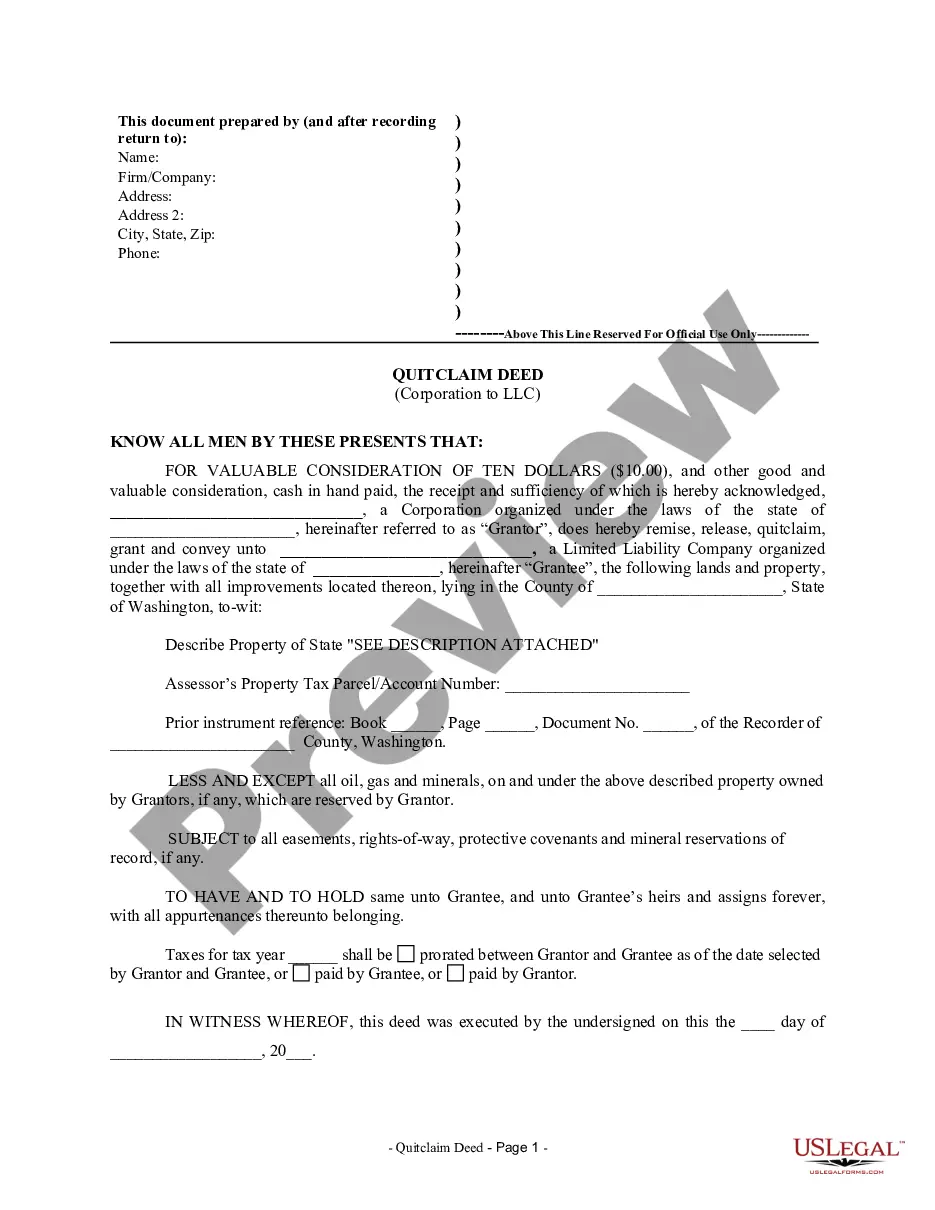

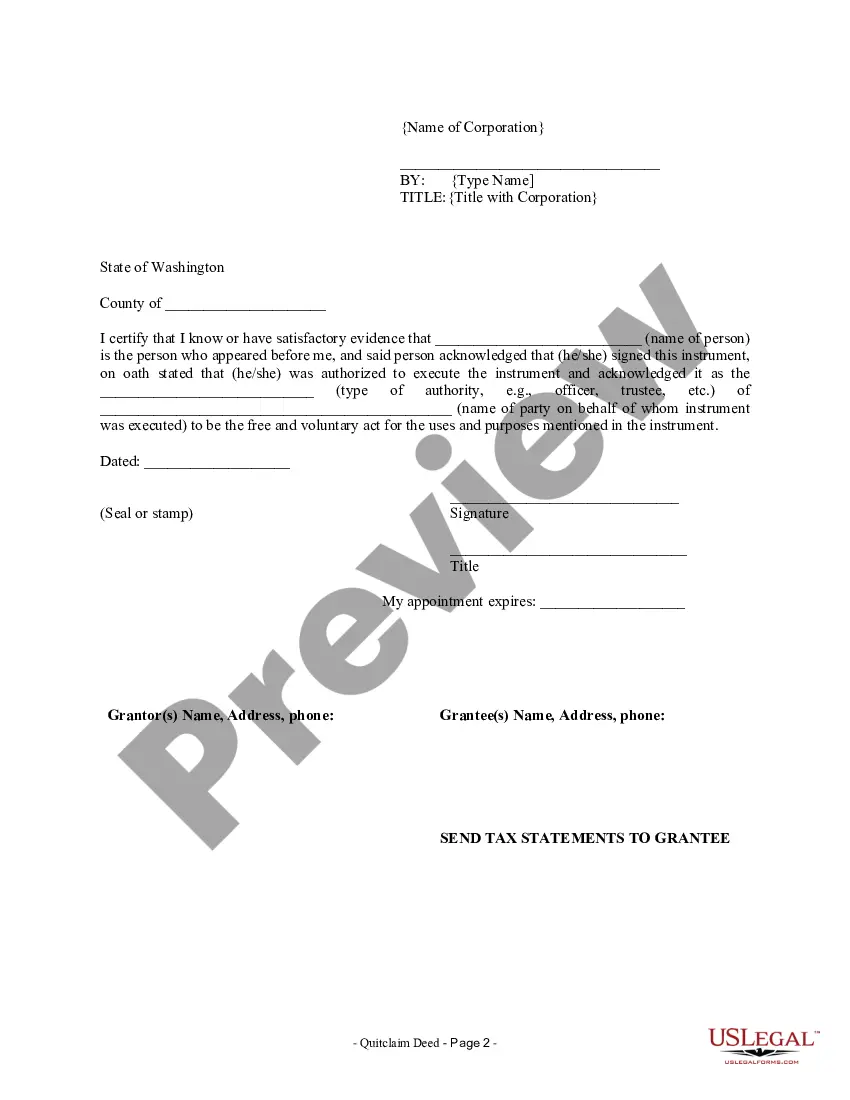

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A King Washington Quitclaim Deed from Corporation to LLC is a legal document that transfers ownership of a property or real estate from a corporation to a limited liability company (LLC) based in the state of Washington. This type of deed is commonly used when a corporation wishes to transfer ownership of a property it owns to an LLC that it operates or is affiliated with. A quitclaim deed is a type of deed used to transfer ownership rights to a property without providing any guarantees or warranties on the property's title or history. In other words, the granter (corporation) is only transferring whatever rights it may have in the property without making any representations about the property's clear title. This King Washington Quitclaim Deed from Corporation to LLC is an important legal instrument that ensures a clear transfer of ownership, protecting both parties involved. It outlines the specific details of the property being transferred, including the legal description, address, and any existing liens or encumbrances. The deed must be executed following the proper legal procedures, including the necessary notarization and recording with the appropriate county clerk's office in King County, Washington. This recording is crucial for establishing the validity of the transfer and ensuring it is legally recognized. There may be different variations or types of King Washington Quitclaim Deed from Corporation to LLC, including specific considerations such as: 1. King Washington Quitclaim Deed with Consideration: This deed includes a monetary consideration, where the LLC compensates the corporation for the transfer of ownership rights in the property. The consideration amount should be specified in the document. 2. King Washington Quitclaim Deed without Consideration: In this type of deed, no monetary consideration is involved. The transfer of ownership is made without any exchange of funds between the corporation and the LLC. 3. King Washington Quitclaim Deed with Restrictions: This variation includes specific restrictions or limitations on the use or future transfer of the property by the LLC. These restrictions are usually agreed upon and specified by both parties involved. It is essential to consult with legal professionals specializing in real estate transactions to ensure compliance with Washington state laws and regulations. They can provide guidance on the specific type of quitclaim deed required for your situation and assist in drafting and executing the necessary legal documents, thus protecting the rights and interests of all parties involved.A King Washington Quitclaim Deed from Corporation to LLC is a legal document that transfers ownership of a property or real estate from a corporation to a limited liability company (LLC) based in the state of Washington. This type of deed is commonly used when a corporation wishes to transfer ownership of a property it owns to an LLC that it operates or is affiliated with. A quitclaim deed is a type of deed used to transfer ownership rights to a property without providing any guarantees or warranties on the property's title or history. In other words, the granter (corporation) is only transferring whatever rights it may have in the property without making any representations about the property's clear title. This King Washington Quitclaim Deed from Corporation to LLC is an important legal instrument that ensures a clear transfer of ownership, protecting both parties involved. It outlines the specific details of the property being transferred, including the legal description, address, and any existing liens or encumbrances. The deed must be executed following the proper legal procedures, including the necessary notarization and recording with the appropriate county clerk's office in King County, Washington. This recording is crucial for establishing the validity of the transfer and ensuring it is legally recognized. There may be different variations or types of King Washington Quitclaim Deed from Corporation to LLC, including specific considerations such as: 1. King Washington Quitclaim Deed with Consideration: This deed includes a monetary consideration, where the LLC compensates the corporation for the transfer of ownership rights in the property. The consideration amount should be specified in the document. 2. King Washington Quitclaim Deed without Consideration: In this type of deed, no monetary consideration is involved. The transfer of ownership is made without any exchange of funds between the corporation and the LLC. 3. King Washington Quitclaim Deed with Restrictions: This variation includes specific restrictions or limitations on the use or future transfer of the property by the LLC. These restrictions are usually agreed upon and specified by both parties involved. It is essential to consult with legal professionals specializing in real estate transactions to ensure compliance with Washington state laws and regulations. They can provide guidance on the specific type of quitclaim deed required for your situation and assist in drafting and executing the necessary legal documents, thus protecting the rights and interests of all parties involved.