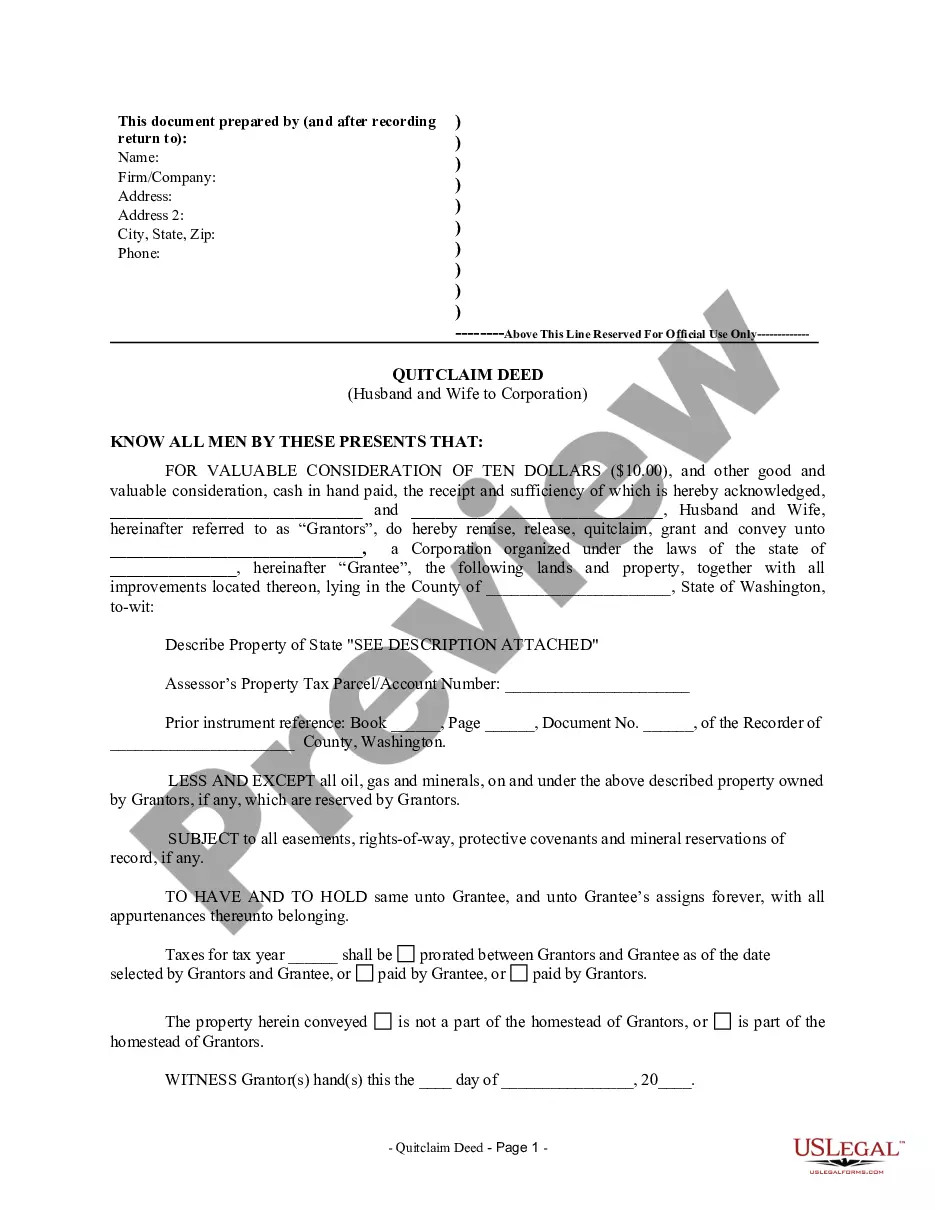

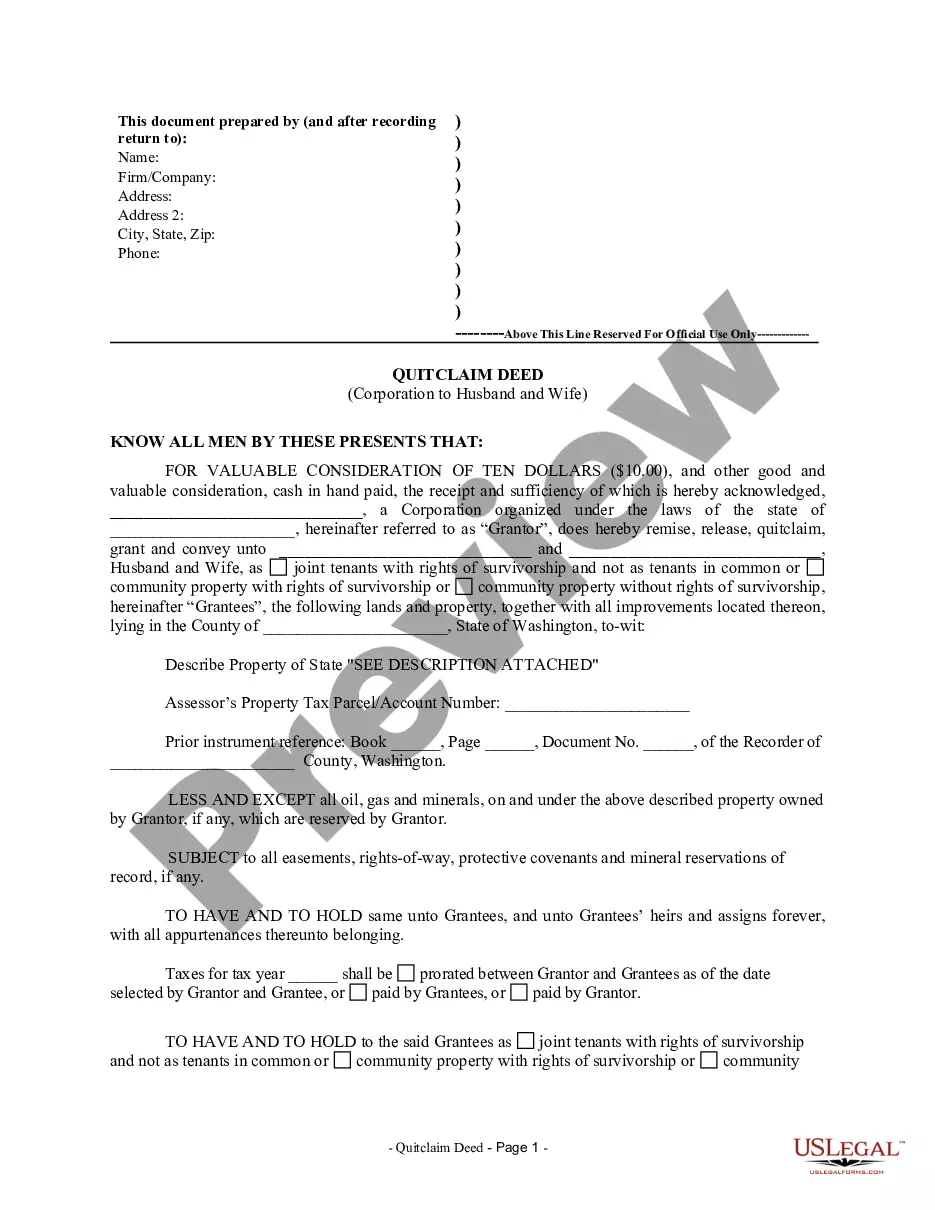

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

King Washington Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out Washington Quitclaim Deed From Husband And Wife To Corporation?

Are you in search of a dependable and economical legal forms provider to obtain the King Washington Quitclaim Deed from Spouse to Corporation? US Legal Forms is your prime option.

Whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our site offers over 85,000 current legal document templates for personal and business use. All templates that we provide are not universal and are structured according to the criteria of specific states and counties.

To acquire the document, you must Log In to your account, find the required form, and click the Download button adjacent to it. Please keep in mind that you can obtain your previously purchased document templates at any time from the My documents section.

Are you a newcomer to our website? No problem. You can create an account with great simplicity, but before that, ensure you do the following.

You can now register your account. Next, select the subscription plan and proceed to payment. Once the payment is finalized, download the King Washington Quitclaim Deed from Spouse to Corporation in any available file format. You can return to the website at any time and redownload the document without incurring any additional charges.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and stop wasting hours investigating legal papers online once and for all.

- Verify that the King Washington Quitclaim Deed from Spouse to Corporation complies with the regulations of your state and locality.

- Review the form’s description (if present) to understand who and what the document is intended for.

- Restart the search if the form is not appropriate for your legal circumstances.

Form popularity

FAQ

Yes, you can complete a quitclaim deed yourself, provided you follow the necessary legal procedures. With the right forms and guidance, you can create a King Washington Quitclaim Deed from Husband and Wife to Corporation without professional assistance. However, using platforms like US Legal Forms can ensure you meet all requirements and simplify the process. Doing it yourself can save costs, but understanding the regulations is vital.

Filing a quitclaim deed in King County, Washington, starts with drafting the deed correctly. Once the document is ready and signed, you will need to go to the King County Recorder's office for filing. After paying the applicable fees, your deed will be recorded, ensuring the transfer of property rights is recognized. Understanding these steps helps in successfully executing a King Washington Quitclaim Deed from Husband and Wife to Corporation.

Recording a quitclaim deed in Washington state involves a few simple steps. First, complete the quitclaim deed form with accurate information and secure the necessary signatures. Then, submit the document to your local recording office, along with the required fees. This process finalizes the transfer and makes the King Washington Quitclaim Deed from Husband and Wife to Corporation legally binding.

A King Washington Quitclaim Deed from Husband and Wife to Corporation primarily benefits the parties involved in the property transfer. Typically, a corporation gains clear title to property without the need for a formal sale, which can streamline business operations. Likewise, the husband and wife can easily transfer ownership, facilitating personal or business arrangements. In essence, both parties achieve their goals efficiently.

Filling out a quitclaim deed form, specifically the King Washington Quitclaim Deed from Husband and Wife to Corporation, involves several steps. First, gather all necessary details, such as names of the parties, property addresses, and any relevant legal language. Then, accurately complete each section of the form, ensuring all information is clear and precise. Using dedicated legal forms from sites like US Legal Forms can simplify this process and reduce the chances of errors.

To fill out a quit claim deed to add a spouse, like the King Washington Quitclaim Deed from Husband and Wife to Corporation, begin by listing the current owner or owners as the grantors. You should then list the spouse as an additional grantor and include the legal property description. Remember to sign the deed in front of a notary to validate it. Online platforms like US Legal Forms can guide you in completing this type of deed accurately.

A quitclaim deed for a married couple, such as the King Washington Quitclaim Deed from Husband and Wife to Corporation, allows both parties to transfer their interest in a property to another entity. This type of deed is particularly beneficial for marital asset transfers or when selling property to a corporation. However, it does not offer protection against claims on the title, so it is advisable to ensure clear ownership before proceeding.

One major issue with a quit claim deed, including the King Washington Quitclaim Deed from Husband and Wife to Corporation, is that it does not guarantee clear title to the property. This means potential problems like unpaid liens or existing claims could affect ownership. Therefore, it's wise to conduct a title search before signing. Consider consulting a legal expert if you're uncertain about any aspect.

To fill out a King Washington Quitclaim Deed from Husband and Wife to Corporation, start by writing the names of both the grantors and the grantee clearly. Next, include a comprehensive legal description of the property being transferred. Finally, ensure that all signatures are notarized to make the deed legally binding. Using a reliable service like US Legal Forms can help streamline this process.

Yes, you can prepare a King Washington Quitclaim Deed from Husband and Wife to a Corporation yourself. Just ensure that you have all the necessary information, including the property details and the names of all parties involved. It's important to follow the specific state guidelines to avoid any errors. If you're unsure, consider using a platform like US Legal Forms for assistance.