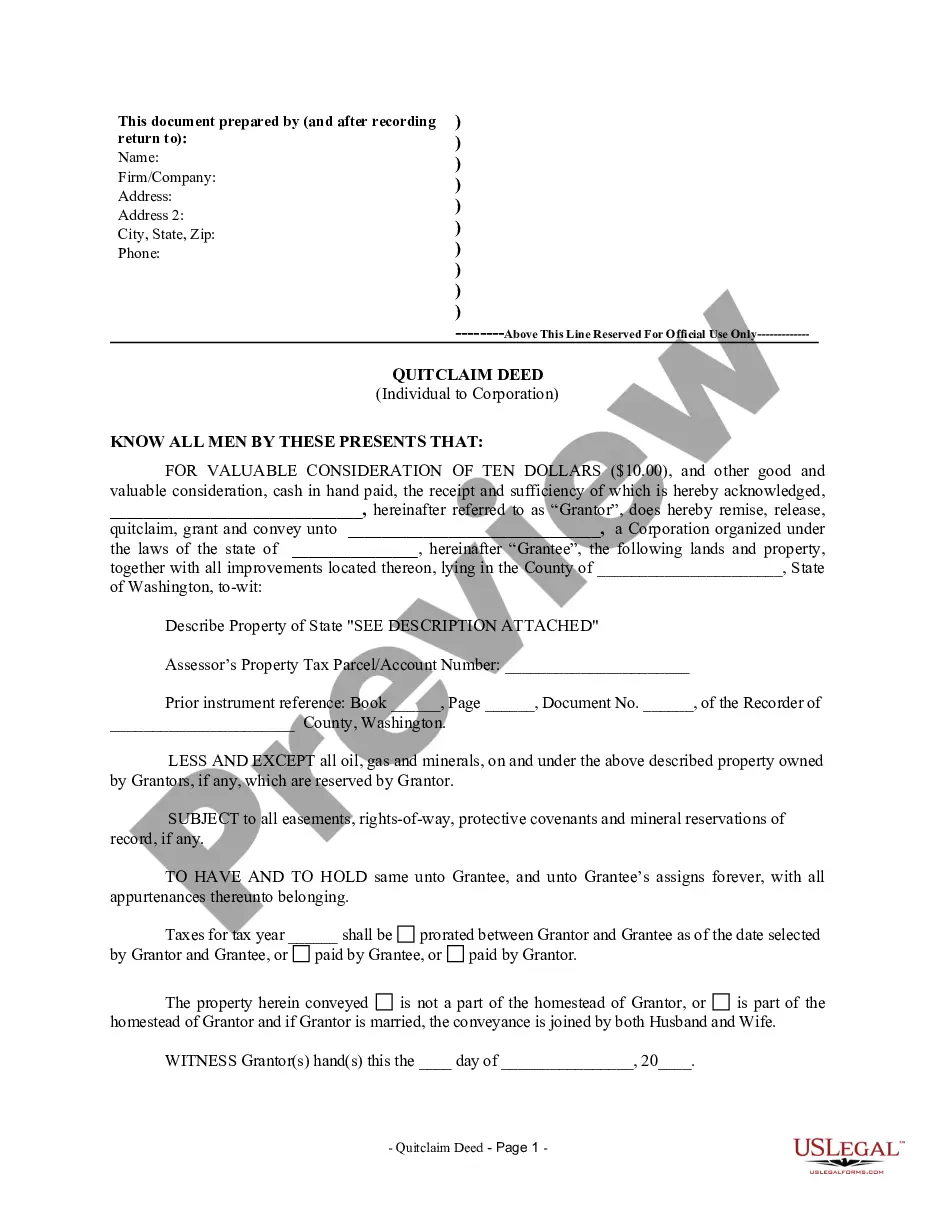

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A King Washington Quitclaim Deed from Individual to Corporation is a legal document that transfers ownership of real estate from an individual to a corporation in the state of Washington, United States. This type of deed is commonly used when an individual wishes to transfer property rights to a corporation for various reasons, such as tax advantages, liability protection, or business restructuring. Keywords: King Washington Quitclaim Deed, Individual to Corporation, real estate, transfer ownership, tax advantages, liability protection, business restructuring, legal document. There are different types of King Washington Quitclaim Deeds from Individual to Corporation that may be used depending on the specific circumstances. These variations include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used for transferring ownership from an individual to a corporation. It transfers the individual's entire interest in the property to the corporation. 2. Limited Quitclaim Deed: This type of deed can be used when the individual wishes to transfer only a specific portion or percentage of their ownership interest to the corporation, while retaining some ownership rights themselves. 3. Conditional Quitclaim Deed: In certain cases, the transfer of property from an individual to a corporation may be subject to certain conditions or restrictions. A conditional quitclaim deed is used to outline these conditions, such as the completion of specific tasks or the fulfillment of certain requirements by the corporation. 4. Trustee-to-Corporation Quitclaim Deed: If the individual holds the property in a trust, they may use this type of deed to transfer the property from the trust to the corporation. When executing a King Washington Quitclaim Deed from Individual to Corporation, it is essential to follow the legal requirements and ensure that all necessary information is included. This typically includes the legal description of the property, identification of the granter (individual), identification of the grantee (corporation), the date of transfer, and the signatures of both parties involved. If there are any specific terms or conditions agreed upon between the parties, such as the purchase price or any additional agreements, these should be clearly stated in the deed as well. It is advisable to consult with a qualified attorney or a real estate professional to guide you through the process and ensure compliance with the applicable laws and regulations governing such transactions. Keywords: General Quitclaim Deed, Limited Quitclaim Deed, Conditional Quitclaim Deed, Trustee-to-Corporation Quitclaim Deed, legal requirements, property transfer, trust, legal description, granter, grantee, purchase price, qualified attorney, real estate professional.A King Washington Quitclaim Deed from Individual to Corporation is a legal document that transfers ownership of real estate from an individual to a corporation in the state of Washington, United States. This type of deed is commonly used when an individual wishes to transfer property rights to a corporation for various reasons, such as tax advantages, liability protection, or business restructuring. Keywords: King Washington Quitclaim Deed, Individual to Corporation, real estate, transfer ownership, tax advantages, liability protection, business restructuring, legal document. There are different types of King Washington Quitclaim Deeds from Individual to Corporation that may be used depending on the specific circumstances. These variations include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used for transferring ownership from an individual to a corporation. It transfers the individual's entire interest in the property to the corporation. 2. Limited Quitclaim Deed: This type of deed can be used when the individual wishes to transfer only a specific portion or percentage of their ownership interest to the corporation, while retaining some ownership rights themselves. 3. Conditional Quitclaim Deed: In certain cases, the transfer of property from an individual to a corporation may be subject to certain conditions or restrictions. A conditional quitclaim deed is used to outline these conditions, such as the completion of specific tasks or the fulfillment of certain requirements by the corporation. 4. Trustee-to-Corporation Quitclaim Deed: If the individual holds the property in a trust, they may use this type of deed to transfer the property from the trust to the corporation. When executing a King Washington Quitclaim Deed from Individual to Corporation, it is essential to follow the legal requirements and ensure that all necessary information is included. This typically includes the legal description of the property, identification of the granter (individual), identification of the grantee (corporation), the date of transfer, and the signatures of both parties involved. If there are any specific terms or conditions agreed upon between the parties, such as the purchase price or any additional agreements, these should be clearly stated in the deed as well. It is advisable to consult with a qualified attorney or a real estate professional to guide you through the process and ensure compliance with the applicable laws and regulations governing such transactions. Keywords: General Quitclaim Deed, Limited Quitclaim Deed, Conditional Quitclaim Deed, Trustee-to-Corporation Quitclaim Deed, legal requirements, property transfer, trust, legal description, granter, grantee, purchase price, qualified attorney, real estate professional.