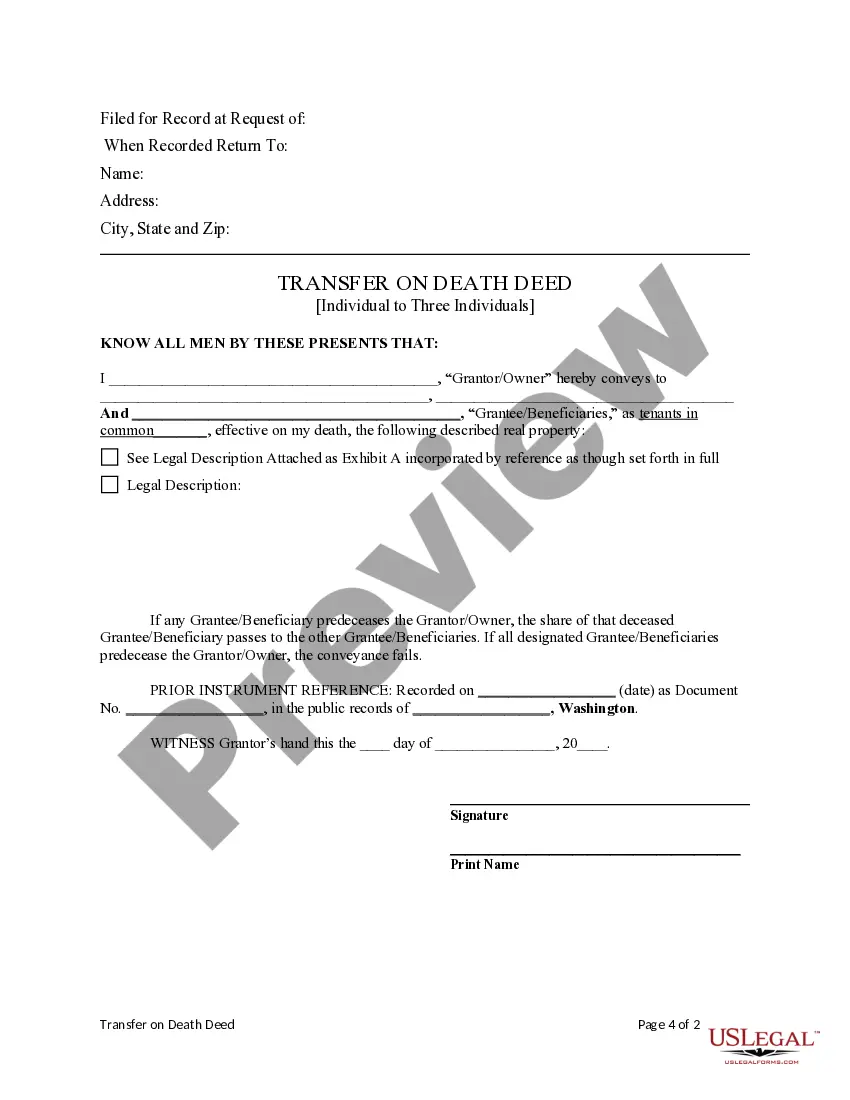

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantees are three individuals. This transfer is revocable by Grantor until his or her death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

The Renton Washington Transfer on Death Deed, also known as a TOD deed, is a legal document used in the state of Washington to transfer ownership of real estate from an individual to three individuals upon the death of the owner. This type of deed does not include alternate beneficiaries, meaning that the transfer of ownership is only valid if all three designated individuals are alive at the time of the owner's passing. The Renton Washington Transfer on Death Deed is a popular estate planning tool that allows property owners to designate specific individuals as beneficiaries and streamline the transfer of ownership without the need for probate. It provides a clear directive for the distribution of the property, ensuring that it goes directly to the intended parties upon the owner's death. By utilizing a Renton Washington Transfer on Death Deed, individuals can maintain control and ownership of their property during their lifetime while also ensuring a smooth and efficient transfer to their chosen beneficiaries. This type of deed can be particularly useful for those who wish to avoid the complexities and costs associated with probate court. It's important to note that this specific type of Renton Washington Transfer on Death Deed applies to cases where a property owner wants to transfer their property to three individuals and does not allow for alternate beneficiaries. However, there may be variations of TOD deeds available that accommodate different numbers of beneficiaries or alternate beneficiaries. When drafting a Renton Washington Transfer on Death Deed, it is crucial to ensure that all relevant details are included, such as the legal description of the property, the names and contact information of the three designated beneficiaries, and the specific conditions that must be met for the transfer to be valid. Consulting with a qualified estate planning attorney is highly recommended ensuring that the Renton Washington Transfer on Death Deed accurately reflects the property owner's wishes and complies with the state's legal requirements.