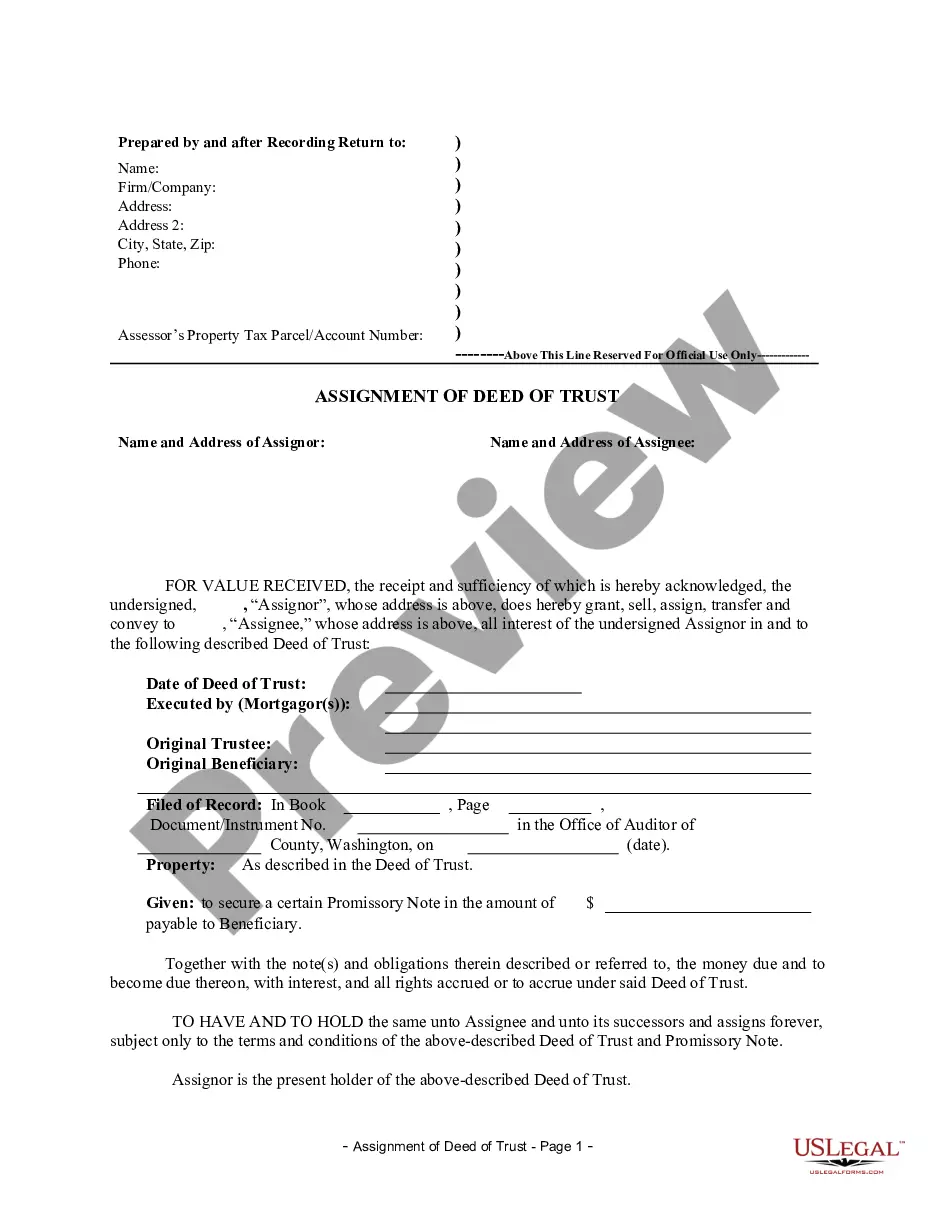

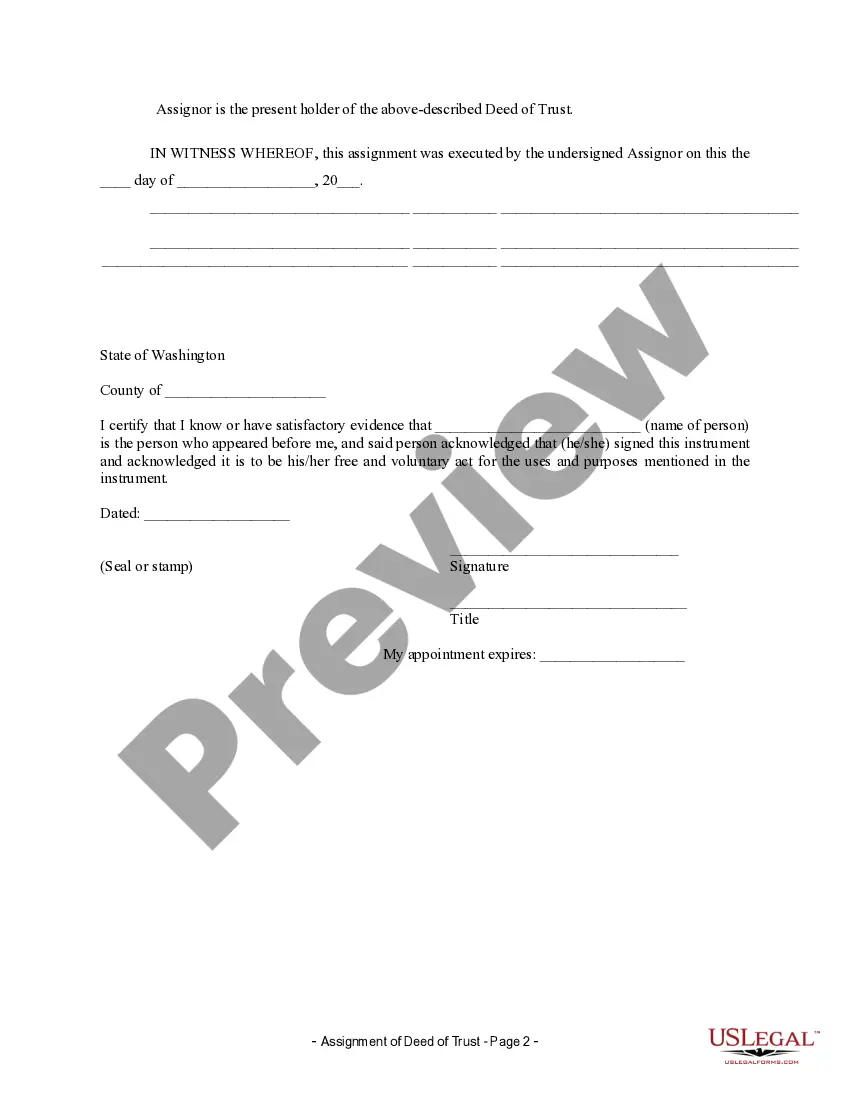

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Title: Understanding Bellevue Washington Assignment of Deed of Trust by Individual Mortgage Holder Description: In Bellevue, Washington, a growing city known for its picturesque beauty and thriving economy, the Assignment of Deed of Trust by Individual Mortgage Holder plays a crucial role in real estate transactions. This detailed description aims to provide insight into the concept and various types of this important legal document. Keywords: Bellevue Washington, Assignment of Deed of Trust, Individual Mortgage Holder, real estate transactions, legal document 1. Introduction: Bellevue, Washington is an attractive location for both homeowners and real estate investors. When it comes to financing properties, the Assignment of Deed of Trust by Individual Mortgage Holder becomes necessary. This legal document is used to transfer the beneficiary interest in a deed of trust from the original mortgage holder to a new party. 2. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust serves as evidence of the transfer and assignment of the rights and interest in a mortgage from one individual mortgage holder to another. It provides legal protection to parties involved and ensures the enforceability of the mortgage. 3. The Role of Individual Mortgage Holder: In Bellevue, individual lenders, private investors, or even homeowners themselves can become mortgage holders. Being an individual mortgage holder allows them to extend loans, secure their investment, and earn interest on the borrowed funds. 4. Reasons for Assignment: a. Investment Opportunities: Individuals may choose to assign their deed of trust to other investors seeking to diversify their portfolio or take advantage of real estate opportunities in Bellevue, Washington. b. Loan Modification: When a mortgage holder wishes to modify the existing loan's terms, such as interest rates or payment schedules, an assignment of the deed of trust can be used to facilitate the process. c. Transfer or Sale: Individual mortgage holders may decide to transfer or sell their beneficial interest to another party, either partially or entirely. 5. Different Types of Bellevue Washington Assignment of Deed of Trust by Individual Mortgage Holder: a. Partial Assignment: In this type, the mortgage holder transfers only a portion of their beneficiary interest to another party while retaining the remainder. b. Full Assignment: Here, the entire beneficial interest in the deed of trust is transferred by the original mortgage holder to a new individual or entity, making them the new beneficiary. c. Assignment with Recourse: This type allows the mortgage holder to retain some liability for the loan even after transferring the ownership rights. They might be responsible if the borrower defaults or certain conditions are not met. d. Assignment without Recourse: In this type, the original mortgage holder relinquishes all liability related to the mortgage, passing on the ownership rights and responsibilities entirely. In Bellevue, Washington, the Assignment of Deed of Trust by Individual Mortgage Holder is imperative for ensuring smooth and legally protected real estate transactions. Whether for investment purposes or loan modification, understanding the different types of assignments can help individuals make informed decisions regarding their mortgage holdings.Title: Understanding Bellevue Washington Assignment of Deed of Trust by Individual Mortgage Holder Description: In Bellevue, Washington, a growing city known for its picturesque beauty and thriving economy, the Assignment of Deed of Trust by Individual Mortgage Holder plays a crucial role in real estate transactions. This detailed description aims to provide insight into the concept and various types of this important legal document. Keywords: Bellevue Washington, Assignment of Deed of Trust, Individual Mortgage Holder, real estate transactions, legal document 1. Introduction: Bellevue, Washington is an attractive location for both homeowners and real estate investors. When it comes to financing properties, the Assignment of Deed of Trust by Individual Mortgage Holder becomes necessary. This legal document is used to transfer the beneficiary interest in a deed of trust from the original mortgage holder to a new party. 2. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust serves as evidence of the transfer and assignment of the rights and interest in a mortgage from one individual mortgage holder to another. It provides legal protection to parties involved and ensures the enforceability of the mortgage. 3. The Role of Individual Mortgage Holder: In Bellevue, individual lenders, private investors, or even homeowners themselves can become mortgage holders. Being an individual mortgage holder allows them to extend loans, secure their investment, and earn interest on the borrowed funds. 4. Reasons for Assignment: a. Investment Opportunities: Individuals may choose to assign their deed of trust to other investors seeking to diversify their portfolio or take advantage of real estate opportunities in Bellevue, Washington. b. Loan Modification: When a mortgage holder wishes to modify the existing loan's terms, such as interest rates or payment schedules, an assignment of the deed of trust can be used to facilitate the process. c. Transfer or Sale: Individual mortgage holders may decide to transfer or sell their beneficial interest to another party, either partially or entirely. 5. Different Types of Bellevue Washington Assignment of Deed of Trust by Individual Mortgage Holder: a. Partial Assignment: In this type, the mortgage holder transfers only a portion of their beneficiary interest to another party while retaining the remainder. b. Full Assignment: Here, the entire beneficial interest in the deed of trust is transferred by the original mortgage holder to a new individual or entity, making them the new beneficiary. c. Assignment with Recourse: This type allows the mortgage holder to retain some liability for the loan even after transferring the ownership rights. They might be responsible if the borrower defaults or certain conditions are not met. d. Assignment without Recourse: In this type, the original mortgage holder relinquishes all liability related to the mortgage, passing on the ownership rights and responsibilities entirely. In Bellevue, Washington, the Assignment of Deed of Trust by Individual Mortgage Holder is imperative for ensuring smooth and legally protected real estate transactions. Whether for investment purposes or loan modification, understanding the different types of assignments can help individuals make informed decisions regarding their mortgage holdings.