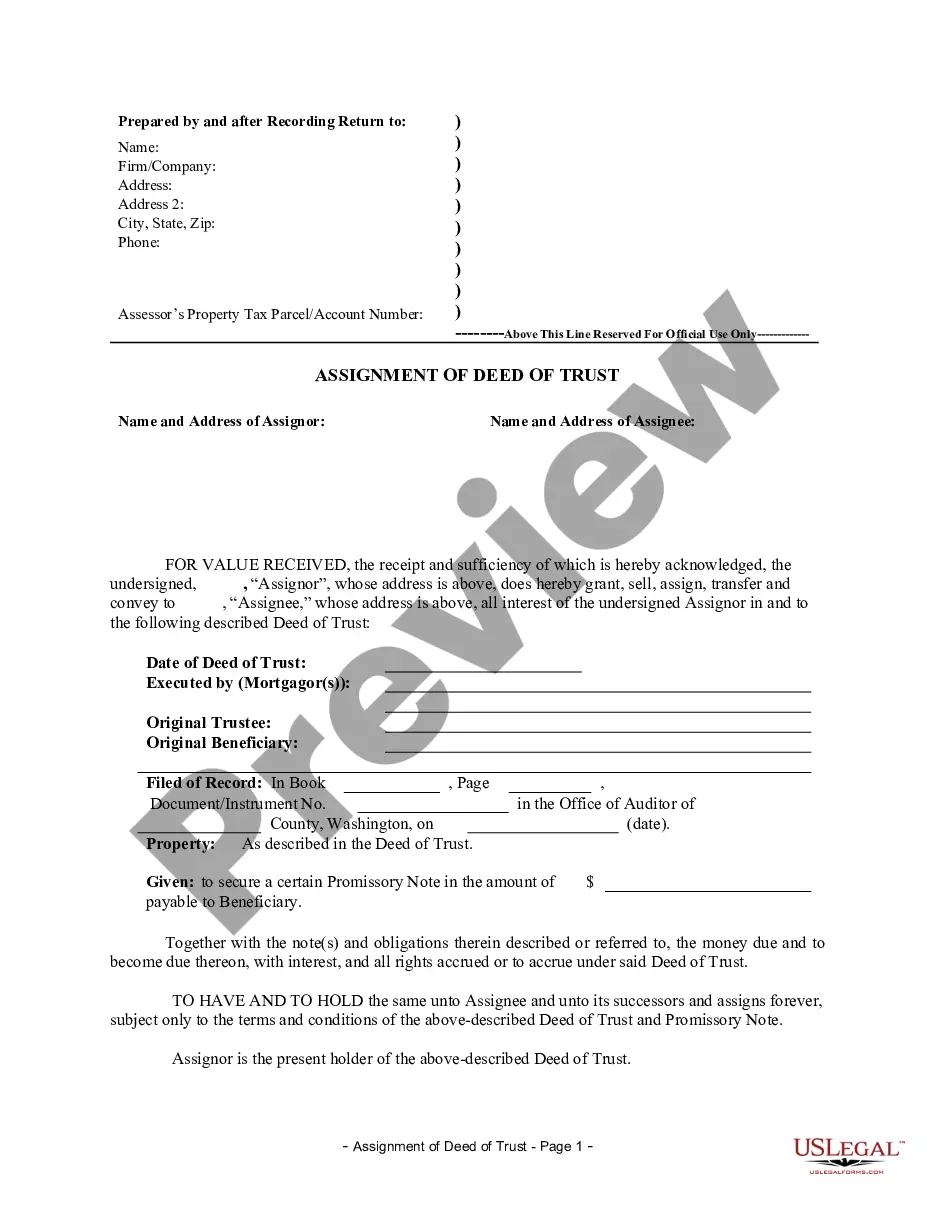

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Title: King Washington Assignment of Deed of Trust by Corporate Mortgage Holder: Explained Introduction: In King Washington (or any relevant geographical location), the Assignment of Deed of Trust by Corporate Mortgage Holder refers to a legal process in which a corporate mortgage holder transfers their rights and interests in a Deed of Trust to another party. This assignment is crucial in mortgage transactions as it allows for the transfer of ownership, typically due to the sale or transfer of the underlying property. This comprehensive description aims to shed light on various aspects of the King Washington Assignment of Deed of Trust by Corporate Mortgage Holder. 1. Key Components of a King Washington Assignment of Deed of Trust: — Deed of Trust: A legal document used in real estate transactions that serves as security for a loan, allowing the lender to foreclose in case of default. — Corporate Mortgage Holder: A corporate entity that owns a mortgage and holds a Deed of Trust as security for a loan against a property. — Assignor: The corporate mortgage holder who transfers their rights and interests in the Deed of Trust to another party. — Assignee: The party receiving the assigned rights and interests in the Deed of Trust, typically a new lender or investor. 2. Purpose of the Assignment of Deed of Trust: The Assignment of Deed of Trust by Corporate Mortgage Holder serves multiple purposes: — Transfer of Rights: It allows the corporate mortgage holder to transfer their rights and interests in the Deed of Trust to another party, enabling the new entity to assume the mortgage position. — Change in Lender: It facilitates the substitution of the original lender with a new lender or investor who may offer more favorable terms. — Due Diligence: This assignment ensures a clear chain of title, allowing the new lender or interested parties to assess the history and validity of the Deed of Trust. 3. Different Types of King Washington Assignment of Deed of Trust by Corporate Mortgage Holder: — Partial Assignment: In this scenario, the corporate mortgage holder assigns only a portion of their rights and interests in the Deed of Trust while retaining a partial interest. This is often seen in cases of loan syndication. — Full Assignment: Here, the entire rights and interests in the Deed of Trust are assigned by the corporate mortgage holder to a new party. This usually happens when a loan is sold to a different lender or investor. 4. Process of King Washington Assignment of Deed of Trust by Corporate Mortgage Holder: — Preparation of Assignment: The assignor, i.e., the corporate mortgage holder, drafts an Assignment of Deed of Trust, specifying the terms of the assignment as per legal requirements. — Execution and Recording: The assignor and assignee sign the assignment document, which is then recorded in the county where the property is located. This ensures public notice of the assignment. — Notice to Borrower: It is essential to notify the borrower of the assignment, as it may affect payment instructions and loan servicing. Conclusion: The King Washington Assignment of Deed of Trust by Corporate Mortgage Holder is a critical legal process that facilitates the transfer of mortgage rights and interests from one corporate entity to another. Whether it's a partial or full assignment, this procedure ensures a smooth transition of ownership and allows interested parties to evaluate the loan's history and legitimacy.Title: King Washington Assignment of Deed of Trust by Corporate Mortgage Holder: Explained Introduction: In King Washington (or any relevant geographical location), the Assignment of Deed of Trust by Corporate Mortgage Holder refers to a legal process in which a corporate mortgage holder transfers their rights and interests in a Deed of Trust to another party. This assignment is crucial in mortgage transactions as it allows for the transfer of ownership, typically due to the sale or transfer of the underlying property. This comprehensive description aims to shed light on various aspects of the King Washington Assignment of Deed of Trust by Corporate Mortgage Holder. 1. Key Components of a King Washington Assignment of Deed of Trust: — Deed of Trust: A legal document used in real estate transactions that serves as security for a loan, allowing the lender to foreclose in case of default. — Corporate Mortgage Holder: A corporate entity that owns a mortgage and holds a Deed of Trust as security for a loan against a property. — Assignor: The corporate mortgage holder who transfers their rights and interests in the Deed of Trust to another party. — Assignee: The party receiving the assigned rights and interests in the Deed of Trust, typically a new lender or investor. 2. Purpose of the Assignment of Deed of Trust: The Assignment of Deed of Trust by Corporate Mortgage Holder serves multiple purposes: — Transfer of Rights: It allows the corporate mortgage holder to transfer their rights and interests in the Deed of Trust to another party, enabling the new entity to assume the mortgage position. — Change in Lender: It facilitates the substitution of the original lender with a new lender or investor who may offer more favorable terms. — Due Diligence: This assignment ensures a clear chain of title, allowing the new lender or interested parties to assess the history and validity of the Deed of Trust. 3. Different Types of King Washington Assignment of Deed of Trust by Corporate Mortgage Holder: — Partial Assignment: In this scenario, the corporate mortgage holder assigns only a portion of their rights and interests in the Deed of Trust while retaining a partial interest. This is often seen in cases of loan syndication. — Full Assignment: Here, the entire rights and interests in the Deed of Trust are assigned by the corporate mortgage holder to a new party. This usually happens when a loan is sold to a different lender or investor. 4. Process of King Washington Assignment of Deed of Trust by Corporate Mortgage Holder: — Preparation of Assignment: The assignor, i.e., the corporate mortgage holder, drafts an Assignment of Deed of Trust, specifying the terms of the assignment as per legal requirements. — Execution and Recording: The assignor and assignee sign the assignment document, which is then recorded in the county where the property is located. This ensures public notice of the assignment. — Notice to Borrower: It is essential to notify the borrower of the assignment, as it may affect payment instructions and loan servicing. Conclusion: The King Washington Assignment of Deed of Trust by Corporate Mortgage Holder is a critical legal process that facilitates the transfer of mortgage rights and interests from one corporate entity to another. Whether it's a partial or full assignment, this procedure ensures a smooth transition of ownership and allows interested parties to evaluate the loan's history and legitimacy.