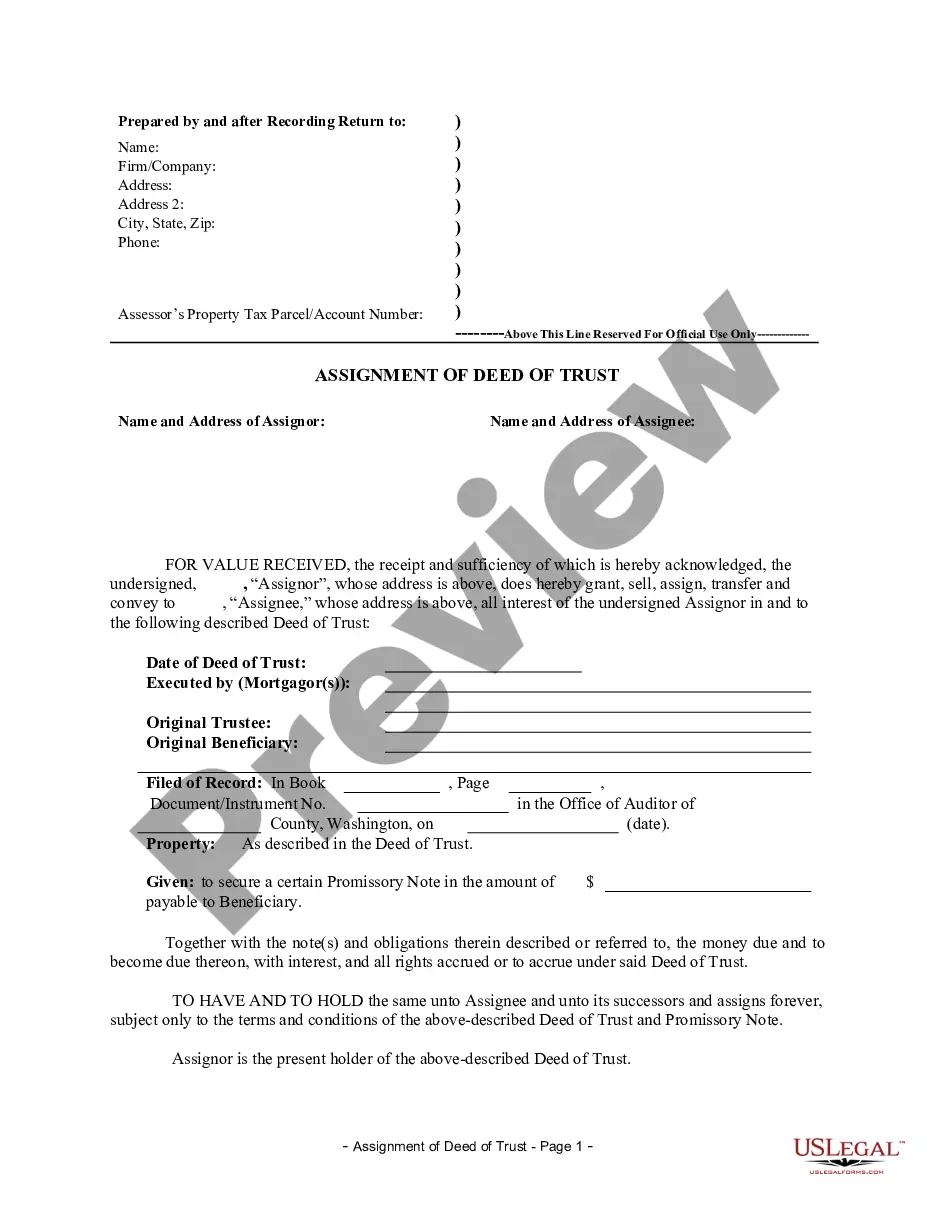

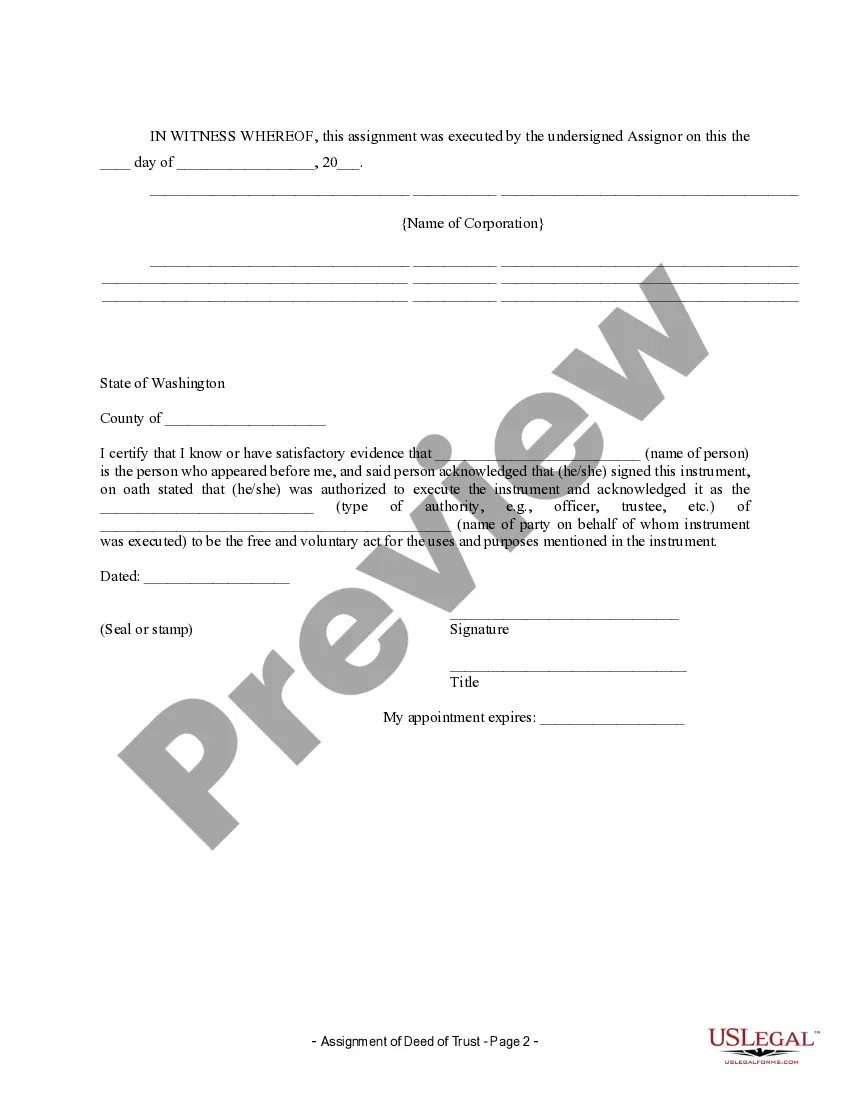

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

The Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document that refers to the transfer or assignment of a Deed of Trust from a corporate mortgage holder to another party. This assignment typically occurs when the original lender, which is a corporate entity, decides to transfer the rights and interests of the Deed of Trust to a different entity. The Deed of Trust is a document that secures a loan or mortgage on a property, giving the lender certain rights and interests in the property as collateral. When the corporate mortgage holder assigns the Deed of Trust, it means it is transferring its rights as the original lender to a new entity, often another financial institution or investor. The assignment process requires specific procedures to be followed to ensure the validity and enforceability of the transfer. It typically involves the preparation of a written Assignment of Deed of Trust document, which outlines the details of the transfer, such as the names of the parties involved, the original loan amount, the property address, and relevant dates. The Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder is governed by state laws, including the Revised Code of Washington (RCW). It is crucial for all parties involved to comply with these laws to ensure the assignment is legally binding and recognized. Seeking legal advice from a real estate attorney specializing in Washington state laws is highly recommended during this process. Different types of Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder may include: 1. Partial Assignment of Deed of Trust — This type of assignment involves transferring a portion of the rights and interests in the Deed of Trust to another party, while the original corporate mortgage holder retains the remaining interest. 2. Complete Assignment of Deed of Trust — In a complete assignment, the corporate mortgage holder transfers all its rights and interests in the Deed of Trust to a new party, effectively transferring the entire loan and any associated obligations. 3. Assignment of Deed of Trust with Note — This type of assignment involves transferring both the Deed of Trust and the associated promissory note, which represents the underlying debt secured by the Deed of Trust. 4. Assignment of Deed of Trust with Assignments of Rents — In this assignment, the corporate mortgage holder transfers not only the rights and interests in the Deed of Trust but also the rights to collect rents from the property, if applicable. These are just a few examples of the different types of Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder. Each assignment may have its specific terms and conditions, depending on the agreements made between the parties involved. It is essential to carefully review and understand the terms of the assignment before proceeding.The Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document that refers to the transfer or assignment of a Deed of Trust from a corporate mortgage holder to another party. This assignment typically occurs when the original lender, which is a corporate entity, decides to transfer the rights and interests of the Deed of Trust to a different entity. The Deed of Trust is a document that secures a loan or mortgage on a property, giving the lender certain rights and interests in the property as collateral. When the corporate mortgage holder assigns the Deed of Trust, it means it is transferring its rights as the original lender to a new entity, often another financial institution or investor. The assignment process requires specific procedures to be followed to ensure the validity and enforceability of the transfer. It typically involves the preparation of a written Assignment of Deed of Trust document, which outlines the details of the transfer, such as the names of the parties involved, the original loan amount, the property address, and relevant dates. The Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder is governed by state laws, including the Revised Code of Washington (RCW). It is crucial for all parties involved to comply with these laws to ensure the assignment is legally binding and recognized. Seeking legal advice from a real estate attorney specializing in Washington state laws is highly recommended during this process. Different types of Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder may include: 1. Partial Assignment of Deed of Trust — This type of assignment involves transferring a portion of the rights and interests in the Deed of Trust to another party, while the original corporate mortgage holder retains the remaining interest. 2. Complete Assignment of Deed of Trust — In a complete assignment, the corporate mortgage holder transfers all its rights and interests in the Deed of Trust to a new party, effectively transferring the entire loan and any associated obligations. 3. Assignment of Deed of Trust with Note — This type of assignment involves transferring both the Deed of Trust and the associated promissory note, which represents the underlying debt secured by the Deed of Trust. 4. Assignment of Deed of Trust with Assignments of Rents — In this assignment, the corporate mortgage holder transfers not only the rights and interests in the Deed of Trust but also the rights to collect rents from the property, if applicable. These are just a few examples of the different types of Renton Washington Assignment of Deed of Trust by Corporate Mortgage Holder. Each assignment may have its specific terms and conditions, depending on the agreements made between the parties involved. It is essential to carefully review and understand the terms of the assignment before proceeding.