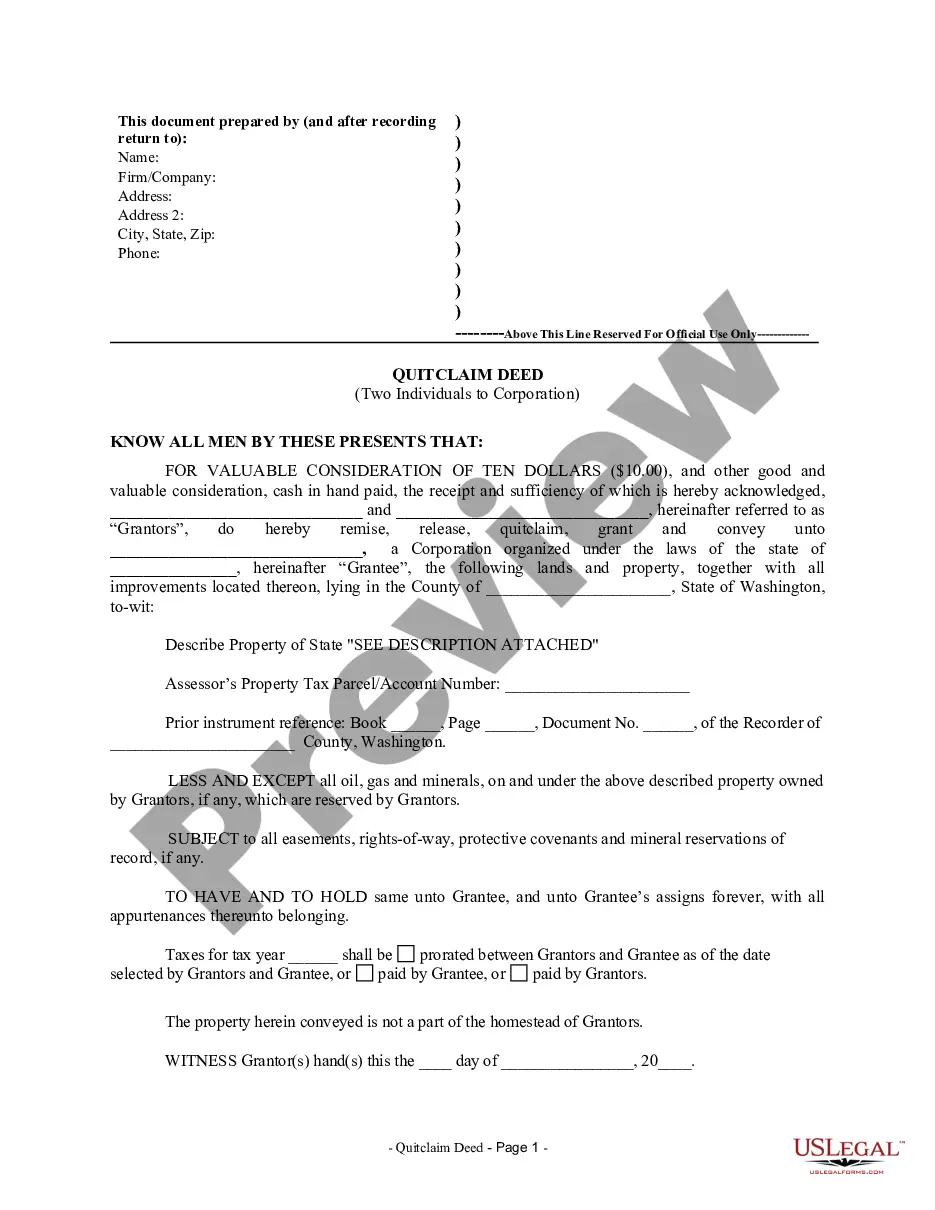

This Quitclaim Deed by Two Individuals to Corporation form is a Quitclaim Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Spokane Valley Washington Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers ownership rights of a property from two individuals to a corporation through a quitclaim deed process. This type of property transfer is commonly used for various purposes, such as asset protection, estate planning, or business restructuring. A quitclaim deed is a legal instrument that allows the transfer of an individual's ownership interest in a property to another party, without providing any guarantees or warranties about the property's title. When two individuals opt to transfer property to a corporation using a quitclaim deed, they essentially give up their ownership rights and grant the corporation complete ownership and control over the property. This type of property transfer offers certain advantages for both the individuals and the corporation involved. For the individuals, it can help protect their personal assets or streamline their estate planning strategies. On the other hand, the corporation benefits by gaining control over the property, allowing for better management and potential tax advantages. In Spokane Valley, Washington, there may be different types of Quitclaim Deeds by Two Individuals to Corporation, depending on the specific circumstances of the property transfer. Some common variations include: 1. Transfer for Business Purposes: This type of quitclaim deed is utilized when two individuals transfer their property to a corporation for business purposes. This could involve consolidating all business-related assets under the corporation's name or facilitating a change in business structure. 2. Asset Protection Transfer: Individuals may choose to transfer their property to a corporation using a quitclaim deed as a way to protect their personal assets against potential liabilities. By transferring ownership to the corporation, the property becomes an asset of the business entity rather than the individuals themselves. 3. Estate Planning Transfer: Quitclaim deeds by two individuals to a corporation can also be part of an estate planning strategy. This allows individuals to facilitate the transfer of property to a corporation, ensuring a smoother transition of assets to beneficiaries or to provide continuity for family-owned businesses. 4. Tax Planning and Structuring: Depending on the specific circumstances, transferring property to a corporation through a quitclaim deed can offer tax advantages such as depreciation benefits, capital gains tax exemptions, or more favorable tax treatment for rental income. It is crucial to consult with a qualified attorney or real estate professional familiar with Spokane Valley, Washington's laws and regulations when considering a quitclaim deed transfer. They can provide guidance and ensure the proper execution of the deed, protecting the rights and interests of all parties involved in the property transfer process.A Spokane Valley Washington Quitclaim Deed by Two Individuals to Corporation is a legal document that transfers ownership rights of a property from two individuals to a corporation through a quitclaim deed process. This type of property transfer is commonly used for various purposes, such as asset protection, estate planning, or business restructuring. A quitclaim deed is a legal instrument that allows the transfer of an individual's ownership interest in a property to another party, without providing any guarantees or warranties about the property's title. When two individuals opt to transfer property to a corporation using a quitclaim deed, they essentially give up their ownership rights and grant the corporation complete ownership and control over the property. This type of property transfer offers certain advantages for both the individuals and the corporation involved. For the individuals, it can help protect their personal assets or streamline their estate planning strategies. On the other hand, the corporation benefits by gaining control over the property, allowing for better management and potential tax advantages. In Spokane Valley, Washington, there may be different types of Quitclaim Deeds by Two Individuals to Corporation, depending on the specific circumstances of the property transfer. Some common variations include: 1. Transfer for Business Purposes: This type of quitclaim deed is utilized when two individuals transfer their property to a corporation for business purposes. This could involve consolidating all business-related assets under the corporation's name or facilitating a change in business structure. 2. Asset Protection Transfer: Individuals may choose to transfer their property to a corporation using a quitclaim deed as a way to protect their personal assets against potential liabilities. By transferring ownership to the corporation, the property becomes an asset of the business entity rather than the individuals themselves. 3. Estate Planning Transfer: Quitclaim deeds by two individuals to a corporation can also be part of an estate planning strategy. This allows individuals to facilitate the transfer of property to a corporation, ensuring a smoother transition of assets to beneficiaries or to provide continuity for family-owned businesses. 4. Tax Planning and Structuring: Depending on the specific circumstances, transferring property to a corporation through a quitclaim deed can offer tax advantages such as depreciation benefits, capital gains tax exemptions, or more favorable tax treatment for rental income. It is crucial to consult with a qualified attorney or real estate professional familiar with Spokane Valley, Washington's laws and regulations when considering a quitclaim deed transfer. They can provide guidance and ensure the proper execution of the deed, protecting the rights and interests of all parties involved in the property transfer process.