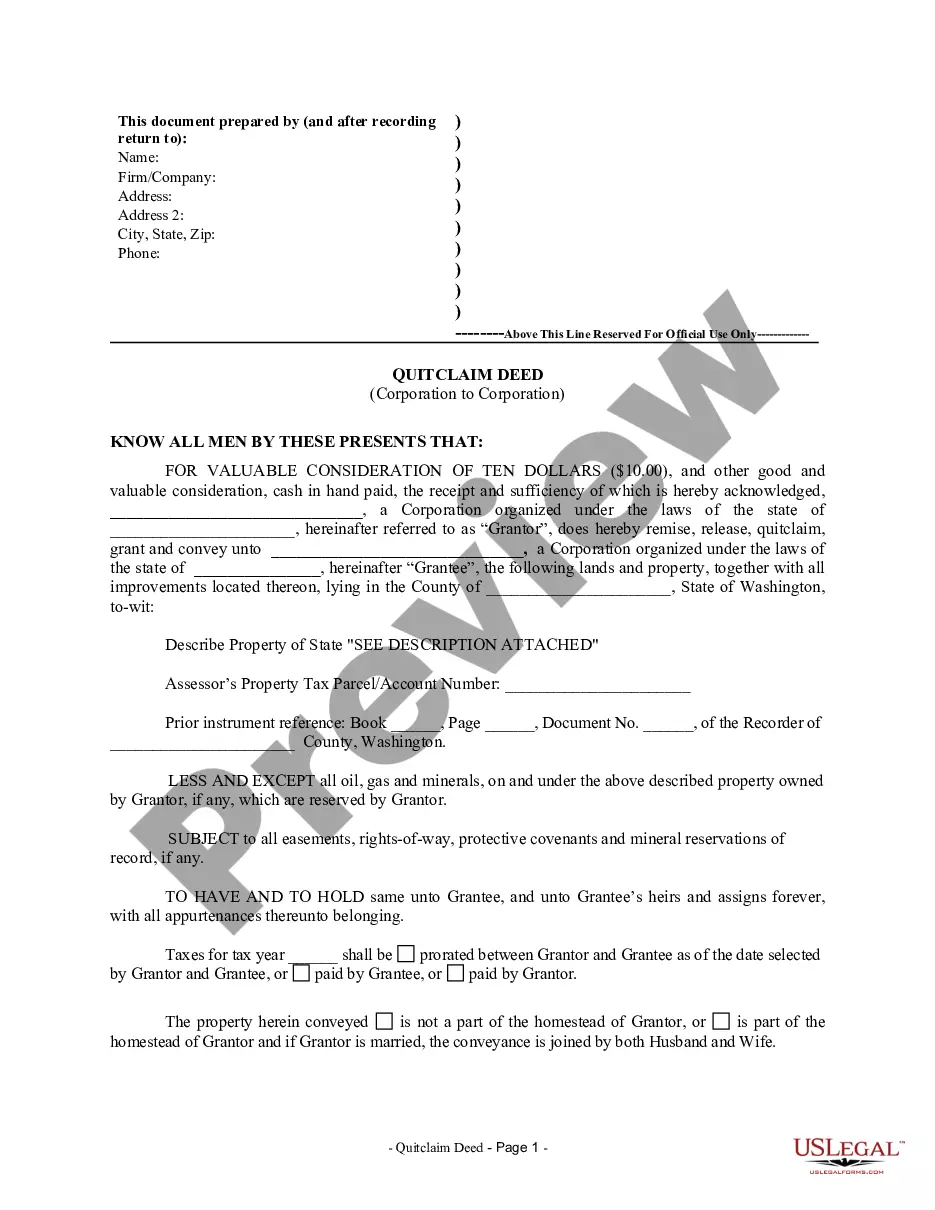

This Quitclaim Deed from Corporation to Corporation form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is a corporation. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

King Washington Quitclaim Deed from Corporation to Corporation

Description

How to fill out Washington Quitclaim Deed From Corporation To Corporation?

Are you in need of a trustworthy and budget-friendly provider for legal forms to obtain the King Washington Quitclaim Deed from Corporation to Corporation? US Legal Forms is your ideal option.

Whether you require a simple agreement to establish rules for living with your partner or a collection of forms to facilitate your divorce proceedings in court, we have you covered. Our service offers over 85,000 current legal document templates for both personal and business use. All templates we provide are tailored and compliant with the regulations of specific states and regions.

To download the document, you must Log In to your account, find the required template, and click the Download button next to it. Please remember that you can access your previously acquired document templates anytime from the My documents section.

Is this your first time visiting our website? No problem. You can set up an account quickly, but before that, please ensure to do the following.

Now you can create your account. After that, select your subscription plan and proceed to payment. Once the payment is finalized, download the King Washington Quitclaim Deed from Corporation to Corporation in any available format. You can revisit the website anytime and redownload the document without incurring any additional charges.

Locating current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to spending hours understanding legal paperwork online once and for all.

- Verify that the King Washington Quitclaim Deed from Corporation to Corporation complies with the laws of your state and locality.

- Review the specifics of the form (if available) to understand who and what the document is designed for.

- Restart your search if the template does not fit your legal needs.

Form popularity

FAQ

To record a King Washington Quitclaim Deed from Corporation to Corporation, you must submit the deed to the county auditor's office where the property is located. Ensure that the deed is properly signed, notarized, and includes all required information. Recording the deed allows it to become part of the public record, providing legal protection for the transaction.

Yes, you can complete a King Washington Quitclaim Deed from Corporation to Corporation by yourself. However, it is advisable to understand the legal implications and requirements before proceeding. Utilizing online platforms like US Legal Forms can streamline this process and provide guidance to ensure your deed is correctly prepared.

To create a valid King Washington Quitclaim Deed from Corporation to Corporation, the deed must be in writing and include the names of both the grantor and grantee. It should state the legal description of the property being transferred. Both parties must sign the deed, and it must be notarized to ensure its validity.

To convey your property to an LLC using a King Washington Quitclaim Deed from Corporation to Corporation, you must prepare the deed with the LLC as the grantee. Make sure to include accurate property details and obtain the necessary signatures. You can find useful resources on platforms like uslegalforms that can guide you through the steps, ensuring everything is correctly handled.

Filing a King Washington Quitclaim Deed from Corporation to Corporation in King County involves submitting the completed deed to the King County Recorder's office. Ensure the document is notarized and that all required information is included. You may also benefit from using services like uslegalforms, which can simplify the process and ensure all requirements are met.

In Washington State, the King Washington Quitclaim Deed from Corporation to Corporation must include specific details such as the names of the corporations involved, a complete legal description of the property, and the signature of the party transferring the interest. Ensuring compliance with state guidelines is crucial for valid execution. Consulting platforms like uslegalforms can aid in obtaining the correct templates and guidance.

When filling out a Quitclaim deed form, start by entering the grantor's and grantee's names clearly, followed by the legal description of the property being transferred. Specify the date of the transfer and ensure both parties sign the document in the presence of a notary public. Using a reliable platform like UsLegalForms can help you navigate the specifics of the King Washington Quitclaim Deed from Corporation to Corporation, making the process easier.

Transferring property to a family member in Washington typically involves executing a Quitclaim Deed. This document allows you to transfer your interest in the property without complicated legal hurdles. It's important to correctly fill out the deed and file it with your local county office. UsLegalForms provides templates and guidance which can help simplify this procedure.

Filling out a Quitclaim Deed in Washington involves including essential information such as the names of the grantor and grantee, the legal description of the property, and the date of transfer. You can find templates online, like those on UsLegalForms, which offer guidance on the necessary details to ensure compliance with state requirements. To finalize the deed, both parties must sign it, and you should have it notarized.