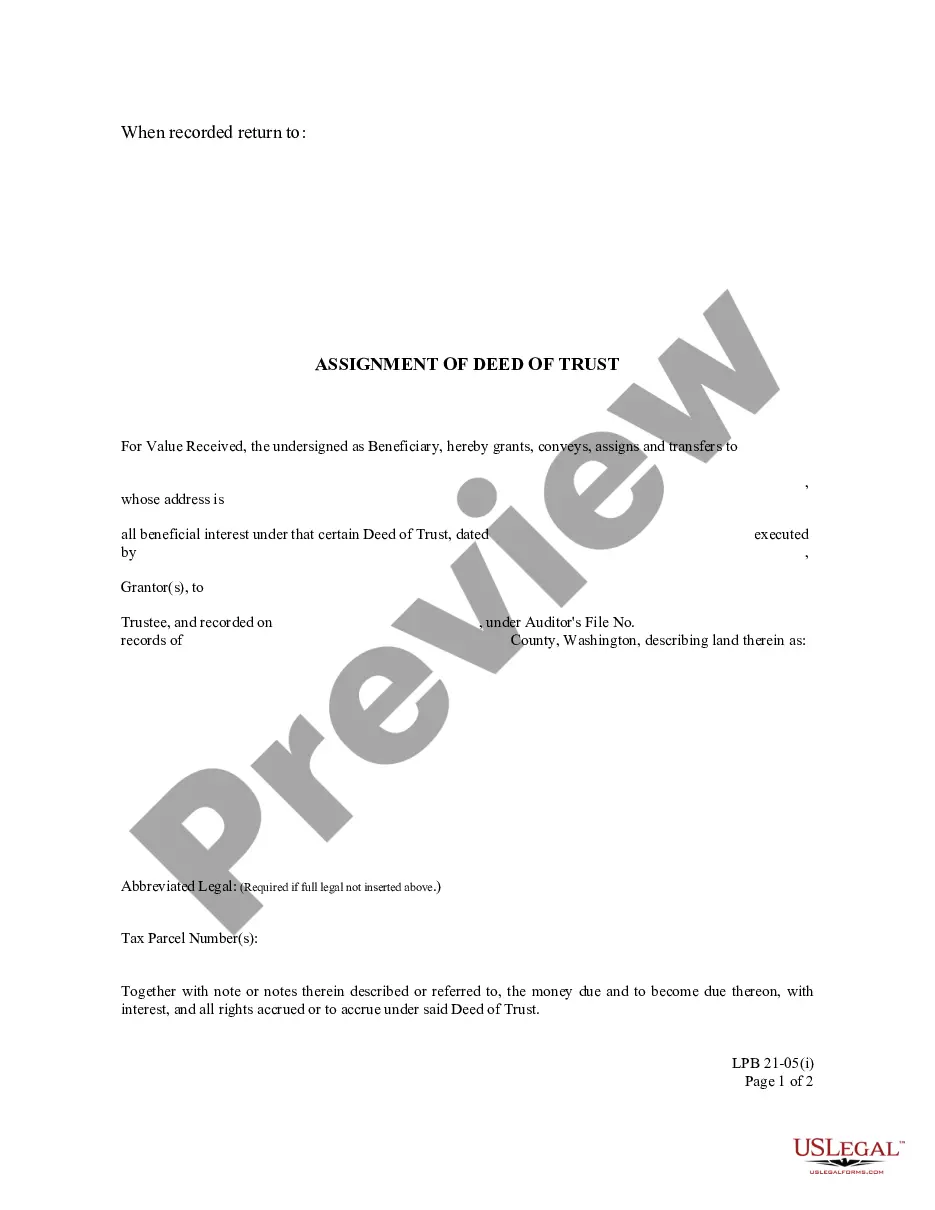

This is an official Washington form for use in land transactions, an Assignment of Deed of Trust (with individual acknowledgment).

Seattle Washington Assignment of Deed of Trust - with individual acknowledgment

Description

How to fill out Washington Assignment Of Deed Of Trust - With Individual Acknowledgment?

If you have previously made use of our service, sign in to your account and store the Seattle Washington Assignment of Deed of Trust - with individual acknowledgment on your device by selecting the Download button. Ensure that your subscription is active. If it is not, please renew it in accordance with your payment plan.

Should this be your initial engagement with our service, follow these straightforward instructions to acquire your document.

You have continuous access to all documents you have purchased: you can find them in your profile under the My documents menu whenever you need to refer to them again. Utilize the US Legal Forms service to quickly find and download any template for your personal or business requirements!

- Ensure you have identified a suitable document. Browse through the description and utilize the Preview option, if available, to verify if it fulfills your requirements. If it does not suit you, make use of the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Acquire your Seattle Washington Assignment of Deed of Trust - with individual acknowledgment. Choose the file format for your document and save it to your device.

- Fill out your form. Print it or utilize professional online editors to complete it and sign it electronically.

Form popularity

FAQ

Because property ownership records are based on legal documents, changes to the name of the property owner may only be made based on legal documents of record. To request an update to the property owner name, submit a written request from the owner along with a copy of the relevant legal document.

How do I get a copy of my deed? You can request a copy of a recorded deed from the Recording Division by phone, in person or by mail. Please visit our Search Recorded Documents page for more information.

The King County Recorder's Office, located in the King County Administration Building in downtown Seattle, is currently closed for walk-in service. Staff are also available by phone at 206-477-6620 or kcrocust@kingcounty.gov to help customers.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

The Washington State Archives has begun to put some of their records, including land records online. They are available on the Washington State Digital Archives web site.

A: Anywhere between 14 to 90 days after closing. A properly recorded deed can take anywhere from 14 days to 90 days. That may seem like a long time, but your local government office goes over every little detail on the deed to make sure the property is correct and there are no errors.

In Washington, real property must be transferred by deed. RCW 64.04. 010. The basic requirements for a Washington deed are that it must (1) be in writing, (2) be signed by grantor, (3) be acknowledged (i.e., notarized), and (4) contain a complete legal description of the property.

Filing the Deed of Trust You can locate the office online or in the government pages (blue pages) of your local phone book. Call to confirm the mailing address for deeds of trust and either send the deed in the mail or go to the County Clerk's office to file the deed of trust in person.

A Washington deed is used to transfer the ownership of property from a grantor, or ?seller,? to a grantee, or ?buyer,? in the State of Washington. This form is usually completed after a purchase and sale agreement has been authorized and a deed transfers the actual property.

(a) A completed real estate excise tax affidavit is required for transfers by gift. A supplemental statement approved by the department must be completed and attached to the affidavit.