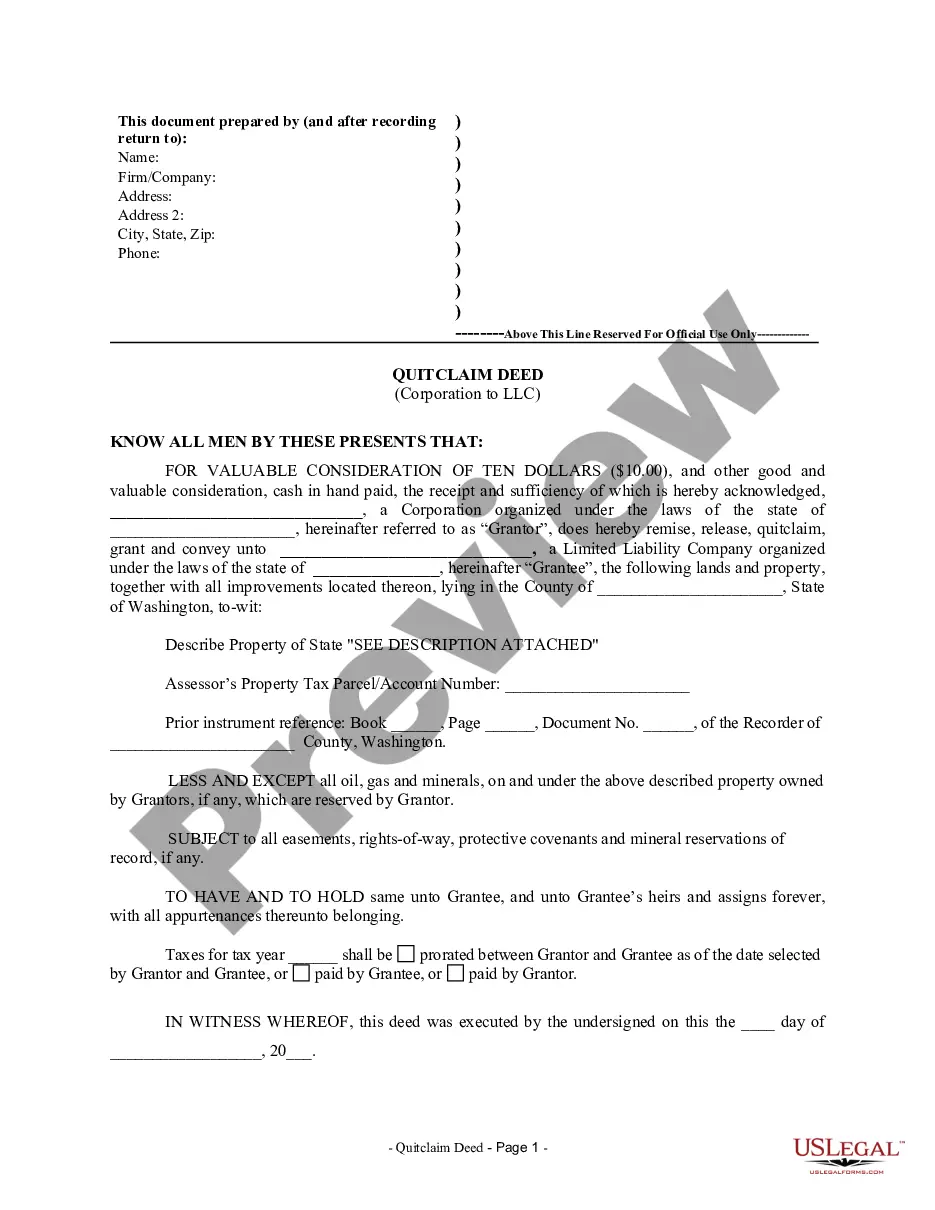

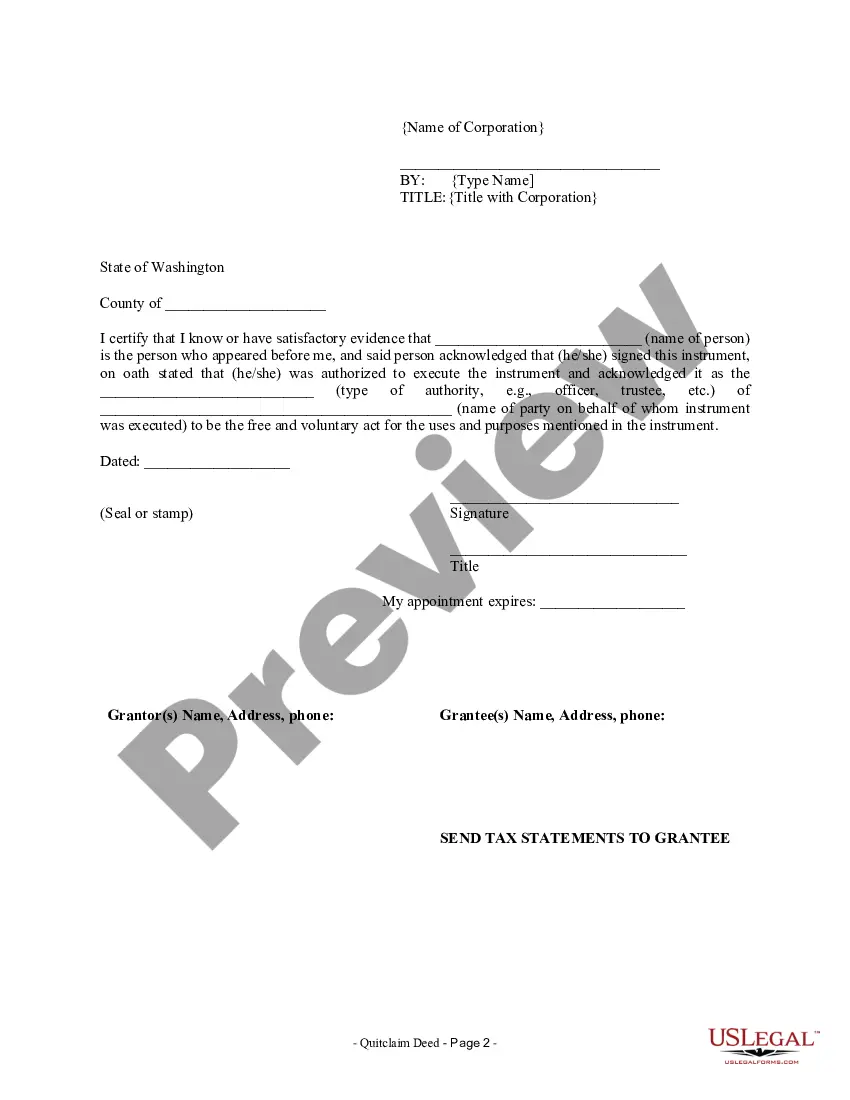

This Quitclaim Deed from Corporation to LLC form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Seattle Washington Quitclaim Deed from Corporation to LLC is a legal document used to transfer or convey property ownership from a corporation to a limited liability company (LLC) in Seattle, Washington. This deed is commonly used when a corporation decides to transfer one or multiple properties it owns to an LLC, which may be more advantageous for various reasons, such as personal liability protection, tax benefits, or restructuring purposes. When executing a Quitclaim Deed, the corporation (granter) transfers any and all interests it has in the property to the LLC (grantee) without making any warranties or guarantees regarding the title of the property. This means that the corporation is making no claims about the property's condition, potential liens, or encumbrances, if any exist. The LLC accepts the property as-is, assuming any potential risks associated with it. It is important to note that a Quitclaim Deed is different from a Warranty Deed. A Warranty Deed provides more comprehensive protection to the grantee, as the granter guarantees that the property has a clear title and assumes responsibility for any potential issues that may arise. However, the Quitclaim Deed is usually sufficient when the transferor and transferee have an existing relationship or when the transfer is made for corporate restructuring purposes. In Seattle, Washington, there may not be specific types of Quitclaim Deeds exclusive to transfers from corporations to LCS. However, the Quitclaim Deed document itself can vary based on specific circumstances, such as whether the transfer is a part of a business merger, asset transfer, or dissolution of the corporation. Each document should clearly state the intentions of the transfer and any pertinent details, including the legal names and addresses of both the corporation and LLC, as well as the property's legal description. Executing a Seattle Washington Quitclaim Deed from Corporation to LLC requires strict adherence to the legal requirements and procedures set forth by the state. It is highly recommended seeking the assistance of a qualified attorney or real estate professional experienced in Seattle's laws and regulations to ensure the process is correctly completed and the transfer of ownership is legally binding. Keywords: Seattle Washington, Quitclaim Deed, Corporation, LLC, property, ownership transfer, limited liability company, convey, advantages, personal liability protection, tax benefits, restructuring, warranties, guarantee, title, liens, encumbrances, relationship, merger, asset transfer, dissolution, legal names, addresses, legal description, execution, requirements, procedures, attorney, real estate professional, laws, regulations.