This is an official Washington form for use in land transactions, a Consumer Use Tax Return (Department of Revenue).

Renton Washington Consumer Use Tax Return - Department of Revenue

Description

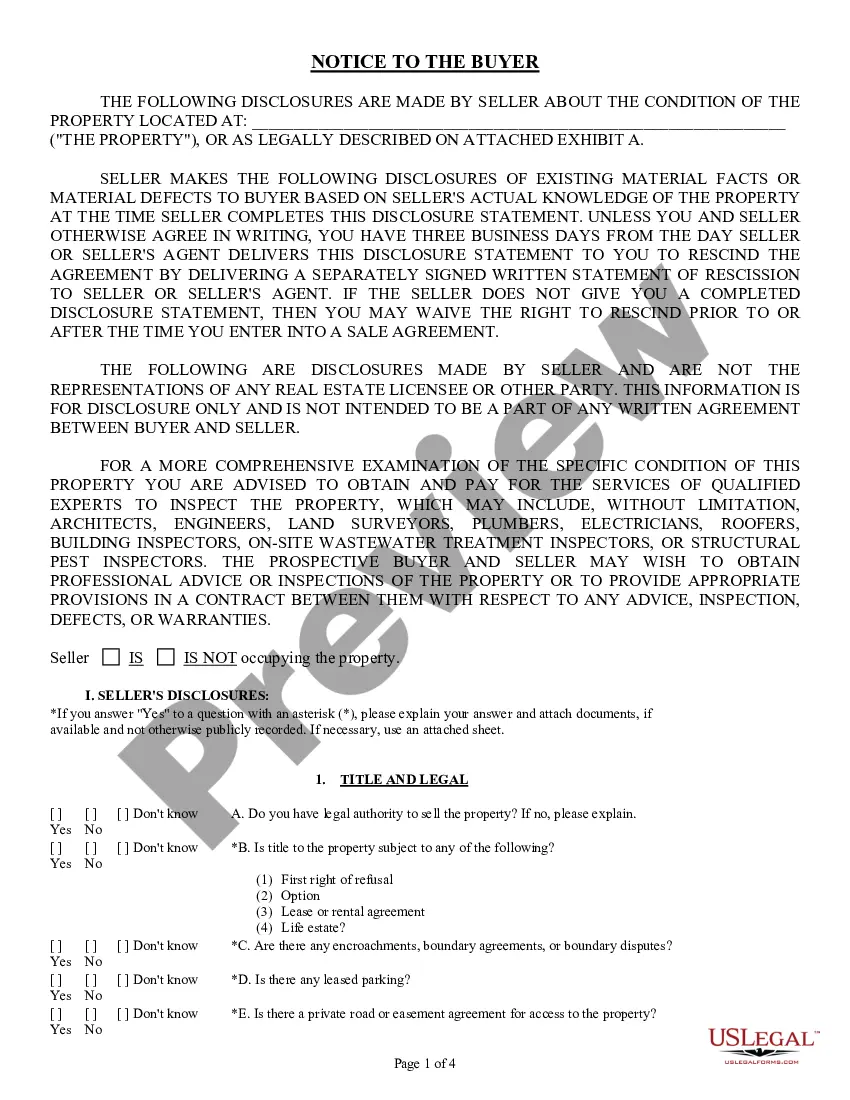

How to fill out Washington Consumer Use Tax Return - Department Of Revenue?

Take advantage of the US Legal Forms and gain immediate access to any form template you need.

Our advantageous website featuring numerous templates enables you to locate and acquire nearly any document sample you require.

It is feasible to download, fill out, and validate the Renton Washington Consumer Use Tax Return - Department of Revenue in only a few minutes rather than spending hours online searching for the correct template.

Utilizing our catalog is an excellent way to enhance the security of your document submissions.

If you have yet to create an account, follow the instructions below.

Access the page containing the template you require. Confirm that it is the form you were looking for: verify its title and description, and take advantage of the Preview feature if it is available. If not, utilize the Search field to find the correct one.

- Our knowledgeable attorneys regularly evaluate all the documents to guarantee that the forms are suitable for a specific area and adhere to new laws and regulations.

- How can you acquire the Renton Washington Consumer Use Tax Return - Department of Revenue.

- If you already possess an account, simply Log In to your profile.

- The Download button will show up on all the documents you access.

- Furthermore, you can find all the previously saved files in the My documents section.

Form popularity

FAQ

Consumer use tax applies to goods purchased without paying sales tax, typically for items brought into Renton from outside the state. On the other hand, vendor use tax is charged to sellers who do not collect sales tax on products sold to consumers. It's essential to understand these distinctions when filing your Renton Washington Consumer Use Tax Return - Department of Revenue. Resources such as uslegalforms can assist you in determining the right tax and ensuring your compliance.

Renton sales tax is a local tax imposed on the sale of goods and services within the city. This tax contributes to city services, such as education, transportation, and infrastructure. If you are a resident or business owner, understanding this tax is important for compliance with the Renton Washington Consumer Use Tax Return - Department of Revenue. Utilizing platforms like uslegalforms can simplify the process of filing your returns and ensuring you meet all regulations.

Sales and use tax and property tax are not the same. Sales and use tax applies to the sale of goods and services, while property tax is based on the value of real estate owned. Understanding these differences is essential when preparing your Renton Washington Consumer Use Tax Return - Department of Revenue, as each tax has distinct regulations and requirements.

A consumer use tax account is a record that individuals maintain to track their consumer use tax obligations. This account helps ensure compliance when you report purchases made without sales tax. When filing your Renton Washington Consumer Use Tax Return - Department of Revenue, refer to this account for accuracy.

Washington use tax is not generally deductible from your federal income tax. Unlike sales tax, which may have specific deductions available under certain conditions, use tax typically remains a separate obligation. Thus, when preparing your Renton Washington Consumer Use Tax Return - Department of Revenue, remember to consider your overall tax strategy.

Current use in Washington state refers to a program that offers property tax relief to landowners who maintain their land for agricultural, horticultural, or open space purposes. It allows land to be taxed based on its current use rather than its potential market value. Understanding this can help when considering your Renton Washington Consumer Use Tax Return - Department of Revenue, especially if property tax factors into your calculations.

You can file use tax in Washington state by completing the appropriate tax return form. You will need to include details about your purchases, especially those where tax was not collected. Ensure clarity and accuracy in your Renton Washington Consumer Use Tax Return - Department of Revenue to avoid any potential penalties.

To obtain a refund in Washington, you must file a request through the Department of Revenue, detailing the reasons for the refund. This process allows you to reclaim any overpaid consumer use tax. Using services like US Legal Forms can simplify your submission of the Renton Washington Consumer Use Tax Return - Department of Revenue, ensuring you meet all requirements efficiently.

Consumer use refers to the use of tangible personal property that an individual or business acquires without paying sales tax. This typical scenario occurs when items are bought from out-of-state vendors. Knowing how consumer use is defined allows you to evaluate your tax responsibilities, particularly when filing the Renton Washington Consumer Use Tax Return - Department of Revenue.

Consumer use tax is not the same as vendor use tax; they serve different purposes. Consumer use tax applies to individual consumers for items bought without sales tax, while vendor use tax is relevant to businesses buying goods for resale. Understanding these differences can help you effectively manage your financial obligations, especially when dealing with the Renton Washington Consumer Use Tax Return - Department of Revenue.