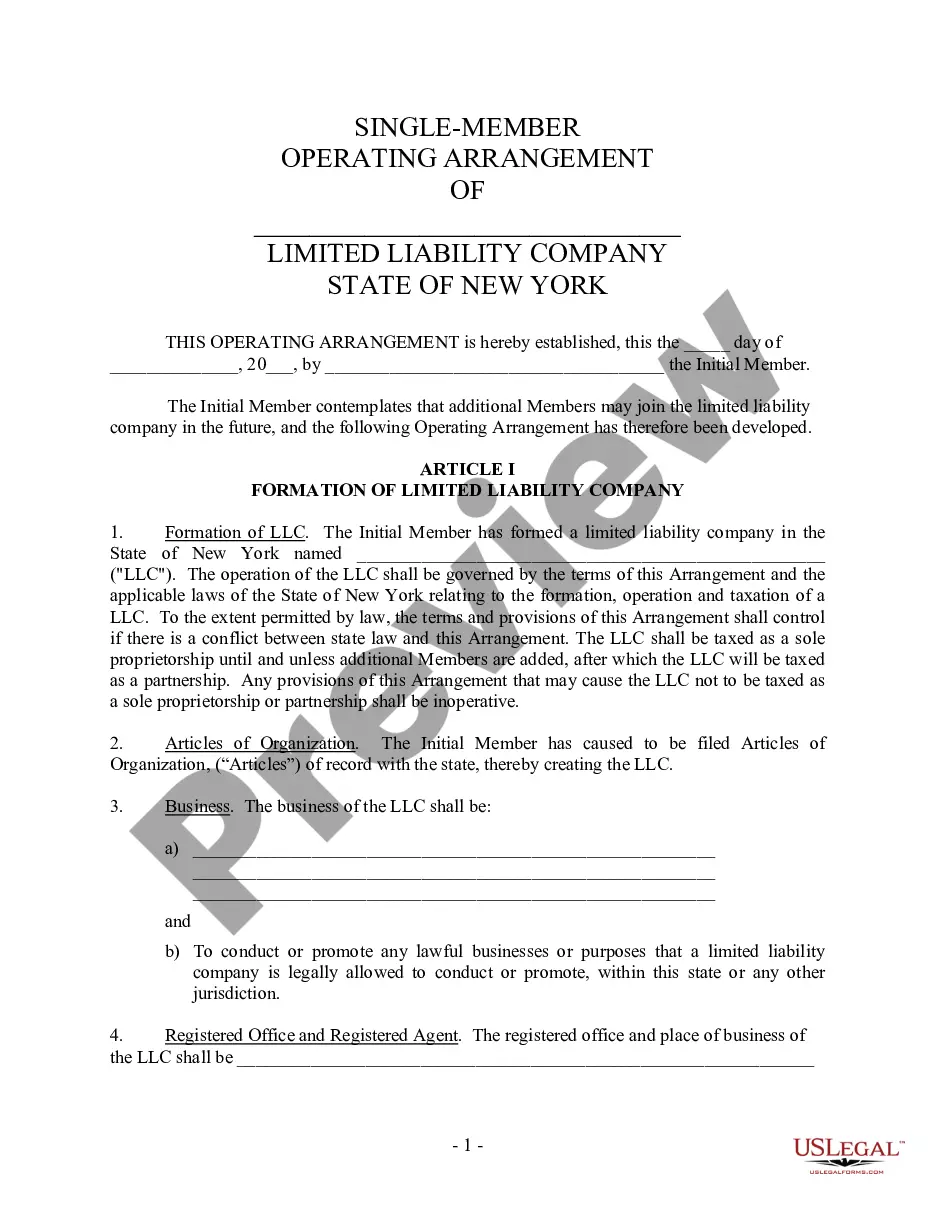

This form is a Bargain and Sale Deed where the grantors are husband and wife and the grantee is the husband. Grantors convey and grant the described property to the grantee. This deed complies with all state statutory laws.

Seattle Washington Bargain and Sale Deed from Husband and Wife to Husband

Description

How to fill out Washington Bargain And Sale Deed From Husband And Wife To Husband?

If you have previously made use of our service, Log In to your account and retrieve the Seattle Washington Bargain and Sale Deed from Husband and Wife to Husband on your device by clicking the Download button. Ensure your subscription is current. If not, renew it according to your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continual access to every document you have acquired: you can find it in your profile within the My documents section whenever you need to access it again. Utilize the US Legal Forms service to swiftly find and store any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Review the description and utilize the Preview feature, if accessible, to verify if it suits your needs. If it does not meet your criteria, use the Search tab above to discover the correct one.

- Purchase the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and complete a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Seattle Washington Bargain and Sale Deed from Husband and Wife to Husband. Choose the file format for your document and store it on your device.

- Complete your template. Print it out or leverage professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

It is possible to transfer the ownership of a property to a family member as a gift, meaning no money exchanges hands. This differs to a Transfer of Equity, where the owner remains on the title and simply adds someone else to it.

Because property ownership records are based on legal documents, changes to the name of the property owner may only be made based on legal documents of record. To request an update to the property owner name, submit a written request from the owner along with a copy of the relevant legal document.

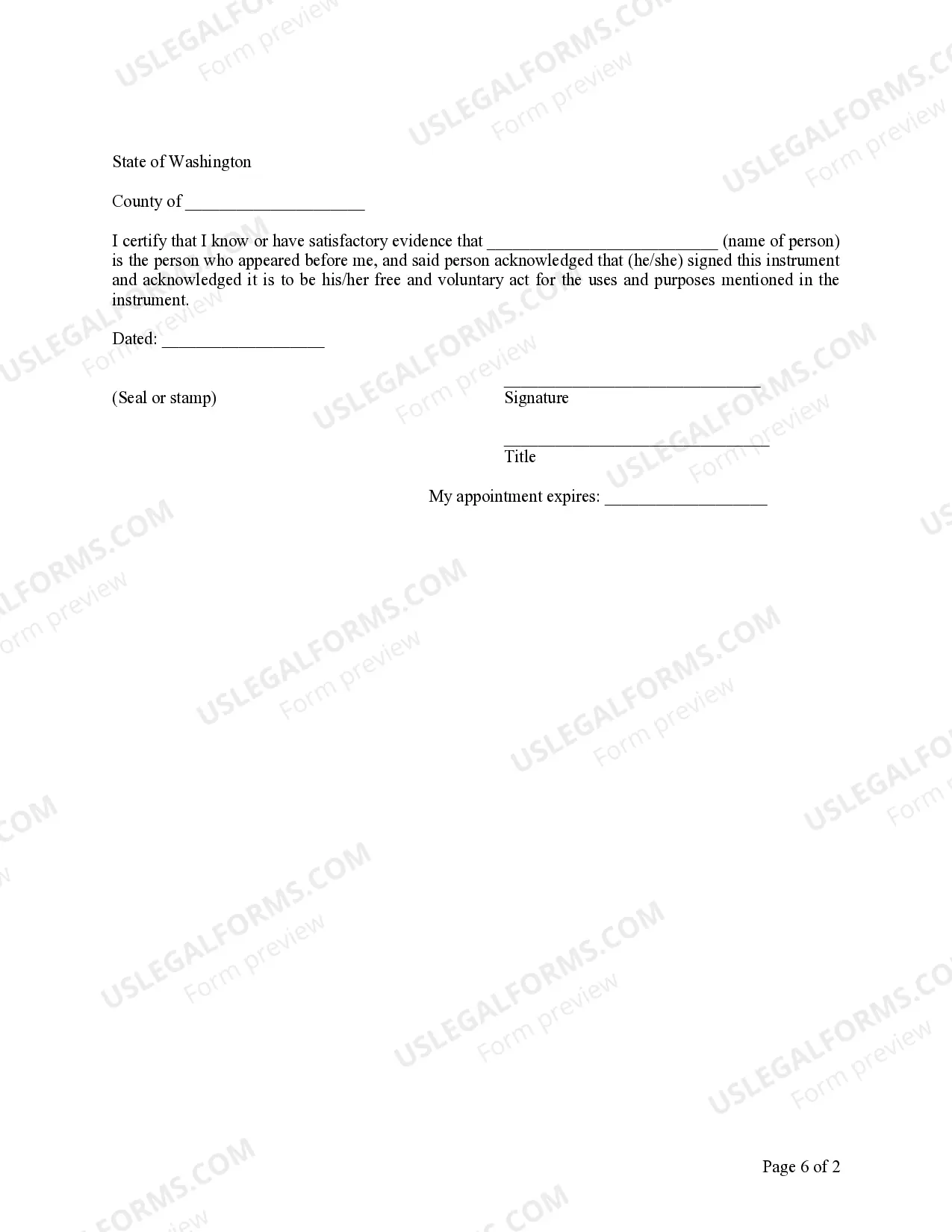

In Washington, real property must be transferred by deed. RCW 64.04. 010. The basic requirements for a Washington deed are that it must (1) be in writing, (2) be signed by grantor, (3) be acknowledged (i.e., notarized), and (4) contain a complete legal description of the property.

What is a Washington Bargain and Sale Deed? A Washington bargain and sale deed form transfers Washington real estate from the current owner (grantor) to a new owner (grantee) with a warranty of title that is limited to the time period that the grantor owned the property.

In Washington, real property must be transferred by deed. RCW 64.04. 010. The basic requirements for a Washington deed are that it must (1) be in writing, (2) be signed by grantor, (3) be acknowledged (i.e., notarized), and (4) contain a complete legal description of the property.

(a) A completed real estate excise tax affidavit is required for transfers by gift. A supplemental statement approved by the department must be completed and attached to the affidavit.

How much are transfer taxes in Washington? The REET in Washington State is: 1.1% on homes less than $500,000. 1.28% on homes between $500,000 and $1,500,000.

How to Transfer Property Title to Another Person ?Obtain the form.?Contact the parties.?Make sure all are in agreement.?Complete the form.?Find a notary public.?Sign the document.?Supply copies.?Go the the county recorder's office.

A Washington deed is used to transfer the ownership of property from a grantor, or ?seller,? to a grantee, or ?buyer,? in the State of Washington. This form is usually completed after a purchase and sale agreement has been authorized and a deed transfers the actual property.