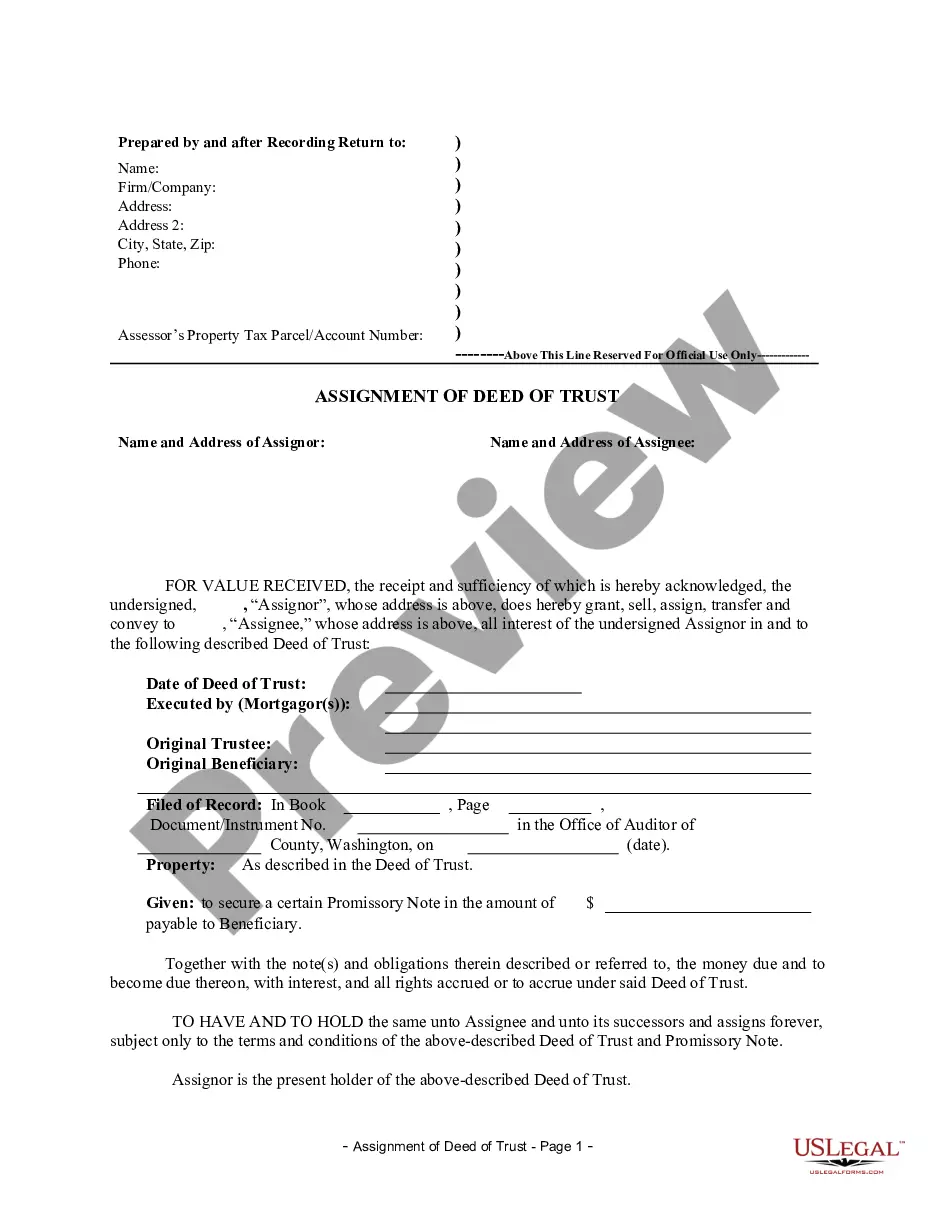

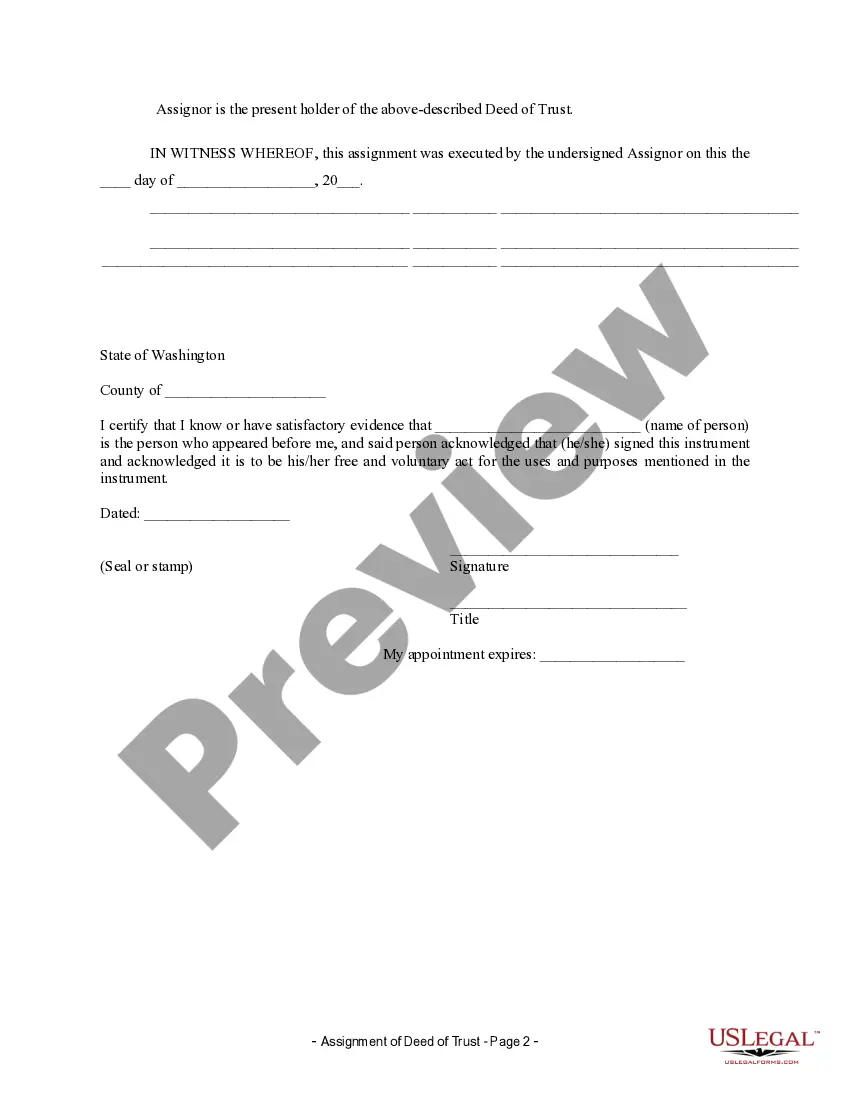

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

The Seattle Washington Assignment of Deed of Trust by Individual Mortgage Holder refers to a legal document that transfers the right to collect debt and enforce a mortgage from an individual mortgage holder to another party. This assignment occurs when the original mortgage holder, often the lender, decides to transfer their interest in the mortgage to another entity. The assignment of deed of trust is a common practice in real estate and mortgage transactions, allowing mortgage holders to sell or transfer their rights to the mortgage debt to another party. This can happen for various reasons, such as when a mortgage holder wants to sell their investment, consolidate their portfolio, or transfer the mortgage to a specialized entity for servicing purposes. The detailed document of the Assignment of Deed of Trust includes relevant information such as the names of all parties involved, the original mortgage instrument's details (such as the original loan amount, interest rate, and terms), and the specific provisions outlining the transfer of rights and responsibilities. The document should also mention the new mortgage holder's contact information and address, ensuring proper communication channels for future transactions and payments. In Seattle, Washington, there may be different types of Assignments of Deed of Trust by Individual Mortgage Holder, depending on the specific circumstances or purposes of the transfer. Some possible variations include: 1. Partial Assignment: This occurs when a mortgage holder transfers only a portion of their interest in the mortgage to another party. For example, a mortgage holder may sell a portion of the mortgage debt to an investor while retaining ownership of the remaining percentage. 2. Full Assignment: This type of assignment involves the complete transfer of all rights and interests in the mortgage to another party. The new mortgage holder assumes the responsibility for collecting debt payments and enforcing the mortgage terms. 3. Servicing Rights Assignment: In some cases, a mortgage holder may choose to transfer only the servicing rights of the mortgage while retaining ownership of the actual debt. This allows them to outsource the administrative tasks of managing the mortgage, such as payment collection and customer service, to a specialized servicing company. Each type of Assignment of Deed of Trust provides specific rights and obligations for the involved parties, ensuring a smooth and legally enforceable transfer of the mortgage. It is crucial that all parties involved review the document carefully, consult legal professionals if necessary, and execute the assignment in compliance with Seattle's laws and regulations.The Seattle Washington Assignment of Deed of Trust by Individual Mortgage Holder refers to a legal document that transfers the right to collect debt and enforce a mortgage from an individual mortgage holder to another party. This assignment occurs when the original mortgage holder, often the lender, decides to transfer their interest in the mortgage to another entity. The assignment of deed of trust is a common practice in real estate and mortgage transactions, allowing mortgage holders to sell or transfer their rights to the mortgage debt to another party. This can happen for various reasons, such as when a mortgage holder wants to sell their investment, consolidate their portfolio, or transfer the mortgage to a specialized entity for servicing purposes. The detailed document of the Assignment of Deed of Trust includes relevant information such as the names of all parties involved, the original mortgage instrument's details (such as the original loan amount, interest rate, and terms), and the specific provisions outlining the transfer of rights and responsibilities. The document should also mention the new mortgage holder's contact information and address, ensuring proper communication channels for future transactions and payments. In Seattle, Washington, there may be different types of Assignments of Deed of Trust by Individual Mortgage Holder, depending on the specific circumstances or purposes of the transfer. Some possible variations include: 1. Partial Assignment: This occurs when a mortgage holder transfers only a portion of their interest in the mortgage to another party. For example, a mortgage holder may sell a portion of the mortgage debt to an investor while retaining ownership of the remaining percentage. 2. Full Assignment: This type of assignment involves the complete transfer of all rights and interests in the mortgage to another party. The new mortgage holder assumes the responsibility for collecting debt payments and enforcing the mortgage terms. 3. Servicing Rights Assignment: In some cases, a mortgage holder may choose to transfer only the servicing rights of the mortgage while retaining ownership of the actual debt. This allows them to outsource the administrative tasks of managing the mortgage, such as payment collection and customer service, to a specialized servicing company. Each type of Assignment of Deed of Trust provides specific rights and obligations for the involved parties, ensuring a smooth and legally enforceable transfer of the mortgage. It is crucial that all parties involved review the document carefully, consult legal professionals if necessary, and execute the assignment in compliance with Seattle's laws and regulations.