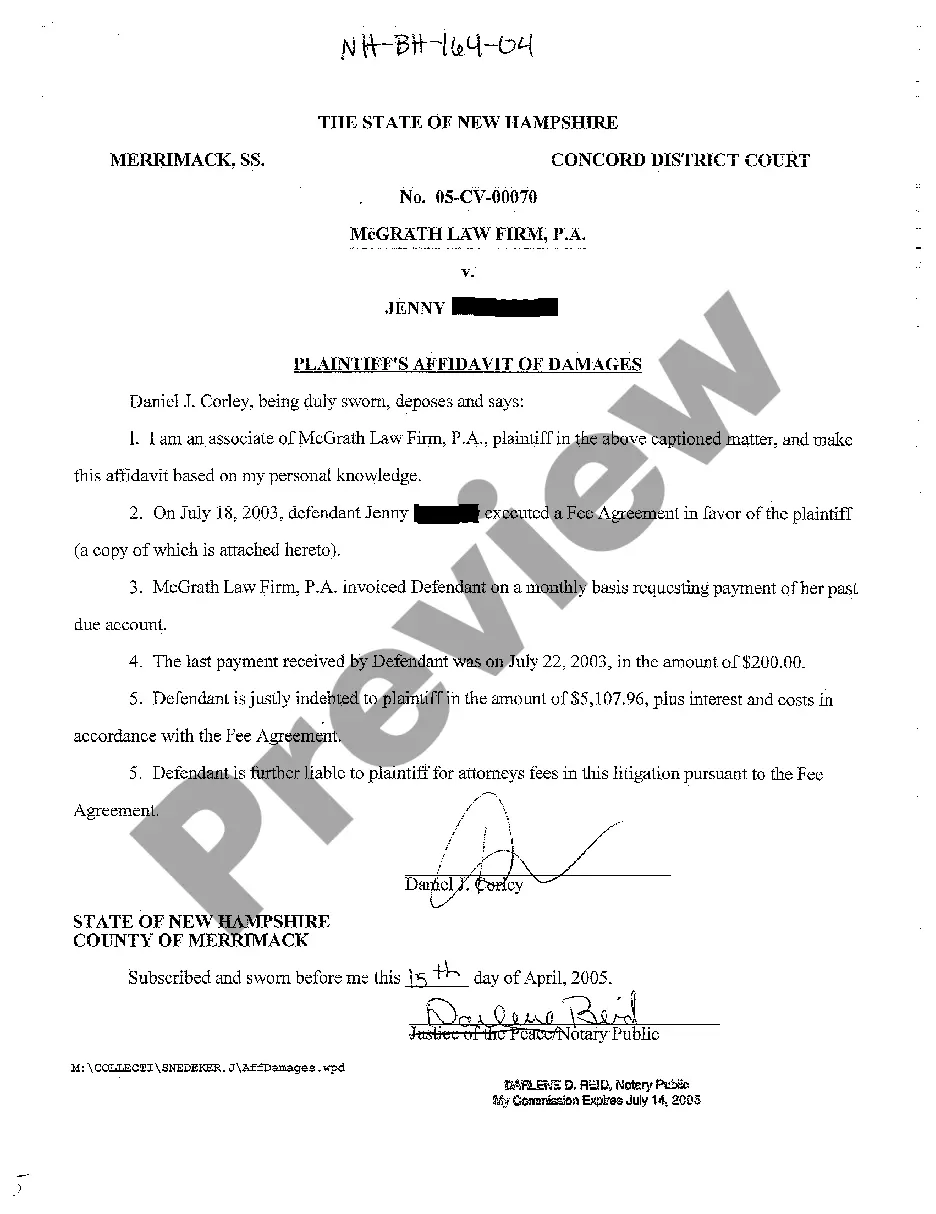

This Quitclaim Deed from Corporation to Husband and Wife form is a Quitclaim Deed where the Grantor is a corporation and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

King Washington Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Washington Quitclaim Deed From Corporation To Husband And Wife?

Obtaining verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

This online repository offers over 85,000 legal documents for various personal and professional requirements as well as any actual situations.

All the paperwork is systematically organized by usage area and jurisdiction, making it as straightforward as can be to find the King Washington Quitclaim Deed from Corporation to Husband and Wife.

Purchase the document. Click on the Buy Now button and choose the subscription plan that you prefer. You will need to create an account to access the resources of the library.

- For those already acquainted with our catalog and who have used it previously, acquiring the King Washington Quitclaim Deed from Corporation to Husband and Wife only requires a few clicks.

- Simply Log In to your account, choose the document, and hit Download to store it on your device.

- The procedure will take a few additional steps for first-time users.

- Review the Preview mode and document description. Ensure you’ve selected the correct one that fits your needs and fully complies with your local jurisdiction regulations.

- Search for another template, if necessary. If you discover any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

Form popularity

FAQ

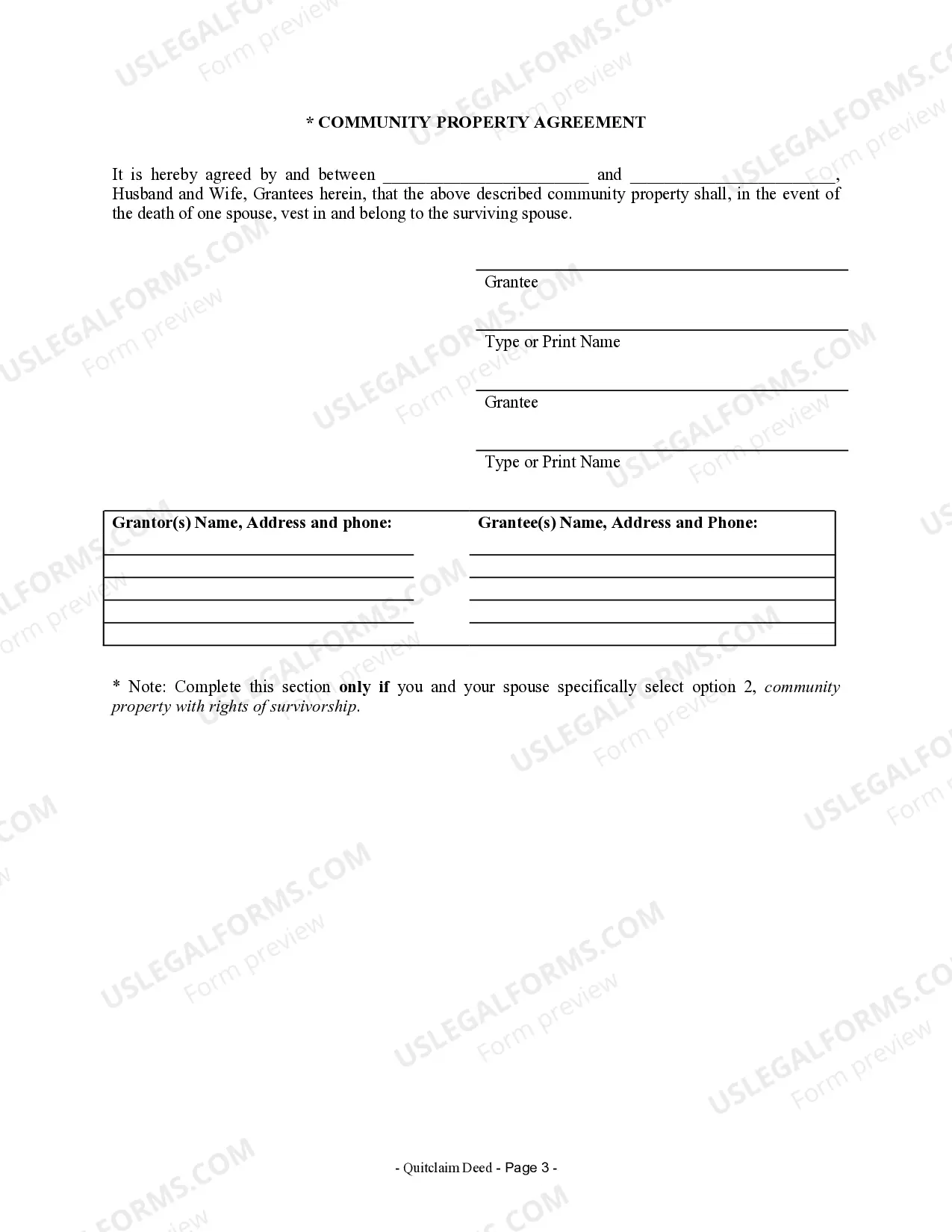

Using a quitclaim deed, such as the King Washington Quitclaim Deed from Corporation to Husband and Wife, is common for several reasons. Most often, this deed is employed to clarify ownership among family members or when changing property titles. Additionally, it is frequently used in divorce settlements to transfer property rights without a lengthy legal process.

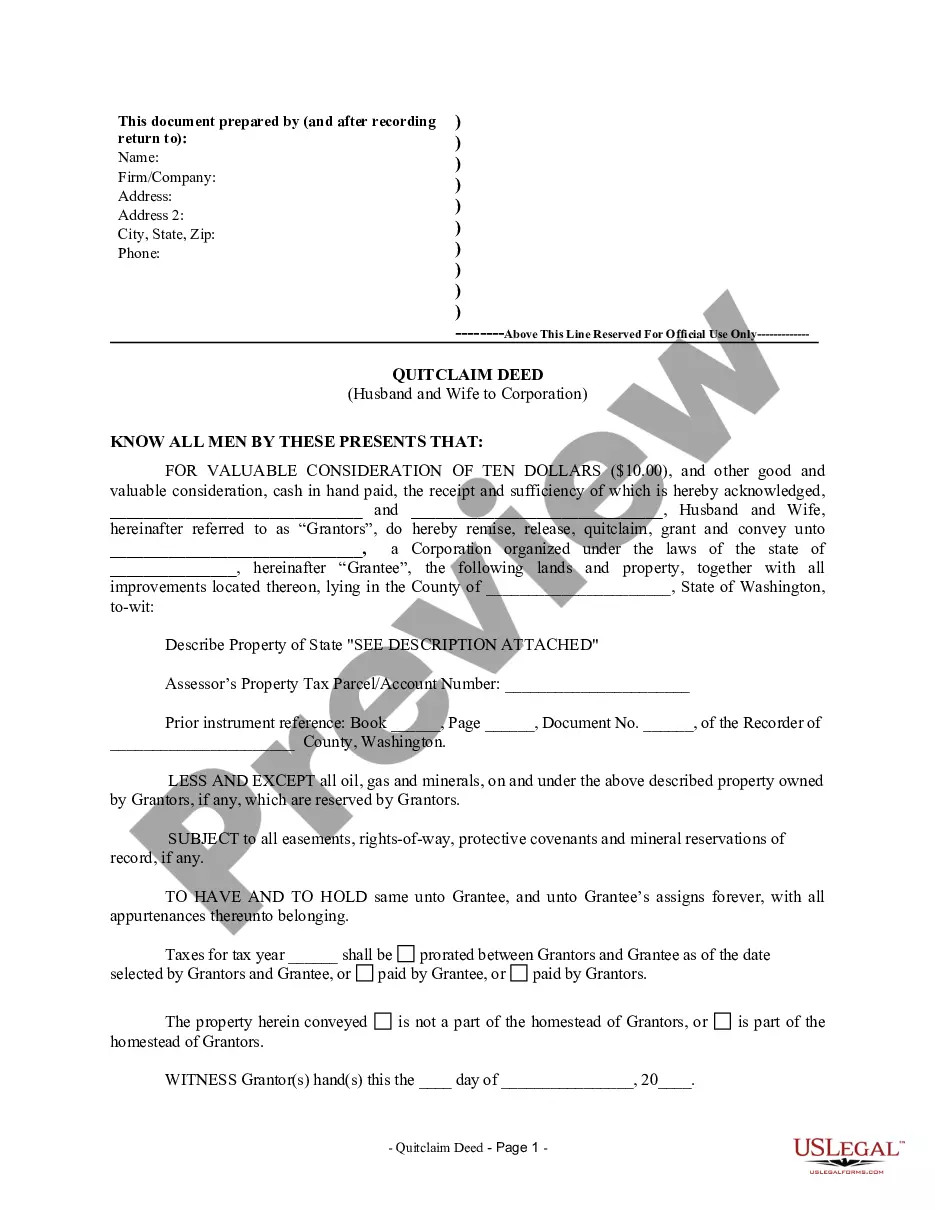

To transfer property to a family member in Washington state, you can use a King Washington Quitclaim Deed from Corporation to Husband and Wife. This process involves preparing the deed with the names of the grantor and grantee and a clear property description. Once you have signed and notarized the document, you must then record it with your county’s property records office for it to take effect.

A quitclaim deed for a married couple, such as in a King Washington Quitclaim Deed from Corporation to Husband and Wife, is used to transfer property interests between spouses. This deed allows one spouse to relinquish any claim to the property without guaranteeing that the title is clear. It serves as a straightforward way to clarify ownership and avoid future disputes over property rights.

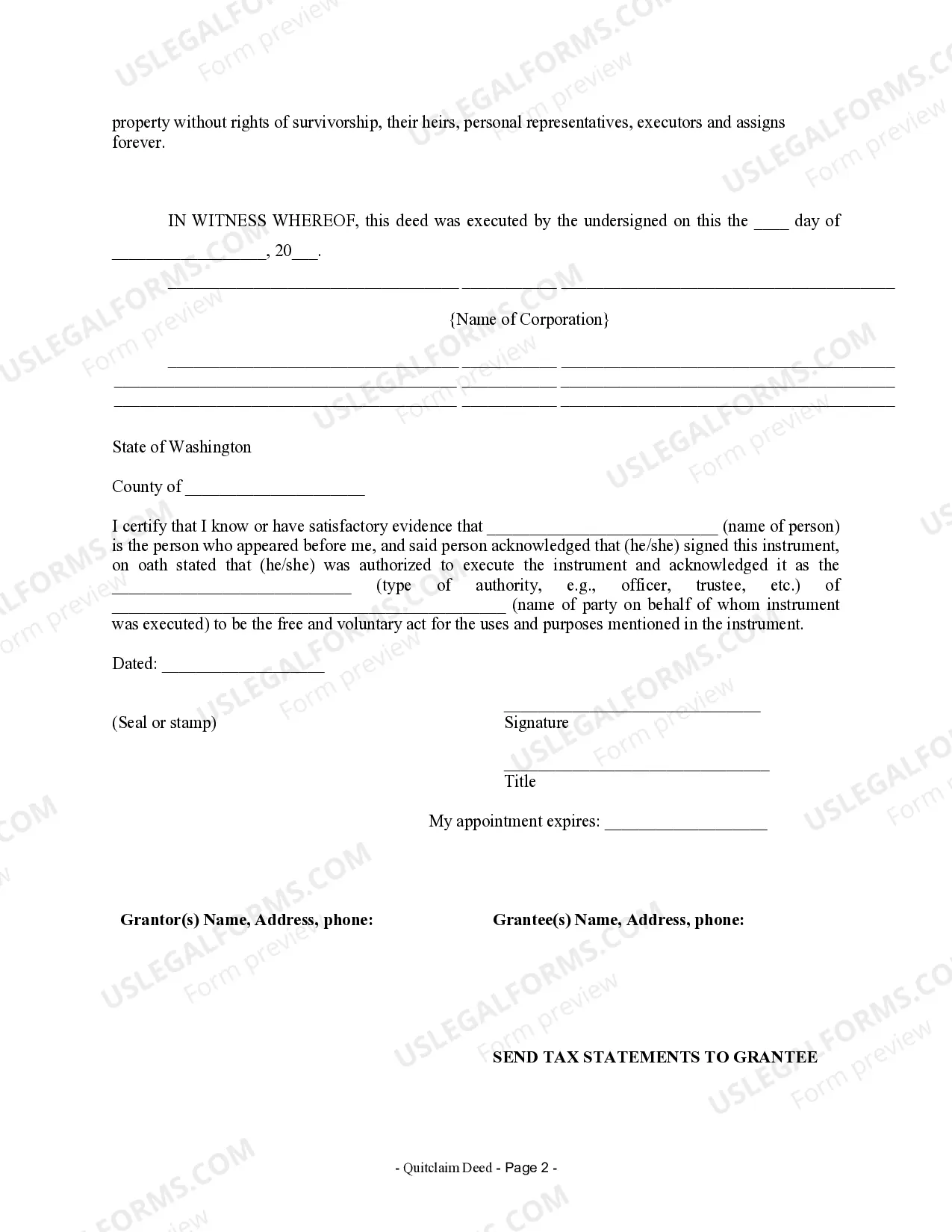

The requirements for a King Washington Quitclaim Deed from Corporation to Husband and Wife include specific essential elements. The deed must name the parties involved, describe the property adequately, and be signed by the grantor. Furthermore, the signature must be notarized to ensure that the deed is recognized as valid under state law.

In Washington, if a spouse signs a King Washington Quitclaim Deed from Corporation to Husband and Wife, it can impact their rights to property. Typically, this deed transfers ownership, but the signing spouse may retain certain rights, depending on the circumstances. It is crucial to understand the implications of signing this type of deed and consult with a legal expert if there are questions.

To create a valid King Washington Quitclaim Deed from Corporation to Husband and Wife, certain requirements must be met. First, the deed must include the names of both the grantor and the grantee. Additionally, the property description must be clear and precise. Finally, the deed needs to be signed by the grantor and notarized to be legally effective.

In Washington State, a valid King Washington Quitclaim Deed from Corporation to Husband and Wife must include the names of the grantor and grantee, a legal description of the property, and the signature of the grantor. Furthermore, the deed must be notarized to verify the identities of the parties signing it. It’s also recommended to check local regulations regarding any additional requirements. Utilizing services like US Legal Forms can simplify the process of creating a compliant quitclaim deed.

Filling out a King Washington Quitclaim Deed from Corporation to Husband and Wife requires attention to detail. Begin by gathering necessary information, including property descriptions and the names of all parties involved. Complete the deed form, ensuring everything is accurate, then have it signed and notarized. Finally, submit it to your local recording office; using platforms like US Legal Forms can streamline this experience and help avoid common pitfalls.

To add your spouse using a King Washington Quitclaim Deed from Corporation to Husband and Wife, start by obtaining the correct form. Next, clearly fill in the names of both spouses in the designated sections, ensuring that you include any corporation details if applicable. Sign the document in front of a notary, and make sure to adhere to local recording requirements to finalize the process. Utilizing a service like US Legal Forms can simplify this further, providing guidance throughout.

You can add your spouse to your deed without refinancing by using a quit claim deed. The King Washington Quitclaim Deed from Corporation to Husband and Wife can be easily obtained and filled out to transfer ownership without affecting your mortgage. Ensure you follow the local regulations for recording the deed to complete the process correctly. For additional support and guidance, uSlegalforms offers templates and resources to make this transition easier.