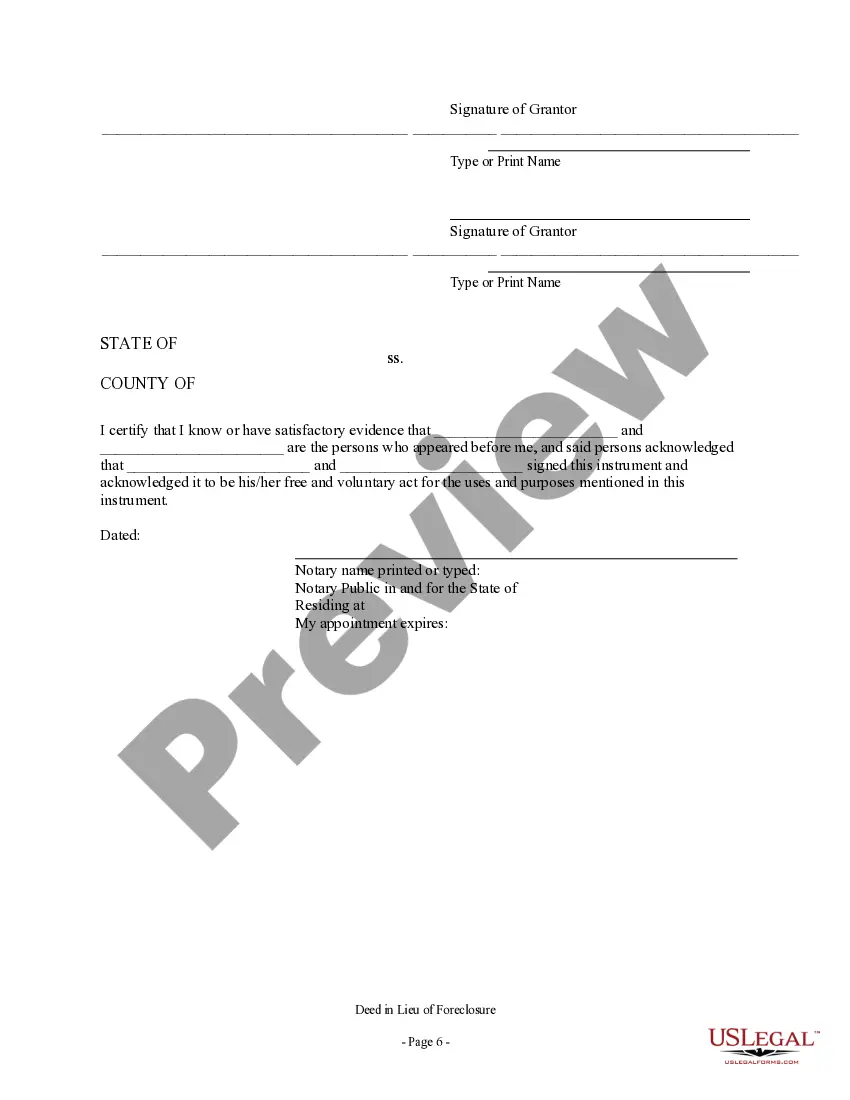

This form is used as a method for a lienholder of property to avoid a lengthy and expensive foreclosure process. With a deed in lieu of foreclosure, a foreclosing lienholder agrees to have the ownership interest transferred to the bank/lienholder as payment in full. The debtor simply deeds the property to the bank as a substitute for foreclosure.

Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation

Description

How to fill out Washington Deed In Lieu Of Foreclosure - Husband And Wife To Corporation?

If you are looking for a legitimate document, it’s hard to select a more suitable platform than the US Legal Forms site – likely the most comprehensive online repositories.

Here you can obtain thousands of templates for business and personal uses categorized by types and jurisdictions, or keywords.

With the excellent search capability, obtaining the latest Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Retrieve the template. Select the file format and save it to your device. Make modifications. Fill out, edit, print, and sign the obtained Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

- Additionally, the relevance of each document is verified by a team of professional attorneys who regularly review the templates on our platform and update them according to the latest state and county regulations.

- If you are familiar with our system and possess an account, all you need to do to secure the Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation is to Log In to your profile and select the Download option.

- If you are using US Legal Forms for the first time, just adhere to the instructions outlined below.

- Ensure you have accessed the form you wish. Review its details and utilize the Preview feature to examine its contents. If it doesn’t fulfill your requirements, use the Search feature located at the top of the page to locate the appropriate document.

- Validate your choice. Select the Buy now button. Subsequently, choose the desired pricing plan and supply your information to create an account.

Form popularity

FAQ

In Washington state, the foreclosure process typically takes around 120 days to six months, depending on various factors, including the type of foreclosure. After the notice is issued, homeowners have a specific time to respond before the sale occurs. Understanding this timeline can be crucial, especially for those considering options like the Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

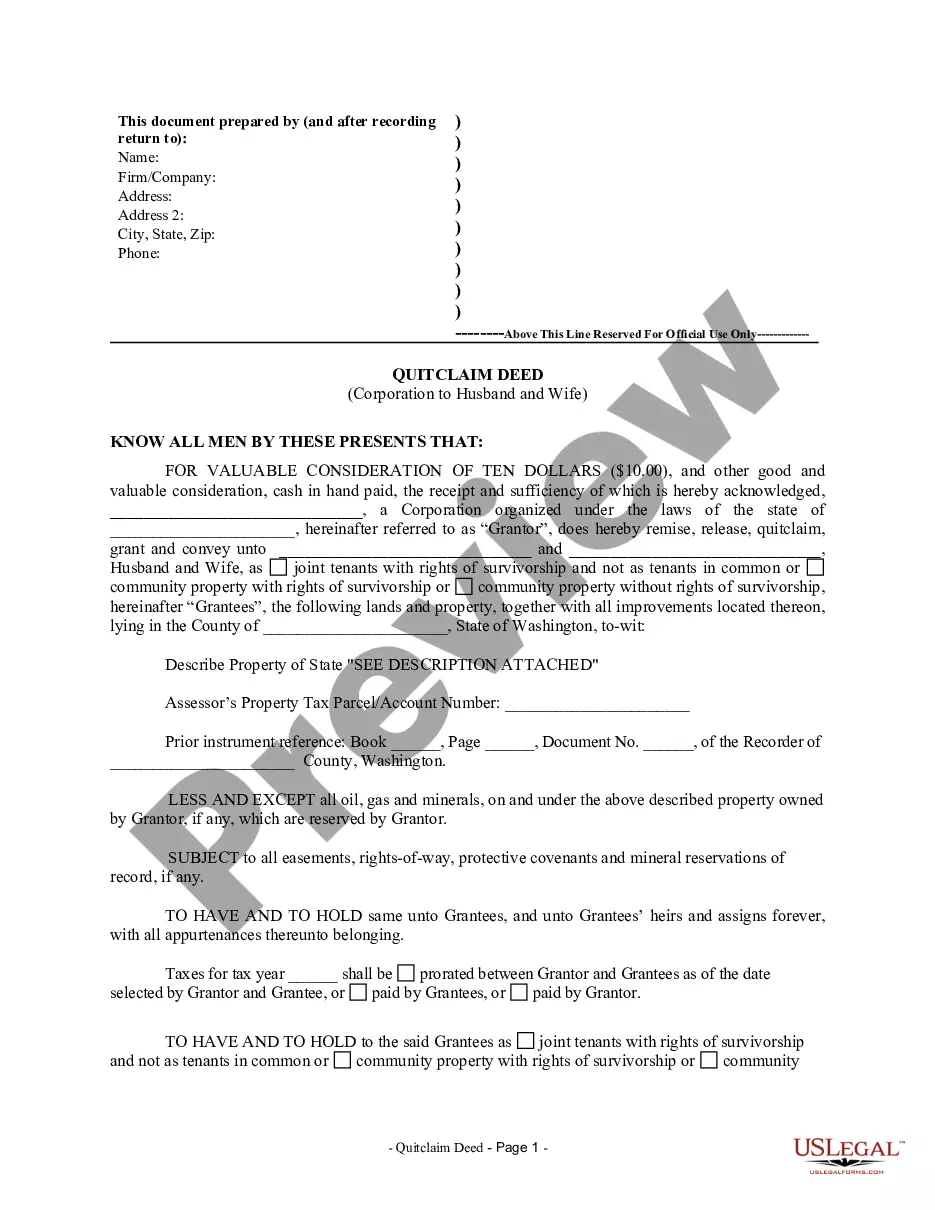

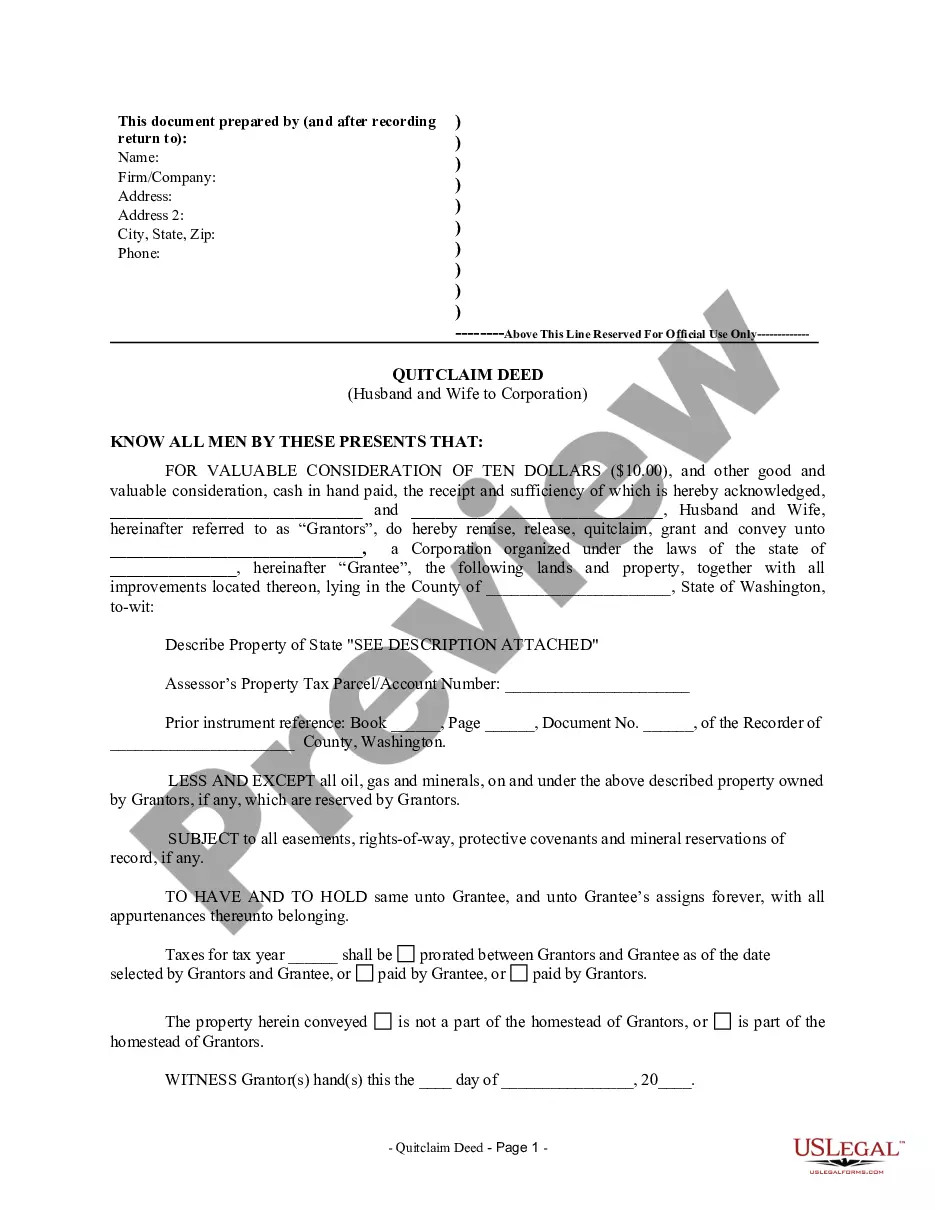

The best way to add your wife to your deed is to execute a quitclaim deed that lists both your names. This method is straightforward and ensures clarity in ownership. After preparing the deed, both of you should sign it in the presence of a notary and file the signed document with the county auditor. This process is particularly significant when navigating matters like the Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

In Washington state, several types of deeds exist, including warranty deeds, quitclaim deeds, and special warranty deeds. A warranty deed offers guarantees about the property title and is often used in sales, while a quitclaim deed simply transfers interest without warranties. Knowing the right type of deed is essential when dealing with situations such as the Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

Yes, you can add your partner to your house. This typically involves preparing a new deed that lists both of your names as co-owners. After signing the deed in front of a notary, you will file it with your local county auditor's office. This adjustment becomes especially important in the context of financial decisions like the Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

To transfer a property title to a family member in Washington state, you need to prepare a new deed that clearly indicates the transfer of ownership. Using a quitclaim deed is a common option for family transfers, as it simplifies the transaction. Ensure that both parties sign the deed in the presence of a notary, then submit it to the county auditor. This is particularly relevant in discussions about the Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

Adding someone to a deed in Washington state involves preparing a new deed that includes their name. It’s wise to use a quitclaim deed as this type of deed is often used for this purpose. After completing the deed, both you and the new owner should sign it before a notary. Finally, file the signed deed with the county auditor's office to make the change official.

To add your spouse to the house deed in Washington state, you must prepare a new deed that includes both of your names. This could be a quitclaim deed or a warranty deed, depending on your specific situation. Once the deed is created, you should sign it in front of a notary and then file it with your local county auditor’s office. This process is crucial, especially when considering the Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation.

To process a Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation, homeowners should start by communicating directly with their lender. They will need to provide necessary documentation and potentially negotiate terms. Utilizing platforms like USLegalForms can streamline the process, offering guidance and templates that simplify the paperwork involved.

A key disadvantage for lenders when accepting a deed in lieu of foreclosure is the inability to pursue legal action for any remaining debt. This might result in a financial gap that lenders need to address later. The Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation represents a simplified solution, but it can complicate the lender's financial recovery efforts.

When considering a Vancouver Washington Deed in Lieu of Foreclosure - Husband and Wife to Corporation, there are some disadvantages for homeowners to keep in mind. For instance, this process may result in a loss of equity in the property, as the lender may not be required to forgive any outstanding debt. Additionally, it may require the homeowners to face tax implications depending on the situation.